Banks may be weighing on your portfolio

Earlier this year, the Australian equity market experienced a paradigm shift as BHP amalgamated its UK and Australian listings into one on the ASX. In one move, BHP overtook CBA to be Australia’s largest listed company. But because of this unification, investors in an Australian equity fund that tracks or benchmarks to the S&P/ASX 200 or S&P/ASX 300 are now exposed to greater risk. Risk they may not even be aware of.

However, new research shows there is a simple way to avoid this risk.

The Australian equities market is one of the most concentrated by stock and sector. The universe is also small relative to global markets. New research, The Australian Concentration Conundrum: Why factors are not pronounced in Australian Equities, released last week, shows that these nuances present challenges when investing in Australia. Despite these challenges, the paper shows that there is an alternative way to invest in a diversified portfolio of Australian equities that has historically achieved excess returns over the long term.

Most Australian investors are aware of ‘factor’ investing. Over the past two decades, access to passive factor investing (also known as smart beta) has become readily available via ETFs. Factor-based ETFs combine the best aspects of active and passive management by tracking indices with defined rules, designed to deliver a targeted investment outcome, while retaining transparency, liquidity and ease of trading for investors.

Globally, factor-based ETFs assets under management is approximately $1 trillion as at 17 June 2022, with the majority of strategies covering global, European and US equity market. One of the biggest ETFs on ASX, VanEck MSCI International Quality ETF (QUAL), has achieved outperformance relative to the MSCI World ex Australia Index. QUAL is a portfolio of international equities. The question then is, does MSCI’s quality factor also work in Australia?

According to the new research released last week, the answer is no.

The paper highlights three reasons for this:

- The Australian equity market is too concentrated by stock, the 10 largest companies represent over 45% of the S&P/ASX 200 Index;

- The market is too concentrated by sector, financials and materials dominate; and

- The market is too small by the number of companies and by size or market capitalisation.

These constraints result in the crossover of constituents between factor strategies in Australia. This limits the effectiveness of factor investing.

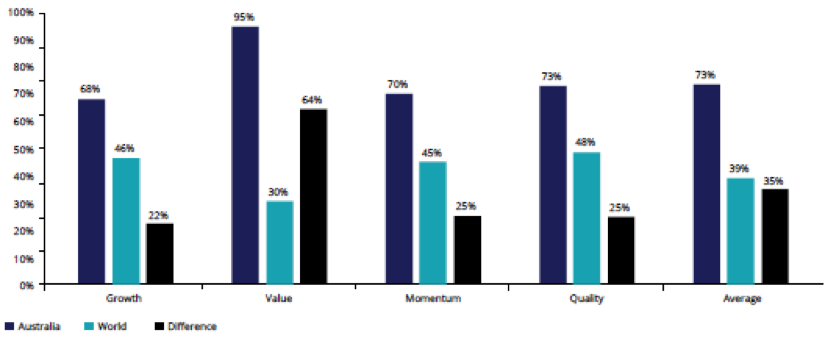

By way of example, Figure 1 below shows the percentage allocation of factor indices to the top 20 holdings. The chart, which uses MSCI’s global and Australian factor strategies, illustrates that the stock weighting to the largest 20 holdings in single factor strategies in Australia is much higher compared to global indices. In Australia the top 20 companies account for, on average, 73 percent of total exposure compared to MSCI World ex Australia factor strategies which is 39 percent.

Figure 1: Top 20 holdings as a percentage of total weight

Source: MSCI, as at 30 April 2022, MSCI World Factor Indices, MSCI Australia IMI Factor indices, Value as MSCI World Enhanced Value and MSCI Australia IMI.

High stock concentration and the small universe in Australia reduces the breadth of unique coverage.

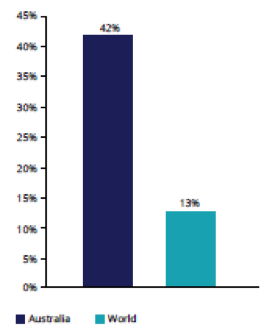

This is also illustrated when comparing holdings crossover between the growth and value factors. Intuitively, the crossover should be low, as growth and value strategies are dissimilar. Growth targets companies that have delivered strong earnings and sales growth which trade at higher price to valuations. Value targets cheap companies that trade at low price to valuations. In Australia, growth has a 42 percent holdings crossover with value, over triple the 13 percent crossover globally.

Figure 2: Growth holdings as a percentage of value

Source: MSCI, as at 30 April 2022, Australia as MSCI Australia IMI Growth holdings crossover with MSCI Australia IMI Enhanced Value. World as MSCI World Growth holdings crossover with MSCI World Enhanced Value.

This new research reinforces a recent Vector Insights, The Quality Wizard of Oz.

According to the new paper, there are many ways, beyond single factor investing, to invest in a diversified portfolio of Australian equities.

Investing in active Australian equity funds is popular, but as the Year End 2021 S&P Indices Versus Active (SPIVA) Australia report shows, 62 percent of managers failed to beat the S&P/ASX 200 over 3 years to 31 December 2021 and the fail rate increases the longer the time period. These results are consistent with previous surveys, irrespective of the market conditions.

The paper considers a factor indifferent approach such as equal weighting.

Equal weighting is something we have talked about before, most recently here and here.

As the name suggests equal weighting gives the same importance to each stock in a portfolio, regardless of a company’s size.

The Australian equities universe is stock and sector concentrated by market capitalisation weight but when you equal weight, these biases disappear.

The paper shows that the VanEck Australian Equal Weight ETF (MVW) is a way to access an Australian equity portfolio to achieve active outcomes, while retaining transparency, liquidity and ease of trading for investors.

Click here to download a copy of The Australian Concentration Conundrum: Why factors are not pronounced in Australia

Published: 22 July 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.