Moneyball, The Big Short and overcoming the flaws in human judgment

Lessons from Moneyball and The Big Short reveal limitations in human judgment. Explore how investors can overcome similar pitfalls.

Technology is unlocking new ways to invest.

Moneyball

For those unfamiliar, Moneyball is a movie starring Brad Pitt, Jonah Hill, Philip Seymour Hoffman, Robin Wright and Chris Pratt. It is a sports drama about the 2002 Oakland A's season and, at the time, the unique way general manager Billy Beane assembled a competitive baseball team on a limited budget using statistical analysis (sabermetrics).

The film is based on Michael Lewis’s book (of The Big Short fame), and it shows how statistical analysis and perseverance can challenge traditional thinking and help achieve success against the odds.

At the start of the 2002 baseball season, the richest team, the New York Yankees, had a payroll of US$126 million. The Oakland A’s had less than a third of that, about US$40 million.

By the end of the season, the A’s had won 103 games, the same as the Yankees. Put another way, the Yankees paid US$1.2 million for each victory, while each win cost the A’s just over US$388,000.

How was the A’s success achieved?

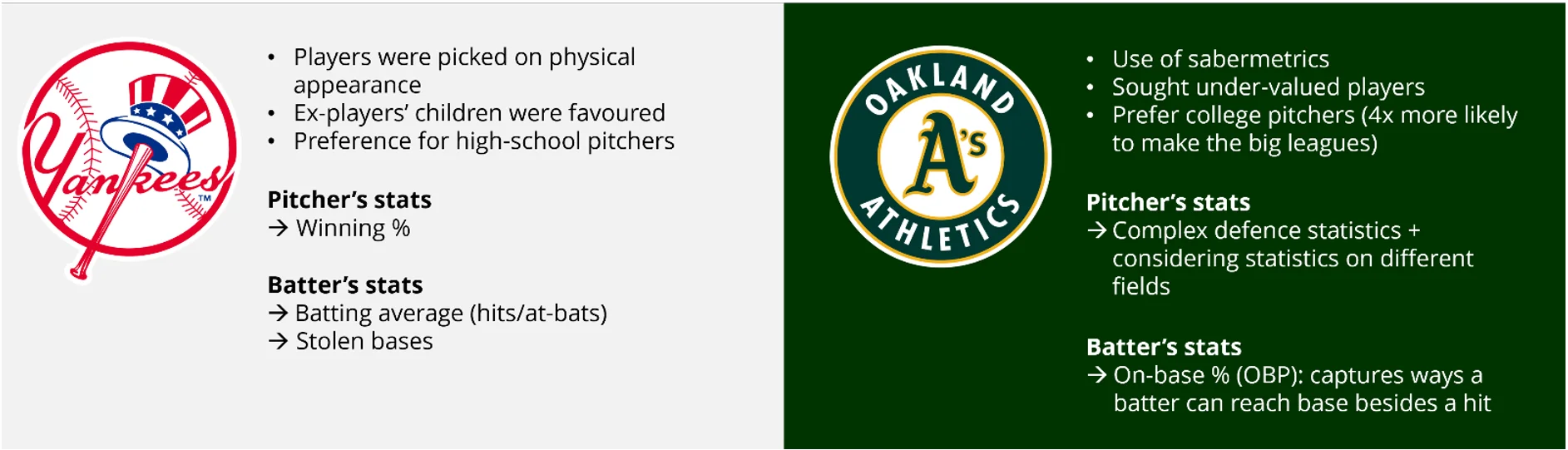

Exhibit 1: Finding value: different approach to 2002 off-season roster changes

As the film and book details, A’s general manager, Billy Beane, opted for the advice of statisticians who used overlooked/non-standard metrics to find players, over the advice of old-school scouts who used traditional statistics and ‘the vibe’. Players such as David Justice (considered too old), Chad Bradford (a pitcher with an unorthodox motion) and Scott Hatteberg (couldn’t throw from the outfield) were identified.

On their way to their 103-59 season, the A’s had a 20-game win streak, an American League record at the time.

While this different approach worked in the regular season, the A’s did not make it past the first round of the playoffs. The book highlights that humans are still involved. Sometimes, to be a winner beyond pure statistics, you need to be able to perform under pressure. It is that human element that makes sports exciting.

What Moneyball illustrates is that:

- Humans make mistakes, even professionals can be influenced by biases and noise in judgements.

- Statistics and rules can reduce errors and be used to find ‘value’.

Now let’s turn this to investing. Can statistics and recent advancements in computational analysis reduce biases and noise in judgements?

Rules-based investing

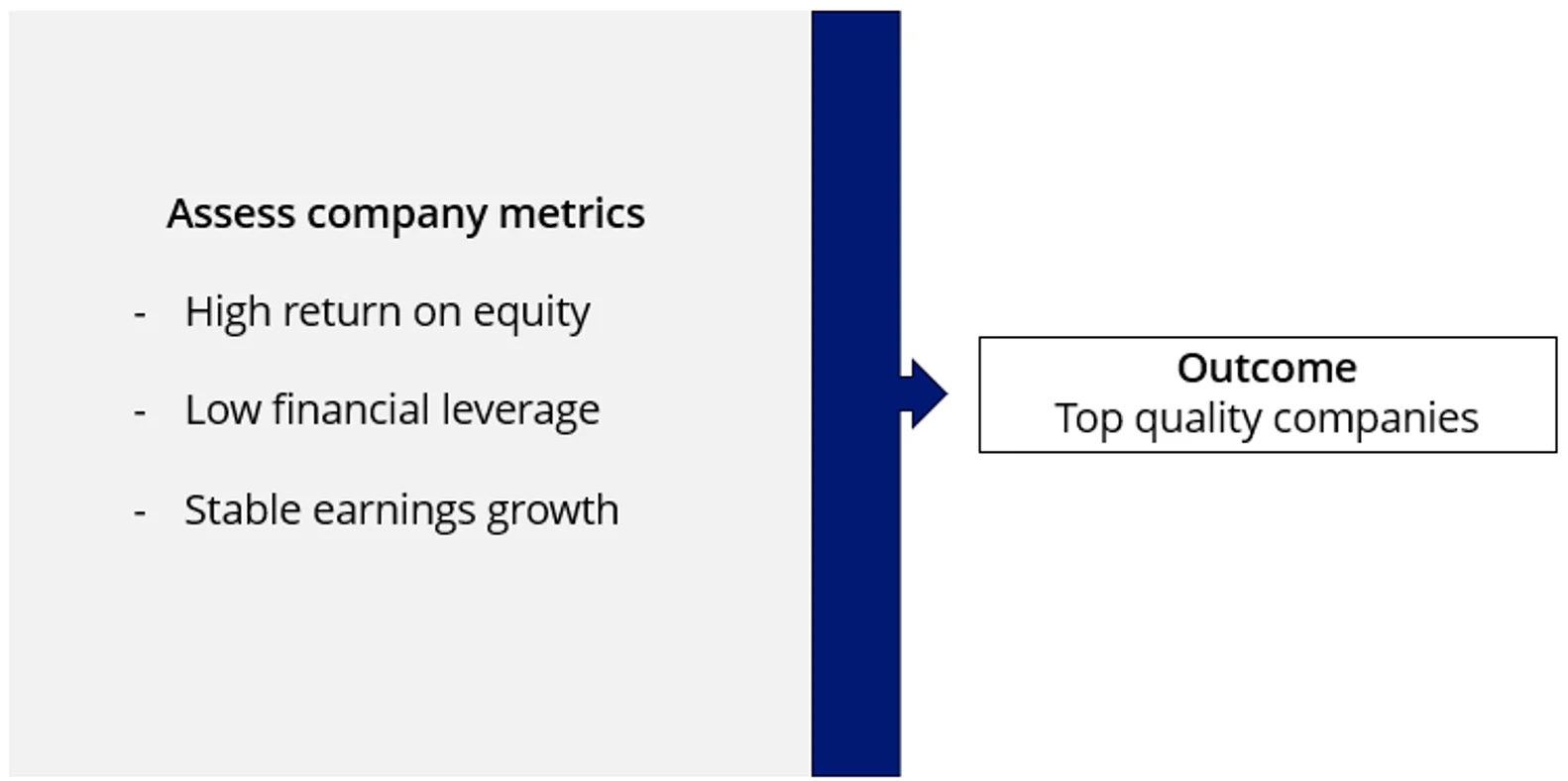

At a simple level, rules and statistics are already being used by ETF investors. An example of this is our flagship international quality ETF, QUAL. Its approach is laid out below:

Exhibit 2: A smart beta approach

Very simply, QUAL screens the entire developed market global equity universe for companies with three characteristics, considered to target the ‘quality factor’: High return on equity, low financial leverage and stable earnings growth. These are data that is readily available in companies’ financial reports.

This rules-based approach has historically outperformed over the long term. Although, we caution that past performance should not be relied upon for future performance.

Nobel prize winner Daniel Kahneman and his co-authors of Noise, wrote about this “An algorithm could really do better than humans because it filters out noise.”

In ETFs such as QUAL, ‘noise’ is eliminated from the decisions.

Leveraging data science and programmed learning

Innovations like QUAL, were made possible because of ‘big data’. Advancements in computing power are driving new approaches allowing investors to access the outcome of complex analysis.

The advantage of more complex rules, according to Kahneman and his co-authors, “is not just the absence of noise but also the ability to exploit much more information.”

Over the past few years, one of the biggest themes in the investing world has been the artificial intelligence (AI) boom. The authors of Noise considered AI too. Chapter 10, Noiseless Rules starts with, “In recent years, artificial intelligence (AI), particularly machine-learning techniques, has enabled machines to perform many tasks formerly regarded as quintessentially human.” The authors went on, “AI often performs better than simpler models do.”

More Complexity: Toward Machine Learning

Under the above subheading, the authors of Noise say, “What if we could use many more predictors, gather much more data about each of them, spot relationship patterns that no human could detect, and model these patterns to achieve better prediction? This, in essence, is the promise of AI.

“Very large data sets are essential for sophisticated analyses, and the increasing availability of such data sets is one of the main causes of the rapid progress of AI in recent years.”

What if we could use this technology, which is now being used around the world in other fields, to create equity portfolios?

Advancements in technology and hardware to cater for an unimaginable number of calculations and data points make it possible to construct portfolios to further eliminate ‘noise’, we think.

For example, LLMs (large language models) allow for intricate calculations, programmed learning and consideration of factors beyond traditional investing metrics to create portfolios designed to harvest investment outcomes.

Using all the rules and algorithms

VanEck has a distinguished history of harnessing technology-driven insights and advanced analysis to identify and unlock opportunities for investors. As pioneers of smart beta strategies in Australia for over a decade, we have launched smart beta ETFs that were the first of their kind on the ASX enabling investors to construct investment strategies with a targeted outcome in mind.

The VanEck Australian Long Short Complex ETF (ALFA) extends on this experience. ALFA leverages a very large data set to systematically assess 12,000 strategies across quantitative, technical & pairs trading and macroeconomic inputs to create a high-conviction, benchmark and style-agnostic Australian equity portfolio that targets long and short positions.

Since its inception on 21 January 2025, ALFA is ahead of the standard Australian benchmark index, the S&P/ASX 200, by 4.76%, reflecting the Fund’s ability to remain agile yet intentional amid evolving market signals. Noting, of course, that this is a short period and past performance should not be relied upon for future performance.

Exhibit 3: ALFA Performance to 31 May 2025

Noting this is a short period and past performance should not be relied upon for future performance.

* ALFA Inception date is 21 January 2025. A copy of the factsheet is here.

Table 1 source: Bloomberg. The table above shows the past performance of ALFA from 21 January 2025. Results are calculated daily and assume immediate reinvestment of distributions. Past performance is not a reliable indicator of current or future performance, which may be lower or higher. ALFA results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. The S&P/ASX 200 Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the broad Australian equities market. It includes the 200 largest ASX-listed companies, weighted by market capitalisation. ALFA is an actively managed, high-conviction, systematic long short Australian equity strategy that aims to outperform the S&P/ASX 200 Accumulation Index over the medium to long term after fees and other costs. Click here for more details.

We think investments like smart beta and investment approaches like ALFA are the portfolio construction tools of the future, echoing the authors of Noise who pondered, when considering rules and technology, “Given these advantages and the massive amount of evidence supporting them, it is worth asking why algorithms are not used much more extensively.”

You can see a replay of the presentation here.

Key risks:

Investments in the VanEck MSCI International Quality ETF (QUAL) and the VanEck Australian Long Short Complex ETF (ALFA) are subject to various risks. QUAL carries risks including ASX trading time differences, financial markets risk, individual company management risk, industry sector risk, foreign currency risk, country or sector concentration risk, political, regulatory and tax risk, fund operations risk, and index tracking risk. ALFA is considered higher risk than funds that do not use leverage or short selling, and investors should actively monitor their investment. Risks specific to ALFA include short selling risk, leverage risk, prime broker risk, counterparty risk, concentration risk, operational risk, and material portfolio information risk. Please refer to each fund’s PDS and TMD for further details.

Published: 30 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.