The mighty smalls are on sale

Global equity markets have been on a “tariff rollercoaster”1recently. Since US Treasury Secretary Bessent's comment about “unsustainable tariffs” on 22 April 2025, a mass unwinding of tariff hedges has been triggered, sparking a relief rally across risk assets. To the end of May, global quality small caps, as represented by the MSCI World ex Australia Small Cap Quality 150 Index (QSML Index), have been a stand-out since Tariff Liberation Day in early April and since Bessent’s comment.

Chart 1: Global quality small caps outperformed since the Tariff Liberation Day

Source: VanEck. Bloomberg. Data as at 27 May 2025. Performance in AUD. QSML Index is MSCI World ex Australia Small Cap Quality 150 Index. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Stars aligning for further pullback of US tariff aggression

While equity market volatility is likely to remain elevated until the tariff dust settles, a number of factors reinforce our confidence in a further pullback of US tariff policy. This could provide support, or at least lower barriers for, growth-oriented equity segments.

- Looming US fiscal deficit limits the margin of error for policy making. With outstanding Federal debt above US$36 trillion, the debt-to-GDP ratio lingering around 124%, and long-term bond yields at multi-year highs, it has become increasingly expensive for the US to service existing liabilities. The world’s largest economy is in dire need of a speedy resolution to its global trade disputes to keep control of imported inflation and sustain demand for US Treasuries. This may mean a marked departure from its current stick-and-carrot approach.

- Escalating stagflation fear felt by the US consumers. In April, the University of Michigan’s surveys showed that US consumers were expecting inflation to reach 7% in 12 months (more than double the current level), while sentiment reached a 3-year low. This creates significant political pressure to alleviate cost-push forces like tariffs.

- A structural decline in global confidence about US exceptionalism. Global central banks and policymakers are openly diversifying away from the US As global de-dollarisation and US-asset diversification continues to direct government investment decisions, the US is having to rethink the appropriate trade policy to avoid excessive capital outflows and depreciation of asset valuations.

Global small caps remain one of few segments on sale

Tariff tensions easing is somewhat of a two-edged sword. While market exuberance has clearly re-emerged over the month of May, helped by a resilient S&P 500 earnings season, the sharp rebound has led to a rapid repricing of equity valuations, which has pushed most segments well above long-term averages, thereby compressing further upside potential and increasing the risk of a pullback.

Against this backdrop, global small caps remain one of the few areas still trading at meaningful discounts relative to historical averages.

Chart 2: Valuations of global small-cap equities remain compelling

Source: VanEck. Bloomberg. MSCI World Sector and Style Indices. Data as at 30 April 2025.

Assuming the worst of tariff risk is behind us, global small-cap valuations could increase towards long-term averages. For investors seeking relative value opportunities, this relative value dynamic presents an attractive entry point. Historically, global small caps typically outperform during periods of prolonged market rallies.

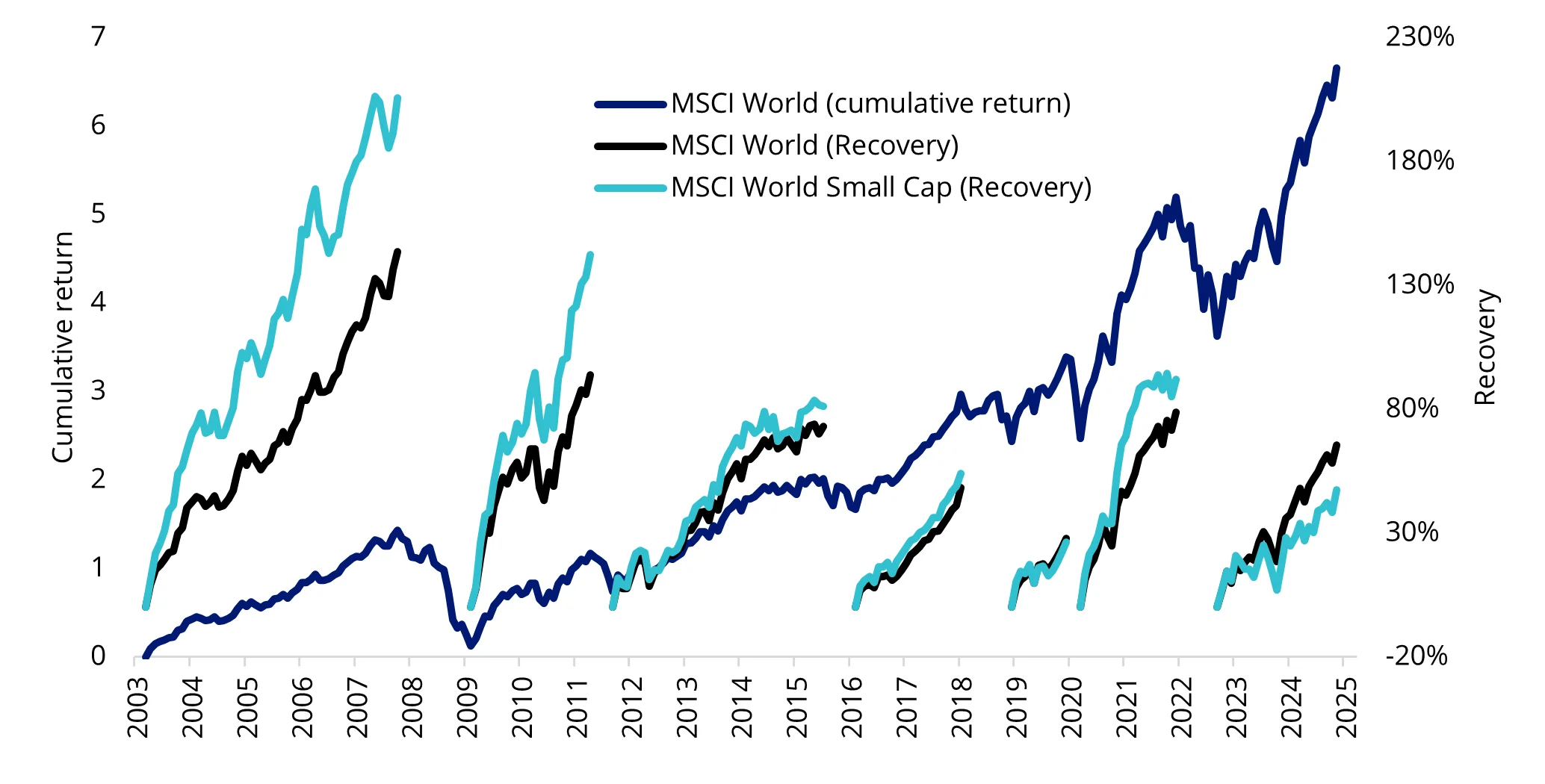

Chart 3: Global small caps typically outperform during prolonged market rallies

Source: VanEck. Bloomberg. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

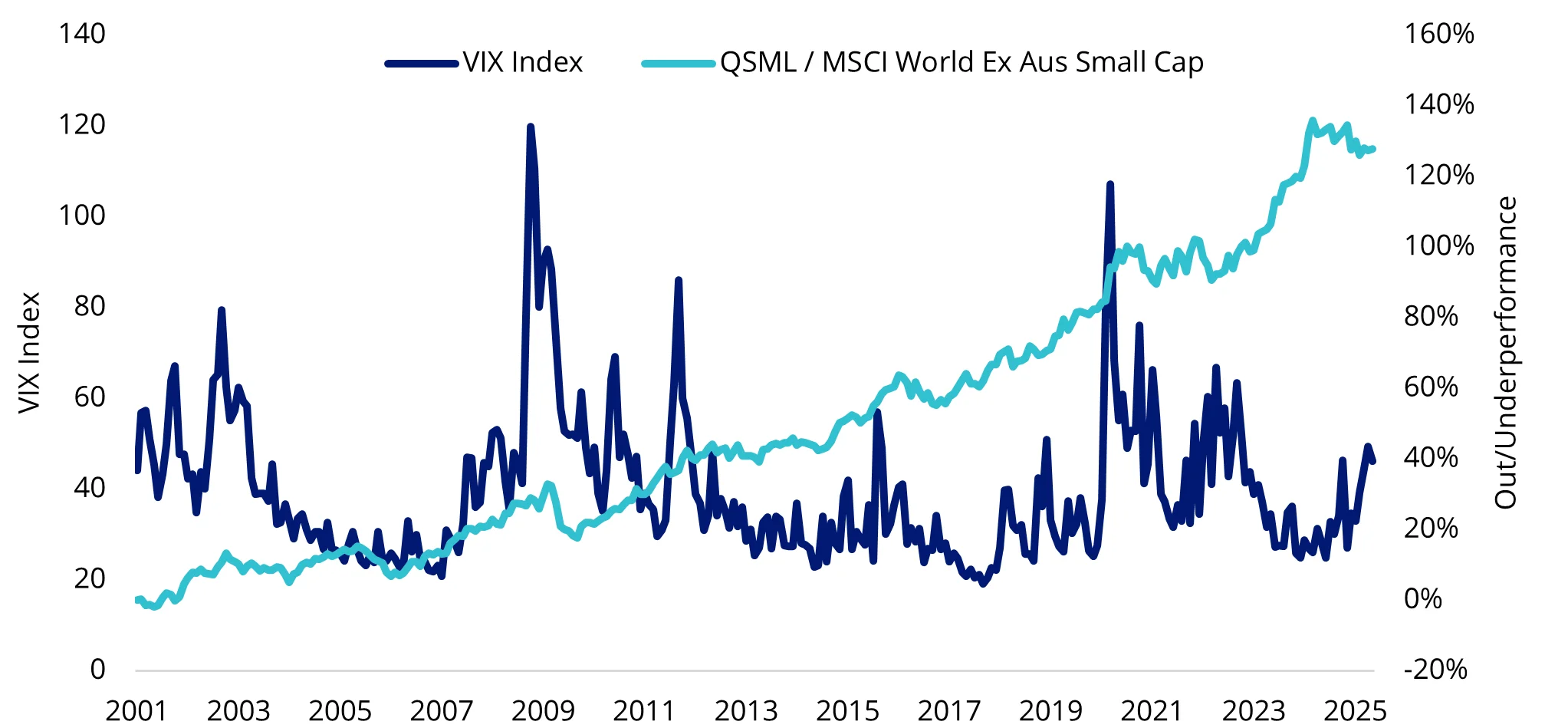

Quality is key

With small companies investing, it pays to be prudent. The MSCI World ex Australia Small Cap Index includes over 4,000 companies, however many of these are not profitable, highly leveraged and have weak balance sheets. Quality is a factor approach that targets companies with a high return on equity (ROE), low debt and stable earnings – a strategy that has historically outperformed most during a contraction and subsequent recovery, thus earning it a reputation as being a ‘defensive factor’.

While we always point out that past performance cannot be relied upon for future performance, the VanEck MSCI International Small Companies Quality ETF (QSML) may be used by investors looking to take advantage of a global recovery in a slow growth environment/post-recession environment while seeking valuation dislocations. An AUD-hedged version is also available.

Chart 4: Quality small-cap companies have historically outperformed amid volatile times

Source: VanEck. Bloomberg. QSML is MSCI World ex Australia Small Cap Quality 150 Index. Data as at end of May 2025. Performance in AUD. Index performance is not illustrative of fund performance. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck MSCI International Small Companies Quality ETF PDS and TMD for more details.

Source

Published: 11 June 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.