The new “game changers” hitting a high score in global markets

The trajectory of US equities since the ‘Liberation Day’ tariffs1suggests there could be a lot more in the tank for equities. While Trump’s extreme stance on global trade initially threw markets into a tailspin, every concession he has made since has led to a step-up in risk sentiment and, thereafter, a rally on the S&P 500.

The strength of the S&P 500 to date is undeniable. Despite navigating surging inflation, a global central bank rate cycle and the US debt crisis, over the past 5 years, the S&P 500 has had a stellar run, gaining 142% (as of 30 June 2025), an equivalent of over 19% per annum.

Chart 1: The S&P 500 Index had only three negative quarters in the past five years

Source: VanEck, Bloomberg, 30 June 2025. Performance in AUD. Past performance is not indicative of future performance.

What has been the driver of this almost unstoppable rally? Looking at both US equities and global stocks, that honour goes to growth companies. Since early April, in the face of US tariff aggression, geopolitical shocks in the Middle East, and renewed US debt pressure, global growth stocks (proxied by the MSCI World Growth index) have outperformed the MSCI World Index.

Drilling down even further, the video gaming and esports sector stands out as being at the pinnacle of the global growth. These companies, proxied by the MVIS Global Video Gaming & eSports index, have gained more than 20% since the Tariff Liberation Day, outperforming the MSCI World Growth index by 4.8% and the MSCI World index by 11.4% (as at 30 June 2025).

Chart 2: Video gaming & esports at the pinnacle of the growth rally

Source: VanEck, Bloomberg, 30 June 2025. MSCI World style and size indices. Video gaming & esports is proxied by the MVIS Global Video Gaming & eSports Index Performance in AUD.

Fundamentals support sustainable growth in the video gaming and esports sector

Further analysis reveals that the sustainability of growth in this sector is supported by key fundamental metrics.

- Strong EPS growth: We consider this the key metric for measuring "value for money" in growth stocks. The data shows that the average 12-month EPS growth of video gaming and esports companies (proxied by the MVIS Global Video Gaming & eSports Index) has grown by 6% since the end of the first quarter, significantly outperforming the S&P 500 Index (-6.4%), the Nasdaq Index (-5.8%), and the "Mag 7" (0.6%).

Chart 3: 12-month EPS growth of video gaming stocks exceeds “Mag 7” levels

Source: VanEck, Bloomberg, 30 June 2025. Video gaming & esports is proxied by the MVIS Global Video Gaming & eSports Index. The “Mag 7” Index is Bloomberg the Magnificent Seven Index.

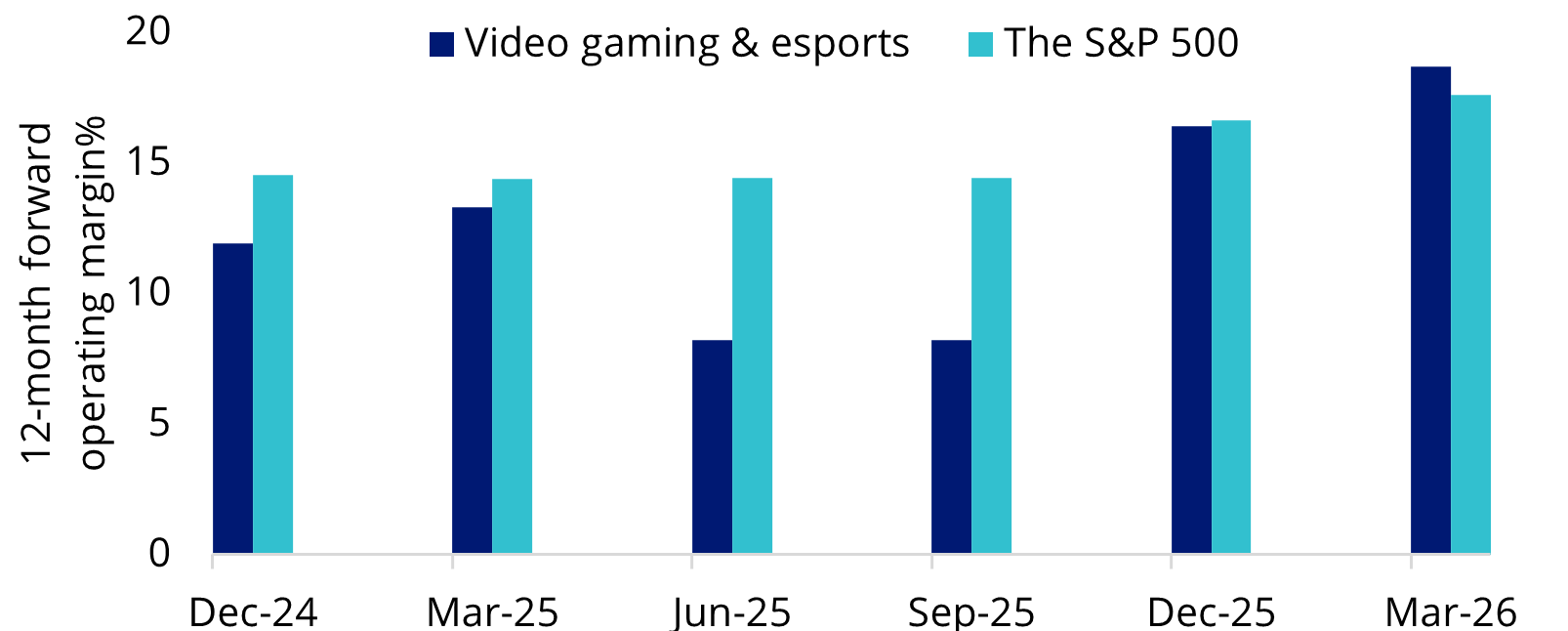

- Consistent margin expansion: Analyst forecasts show the average operating margin of the video gaming and esports sector is expected to grow from 14% today to 18.7 % by Q126, outpacing broader US equities. This indicates these companies are maturing into cash-rich, moat-protected businesses that are poised for sustained earnings outperformance and further valuation uplift relative to the broader market.

Chart 4: The rising profitability of video gaming & esports companies

Source: VanEck, Bloomberg, 30 June 2025. Video gaming & esports is proxied by the MVIS Global Video Gaming & eSports Index.

- Positive analyst sentiment: Persistent AI optimism has shifted sell-side analysts' sentiment on video gaming and esports companies from cautious to outright bullish. Among the 25 holdings in the MVIS Global Video Gaming & eSports Index, 68% have a "Buy" rating, well above the S&P 500's 54%.

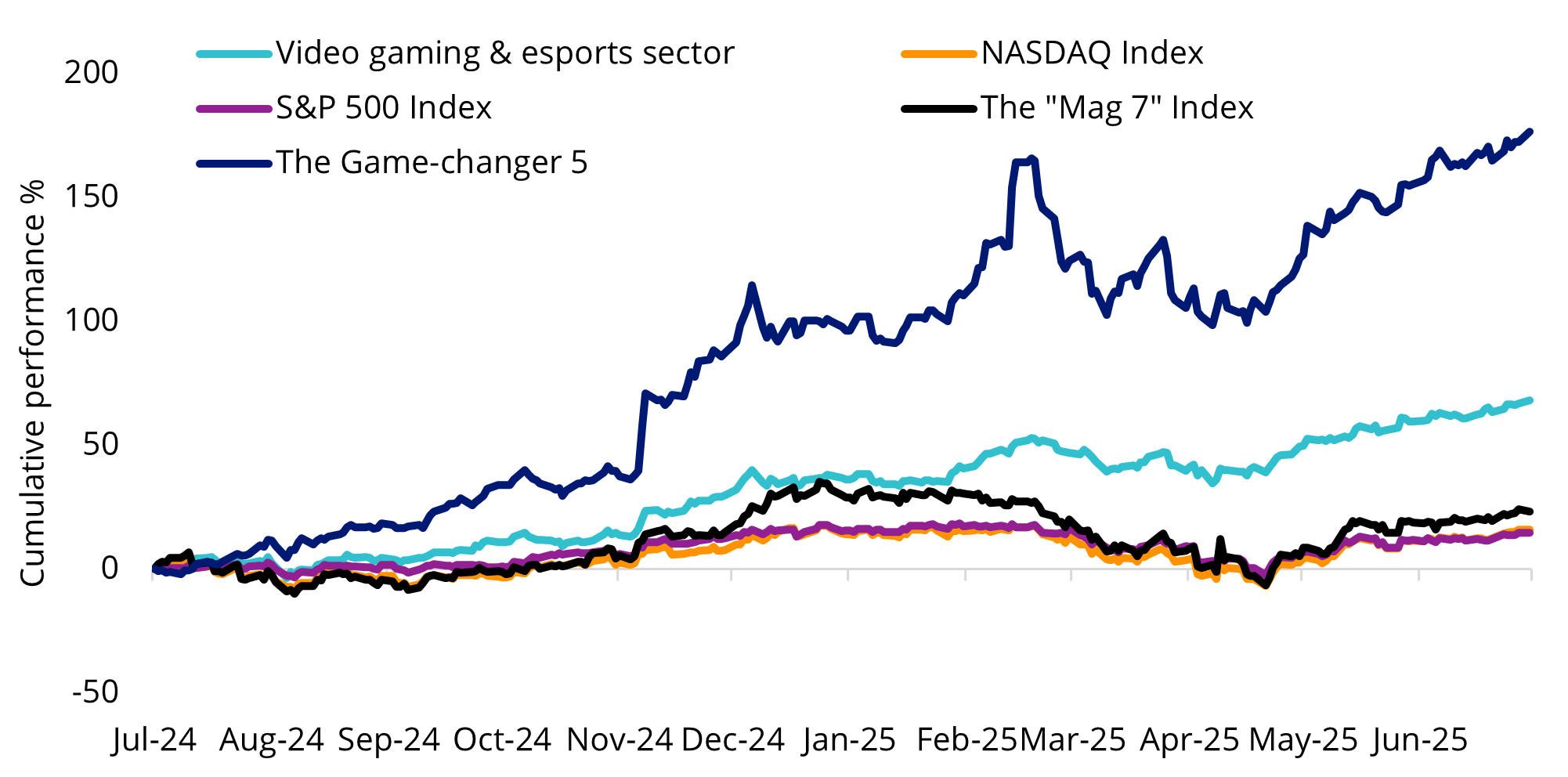

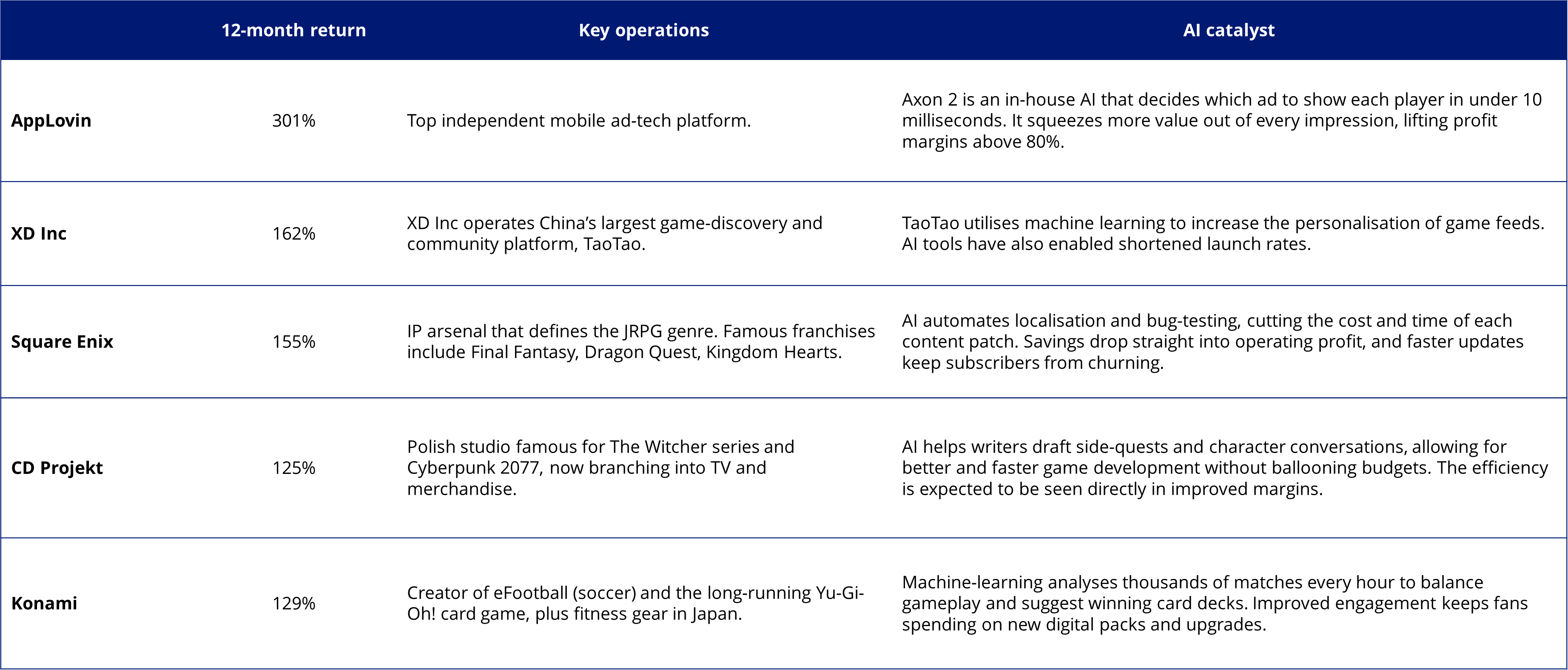

Meet the Game-changer 5

While the Magnificent 7 has long ruled the roost as the most prominent high-growth stocks, we think it could be time for these tech mega caps to pass the baton. The AI revolution has been a fresh growth driver for video gaming & esports companies, and five stocks in particular have benefited from this boost while also ranking high in the aforementioned fundamentals: AppLovin, XD Inc, Square Enix, CD Projekt and Konami. These five elites, which we refer to as the Game-changer 5, have more than doubled in value over the past year, with some edging toward a threefold gain. They also offer benefits of global diversification (unlike the US-centric Mag 7), with holdings domiciled in the US, Japan, Poland, and Hong Kong.

Chart 5: The “Game-changer 5” tops the growth rally

Source: VanEck, Bloomberg, 30 June 2025. ESPO Index is the MVIS Global Video Gaming & eSports Index. Performance in AUD. The “Gamer-changer 5” is an equal-weight portfolio of Applovin, XD Inc, Square Enix, CD Projekt and Konami Group. Past performance is not indicative of future performance.

The impressive outperformance relative to major US equity indices, including the “Mag 7,” stems from technological breakthroughs across the gaming value chain. These include AI-powered ad-bidding engines, real-time 3-D asset creation, procedural world-building, personalised player matchmaking, and data-driven live-service monetisation, each translating into faster revenue growth and steadily increasing operating margins.

Table 1: Snapshot of the “Game-changer 5”

Source: VanEck, Bloomberg, 30 June 2025. This is not a recommendation to act.

Accessing the global video gaming and esports sector

Investors who want to benefit from the growth of this thriving industry can consider the VanEck Video Gaming and Esports ETF (ESPO), which tracks the MVIS Global Video Gaming & eSports index. ESPO gives investors exposure to a diversified portfolio of the largest and most liquid companies involved in video game development, esports and related hardware and software globally.

Key risks: An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See VanEck Video Gaming and Esports ETF PDS and TMD for more details.

Source:

1Gold in times of turmoil: The impact of tariffs and uncertainty

Published: 10 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.