Emerging markets – old or rich…which comes first?

An interesting trend is apparent if you take a closer look at emerging markets demographics.

It is common knowledge that the largest emerging economy―China―is getting old before getting rich. We thought it would be worthwhile to investigate if this phenomenon is common among emerging markets.

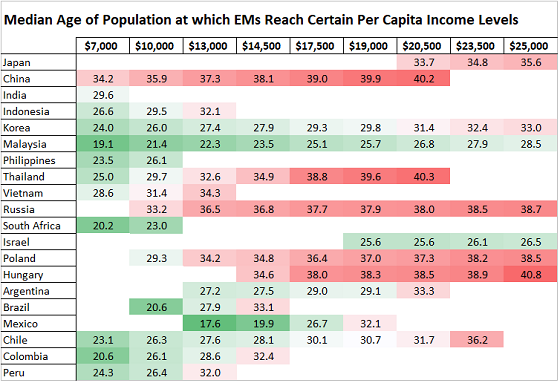

We found out that quite a few of them are in the same boat. The first chart below shows that Russia and Central Europe are hitting key per capita income milestones at a more advanced age than, say, Japan. Further, the same process is taking place in parts of Latin America (Chile, Peru, Colombia) and Asia (Thailand, Vietnam). One country we are watching with great interest is India. India is still “poor” on a per capita income basis. However, its median age/income trend looks closer to China than to other regional peers like South Korea or Malaysia, which got richer at a relatively younger age.

Chart 1: Emerging markets demographic trends – China is just the tip of the iceberg

Source: VanEck Research; Bloomberg LP

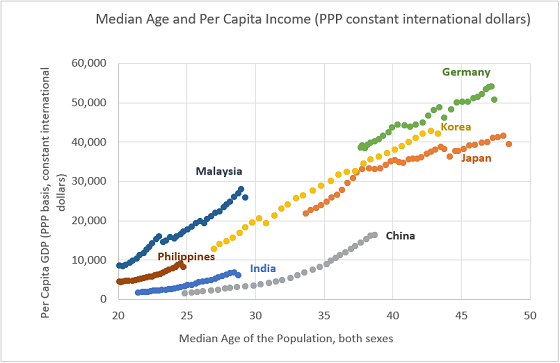

If you have a look at this second chart, below―you can see what we are talking about. This is the reasons why structural reforms (including digitalisation) and responsible policies are of such importance―in India and across emerging markets.

Chart 2: Emerging markets getting older before they get richer

Source: VanEck Research; Bloomberg LP

Published: 18 December 2020

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity of VanEck Vectors MSCI Multifactor Emerging Markets Equity ETF (‘EMKT’) and VanEck Vectors Emerging Income Opportunities Active ETF (Managed Fund) (‘EBND’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if a fund is appropriate for your circumstances. The PDS is available here. An investment in EMKT carries risks associated with: emerging markets, financial markets generally, individual company management, industry sectors, ASX trading time differences, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. An investment in EBND carries risks associated with: emerging markets bonds and currencies, bond markets generally, interest rate movements, issuer default, currency hedging, credit ratings, country and issuer concentration, liquidity and fund manager and fund operations. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.