Evaluating valuations in quality small caps

Often companies exhibiting the characteristics of the ‘quality’ factor, being strong balance sheet, stable earnings and low leverage, are expensive as many investors seek these companies, subsequently driving up their prices.

This played out last year, as many investors braced for an economic slowdown, some companies have been more desirable for many investors and large cap, quality companies, did relatively well. For many large-caps, this has pushed valuations higher.

A different story is playing out in the quality small cap space.

The potential of global small-cap companies, in particular, ‘quality’ global small-cap companies, we think, has been overlooked by many Australian investors and we think investors positioning for an eventual recovery may do well to consider quality small companies. The VanEck MSCI International Small Companies Quality ETF (QSML), which we affectionately call ‘Baby QUAL’, harvests the Quality factor, like VanEck’s International Quality ETF (QUAL), but QSML selects its companies from the international small-cap universe.

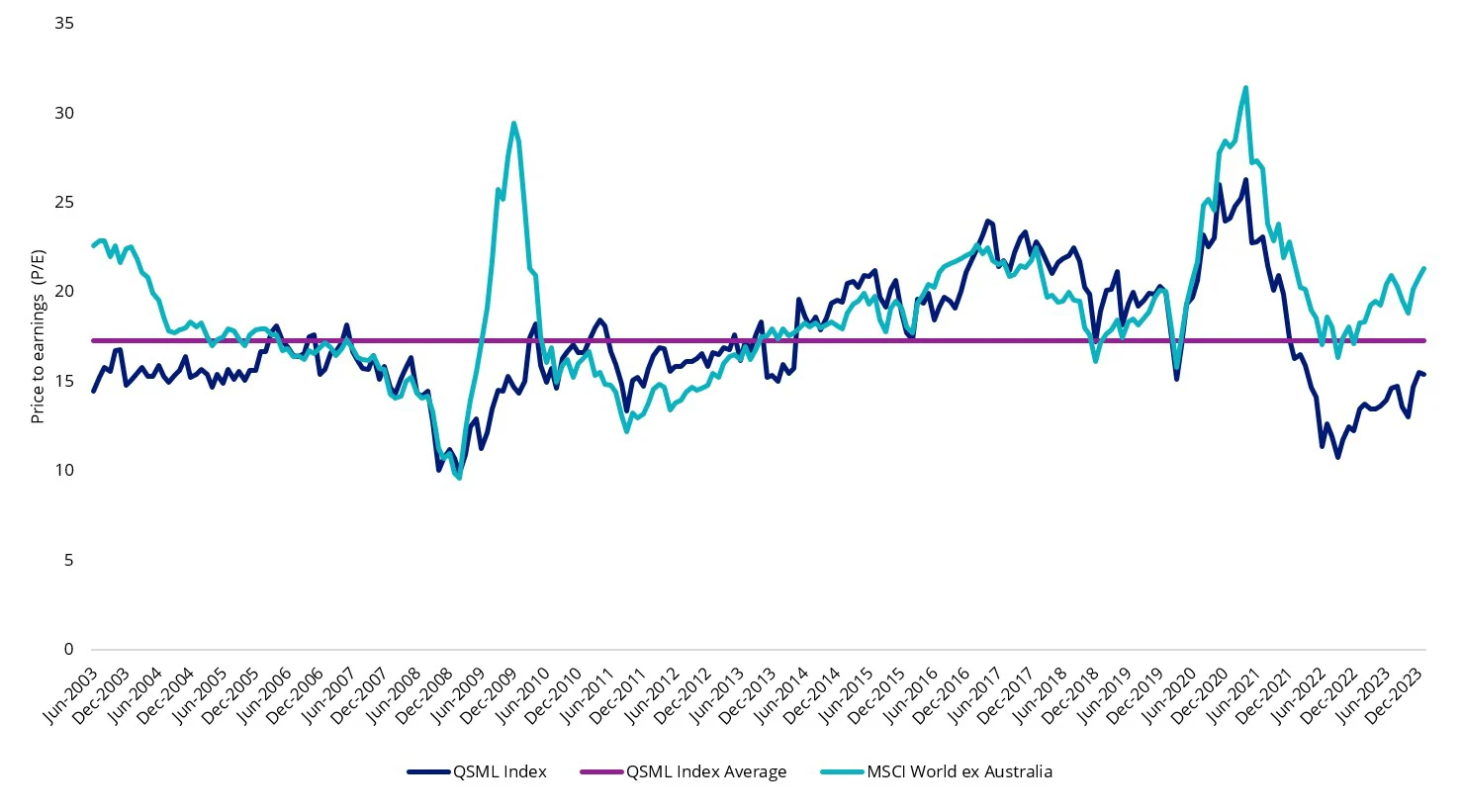

Quality small companies are trading at historically low levels

During the 2022 equity market sell-off, quality small companies were sold off more than large companies. Traditionally, after such a dislocation, quality small companies’ rally and valuations tend to move closer together. This happened after the GFC. After the dot-com crash, the recovery of small-cap valuations took a bit longer. You can see this in the chart below. What is also evident in the chart below is that the 2022 dislocation has not yet normalised, so quality global small-cap companies may present a compelling relative value opportunity. In addition, valuations for quality global small companies remain below historical averages.

Chart 1: Price to equity (P/E) of quality global small companies (QSML) and the large-cap MSCI World ex Australia Index

Source: FactSet, as at 31 January 2024. QSML index is the MSCI World ex Australia Small Cap Quality 150 Index.

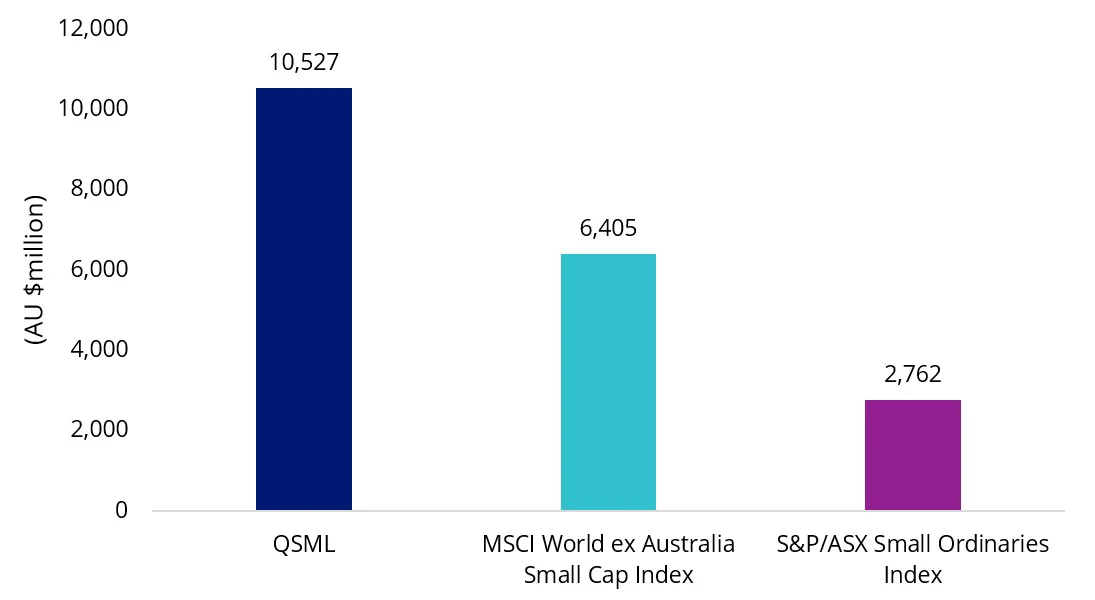

The world is far bigger than the ‘Small Ords’Australian advisers and their clients are no strangers to small companies. Most portfolios include an allocation to Australian small companies. But the world is far bigger than the ‘Small Ords’. The international small-cap universe presents over 4,000 companies and, as size is a relative term, many of these companies are not small by Australian standards.

Local investors might be surprised to learn that international small-caps, in the context of market size, would be characterised as mid-caps in Australia when measured by market capitalisation, and there are a lot more of them, therefore there are more opportunities. Like in Australia, it pays to be prudent in investing in international small-cap companies and right now, valuations are compelling, relative to large-cap companies. The potential of global small-cap companies, in particular, ‘quality’ global small-cap companies has been overlooked by many Australian investors.

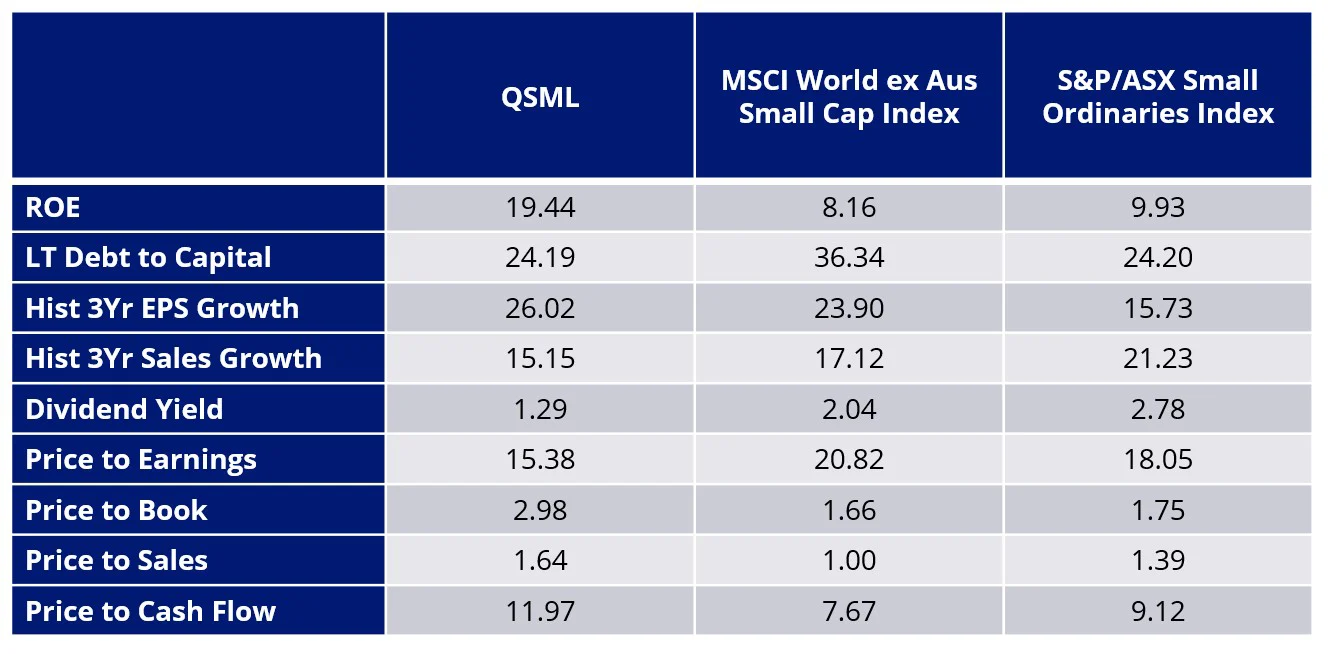

Relative to the small companies benchmarks, quality global small caps, as represented by VanEck’s International Small Companies Quality ETF (QSML), exhibit considerably higher return on equity and they tend to skew larger.

Table 1: Attractive fundamentals relative to benchmarks

Source: FactSet, MSCI, as at 31 January 2024. Past performance is not indicative of future performance.

Chart 2: QSML has a ‘larger’ cap bias - Weighted average market cap

Source: FactSet, MSCI, as at 31 January 2024

We have written in the past that international quality small companies outperform its international small-cap index, and in turn, that international small companies index outperforms the S&P/ASX Small Ordinaries Index.

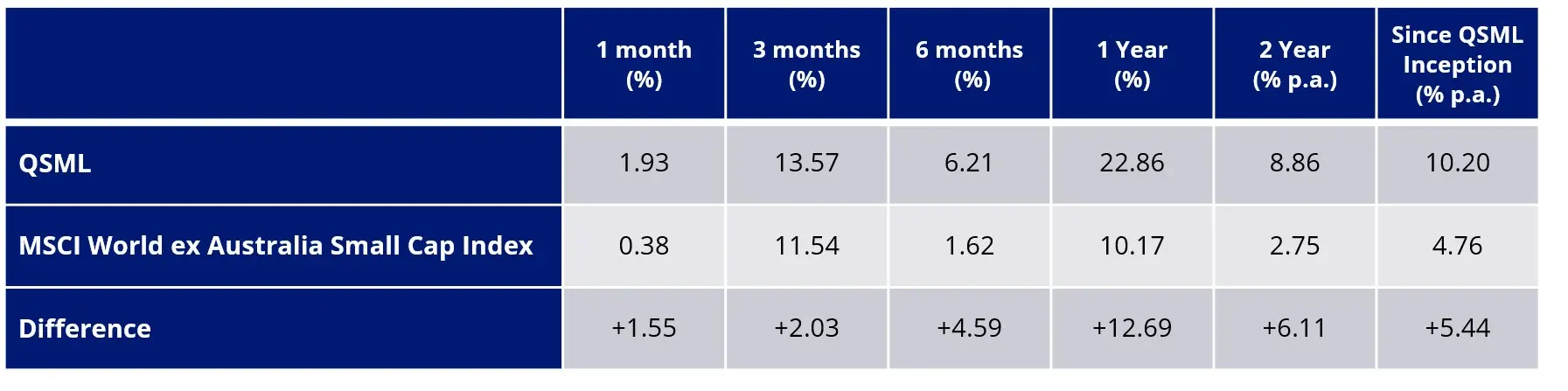

A way Australian investors can access quality small companies is via the VanEck MSCI International Small Companies Quality ETF (QSML). Since its inception, QSML has been outperforming the market benchmark index for international small-cap companies, the MSCI World ex Australia Small Cap Index. It is worth noting that past performance is by no means a reliable indicator of future performance.

Table 2: Trailing returns as at 31 January 2024: QSML vs MSCI World ex Australia Small Cap Index

Source: VanEck, Morningstar. Past performance is not a reliable indicator of future performance. QSML results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. QSML inception date is 8 March 2021 and a copy of the factsheet is here. The MSCI World ex Australia Small Cap Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market small companies, weighted by market cap.

Learn more about QSML, the most cost-effective smart beta (and for that matter active) international small companies strategy on ASX.

Published: 16 February 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QSML is indexed to an MSCI index. QSML is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML, or the MSCI World ex Australia Small Cap Quality 150 Index. The QSML PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QSML.