An analysis of growth investing

Australian investors have been investing offshore for some time, and the rise of ETFs has increased the opportunity set, further opening the investment landscape. Investing internationally makes sense. The size of the ASX is less than 2% of total assets invested on exchanges globally as at the end of 2024, according to the World Federation of Exchanges. No investor should be missing out on 98% of opportunities. Some of these opportunities include companies like Microsoft, Netflix and Uber. These are all household names, but for Australian investors looking to access their growth, these investment propositions have not been readily available on the ASX.

At the end of last month, we launched our newest ETF, the VanEck MSCI International Growth ETF (GWTH).

Growth has been a hot topic among international equity investors since the GFC, as ‘growth’ companies outperformed ‘value’ companies after many decades of underperformance. It has also been identified as the go-to factor during the recent AI rally, which has continued in 2025 even after ‘liberation day’.

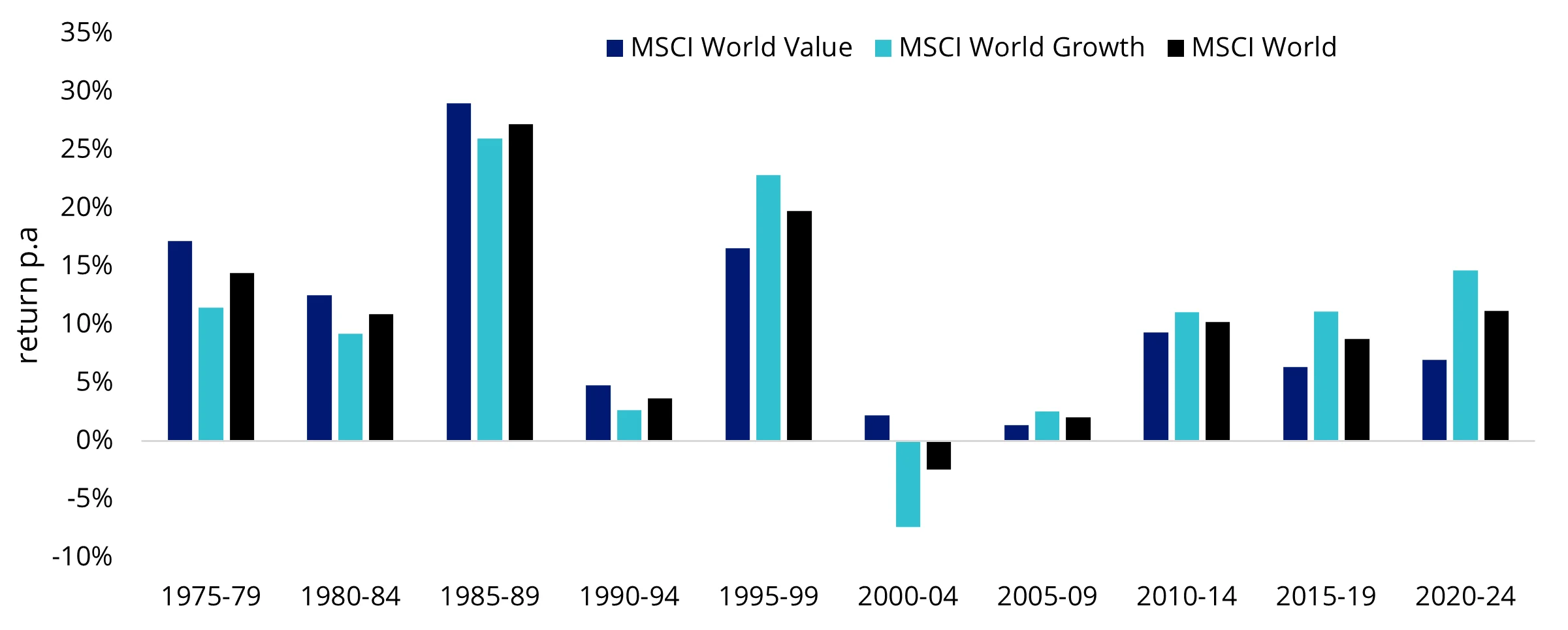

Chart 1: Since the GFC, growth has outperformed

Source: Bloomberg. You cannot invest in an index. Past performance is not indicative of future performance.

Traditionally, ‘growth’ has been the domain of active managers. These active managers aim to outperform the standard international equity index the MSCI World ex Australia Index (for ease of reading, we’ll refer to that index as the International Equity Index.

Investing with a skilful ‘growth’ active manager, who is selective and curates their portfolio, has been rewarding for investors, irrespective of the era. Growth investing focuses on identifying companies poised for rapid revenue and earnings expansion, often driven by innovation, market disruption or evolving consumer preferences.

Successful growth investors emphasise:

- Strong historical and future earnings growth

- Competitive advantage through innovation or market leadership

- Sustainable long-term growth trends rather than short-term valuations.

For a fraction of the costs of the typical active management fee, we think that it is possible to access the growth factor utilising a systematic, rules-based approach that targets outperformance.

Active management provides the key: selectivity.

VanEck has a distinguished history of harnessing technological advancement and advanced analysis to identify and unlock opportunities for Australian investors. For over a decade, we have pioneered smart beta ETF strategies in Australia, with a vast number of our smart beta ETFs being the first of their kind on the ASX, offering investors the ability to construct portfolios with a targeted outcome in mind.

It is with this mindset that we contemplated the growth factor and a selective, systematic approach.

The result is GWTH.

GWTH will invest in around 100 international companies that have been selected, according to MSCI, as being among the top companies based on:

- Long-term forward earnings-per-share (EPS) growth rate

- Short-term forward EPS growth rate

- Current internal growth rate

- Long-term historical EPS growth trend

- Long-term historical sales-per-share growth trend

GWTH is an ETF that allows investors to add a growth tilt to their portfolio, for passive fees. Importantly, it is a diversifier to the growth factor away from the over-held companies you may have in other ETFs or funds, with NVIDIA and Microsoft being the only ‘Magnificent-7’ companies currently included in the portfolio.

You can read more about growth investing - here

So, let’s walk through the difference between the GWTH and the International Equity Index.

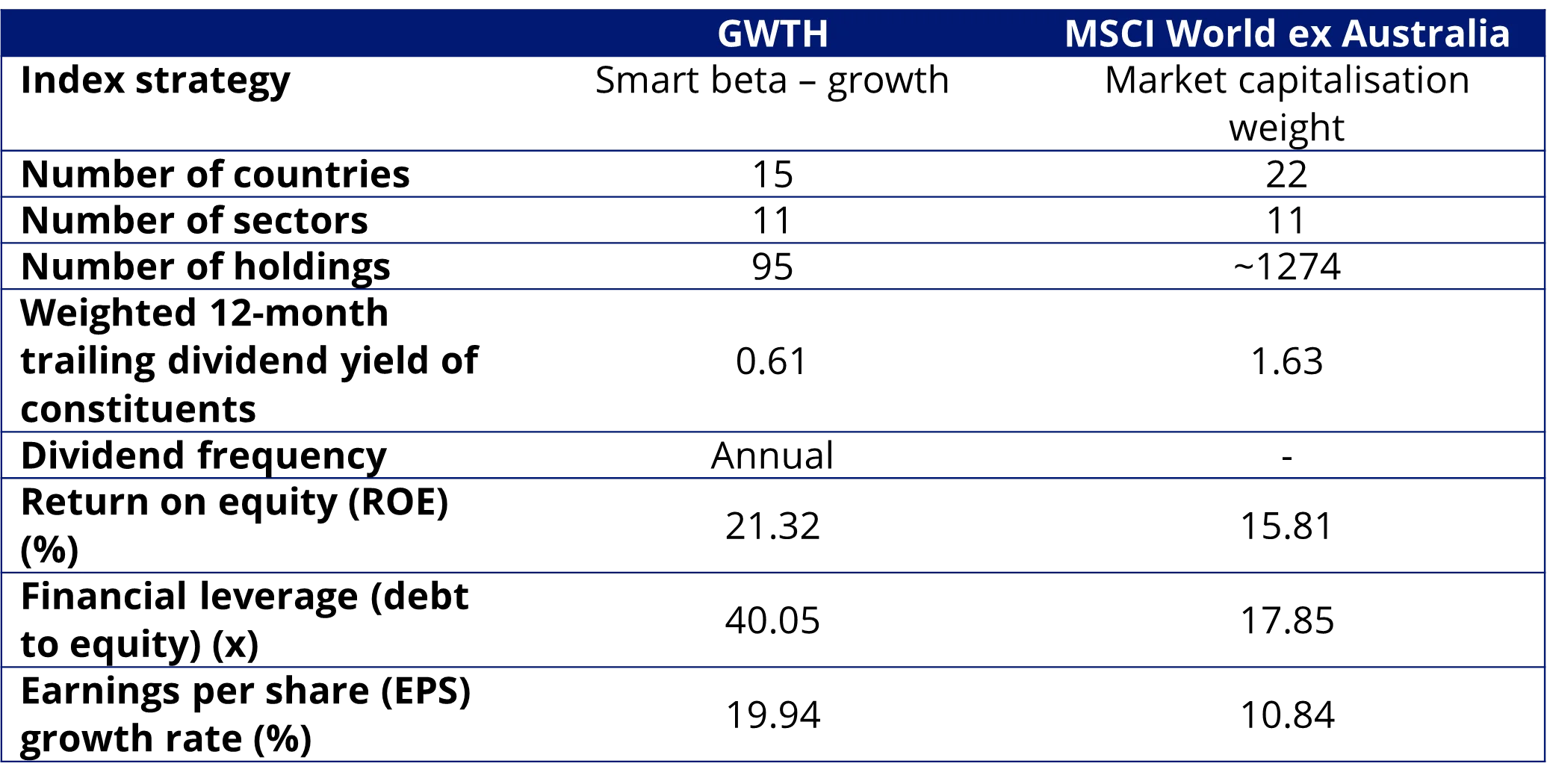

GWTH vs International Equity Index – Fundamentals

Table 1: Statistics and fundamentals

Source: VanEck, MSCI, FactSet, as at 31 August 2025. You cannot invest directly in an index. Past performance is not indicative of the current or future performance.

As you would expect, GWTH has higher ROE, higher debt to equity and a higher EPS growth rate.

GWTH vs International Equity Index - Top 10 holdings

Below you can see the top 10 companies. The top 10 holdings currently include companies that investors can relate to in their day-to-day lives – to see all the holdings in GWTH and their weightings click here.

Table 2: Top 10 holdings GWTH & Table 3: Top 10 MSCI World ex Australia Index

Source: FactSet, VanEck, MSCI, as at 31 August 2025. Add after this: Holdings and weights are subject to change without notice

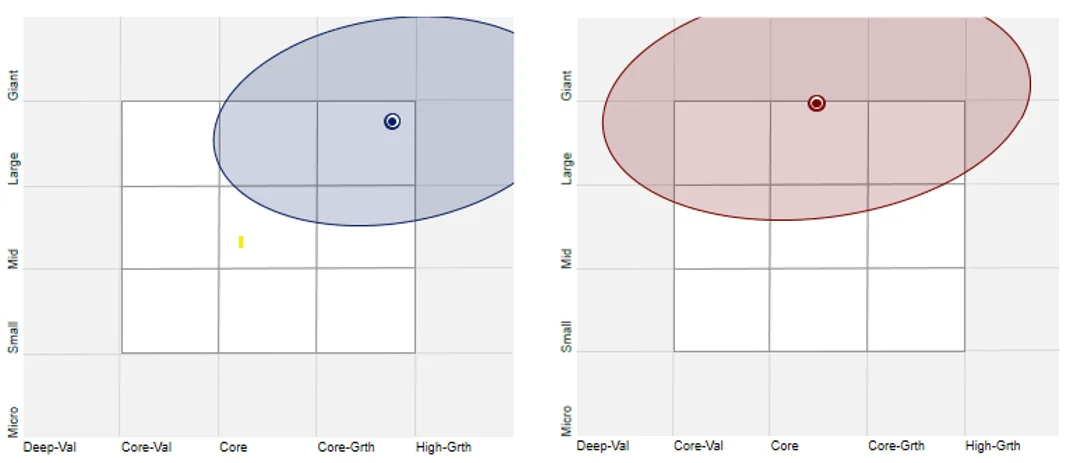

GWTH vs International Equity Index - Style

When considering portfolios, it is important to determine what style, e.g. value or growth, and what size bias a portfolio holds, e.g. giant, large, mid or small. Below we can see GWTH’s. As you would expect from a growth-focused strategy, GWTH holds giant companies with a growth orientation relative to the International Equity Index.

Chart 2: GWTH holdings based style map & Chart 3: MSCI World ex Australia Index holdings based style map

Source: Morningstar Direct, as at 31 August 2025

Using GWTH in a portfolio

We recently wrote a blog on using GWTH in a portfolio – click here

A recent Vector Insights also covered the topic of growth investing – click here

To quote that piece, “Exposure to the growth factor can turbocharge your portfolio, but it can also weigh it down. It’s worth understanding the fundamentals and companies that will make it move.”

While many international equity ETFs have merits for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker.

For further information you can contact us at +61 2 8038 3300.

Key risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS and TMD for more details.

GWTH is likely to be appropriate for a consumer who is seeking capital growth, is intending to use the product as a major, core, minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years; and has a high risk/return profile. show less

Published: 05 September 2025