More surprises in store for gold?

Gold continues to beat expectations as gold companies maintain their capital discipline. We were also impressed by what we saw on the first analyst tour of Nevada Gold Mines, the joint venture between Barrick and Newmont.

Consolidation looms but risks loom larger

The gold price has maintained a sustained rise over the past three months, increasing to a six-year high of US$1,557 per ounce at one point, before consolidating at around US$1,500 in September. The gold price found support earlier in the month when the European Central Bank (ECB) joined the US Federal Reserve (Fed) in a monetary about-face by easing policy, nine months after signalling it was done with loosening policies. The ECB cut deposit rates to-0.5% and will start buying US$22 billion worth of debt from November in a bid to avert a Eurozone recession. A missile and drone attack on a large Saudi oil facility that knocked out 5% of global oil supply further supported the yellow metal.

Systemic risk surfaced when the overnight repo market lacked the liquidity to handle the confluence of a corporate tax payment with the settlement of a US Treasury debt auction on September 17. Banks refused to lend, as repo rates trended up to 10%, and the Fed was forced to inject billions of dollars into the financial system to stave off the liquidity crunch. Post-crisis banking rules, the Treasury’s voracious appetite for cash, and the Fed’s management of its trillions of dollars of balance sheet securities have created unintended consequences that appear to be resolved for now. However, it begs the question as to how financial markets will behave under a less benign variety of systemic stress.

The gold price was kept in check as US trade tensions with China eased somewhat after both sides agreed to talks in October. Gold faced further headwinds as the S&P 500 came within a hair of its all-time high in mid-September, and the US Dollar Index trended to a new 28-month high at the end of the month.

The gold market held up well, even as the dollar’s strength seemed to overwhelm the yellow metal at times. We have been wondering whether an interim correction in the gold price would come at US$1,500 or at higher levels. We now have the answer as gold fell by 3.2% in September to US$1,472.39, and it looks like October is shaping up to be a month of correction. Gold stocks also gave back some gains as the NYSE Arca Gold Miners Index fell by 10% and the MVIS Global Junior Gold Miners Index declined 11.2%.

Gold continues to beat expectations

The upward move in gold prices so far this year has caught most investors by surprise. There have been strong inflows to the bullion exchange-traded products (ETPs). Yet anecdotally, we have seen little flows into gold equity funds. For many, this move harks back to the first half of 2016 when the gold price advanced US$260 and the Gold Miners Index doubled. However, gold and gold stocks failed to sustain their momentum then, and started to pull back. The industry went nowhere for three years, hence equity investors are now understandably cautious and reluctant to step in. With the correction now in motion, we will soon find out whether this year would end up being another flash-in-the-pan or the beginning of a new bull market.

That said, the current macro backdrop is much more supportive than it was in 2016. Both the expansion and the general equity bull market are now the longest on record. Global growth is slowing materially. Real rates have been falling and are expected to continue falling for the foreseeable future. Negative-yielding debt has reached an astronomical US$15 trillion globally and is growing. Global leadership seems to keep getting worse.

Previously, the established upside resistance level for gold was US$1,365. Once the upside resistance is broken, it often becomes downside support. Therefore, in the current correction, gold could pull back to that level and still maintain a strong bull market trend. Equally, it is possible that gold might consolidate at higher levels, say between the range of US$1,400 and US$1,450. The duration of this correction might take as little as a month, or continue to the year-end. While the details would only be known in hindsight, the strong macro drivers in place suggest this correction would only be a bump in the road, not the end of the line. And given the performance of gold this year, we would not be surprised if it continues to beat our expectations.

Capital discipline a welcome surprise

We met several companies at the Denver Gold Forum last month. Despite the high gold prices, there was no sense of euphoria; the overall message was one of sound business fundamentals. When asked how they would deal with the generous cash flows this year and possibly beyond, some producers plan to reduce debt further, while others are deciding on proper dividend policies. We expect exploration budgets to increase, and some capital reinvested to sustain businesses. Companies are also likely to hold the line on costs by maintaining cutoff grades, and to plan their operations based on the assumption that the price of gold would be at about US$1,200. We therefore believe profit margins may increase with gold prices.

Companies also placed a priority on organic growth through brownfields expansion and/or increasing reserve lives. They were not talking about expansions through M&A or large greenfields development – these were the main sources of value destruction in the last bull cycle, when companies overpaid for acquisitions and developed properties that required too much capital. Given that the gold price has just hit US$1,500, the real test will come at the next Denver Gold Forum. We would be elated if the gold price remains elevated, and if companies continue to exhibit strong capital discipline while containing costs.

Gold’s Top Producers Showcase Impressive Developments

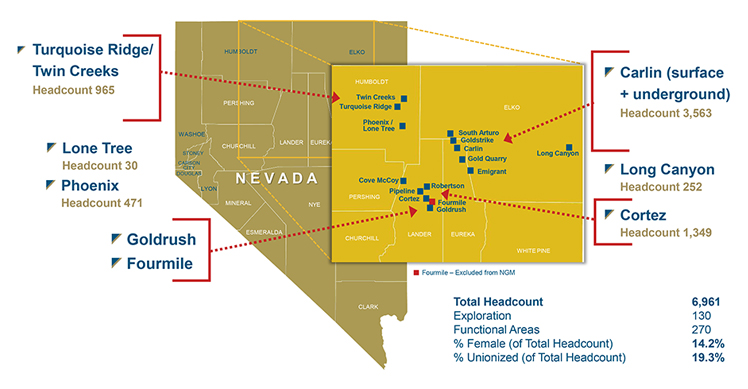

After the Forum, we headed to northern Nevada for Nevada Gold Mines’ (NGM) inaugural analyst tour. NGM is a joint venture between Newmont (38.5%) and Barrick (61.5%), which operates the mine. The map shows NGM’s three major mining centres – Carlin, Cortez, and Turquiose Ridge/Twin Creeks. The three centres are roughly one- to two-hours’ drive from each other. Each has an open pit, underground mines and multiple processing facilities that can treat various types of ore.

Source: Barrick

IMPORTANT DISCLOSURES

Published: 10 October 2019