The lesser-known tech giant playing to win

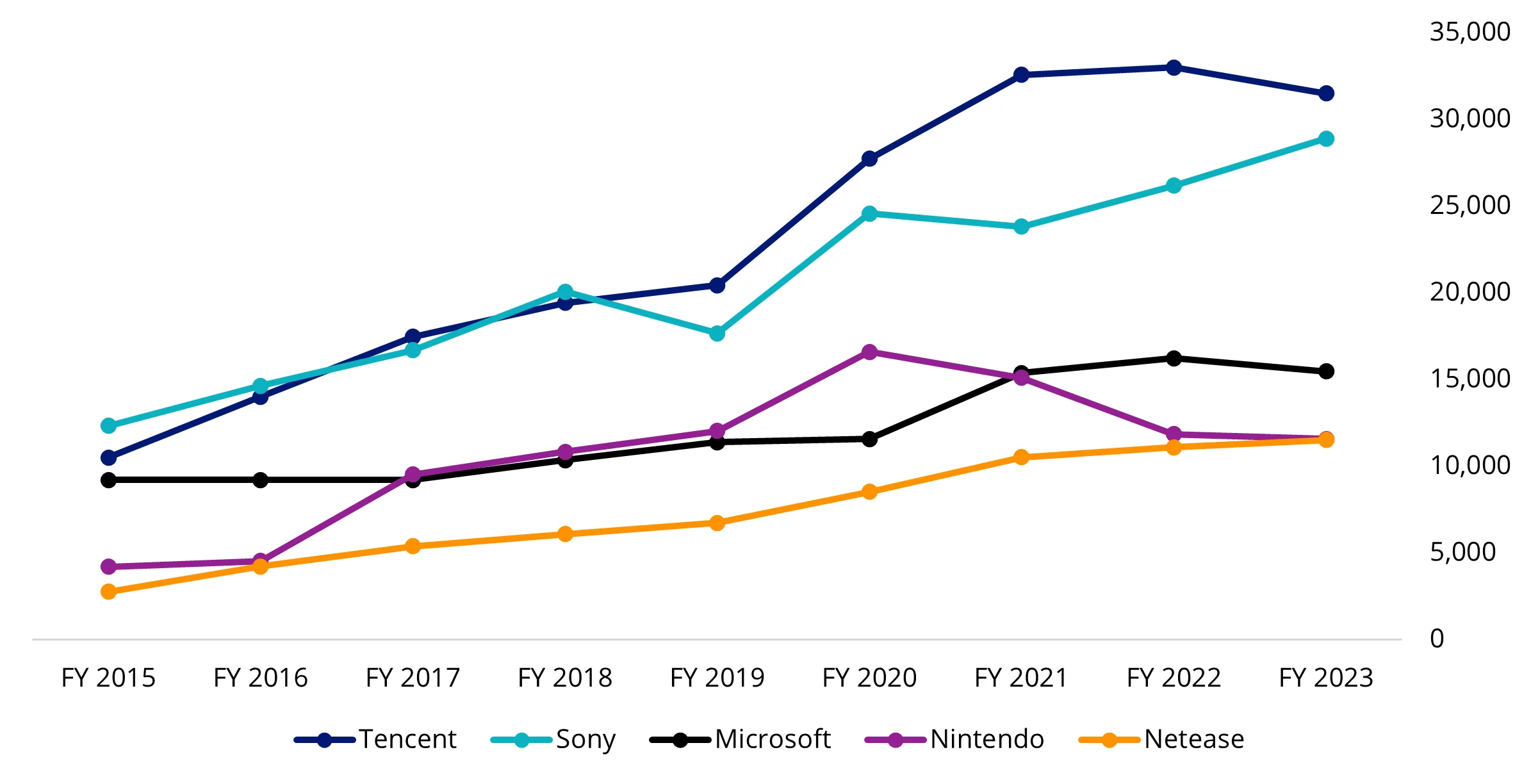

Few people are likely to know what the largest video gaming company in the world is (based on revenue). This status belongs to the Chinese tech giant Tencent, which took the throne from Sony in 2019 and has since maintained the lead in the industry.

For investors looking for alternative tech exposure, Tencent is a company to watch. The company has established itself as a major player in the global gaming sector through acquiring stakes in several major gaming companies, such as Riot Games (“League of Legends”), Epic Games (“Fortnite”) and Supercell (“Clash of Titans”), but also through increased capacity for developing its own in-house games in recent years.

Chart 1: The world’s largest video gaming companies by revenue (US$mn)

Source: Company data

Expanding game portfolio and flagship titles

One of the pillars of Tencent's gaming success is its vast and diverse game portfolio. The latest blockbuster AAA game, "Black Myth: Wukong", was developed by China’s Game Science studio (which is backed by Tencent) and topped Steam's most-played games chart, with 1.4 million concurrent players hours after its release on 19 August. Built using the Unreal Engine 5 video game development tool, the game is very visually realistic featuring lifelike graphics and complex combat systems. According to the latest data compiled by gaming market researcher VG Insights, the global sales have exceeded 21 million copies to date, totaling US$1 billion.

We expect Tencent to continue to thrive with its extensive operational know-how in games. Goldman Sachs projects that Tencent’s domestic games revenue could double and international games revenue to triple by 2035.

Strategic acquisitions and investments

Tencent's growth strategy has been heavily influenced by investments and acquisitions in gaming studios around the world. According to its company data, games account for 16.7% of the whole investment portfolio Tencent holds as of October 2024. It holds stakes in several industry-leading independent games studios, including Riot Games, Epic Games and Supercell, in addition to over 10% stake in France based Ubisoft and South Korea based Krafton respectively. According to a news report, Tencent and Guillemot Brothers have been in discussion to take Ubisoft private, resulting in 33% jump in the company’s share price at the start of October. This global expansion has allowed Tencent to tap into various gaming genres and markets, leveraging the expertise of these studios to build a robust game development ecosystem.

For example, Riot Games, which is responsible for League of Legends, has expanded its franchise with Wild Rift for mobile and Valorant, a tactical first-person shooter that gained massive success globally. Tencent’s 40% stake in Epic Games, the creator of Fortnite, has positioned itself to influence next-gen game development tools, further driving innovation.

Mobile gaming leadership

Tencent is also leading in the rapidly growing mobile gaming market, which represents almost half of the gaming revenue globally in 2023 discussed in our previous blog. Home-grown games like Honor of Kings, which has consistently ranked as one of the highest-grossing mobile games in China, showcase Tencent’s strategy in mobile game design and monetisation. PUBG Mobile, which has a significant player base across Asia, Europe, and North America, is another shining example of Tencent’s mobile gaming prowess through local adaptation – the game is rebranded as Game for Peace to comply with local regulations, which has contributed to its popularity among Chinese gamers.

The rise of mobile gaming has been instrumental in Tencent’s growth, particularly in markets like China, India, Southeast Asia, and Latin America, where mobile gaming is a dominant form of digital entertainment. As more people gain access to affordable smartphones and internet connections, Tencent’s mobile game portfolio is well positioned to capture further growth.

Improving regulatory environment

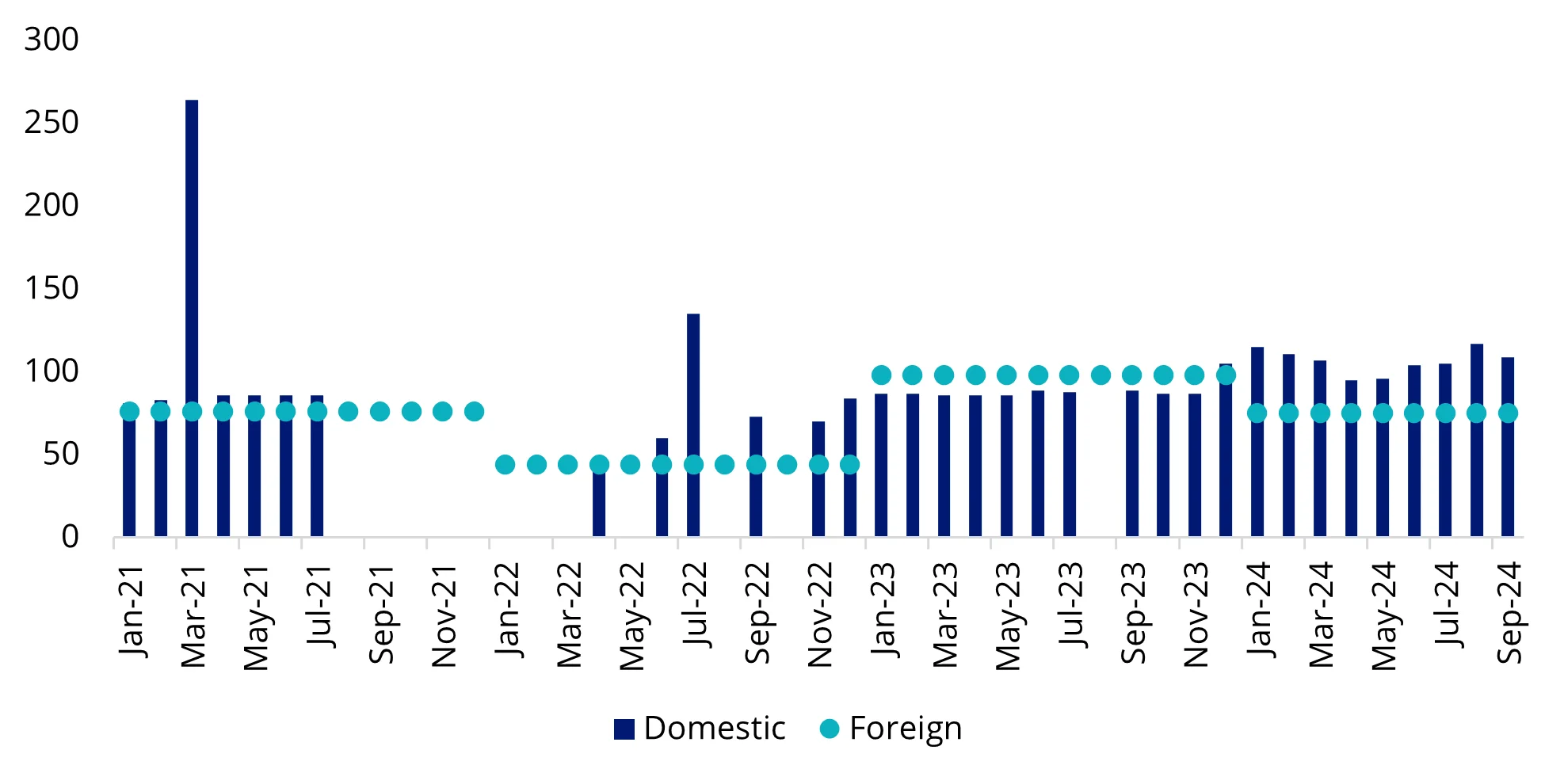

We note that regulatory landscape in the video gaming sector in China is becoming more supportive. The National Press and Publication Administration (NPPA) which regulates China's video games sector, had approval halts in 2018 and 2021 respectively, which hurt the growth in terms of capping industry supply, but also time spent/dollar spent by minors on games, which has impacted the long-term growth algorithm for the industry. Since the episodes of crackdown, approvals by the NPPA rose 22% in the first half of 2024 with a pick-up in monthly games approved since Dec 2023.

Chart 2: The number of games approved by China’s National Press and Publication Administration

Source: NPPA as at 21 October 2024. Foreign game approval released on an annual basis.

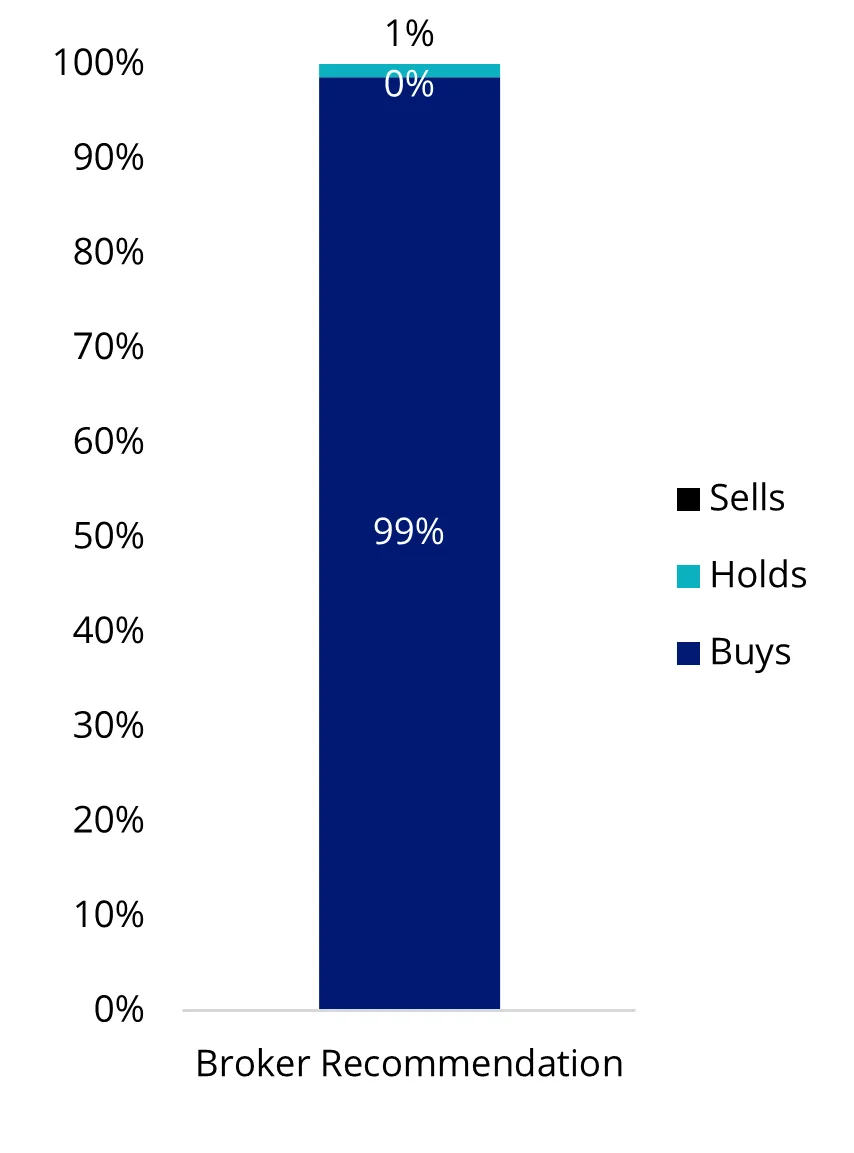

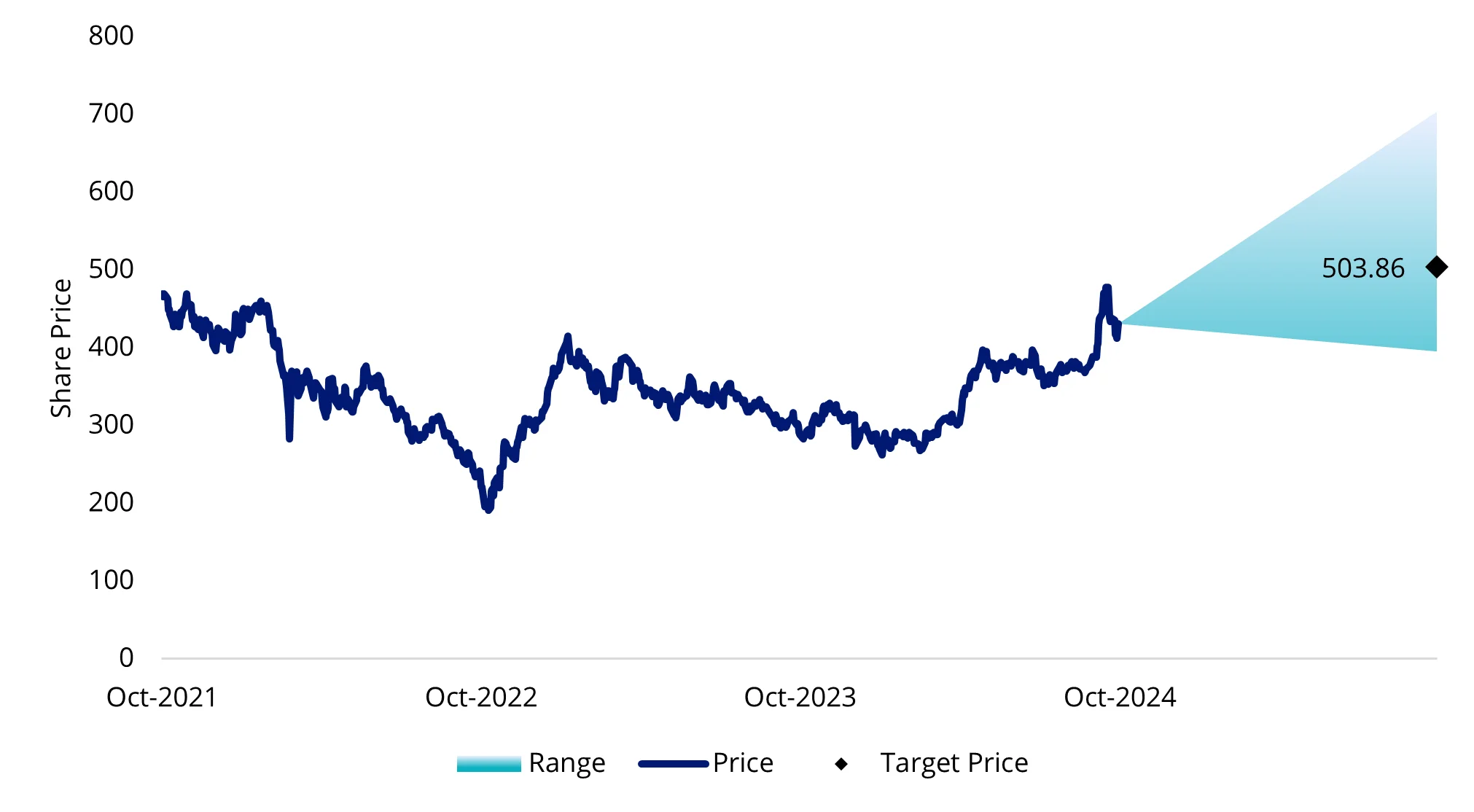

71 of out 72 sell-side analysts covering Tencent recommend buying the stock, with an expected upside of 18% over the next year. Even with the rally this year, the company is still 40% cheaper compared to the peak level in 2021. The 12-month forward P/E of Tencent is at 17x, considerably cheaper than the Nasdaq 100's 30x.

Chart 3: Tencent: sell-side analyst recommendation (72 analysts in total)

Target price:

Source: Bloomberg as at 21 October 2024. Not a recommendation to act.

The growth potential in the video gaming and esports sector globally can be accessed through our VanEck Video Gaming and Esports ETF (ASX: ESPO), an offering for investors who are interested in diversifying away from the traditional technology players in the US.

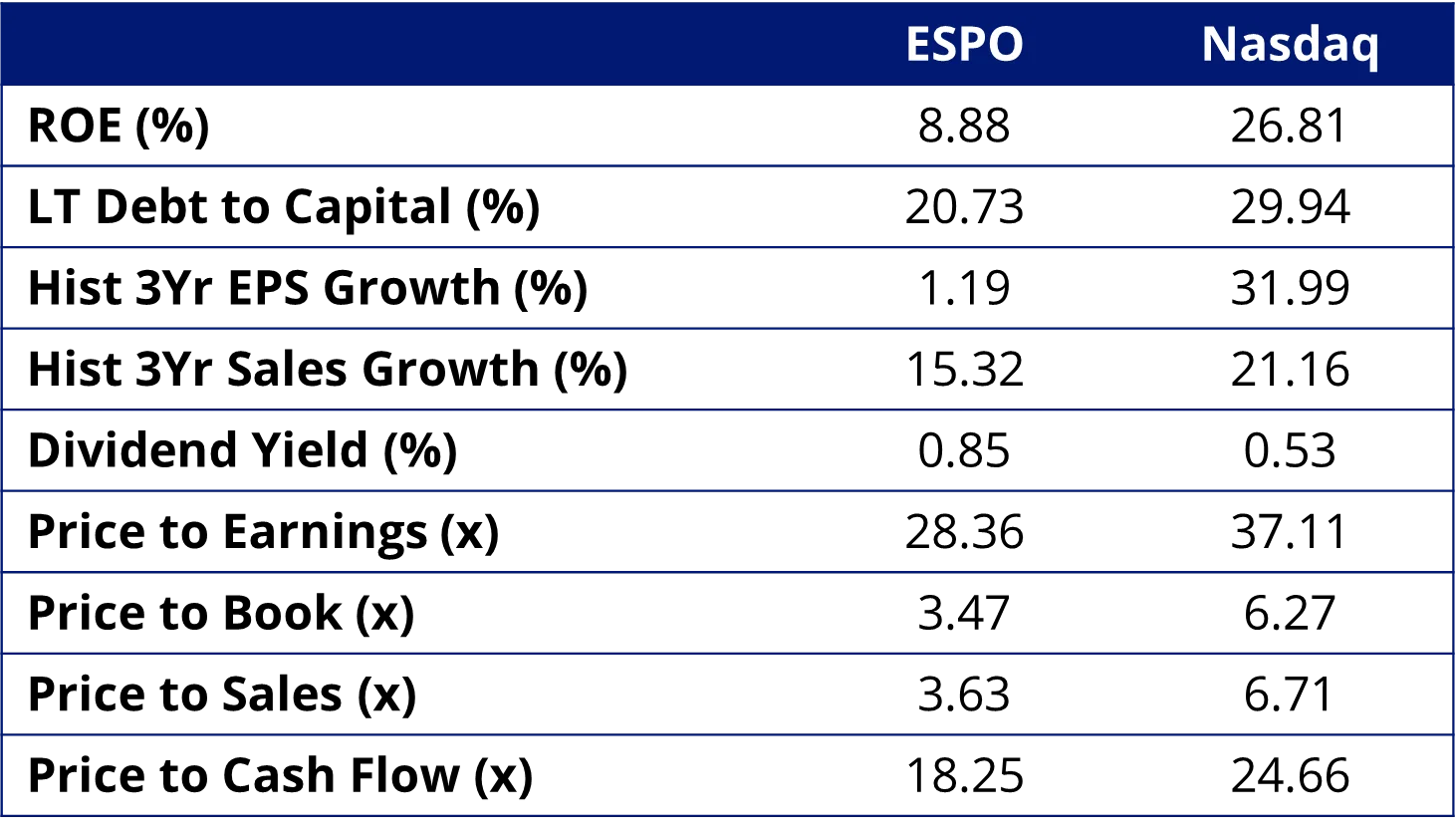

Table 1: ESPO vs Nasdaq fundamentals

Source: FactSet, as at 30 September 2024

Key risks

An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Video Gaming and Esports ETF PDS and TMD for more details.

Published: 22 October 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.