Don’t miss the disruptor

Disruptive innovation is currently underway in the Australian funds management industry.

Blockbuster did not see Netflix; they were more concerned about other DVD rental companies. Encyclopaedia Britannica did not see Wikipedia; they were more concerned about World Book. Likewise, Blackberry did not see Apple; they were more concerned with Nokia. In each of these examples, the existing market leader was more concerned about competitors offering similar goods and services. In each case, the entire market was disrupted by a new technology few saw coming.

The incumbents noted above did not survive their industry being disrupted. This is why being aware of disruptive innovation has become paramount for industry leaders.

Harvard professor Clayton Christensen was the first to describe the process of disruptive innovation in his seminal work, The Innovator’s Dilemma. As a result, Christensen catapulted to super-star status in tech-savvy Silicon Valley in the 1990s.

According to Christensen, disruptive innovation should either “originate in a low-end market and move upstream to higher value markets” or create a “new market foothold”, meaning it creates a new market where none existed. These apply to each of the examples above.

Now, in Australia, ask an active fund manager which competitor or set of funds they are concerned about, and they will likely respond with “passive funds”.

If they do, they are potentially making the same mistake as Blockbuster, Britannica and Blackberry. They are overlooking a technology.

Since sailing ships were replaced by steamboats, disruptive innovations have been transforming industries. Funds management could soon be added to the list. Smart beta, we think, is a disruptive innovation that has the potential to disrupt the industry.

In sync with Christensen’s framework, smart beta, as an investment method, originated in the low-end market. Institutional investors have used them as a low-cost way to invest, and their genesis can be traced back to the 1970s. This is not something that only we are saying.

The CFA Institute forewarned the rise of smart beta.

The rise of smart beta was the subject of a 2016 scholarly article published in the Chartered Financial Analyst (CFA) Institute's Journal. Authors Ronald Kahn and Michael Lemmon, in their paper, ‘The Asset Manager's Dilemma: How Smart Beta is Disrupting the Investment Management Industry', described smart beta as:

“a disruptive financial innovation with the potential to significantly affect the business of traditional active management.” (Kahn and Lemmon, 2016)

The paper successfully illustrated that the fee levels of the global equity universe they analysed were inconsistent with the performance outcome. They are too high. According to Kahn and Lemmon’s analysis, over 35% of global equity managers will be disrupted by smart beta. That is, over a third would potentially suffer the same fate as Blockbuster, Britannica and Blackberry.

The disruption in the Australian funds management industry, we think, is underway. And ETFs are enabling this. Like streaming facilitated Netflix, and the internet facilitated Wikipedia, ETFs are an innovation facilitating the disruptor.

Smart beta ETFs combine the best aspects of active and passive management by tracking indices that deliver a chosen investment outcome, all the while retaining transparency, liquidity and ease of trading within defined rules.

Smart Beta has been harnessed by institutional investors, where it started. And it has become accepted and widely used by financial advisers, and we think its use will expand, if it hasn’t already, to every investor type.

Adoption by financial advisers

Each year, VanEck conducts a Smart Beta Survey among Australian financial advisers. It is the biggest survey of its kind worldwide and is now in its 10thyear.

A consistent feature of the results over ten years has been that the reason Australian advisers select smart beta ETFs is not the low fees commonly associated with ETFs, but performance.

Source: VanEck Smart Beta Survey, 2025

And, this is a performance profile that advisers are satisfied with. Since 2018, the survey has shown that 97-99% of financial professionals are satisfied with their smart beta investments

Active managers should take note. This past month S&P Dow Jones released its most recent SPIVA report for Australian Funds, and once again, it does not make good reading for active fund managers. The summary states: “a firm majority of funds underperformed over the decade ending in June 2025.”

More worrying for active managers, the VanEck Smart Beta Survey indicates over 60% of advisers are using smart beta to replace active managers. Over 75% either agree or strongly agree, smart beta is going to become more prevalent in portfolios.

Source: VanEck Smart Beta Survey, 2025

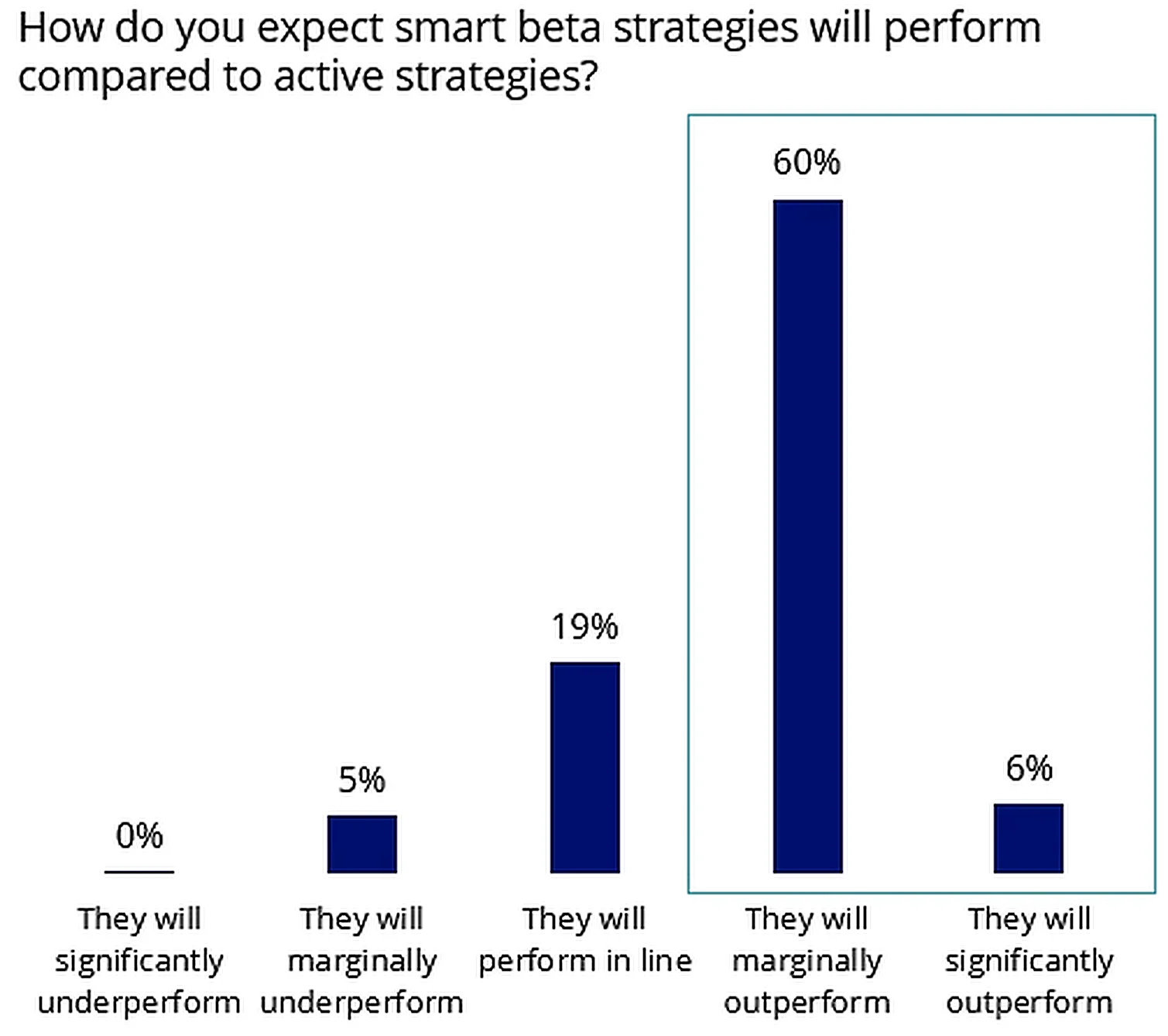

… And that these strategies will either perform inline, or they will outperform active managers (two thirds of respondents).

Source: VanEck Smart Beta Survey, 2025

Think back to the examples of Blockbuster, Britannica and Blackberry above. Are active fund managers worrying about the right competition if they see low-cost passive managers as their major competition? They also need to recognise the potential disruptive threat of smart beta.

Some of them, it turns out, are adapting to what could be the future investment landscape.

Coinciding with the rise of AI, many active fund managers have increased their use of systematic investing. This is potentially the next evolution of smart beta investing. Some budding fund managers focus on these quantitative models. Forward-thinking existing active managers, who do not have this capability, have acquired up-and-coming managers within the field to help compete effectively.

We think this transition will continue.

Announcing the results of the 10thAnnual Smart Beta Survey in a release last week, I commented on the trajectory of ETFs and smart beta:

“One thing is clear from ten years’ worth of survey data: ETFs have become an indispensable tool for advisers targeting cost-efficient outcomes. Penetration is effectively universal at 96.41%. We see smart beta tracking the same arc, with adoption lifting from 36.81% in 2016 to 47.85% in 2025.

“The smart beta switch has been reflected in net flows. In 2023, only two months cleared $500m. Last year, this surged to nine months, with four months crossing the $1 billion threshold for the first time. This year has been softer with the broader market’s pullback, however six out of eight months still topped $500m, and July set a new all-time high of $1.1 billion.”

The next disruptive innovation is happening. Does your portfolio (and your fund manager) reflect the new world?

Published: 12 October 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.