The silver linings playbook

Volatility brings discomfort, but also clarity and opportunities. Three asset classes offer relative value and rerating potential.

For years, equity valuations looked stretched as the world embraced the narrative of US exceptionalism1. However, non-stop tariff shocks since Trump returned to the White House have forced investors to navigate a new playbook of globalised protectionism2. In this new regime, there is no more ‘free lunch’ for what were once considered “safe” assets, particularly for US equities.

While market resets are never easy, they can be a necessary evil following a period of inflated asset prices, as they help to bring prices down to more realistic valuations. As investors reassess the relative value dynamics, three international equity sectors start to look more appealing:

- Global small caps

- Global value equities

- Global listed private credit

Small caps offer big discounts

Historically, small-cap companies have demonstrated higher risk-return profiles and are often among the first to endure selloffs during periods of market stress. This creates valuation dislocations for investors seeking relative value opportunities. With the Trump administration now gradually winding back its tariff threats, near-term market volatility could stabilise. Global small-cap stocks, which are trading at reasonable valuation levels, may be well positioned to outperform in the coming months.

With small companies investing, it pays to be prudent. The MSCI World ex Australia Small Cap Index includes over 4,000 companies, many of which are not profitable, highly leveraged and have weak balance sheets. Quality is a factor approach that considers balance sheet strength, so investors may benefit from being selective in global small companies by taking a ‘quality’ approach. Quality small-cap companies with healthy balance sheets and stable earnings have historically proven to be more resilient against a backdrop of heightened volatility.

For investors who prefer a risk-aware approach while seeking valuation dislocations. The VanEck MSCI International Small Companies Quality ETF (QSML) provides a smart way to gain exposure. An AUD-hedged version of this fund is also available.

Chart 1: Valuations of global small-cap equities are lower than historical average levels

Source: Bloomberg. Small Caps as MSCI World Small Caps. 15 April 2014 to 15 April 2025. MSCI World is the MSCI World Index. Price to 12-month forward earnings is calculated by dividing the current share price by the projected earnings per share over the next year. It serves as a forward-looking valuation metric, helping investors assess how much they’re paying today for expected future earnings.

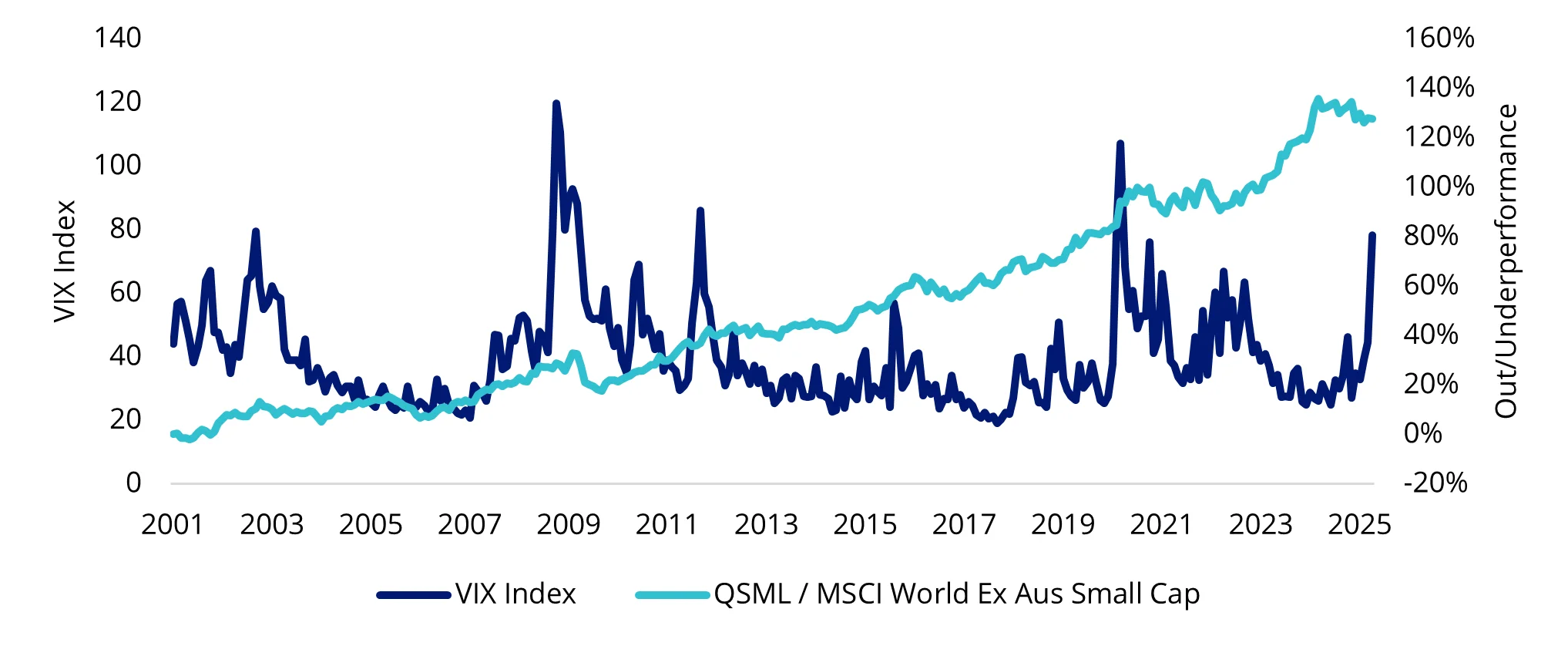

Chart 2: Quality small-cap companies have historically outperformed amid volatile times

Source: VanEck. Bloomberg. QSML is MSCI World ex Australia Small Cap Quality 150 Index. Data as at April 2025. Performance in AUD. Index performance is not illustrative of fund performance. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Value equities back in play

With growth companies dominating equity markets for the past decade, many investors have overlooked value strategies – the very approach Warren Buffett used to build his wealth empire. In his words, “the three most important words in investing are ‘margin of safety’.” Margin of safety refers to the difference between the intrinsic value of an investment and the price an investor pays for it.

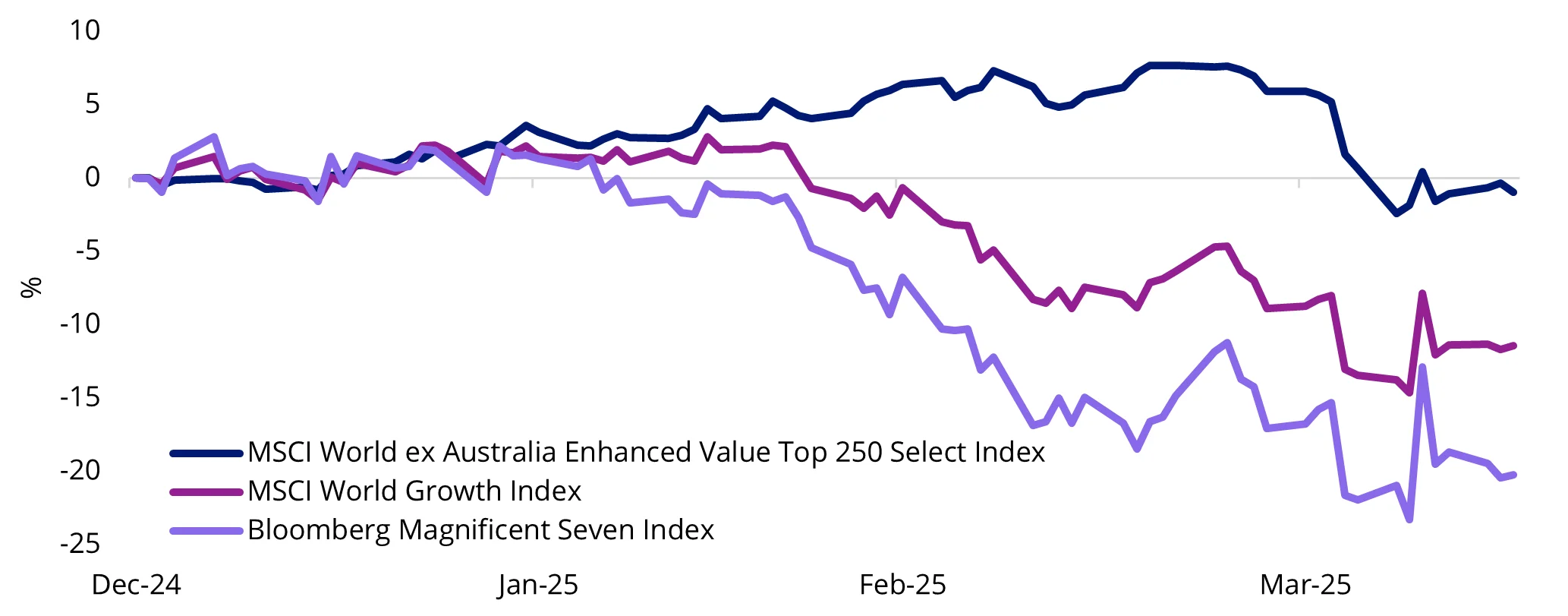

Buffett’s mantra has been gaining attention again since the start of the year, where global value equities (proxied by MSCI World ex Australia Enhanced Value Top 250 Select Index) have outperformed their growth counterparts (proxied by MSCI World Growth Index) by a whopping 13% (as at 16 April).

Chart 3: Value equities outperformed their growth counterparts

Source: VanEck. Bloomberg. Performance in AUD. Data as at 15 April 2025. Index performance is not illustrative of fund performance. You cannot invest directly in an index.

Historically, value has typically outperformed following market stress events, which tend to disproportionately impact growth companies with rich valuation premiums. Notable examples include:

- Post dot-com bubble burst (Jan 2000 to Dec 2006): value outperformed growth by 59.65%.3

- Post GFC (Mar 2009 to Mar 2010): value outperformed growth by 5.75%.

- Post COVID (Sep 2020 to June 2021): enhanced value outperformed growth by 11.42%.

Furthermore, after years of growth dominance, global value equities are trading at record discount levels, offering further headroom for a recovery.

For investors seeking exposures to quality value companies, the VanEck MSCI International Value ETF (VLUE) offers a portfolio of international companies that are selected for their high value score relative to sector peers as measured by MSCI based on: (i) price to book value; (ii) price to forward earnings; and (iii) enterprise value to cash flow from operations. A AUD-hedged version of this fund is also available.

Listed global private credit on sale

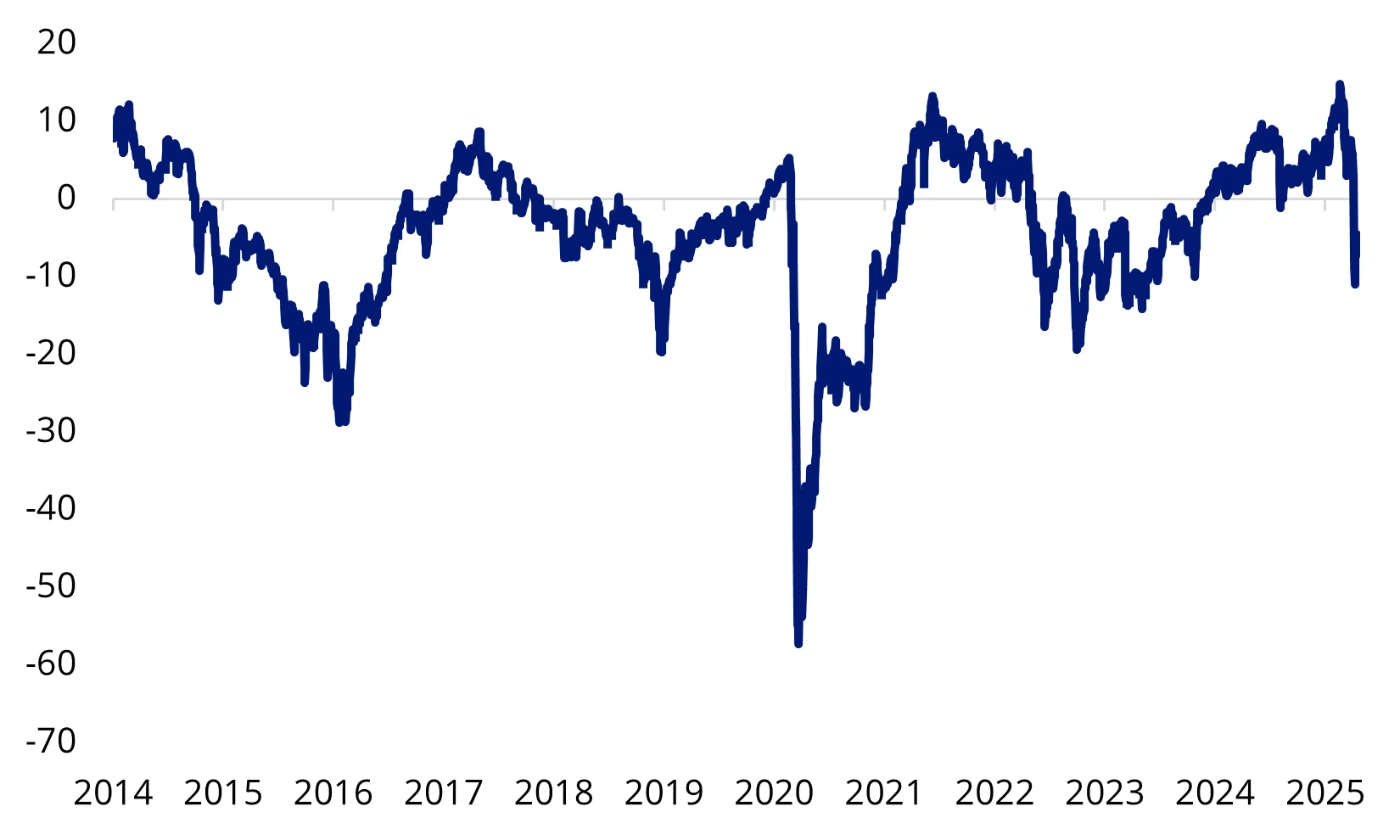

Volatility causes discomfort, but also provides valuable windows for repricing, and thereafter creates opportunities for entry. The chart below highlights that, after the cross-asset turmoil triggered by Trump’s tariff aggression, listed private credit has been ‘on sale’ for the first time since December 2023, trading at a circa 5% discount to book value and 10.50% dividend yield. Over the coming months, as markets continue to adapt to the new global trade playbook, listed private credit prices may recover.

Chart 4: Listed Global Private Credit Premium/Discount to Net Asset Value (NAV)

Source: VanEck. Bloomberg. DLX Direct Lending Net Asset Value Premium/Discount Index. Data as at 15 April. Performance in AUD.

The VanEck Global Listed Private Credit (AUD Hedged) ETF (LEND) provides access to a portfolio of 25 of the largest listed companies involved in private credit. For investors seeking a smarter way to access opportunities in the private market without locking up capital, LEND offers a timely entry point into a space where fundamentals appear compelling.

Key risks

An investment in QSML, VLUE or LEND carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS and TMD for more details.

Source

1VanEck Quarterly ViewPointTM- Priced to perfection January 2025

2VanEck Quarterly ViewPointTM- Tariff turbulence April 2025

3Due to data availability MSCI World Value Index was used to represent value stocks.

Published: 01 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QSML and VLUE are indexed to MSCI indices. QSML and VLUE are not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML, the MSCI World ex Australia Small Cap Quality 150 Index, VLUE or the MSCI World ex Australia Enhanced Value Top 250 Select Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck, QSML and VLUE.

LPX and LPX Listed Private Credit AUD Hedged Index are registered trademarks of LPX AG, Zurich, Switzerland. The LPX Listed Private Credit AUD Hedged Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.