ETFs have busted the myths

Over the past few years some naysayers warned us that passive investing and ETFs (Exchange Traded Funds) were creating systemic risks which would be the cause of the next crisis or, if they were not the cause, they would exacerbate losses.

These pundits were wrong.

We predict that Australian investors will increase their adoption of passive investing and ETFs in the new world.

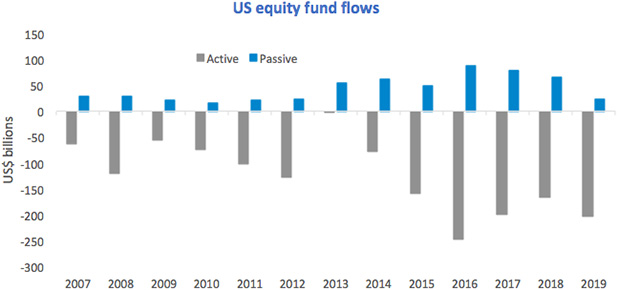

In between the GFC and COVID-19 pandemic, the share market experienced its longest bull market in history. In the US, domestic equity flows throughout that period reflected the well-documented rise of passive investing. In 13 years, net flows into passive funds was positive for every calendar year while active funds experienced net outflows in each of those years.

Source: Morningstar Direct. Asset Flows - US Open-end ex MM ex FOF.

Passive investing was seen as investments used to build investors’ wealth without high fees eroding returns. It has also been well documented that active managers have been struggling to outperform their benchmarks. Therefore, in more recent times, in addition to providing investors with lower fees, passive funds have also been delivering investors with above average returns when compared to their active peers.

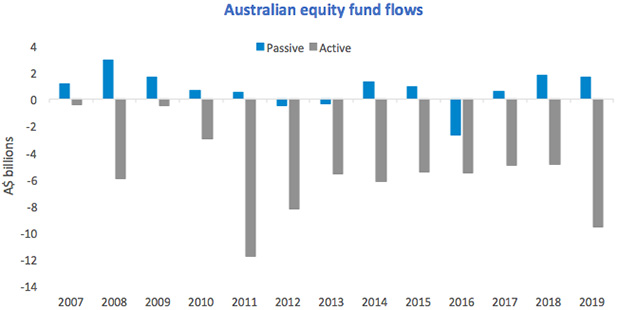

A review of Australia’s funds management landscape and its associated equity market shows a similar trend. A noticeable difference is that flows to passive funds peaked in 2008 in Australia, whereas in the US, the largest flows to passive funds were nearer to the end of the bull market.

Source: Morningstar Direct, VanEck. Asset Flows - Australia Funds ex ETF, Include Obsolete Funds, Morningstar Category: Equity Australia Large Blend, Equity Australia Large Geared, Equity Australia Large Growth, Equity Australia Large Value.

We think that the flows of Australian equities in the next few years will be more similar to those experienced more recently in the US, notwithstanding the active fund managers who employ benchmark agnostic or absolute return approaches who will also do well. No longer will Australian investors be as willing to accept poor returns, nor will they accept high fees. Exchange Trade Funds (ETFs), as passive investments, are positioned to benefit from this growth. In addition to these factors, a number of mistruths perpetrated by the active community about passive investing and ETFs, haven’t played out as they predicted during a market crisis.

ETFs have passed the COVID-19 market test with flying colours. The 2020 market falls:

- were not a result of an ETF bubble

- were not exacerbated by ETFs

- did not result in a liquidity crisis caused by ETFs

- did not cause ETFs to behave like CDOs in 2008.

It is worthwhile illustrating how ETFs deconstructed each of these claims during the most recent market turmoil.

Myth 1 busted: ETFs created bubbles

Let’s start with the claims that ETFs had created a ‘bubble’. The argument was that ETFs were mindlessly driving up prices by buying stocks regardless of their fundamental value and as a result markets were constantly reaching new highs.

While this myth had been shot down in the past, for some reason it still persisted. The simple fact is that in Australia, ETFs do not own enough of the stock market to be a systemic risk, let alone impact fundamentals in any meaningful way. ASX’s total stock market value is $2.5 trillion, up from $1.5 trillion dollars in 2012. In that time ETFs grew from $10 billion in 2012 to be around $55 billion today of which only 30% is invested in Australian equities. Even though ETFs have grown more than five times, they still only represent 2.2% of the stock market.

Myth 2 busted: ETFs exacerbated the correction

The story, prior to COVID-19, was as investors ran to the exit, ETFs would have to sell their underlying holdings, driving prices lower. The lower prices would spook more ETFs investors to redeem and so the cycle would be perpetuated and prices would spiral. These liquidity concerns about ETFs are the same liquidity concerns investors have with active funds that get too large. They can just as easily impact a stock’s liquidity (and value) on days when active funds trade or receive redemptions.

In regards to ETFs including the most recent crisis, in Australia ETFs represent around just 5% of trading volume. This is not enough to distort the economics of trading. Investors should perhaps be more aware that trading by ETF fund managers is not evenly spread over the year. Most of it happens on the days the indices rebalance. Investors should avoid trading on these days like they would avoid buying stocks the day before they go ex-dividend or selling right afterwards.

Myth 3 busted: ETFs will cause a liquidity crisis

The liquidity of ETFs and the rules which they operate under are not well understood by most critics of ETFs. We have written about ETF liquidity previously - here and included a section on it more recently - here.

It is worth addressing here then, the question of liquidity in ETFs that hold assets which are not readily traded on exchanges, like bonds. These include fixed income and credit ETFs. Fixed income securities trade ‘over-the-counter’ instead of ‘on exchange’ and many of the criticisms of ETFs had focused on the liquidity of these over-the-counter (OTC) markets.

OTC markets are made possible by banks and brokers, who facilitate bond trading between institutions. Under normal market conditions they generally carry a book of bonds on their balance sheet to assist with trading and making a liquid market.

There is however a limit to how much they can hold on their balance sheets. In a market environment where there are more sellers (of bonds) than buyers, selling bonds at fair prices becomes difficult. This causes a ‘liquidity crunch’. What we saw in March was that some ETFs with these type of exposures experienced wider buy/sell spreads. This is because as liquidity in the underlying OTC bond market dried up, spreads widened to reflect the discounted prices that the underlying bonds could trade for OTC. This was then reflected in the price of the ETF, as a discount to the Net Asset Value (NAV) of the fund’s underlying holdings.

But as was pointed out in a Wall Street Journal article, ETFs Have Passed Their Covid-19 Stress Test, these bond ETFs were more of a reflection of where the OTC bond market was at, and that bond prices “need(ed) to catch up”. And in following this same point, Robin Wigglesworth in the Financial Times said, “Moreover, the discounts meant that sellers of the ETF bore the cost of instant liquidity, rather than the remaining investors in the fund. This is a fairer outcome than what happens with traditional bond funds, which often sell their most liquid, higher-quality assets to accommodate outflows, leaving remaining investors holding an inferior portfolio.”

Spreads have returned to more ‘normal’ levels, but it is important to point out that during the crisis ETFs with physical backed assets could still be bought and sold. We are not aware of any such ETF that stopped trading on the ASX.

Investors however should still avoid asset classes they do not understand. Always check the label of the ETF in which you are investing.

ETFs are the largest type of Exchange Traded Products (ETPs) listed on ASX. In addition to ETFs, ETPs include Active ETFs, exchange traded managed funds (ETMFs), hedge funds, funds with derivatives based ‘synthetic’ exposures, and structured products. For investors, the ETP's full legal name should alert you to potentially hidden risks. This leads us into Myth 4.

Myth 4 busted: ETFs are risky and complex like derivatives such as CDOs

In terms of the regulatory regime under which ETFs operate, in Australia they are ‘registered managed investment schemes’ as defined by the Corporations Act. Therefore they operate under the same rules as apply to unlisted managed funds under the Corporations Act and are regulated by ASIC. ETFs must also comply with a subset of the ASX rules, overseen by ASX. Like unlisted managed funds, the assets of the ETFs are physically held by a professional custodian. With very few exceptions, ETFs are not complex derivative instruments, like CDOs. Rather they are transparent, highly regulated investment vehicles which marry the best features of unlisted managed funds and listed securities, backed by real assets. The exceptions that use derivatives to a material extent must be labelled ‘synthetic’.

Always check the label of the ETF you are investing, if you are unsure, contact the ETF issuer.

The hysteria about ETFs was based on myths. Much of the negative focus on ETFs has been written by those who stand to lose the most. It is important however to look past the positive and negative commentary and concentrate on your long term goals. A financial planner or stock broker is best placed to help, or to learn more about the ETF market, our ETFs and for guidance on best practice ETF execution, please visit our website vaneck.com.au or call us on 02 8038 3300 or email us at info@vaneck.com.au.

Related Insights

Published: 01 May 2020