China’s evolving consumption

With over a month to go in 2020, we explore evolving consumption trends in China.

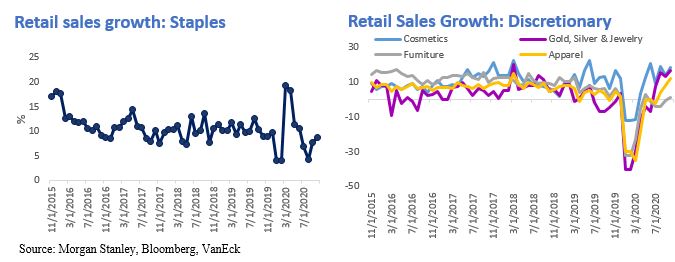

Retail data is reassuring – consumer staples growth remains resilient at around 10%, whereas consumer discretionary growth has made a strong comeback since February in various categories, ranging from cosmetics to gold & jewellery. Restaurants & dining growth has turned back to positive territory for the first time since the start of the year.

Morgan Stanley estimates that household consumption is going to be in the driver’s seat contributing half of China’s GDP growth in 2021, supported by the following:

- Continuously falling unemployment rate surveyed in 31 major cities at 5.3% as of end of October 2020, only 0.2% higher YoY;

- Higher savings build-up during the pandemic accounting for 37% of disposable income, compared to 31% for the last seven years on average;

- Export cycle driving wage growth.

Looking forward, there are a few emerging Consumer trends in China in terms of where, how and what.

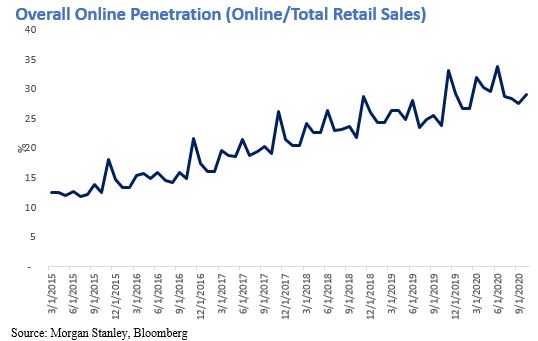

Where - online sales are gaining momentum, reaching 30% of total retail sales in China from under 15% in 2015. The online presence of retailers are more important than ever. Consumers have access to millions of goods and services with a click of a button, partnered with seamless payment systems such as Alipay and WeChat Pay in China.

How - Another booming part of online in China is live streaming e-commerce, thanks to the strong online penetration of retail brands and influencer loyalty. Generally this takes place on the e-commerce platforms such as Taobao and JD.com, where social media influencers and celebrities promote products, try them on and interact live for digital audiences. This is becoming an effective way of marrying physical shopping experience with online purchase. According to iiMedia estimates, live streaming e-commerce is expected to grow to US$129 billion this year.

What - China is also encouraging people to facilitate transactions in a strong domestic market, which in turn will stimulate domestic demand, as highlighted in the recent 14thFive-Year Plan. This is evidenced by the setup of Free Trade Ports and Free Trade Zones, as well as duty-free shops in China’s tropical island Hainan. From 1stJuly, Hainan has increased its annual tax-free shopping quota from 30,000 RMB (approx.US$4,570) to 100,000 RMB (approx.US$15,236) per person to fuel the demand. October saw the highest monthly duty free revenue of 3.4 billion RMB (approx.US$0.52 billion), largely from the week-long national holiday in the country.

Published: 26 November 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if investing in China is appropriate for your circumstances. The PDS’s for CETF and CNEW are available here. An investment in CETF or CNEW carries risks associated with: China; financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.