More of the same (good) thing in wide moat investing

Wide moat stocks in November told the same story as they have for much of this year: positive performance driven by impressive stock selection. This month, it was the financials sector’s turn to shine.

The VanEck Morningstar Wide Moat ETF (MOAT) has provided plenty of positive news to write about throughout 2019, particularly in the second half of the year, with impressive stock selection being a major story. November continued the theme. This month gave financials sector was the star, extending the Moat Index’s year-to-date outperformance versus the S&P 500 Index to 4.79% to the end of November.

Outperformance across the board

Trailing Return (%) as of 30 November2019

|

|

1 mth |

YTD |

1 Year |

3 Years |

5 Years |

7 Years |

Since Inception |

|

MOAT |

6.17 |

37.63 |

29.60 |

20.88 |

18.17 |

22.72 |

21.88 |

|

S&P 500 |

5.55 |

32.84 |

25.35 |

18.33 |

16.26 |

21.70 |

20.36 |

|

OUTPERFORMANCE |

+0.62 |

+4.79 |

+4.25 |

+2.55 |

+1.91 |

+1.02 |

+1.52 |

Inception date is 25 April 2012. Source: VanEck, Morningstar Direct as at 30 November 2019. Performance is in Australian dollars. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends. MOAT performance includes management fees and other costs incurred in the fund but excludes broker fees and buy/sell spreads associated with investing in MOAT. Past performance is not a reliable indicator of future performance of the index or MOAT.

Moat stocks mega merger

Charles Schwab Corp. (SCHW) was the Moat Index standout in November. The company’s stock price rallied 22% during the month on the heels of the announced acquisition of narrow moat TD Ameritrade (AMTD). The all-stock transaction was valued at an estimated US$26 billion. Morningstar views Charles Schwab’s massive scale and industry-leading cost efficiency as wide moat worthy. Despite the company’s decision to cut commission pricing to $0 in early October, Morningstar believes the company can sustain returns on invested capital well above the cost of capital. A recent note from Morningstar cited a potential 10-15% upside to Charles Schwab’s fair value estimate based on the proposed deal terms.

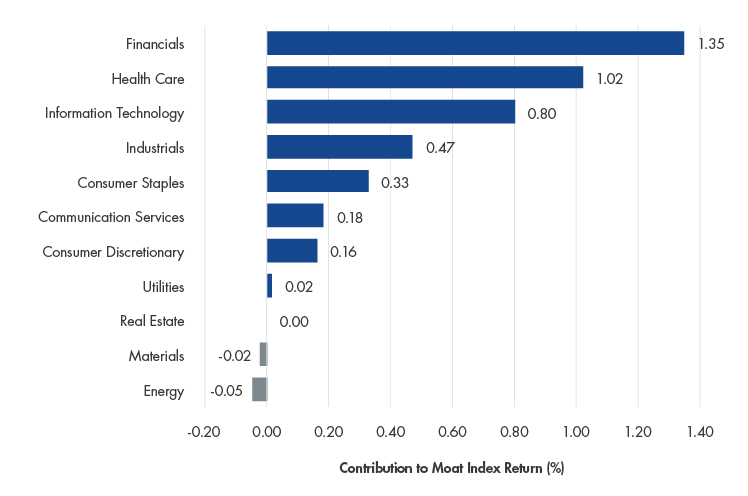

Financials, financials, financials

Three other financials companies, all from different sub-sectors, were among the top performing Moat Index constituents in November. Custody bank State Street Corp. (STT) continued riding the momentum following the strong earnings results it reported in October to post gains in November. Asset manager BlackRock Inc. (BLK) saw a fair value estimate increase in mid-October in light of higher than expected assets under management figures. Lastly, Wells Fargo & Co. (WFC) posted solid performance in November, continuing the strong positive trend that began in mid-August.

Most Sectors Contribute to Positive Returns for Moat Index

1 Month as of 30 November 2019

Source: Morningstar. Past performance is not a reliable indicator of future performance of the index or MOAT.

Down in the HOG pit

41 of Moat’s 51 holdings contributed positively in November. The largest detractor to performance was Harley Davidson Inc. (HOG), which has struggled as consumers replace their bikes with cheaper alternatives. Morningstar notes HOG’s dominant position in the US motorcycle market but also recognises competitive pressures from lower cost providers and international competition in cyclical downturns or periods when exchange-rate differentials allow foreign companies to discount their bikes in the US.

| Name | November Return (%) |

|---|---|

| Charles Schwab Corp | 22.07 |

| ServiceNow Inc | 14.47 |

| State Street Corporation | 13.67 |

| Altria Group Inc | 10.96 |

| Amgen Inc | 10.80 |

| Name | November Return (%) |

|---|---|

| Harley-Davidson Inc | -6.50 |

| KLA Corp | -2.60 |

| Cheniere Energy Inc | -1.64 |

| Comcast Corp Class A | -1.49 |

| Blackbaud Inc | -1.13 |

Source: Morningstar. Past performance is not a reliable indicator of future performance of the index or MOAT.

Important Disclosures

This commentary is not intended as a recommendation to buy or sell any of the named securities. Holdings will vary for MOAT and MOAT Index.

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) is the issuer of the VanEck Vectors Morningstar Wide Moat ETF (‘Fund’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This information contains general advice only about financial products and is not personal advice. It is intended for use by financial services professionals only. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the fund, you should read the applicable PDS available at www.vaneck.com.au or by calling 1300 68 38 37and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The Fund invests in international markets. An investment in the Fund has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

The Morningstar® Wide Moat Focus Index™ was created and is maintained by Morningstar, Inc. Morningstar, Inc. does not sponsor, endorse, issue, sell, or promote the Fund and bears no liability with respect to the Fund or any security. Morningstar®, Morningstar Wide Moat Focus Index™ and Economic Moat™ are trademarks of Morningstar, Inc. and have been licensed for use by VanEck. Effective June 20, 2016, Morningstar implemented several changes to the Morningstar Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover and longer holding periods for index constituents than under the rules in effect prior to this date.

Published: 09 December 2019