The new opportunity powering portfolios

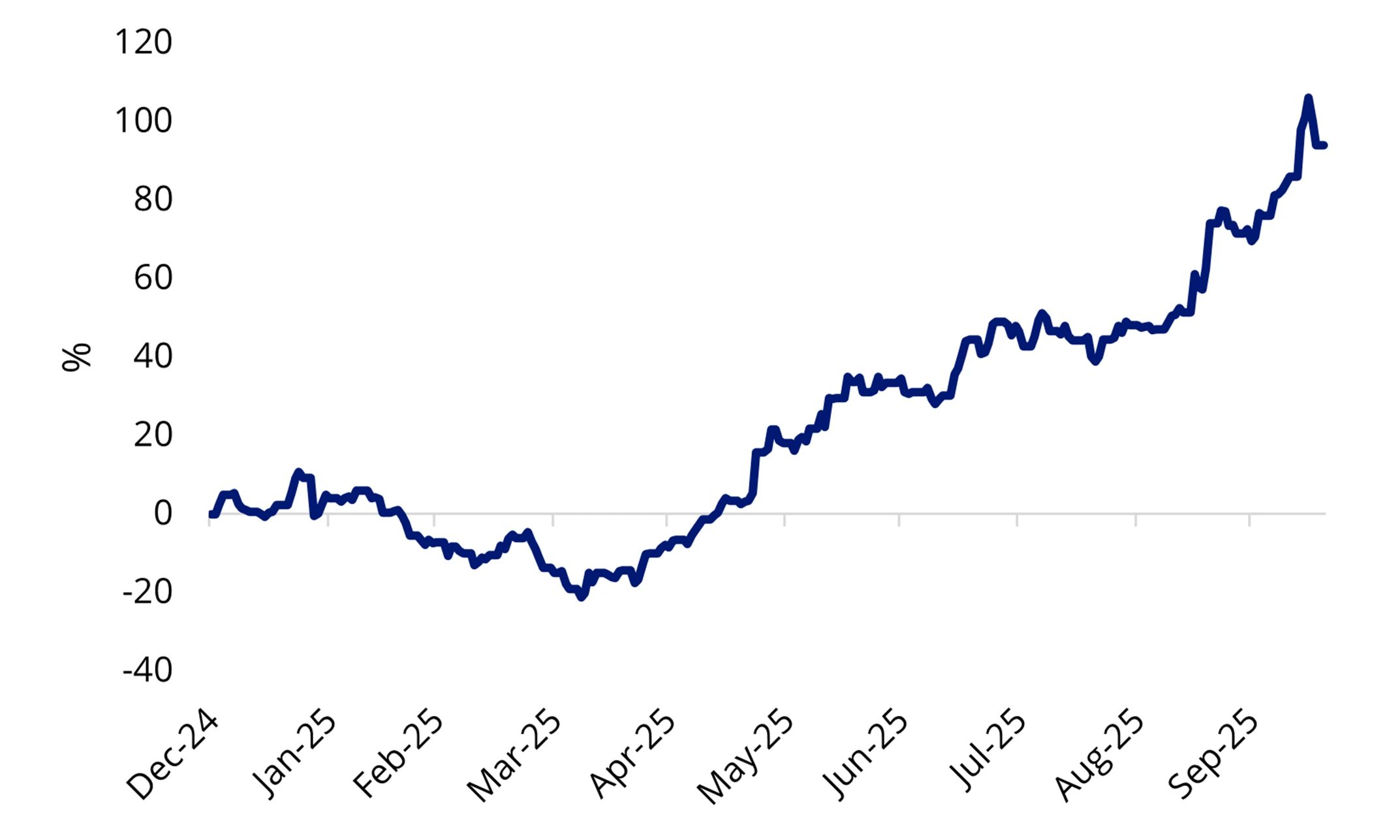

Nuclear energy has become a central pillar in the global shift toward low-carbon energy, as Big Tech firms like Amazon, Meta and Alphabet embrace it. Since the start of the year, nuclear stocks have benefited from this growing trend. The sector, as represented by the MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index (URAN Index), is up by over 100% year-to-date (as of 20 October 2025). Noting that this is not an indication of future performance.

Chart 1: Nuclear sector year-to-date performance

Source: Morningstar, 20 October 2025. The chart above shows the past performance of the MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or URAN.

Just as the 'Magnificent Seven' came to define high-growth tech and the 'Titan Five' led the charge in defence, we believe this year has created the new 'Fission Three': a trio of nuclear stocks driving the surge in the uranium and energy innovation renaissance.

Table 1: Fission Three

| Name of company | Comments |

| Oklo | Oklo (13.42% of URAN Index) is developing advanced nuclear reactors designed to be smaller, faster to deploy and highly efficient. |

| Centrus Energy | Centrus Energy (4.93% of URAN Index) is the world’s most diversified supplier of enriched uranium fuel for civilian nuclear power reactors and is a pioneer in High-Assay, Low-Enriched Uranium (HALEU). |

| Energy Fuels | Energy Fuels (4.52% of URAN Index), a Denver-based mineral company and the largest US uranium provider, supplying American nuclear energy utilities with the first step in the zero-emissions nuclear energy fuel cycle. |

Source: Bloomberg, 30 September 2025. The weightings are subject to change in the future.

These stocks have been building momentum since the start of 2025. Each has returned more than 300% since the beginning of the year, in the case of Oklo, more than 600%. (Source: FactSet, 1 January 2025 to 20 October 2025).

Nuclear energy is no longer an afterthought. In a few short years, the nuclear energy conversation in the US has evolved from (1) decommissioning the US's aging reactor fleet to (2) extending its regulatory life to (3) recommissioning shuttered reactors, and now, (4) considering building new reactors.

With aggressive global policy goals and tech company attention, the focus is likely to stay on nuclear energy as the US and other countries seek to meet their increasing need for electricity.

Let’s look at the key 2025 drivers for the nuclear sector.

Key 2025 nuclear energy catalysts:

US Federal executive orders

In May 2025, the Trump administration issued a series of executive orders aimed at quadrupling US nuclear capacity to 400 GW by 2050 from approximately 100 GW today. His executive orders also focused on expediting nuclear licensing by placing time limits on the Nuclear Regulatory Commission’s licensing review process. His orders also seek to address America’s lack of domestic uranium enrichment and processing capability. The US and much of the world have become dependent on a select few countries, namely Russia, for enriched uranium.

These executive orders supported the nuclear energy ecosystem, providing investor confidence across the supply chain and raising the prospects of increased investment in nuclear capacity across the board.

Tech giants continued commitment to nuclear power

2023 and 2024 were marked by numerous announcements from hyperscalers, including commitments to nuclear power purchase agreements and direct equity investments in nuclear start-ups. The main hyperscalers are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), which offer services like Infrastructure as a Service (IaaS). Microsoft made headlines in late 2023 when it posted a job listing seeking a nuclear engineer to help coordinate the adoption of small modular reactors (SMRs) to power its data centers. 2025 has been a continuation of this trend, such as the Meta and Constellation Energy announcement to enter into a 20-year power purchase agreement (PPA) for nuclear power output from the Clinton Clean Energy Center in Clinton, IL.

Small Modular Reactor projects at military outposts

Among the Trump executive orders was a notable provision for the deployment and use of advanced nuclear reactor technologies at military installations. Shortly after the executive order signing, Oklo saw its share price advance rapidly as speculation circulated that it would be selected to supply its Aurora powerhouse small modular reactor for the Eielson Air Force Base in Alaska. Later, the “Notice of Intent to Award” from the Department of Defense was confirmed justifying the hype around Oklo and other advanced reactor companies. As other military branches look to implement the executive order, the market is patiently waiting to see which SMR companies, both private and public, will win contracts and benefit.

Continued AI capex growth

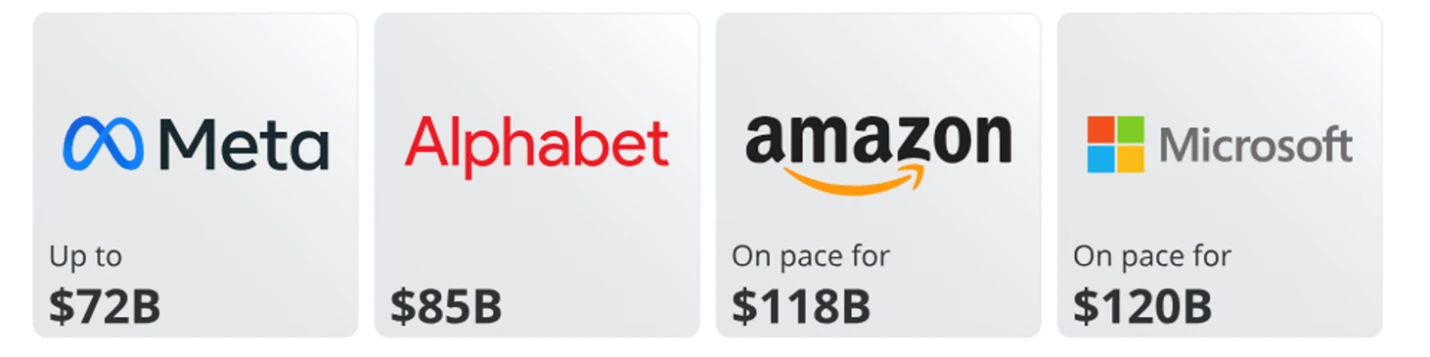

One of the most significant risks facing the nuclear energy renaissance is a slowdown in infrastructure investment. The most acute example of this was the DeepSeek news that sent tech stocks and nuclear companies spiralling in late January 2025. Based on the relative cost-efficiency of DeepSeek’s model, markets reflected the doubts that the massive AI arms race spending was sustainable or even necessary. However, major hyperscalers have not pulled back their capital expenditure commitments, and US electricity demand remains above last year as well as above levels before the global pandemic market disruptions. These companies have not only maintained capex levels, but in many cases have upped commitments.

Big Tech 2025 annual capex outlooks

Source: CNBC; company reports. For illustrative purposes only.

Performance

URAN’s Index is also tracked by VanEck’s Uranium and Nuclear Technologies UCITS ETF (NUCL),1which has a 2+ year track record listed in Europe. The Australian dollar performance of the index is shown in the table below. Note that past performance of the URAN index is not an indication of the future performance of the index or the ETFs.

Table 2: Hypothetical trailing returns: URAN Index

Source: Bloomberg, as at 20 October 2025. Index base date is 31 December 2021. URAN Index performance prior to its launch in October 2025 is simulated based on the current index methodology. Results are calculated daily and assume immediate reinvestment of all dividends, and exclude the costs associated with investing in URAN. You cannot invest in an Index. Past performance information is not a reliable indicator of future performance of the indices or URAN.

The URAN opportunity:

Supporting rapid technological advancement

A sector positioned to meet the accelerating electricity demands from the rapid expansion of AI, computational power and digital infrastructure.

Targeted exposure

Exposure to the largest global companies involved in the uranium mining and nuclear energy sectors, which are typically under-represented in benchmarks.

Emerging growth opportunity

An investment in a revived and alternative global energy supply that supports decarbonisation and the transition to clean energy.

There are a few ways to gain exposure to the nuclear sector. Some investors invest in uranium miners to gain physical exposure to uranium, while others invest in nuclear utilities, such as nuclear power plants and generators.

This week on the ASX, we are launching our VanEck Uranium and Energy Innovation ETF (URAN).

We will be hosting a live webinar about energy innovation and URAN on 28 October 2025. A recording will be available to watch on-demand following.

Click here to register or watch the replay.

1- This is not a recommendation to act or promotion of the product.

Key risks: An investment in our Uranium and Energy Innovation ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS and TMD for more details.

Published: 27 October 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in VanEck ETFs traded on the ASX. Units in the VanEck Uranium and Energy Innovation ETF (URAN) are not currently available. URAN has been registered by ASIC and is subject to ASX and final regulatory approval. The PDS will be available at vaneck.com.au. The Target Market Determination will be available at vaneck.com.au. You should consider whether or not any VanEck fund is appropriate for you. Investing in ETFs has risks, including possible loss of capital invested. See the PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

MarketVector Indexes GmbH (MarketVector) is a related body corporate of VanEck. The MarketVector™ Global Uranium and Nuclear Energy Infrastructure Index is created and maintained by MarketVector. MarketVector does not sponsor, endorse, issue, sell, or promote the Fund and makes no representation or warranty, express or implied, to VanEck or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly and bears no liability with respect to the Fund. Read the PDS for the full index disclaimer.

URAN is likely to be appropriate for a consumer who is seeking capital growth, intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and a very high risk/return profile.