REIT: A Proper(ty) allocation

With a 'lower for longer' interest rate environment, the pursuit of income for investors is now far more pronounced. While A-REITs have been popular for their consistent income over the years, their global counterparts G-REITs, which also offer relatively high income but with additional diversification benefits, have been overlooked. Access to these opportunities has been limited, until now.

There is an abundance of listed real estate investment opportunities beyond Australian shores:

- Despite being early innovators, Australian REITs comprise just 3% of the world’s listed real estate assets;

- According to Nareit, the worldwide group representing REITs and publicly traded real estate companies, nearly 40 countries now offer REITs, the US being the largest.

Earlier this year we launched the VanEck Vectors FTSE International Property (Hedged) ETF (ASX: REIT) which tracks the widely regarded International REIT benchmark, FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged (REIT Index).

In the current rates environment investors are being starved of income so they are turning to REITs.

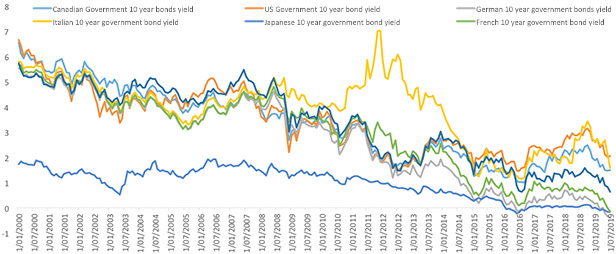

Lower for longer – G7 10 year yields over time

The RBA cut official interest rates in June and July. The US Federal Reserve announced a cut on 31 July. We could see more rate cuts by year end. In late July, Australia’s 10-year bond yield fell to a record low of 1.19%, while the US 10-year bond yield was just 2.26%. Bond yields could move even lower if global growth forecasts are revised down, as the IMF has done several times in the recent past.

Rates around the world continue to hover around historic all-time lows. The outlook, if you believe the bond market is a good indicator, is not good. With bond yields tumbling here and offshore, investors are flocking to defensive assets anticipating a global economic slowdown. However bonds are not providing income to the same level investors have been used to. This is forcing them to consider other asset classes with higher risk profiles such as property, which compared to equities is considered defensive, as the capital is relatively stable and it generally generates reliable income.

10 Year bond yields of G7 nations

Source: Bloomberg, 1 Jan 2000 to 30 June 2019

Prudent portfolio construction includes careful consideration of risk with diversification and asset allocation are paramount, so when seeking alternate sources of income you should beware that while taking on additional risk may offer short-term income upside, it also gives rise to increased risk of principal erosion on the downside. Australian investors have used A-REITs in the past, however, it is a concentrated market and a way to diversify beyond A-REIT's is to also invest in overseas property.

Investing in global property introduces a new risk, currency. However, for investments that are hedged to Australian dollars, the impact of fluctuations in foreign exchange rates on income received by the funds is minimised REIT aims to be 100% hedged.

Stable and high income outside Australia

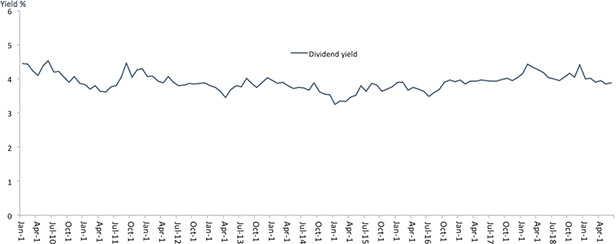

The arguments for investors to consider a greater allocation to global property are strong. Property assets typically deliver reliable income and potential capital growth, as well as portfolio diversification. In recent times, demand for REITs has jumped as interest rates and bond yields have tumbled. REITs are considered 'bond proxies' as they provide a reliable income stream from rents to investors. This contrasts to dividends from shares, which can be volatile, suspended and/or payout ratios reduced. Rents too are typically linked to inflation, a link which bonds and term deposits lack. However, it should be noted that REITs are not correlated to bonds and have a higher risk-return profile.

Reflecting its attractive yield, the trailing 12-month dividend yield of the REIT Index has remained stable at around 4% over the 12 months to 30 June 2019.

12 month trailing divided yield of REIT Index

Source: FTSE to 30 June 2019. REIT Index is - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged. Results are calculated monthly and assume immediate reinvestment of all dividends and exclude costs of investing in REIT. You cannot invest in an index. Past performance of the REIT Index is not a reliable indicator of future performance of the ETF.

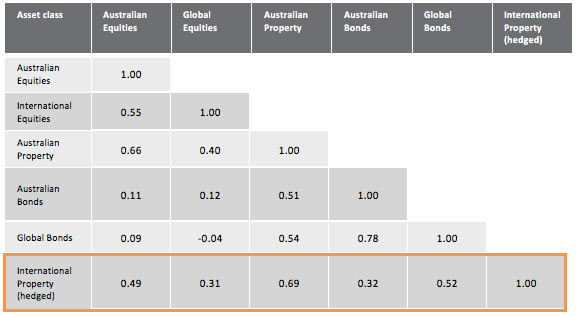

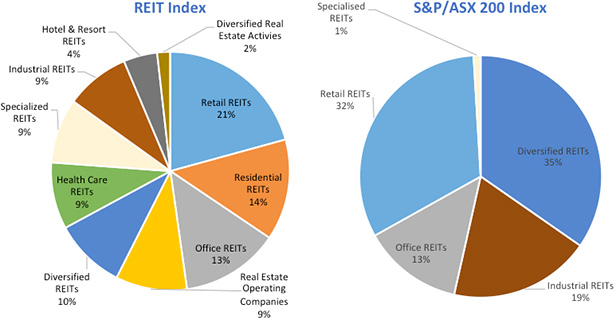

Diversification benefits: REIT gives investors access to more sectors

By investing in a portfolio of hedged international property you are achieving diversification to an asset class that has a low correlation of returns with those of other equities and fixed income investments, as the table below shows. It illustrates how international hedged property is correlated to asset classes in most Australians’ portfolios using standard market benchmarks for each asset class. A correlation of 1.0 means the asset values move together while a score of -1.0 means they move in opposite directions. For investors already in Australian property, the correlation over time to a hedged international property portfolio is not as high as you may expect, so it can provide important diversification benefits for those investors too.

Low correlation to traditional asset classes

Source Morningstar Direct, All returns in Australian dollars. Five year risk-reward 1 March 2014 – 30 June 2019. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used: Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite 0+ years; Global Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD; Australian Property – S&P/ASX 200 A-REIT, International Equities – MSCI World ex Australia Index; Australian Equities – S&P/ASX 200; International Property - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged

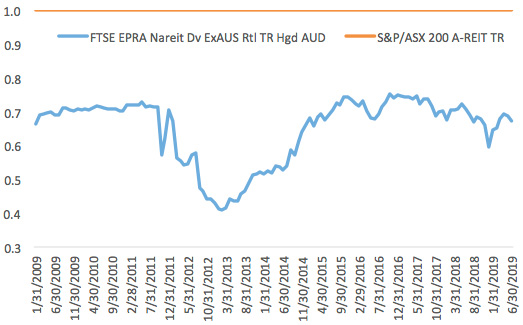

A diversifier away from A-REITs

3 year rolling correlation relative to S&P/ASX 200 A-REIT

Source Morningstar Direct, All returns in Australian dollars. 1 May 2009 – 30 June 2019. REIT index is - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance of the REIT Index is not a reliable indicator of future performance of the ETF.

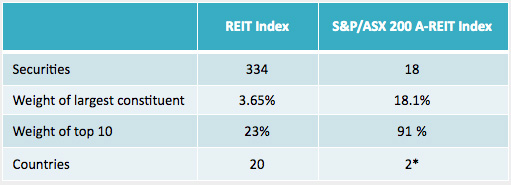

The charts below give a sector breakdown of the REIT Index and the S&P/ASX 200 A-REIT Index. The global property index is well diversified, including healthcare property trusts, hotel and resorts, and specialised REITs such as data centres. These are sectors not readily available in Australia. So investing offshore can broaden investors’ opportunities substantially. Moreover, the top 10 stocks account for just 23% of the REIT Index compared to the top 10 constituting 91% of the Australian A-REIT Index.

Source: Factset, 30 June 2019

Source: FTSE, S&P, Bloomberg. As at 31 January 2006. *Australia and France due to Unibail Rodamco cross-list

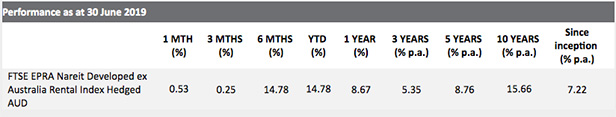

Solid gains over time

Reflecting the rally in international property, the REIT Index is up 8.67% for the year and 14.78% over the six months to 30 June 2019. While assets values have gained, the fundamentals for select real estate markets remain extremely robust. Restricted funding has limited supply and with improving demand, strong rental growth has emerged. We expect this trend is likely to continue in many markets and sectors.

Source: FTSE, Inception date 31 January 2009. Results are calculated monthly and assume immediate reinvestment of all dividends and exclude all costs of investing in REIT. You cannot invest in an index. Past performance of REIT Index is not a reliable indicator of future performance of the REIT Index or REIT.

For more information on REIT please visit our dedicated property and infrastructure microsite.

IMPORTANT NOTICE

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity and issuer of the VanEck Vectors FTSE International Property (Hedged) ETF ('Fund'). This information contains general advice only about financial products and is not personal advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision in relation to the fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies ('LSEG') (together the 'Licensor Parties') and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged ('Index') upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. "FTSE®" is a trademark of LSEG and is used by FTSE and VanEck under license.

Related Insights

Published: 06 August 2019