Move over Mag 7, say hello to the Titan 5

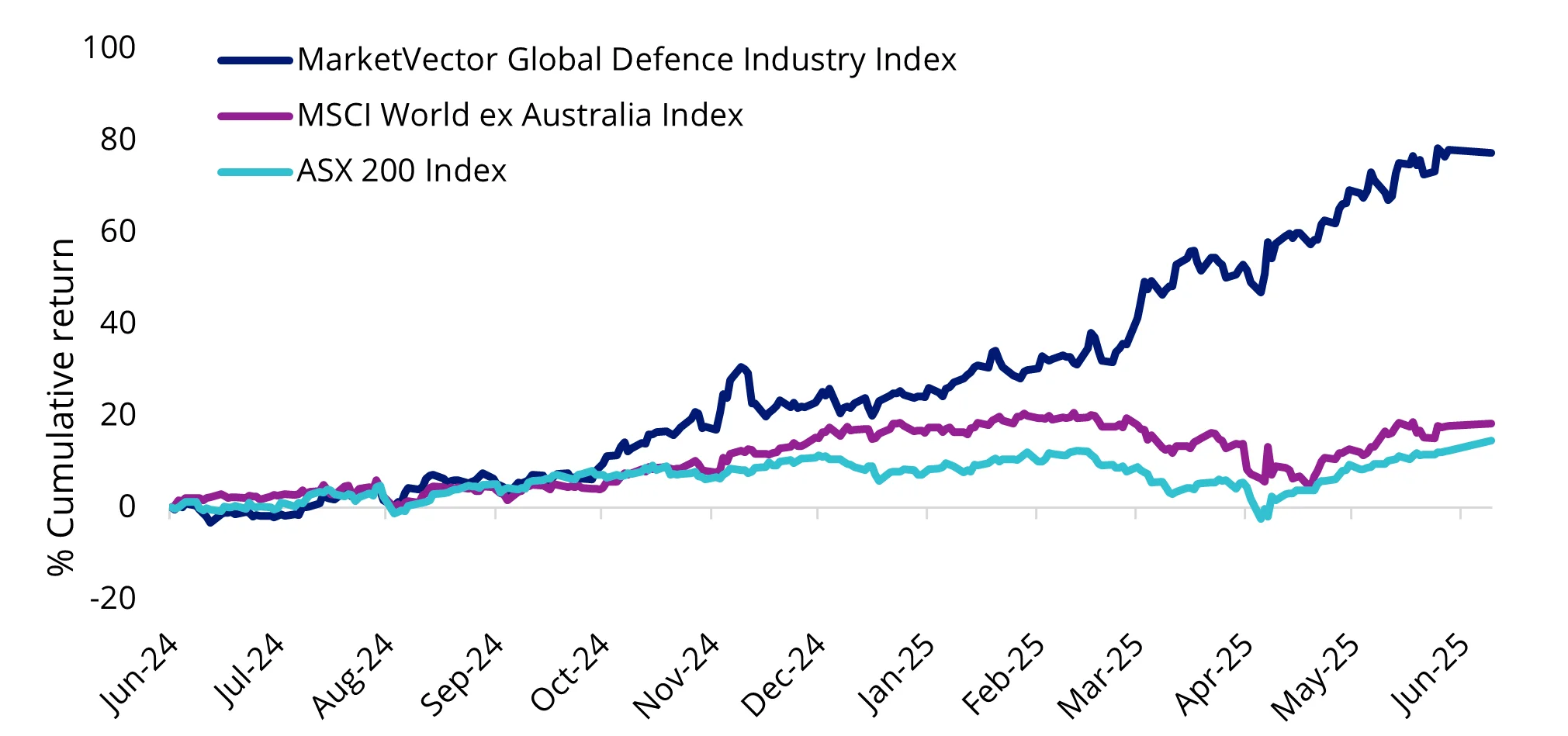

The performance of global defence equities over the last year has taken many industry pundits by surprise. As at 11 June 2025, defence stocks (represented by the MarketVector Global Defence Industry index) returned 79.73% over 12 months, surpassing bitcoin (61.91%) and gold (44.80%) as the best-performing market.

Given the sharp rally experienced by global defence stocks to date, the natural assumption is that further headroom would be limited. We highlight three reasons why we consider the defence sector as well-positioned to continue its epic momentum as it benefits from secular tailwinds.

Chart 1: Global defence equities saw strong outperformance in the last 12 months

Source: VanEck. Bloomberg. Data as at 11 June 2025. Performance in AUD. You cannot invest directly in an index. Past performance of the MarketVector Global Defence Industry Index (‘Index’) is not a reliable indicator of the current or future performance of DFND which aims to track the index.

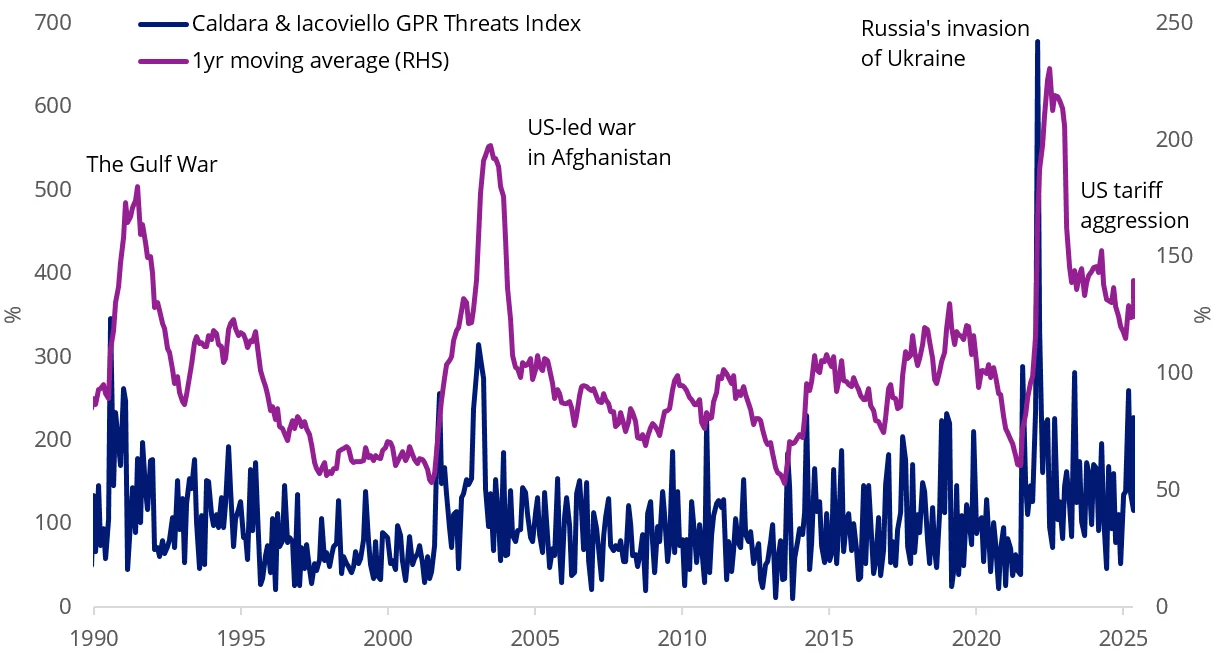

1. Geopolitical risks set to be elevated for longer term

Historically, spikes in geopolitical risk due to cross-border conflict have typically taken time to normalise. Furthermore, every major geopolitical shock appears to set a higher baseline for geopolitical threats. As demonstrated in the chart below, the long-term average level of geopolitical risk rises after each geopolitical event. What does this mean for investors today? We are in an age of elevated long-term geopolitical risk amid the Russia-Ukraine conflict, Middle East tensions, India-Pakistan attacks, and US tariff aggression, which will necessitate ongoing increases to defence spending for countries to maintain national security.

Chart 2: Global geopolitical risk resets to higher “baseline” after each shock

Source: VanEck. Bloomberg. Data as at 11 June 2025. GPR is compiled by Fed economists Dario Caldara and Matteo Iacoviello. It measures the occurrence of impactful geopolitical events/threats/conflicts since 1985 by counting the keywords used in the press.

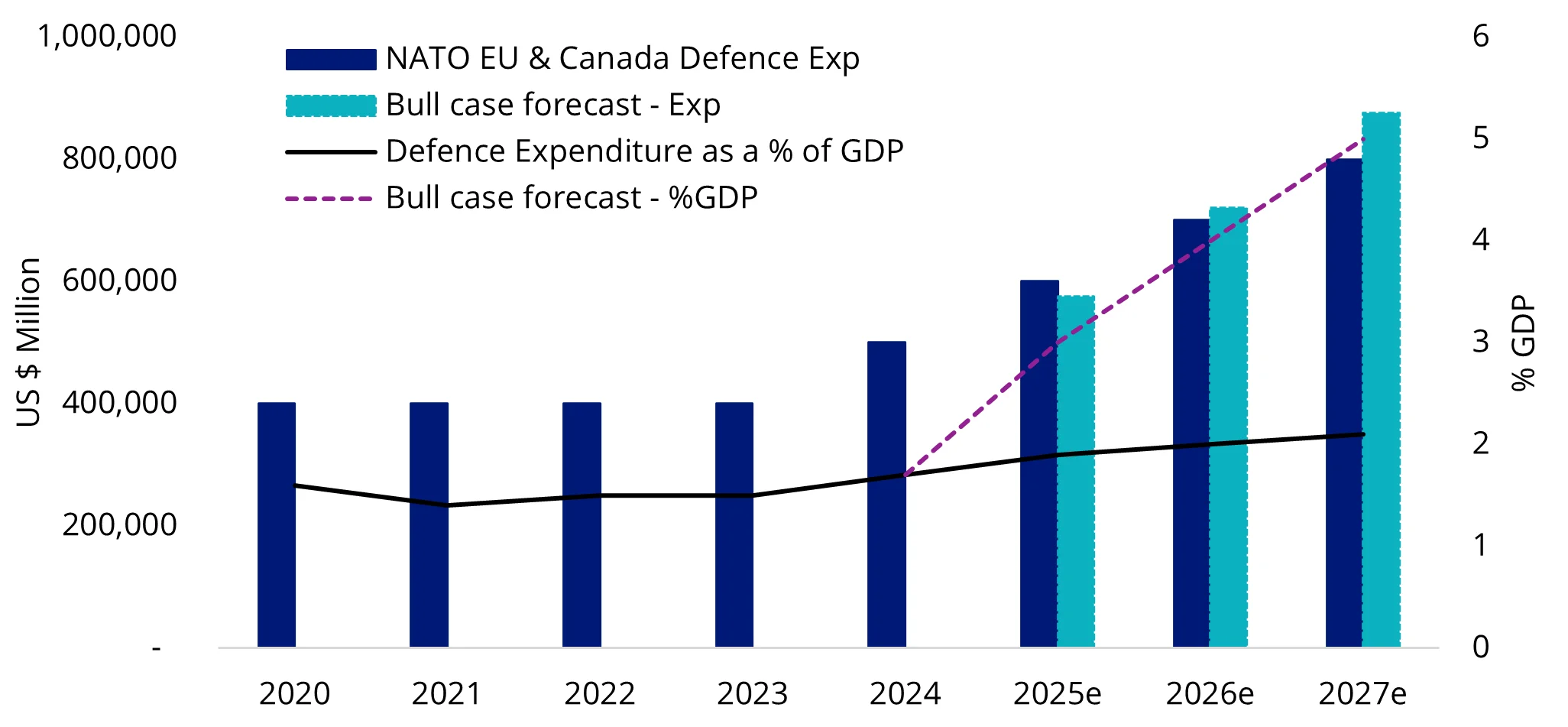

2. From the US to Europe: once-in-a-generation uplift in defence investment

To position for a structural lift of geopolitical risk, major developed economies, especially NATO ex-US countries, have shifted focus to national security and defence investment. This has sparked a generational increase in defence budgets. As of early 2025, 23 out of 32 members have met NATO’s 2%-to-GDP defence budget minimum target.

While the EU’s post-2024 deficit rules have put pressure on many discretionary programmes, defence remains largely insulated, with Brussels allowing NATO-related spending to qualify for “exceptional-circumstance” treatment under its new Stability Act. These carve-outs mean the multi-year defence budgets already on the table are unlikely to be pared back, even if broader fiscal belt-tightening resumes.

Looking ahead, incoming NATO leadership is signalling an increase to minimum defence spending to “well-above 3%,” while the Trump administration is urging a 5%-to-GDP target for all NATO members. These narrative tilts are only showing a tip of the iceberg for the new world of global protectionism, providing long-term support for European defence companies. For example, Hensoldt AG, a German-based company that produces military-grade sensors, saw a 185.43% increase year-to-date (as at 11 June 2025). Thales, a French company that manufactures military aircraft, gained 93.40% over the same period.

Chart 3: Ex-US developed markets step up defence spending

Source: VanEck. Euromonitor, NATO, Morgan Stanley Research. E = Morgan Stanley Research estimates (March 2025).

As a knock-on effect, defence companies in neutral-positioned Asian hubs, such as South Korea’s Hanwha Aerospace Co, have benefited from Europe’s once-in-a-generation defence spending spree. Hanwha is a leader in the Korean aerospace industry, and has gained 189.11% in 2025 so far (as at 11 June 2025).

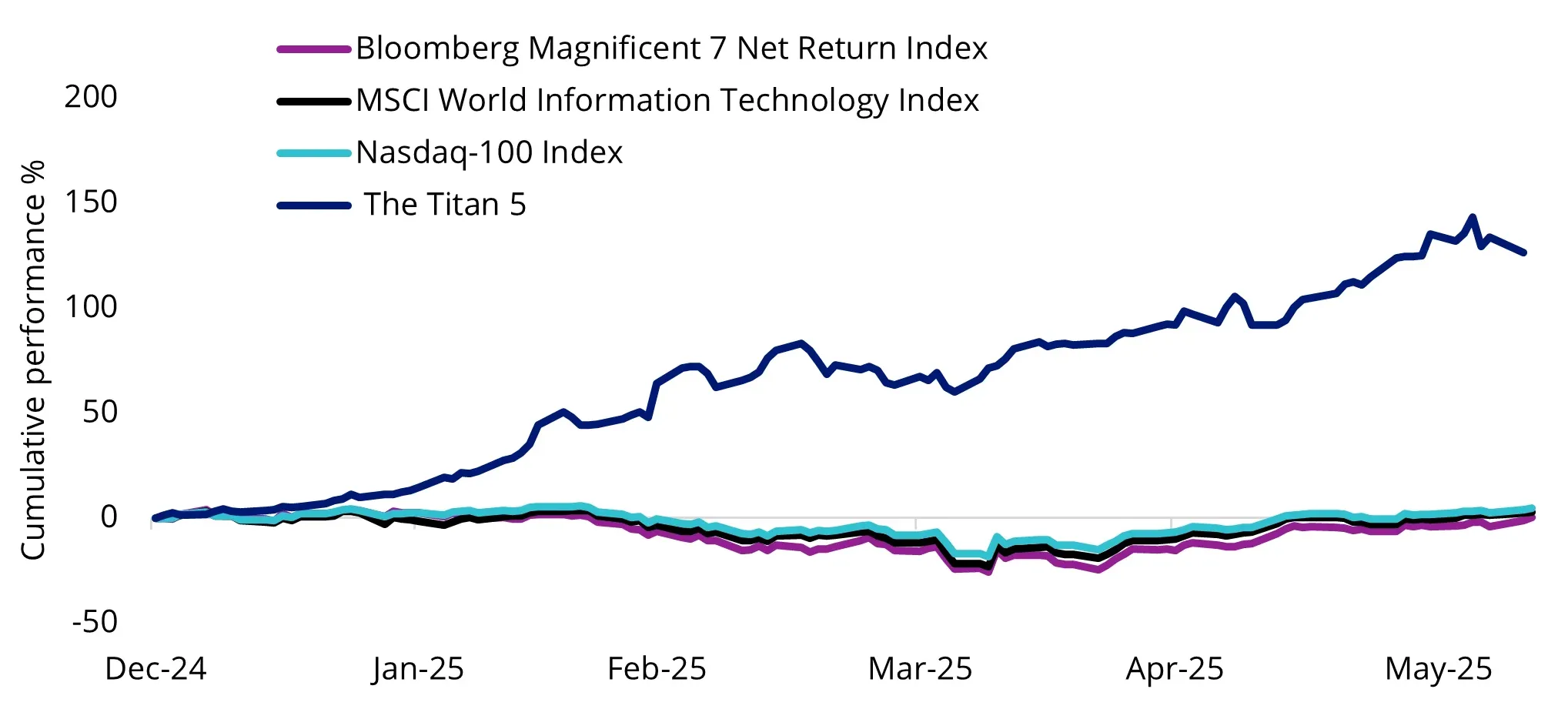

3. AI revolution injects fresh growth driver into defence sector

While “defence companies” have often been associated with businesses that produce military hardware such as tanks, artillery and drones, we highlight the importance and upside potential of defence software, which has received a fresh boost of mission-critical intelligence thanks to AI. Escalating geopolitical tension has significantly increased the strategic importance of next-gen cybersecurity innovation in traditional national surveillance systems such as satellites, government cybersecurity networks, radar, and sonar systems. The support and maintenance services required to keep these running and up to date has always extended the shelf-life of government defence contracts well beyond the initial delivery of hardware, and the additional data processing and resources requirements of AI-powered systems is likely to extend the quantum, longevity and valuations of these contracts even further.

Benefiting from these tailwinds, a handful of leading defence companies have seen triple-digit growth over the last 12 months, namely US-based Palantir Technologies, South Korea-based Hanwha Aerospace, Italy-based Leonardo Spa, Germany-based Hensoldt AG, and British company Babcock International. We refer to these stocks as the “Titan 5”: a cabal of lesser-known global defence stocks that have boomed in the face of broader sharemarket weakness to the tune of 126.31% for the year to date (as at 11 June 2025). This growth significantly outpaced the tech-heavy Nasdaq Index and the once unbeatable 'Magnificent 7,' which returned -0.99% and -7.03% year-to-date as at 11 June 2025.

Chart 4: Defence technology outpaces the “Mag 7” and broader tech industry

Source: VanEck. Bloomberg. Data as of 11 June 2025. The Titan 5 is represented by Palantir Technologies Inc, Hanwha Aerospace, Babcock International Group, Leonardo Spa, and Hensoldt AG. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Accessing the growth story of the global defence sector

For investors seeking access to global defence stocks, the VanEck Global Defence ETF (DFND) offers targeted, pure play exposure to the largest global companies in this segment – which are typically under-represented in broad-based benchmarks. DFND has returned 67.67% since inception on 10 September 2024 (as at 11 June 2025), noting that this is over a short time period, and past performance is not a reliable indicator of future performance.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the DFND PDS and TMD for more details on risk.

Published: 13 June 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.