How the US economy is shaping the global Infrastructure outlook

Recent data from the US bodes well for infrastructure assets, paving the way for renewed optimism for the asset class.

Infrastructure paving the way

The continuation of softening economic data out of the US could see global listed infrastructure perform well over the next few years. Markets are predicting the US Federal Reserve (the Fed) will cut rates four times before the end of the calendar year which is supportive for utility companies and other infrastructure assets which are typically ‘longer duration’ assets.

The concept of ‘duration’ is typically applied to fixed income assets such as bonds, but it is applied to infrastructure because infrastructure assets are long-lived, generally in excess of 30 years, and they produce stable and predictable cash flows.

Historical relative performance of global listed infrastructure versus broad-based equities have tended to have a negative correlation to the US 10-year yield. There was a notable exception, being the pandemic years when airports ceased operating and toll roads experienced decreases in traffic. Only in the second half of 2022, as the US 10-year jumped higher, did infrastructure resume its negative correlation and hence its recent lacklustre relative performance. Given the market expectations for rate cuts in the US, the current interest rate environment bodes well for infrastructure assets. A potential early stage reversal of relative performance for infrastructure assets compared to the market can be seen below.

Chart 1: Potential early stage reversal of relative performance for infrastructure assets compared to the market

Source: Bloomberg. IFRA Index is FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index, You cannot invest in an index. Past performance is not indicative of future performance.

As a result, VanEck’s global listed infrastructure ETF (IFRA) had a strong July, noting of course that this is a short term period and past performance should not be relied upon for future performance.

Table 1: IFRA Performance as at 31 July 2024

Source: VanEck, Bloomberg; as at 31 July 2024. Inception date is 29 April 2016.

Looking at IFRA’s performance and its underlying holdings, over the last 12 months utilities and energy have been strong contributors to performance while communication services have been the main detractor. Utilities performed well due to a sector rotation, with the power needs of AI development being a tailwind. Communication services faced headwinds from threats of overbuild, increased competition and construction risk, with risk associated with increased cost of capital.

Table 2: IFRA underlying holdings sector performance

Source: Bloomberg, 12 months until 31 July 2024

Infrastructure Outlook

- Utilities companies are among the most sensitive to rate changes due to the sector’s heavy reliance on debt financing to grow business. The sector is also characterised by high dividend payments, but as bond yields have been increasing, infrastructure companies have contended with other income generating investments which have emerged as alternatives. Utilities makes up 50% of IFRA and we think is well placed to benefit from the expected US rate cuts.

- There is strong demand for infrastructure assets among super funds, with 11% allocation to this asset class as of March 2024. Demand is expected to grow given high quality infrastructure assets risk/return profile and the investment life being well aligned with super funds. The asset class is also supportive of the income generation required by super and pension funds.

- In the instance of rate rises, user pay assets and utilities have the ability to pass on rate and inflation surprises.

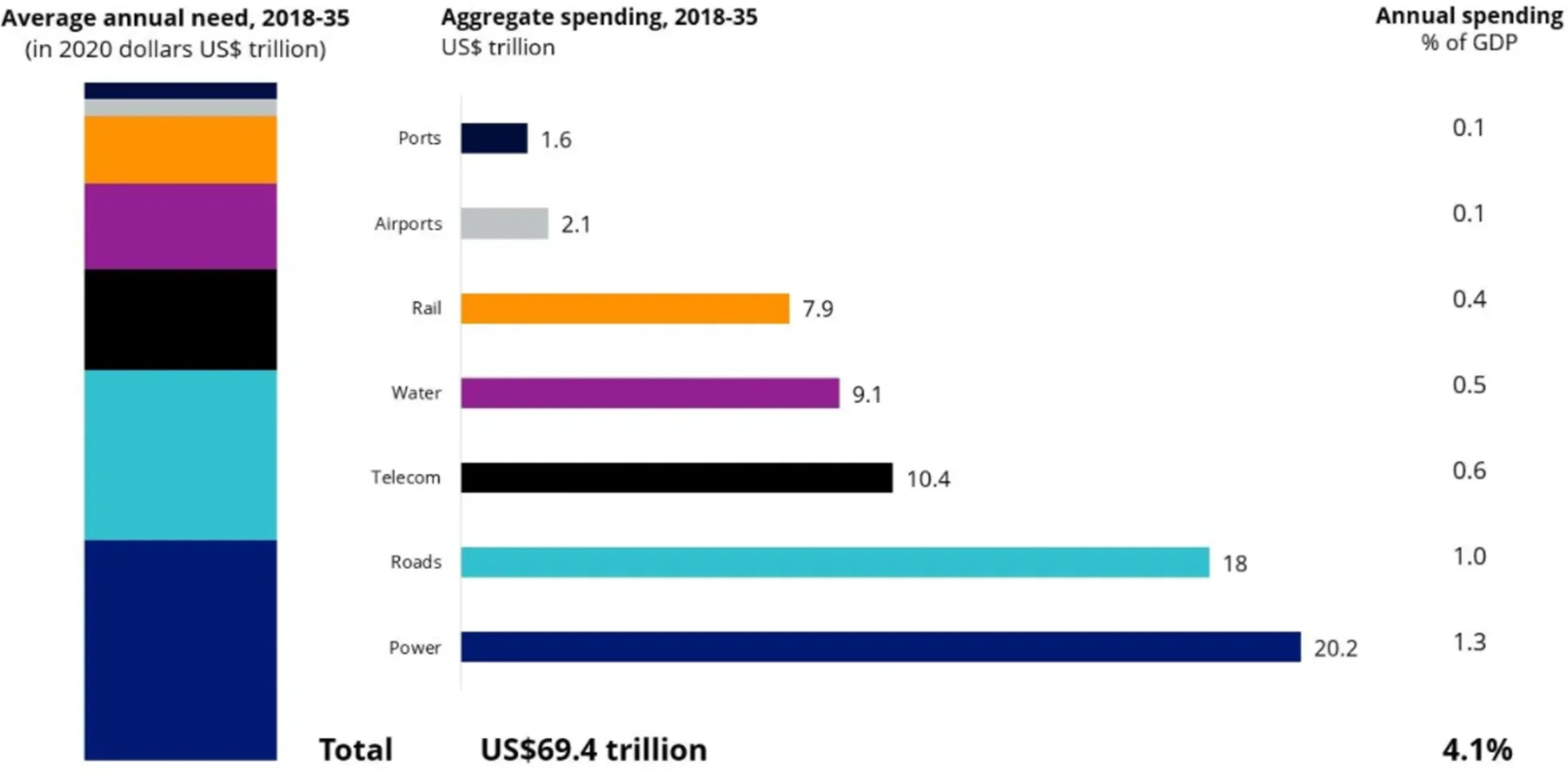

- Critical infrastructure such as toll roads and utilities remain essential for a functioning society despite tougher economic conditions. To keep pace with projected population growth, the world needs to invest US$69.4t through 2035.

Chart 2: Infrastructure sector outlook

Source: McKinsey analysis, McKinsey Global Institute analysis, VanEck

- Despite the strong need for investment, mounting public debt (especially after the COVID-19 fiscal spend) in developed countries are fostering an environment which could see listed infrastructure equities thrive as governments ‘tighten their belts’ and private infrastructure companies gain greater investment opportunities off the public sector.

- An expanding middle class spurs on infrastructure investment in an effort to improve standards of living. Coupled with this, the clean energy transition is predicated on important infrastructure investment which is acting as a tailwind for the sector.

- Infrastructure also has a relatively low correlation with other asset classes, providing diversification benefits which has a place in a strategic asset allocation. See cross asset correlation below.

Table 3: Cross asset correlation

Source: Morningstar Direct, ten year correlation as at 31 July 2024. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged , Australian Bonds – Bloomberg AusBond Composite 0+ years, Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged AUD, A-REITs – S&P/ASX 200 A-REITs Index, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index

Key risks

An investment in our global infrastructure ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck FTSE Global Infrastructure (Hedged) ETF PDS and TMD for more details.

Published: 15 August 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

IFRA is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) and none of the Licensor Parties makes any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (‘Index’) upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to VanEck or to its clients. The Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein. All rights in the Index vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under licence.