Global capital securities – an income alternative/complement to local hybrids

With interest rates near all-time lows, ASX-listed bank hybrids have become an increasingly popular source of regular and stable income for clients alongside the traditional credit and fixed income markets. But there is an alternative investors may have overlooked.

Global capital securities are being used by savvy Australian investors to diversify portfolios beyond local banks that dominate corporate bonds, equity income and hybrid allocations. At present, global capital securities offer more attractive yields than the local ASX hybrid market and provide exposure to the broader global banking universe.

The global banking universe has improved its fundamentals through higher capital ratios and balance sheet de-risking since the global financial crisis much like Australian banks have done.

To date, most global capital securities are only accessible to institutional investors. With its larger market size and variety relative to ASX bank hybrids, they offer ample opportunities for active management through the investment cycle.

What are capital securities?

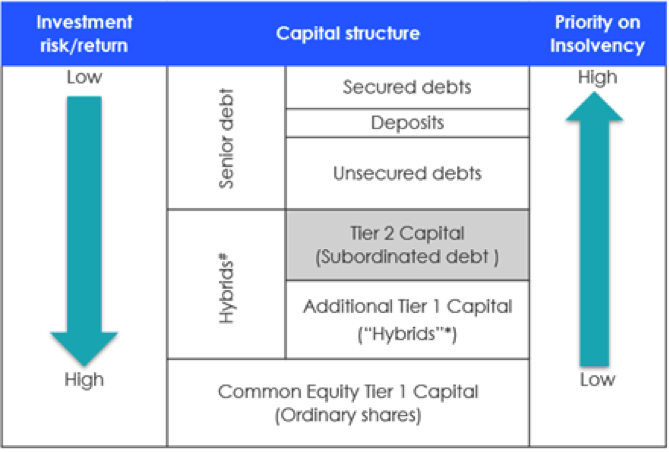

In Australia, capital securities are often called "bank hybrids" because they tend to have both equity-like and debt-like characteristics. In the capital structure (figure 2 below), these securities sit above equities but below senior debt in the event of insolvency. They also offer a higher level of return above unsecured creditors to compensate for this risk. As an asset class, they tend to offer some of the highest yields of all liquid investment grade rated bonds or near-investment grade rated bonds.

During financial stress of the COVID-19 crisis, some banks had their dividends stopped or reduced. However, capital securities were not affected in that period because their issuance terms requires a much higher loss threshold before payments are stopped.

Improvements since the GFC

Since the 2008 financial crisis, banking sector reforms, based on the major rewrite of global banking standards by the Basel committee on Banking Supervision, has:

- driven material increases in the core capital of banks,

- reduced on-balance sheet risk-taking, and

- forced banks to improve liquidity and funding stability.

As a result, banks are required to hold more capital against their assets, in particular against riskier forms of lending (capital charges for banks are based on the level of credit risk). In line with this, banks have revised their risk assessment and lending practices and, in many cases no longer lend to parts of the market with high levels of credit risk.

Subsequently, since 2009 non-performing loans have reduced in the sector, especially in Europe where the periphery has actively provisioned and sold bad loans.

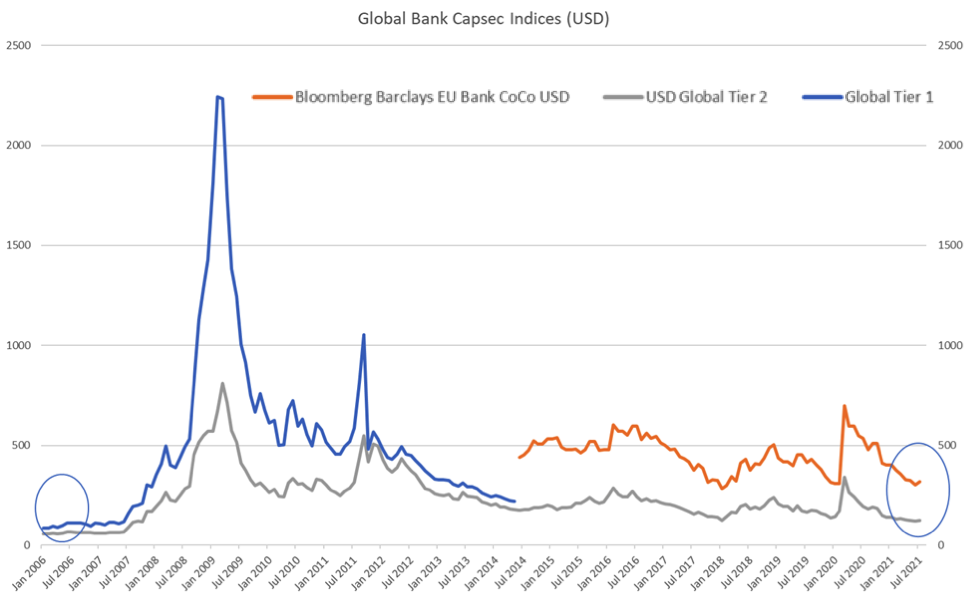

Financial regulators around the world are more conservative than they were and now require banks to have higher capital funding for their balance sheets. As a result, there has been a large amount of issuance of Capital Securities, which has expanded the investment opportunity set. Despite banks now having better capital ratios, the credit spread for these securities is still wider than pre-2008 securities. Remember the credit spread is the difference between the yield of risk-free bonds, such as US Treasuries and another debt security of the same maturity but with a different credit quality. A tight credit spread can indicate good economic conditions, high liquidity or high demand for sought after bonds, so the current spreads may be an opportunity as they are wide considering the capital ratios.

Figure 1: Spreads are wider than 2009 despite better fundamentals

Source: Bentham, Bloomberg, as at 30 July 2021

Two of the more common types of securities are Additional Tier 1 (AT1) and Tier 2 Securities. These securities sit above equity but below senior unsecured debt (as shown in the table below).

Figure 2: Bank’s capital structure

#Per ASIC Report 365. *Per market convention.

Under the original Basel III reforms released in 2010, a bank's AT1 and Tier 2 assets were envisaged to be 1.5% and 2% of its risk-weighted assets, to meet the 6% Tier 1 capital and 8% total capital requirements. Since then, national regulators have taken varying approaches to total capital requirements, generally requiring banks to hold further buffers and allowing more AT1 and Tier 2, which has led to incremental capital security issuance. These securities included key new terms and conditions in regards to loss absorption and coupon cancellation. However, given the fundamental improvements, the primary area of risk focus is on extension risk, being that, the bonds are not called and left outstanding. Because of these terms being included, AT1 securities can also be referred to as ‘contingent convertible securities’ or CoCo’s.

Current Spreads on Offer

Because of the structural improvement in the banks’ balance sheets, the current spreads on offer in this space offshore are attractive relative to liquid investment grade and high yield credit at present. Importantly, COVID-19 showed that bank dividends could be reduced while hybrid coupons remained fully paid.

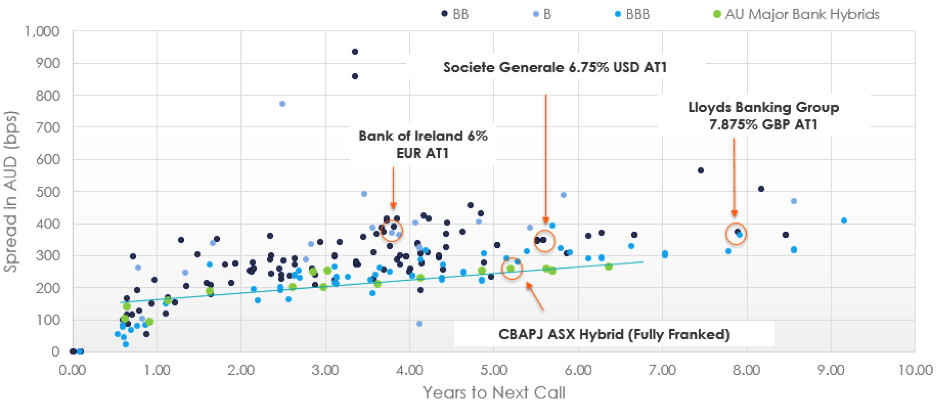

As an example, the Yield to Call1on an average European Capital Securities portfolio is currently around 3.3%, almost 1.0% above that of the local hybrids market (including franking).

Looking at figure 3 below, ASX hybrids are shown by the light green dots versus the European and UK bank CoCo universe. You can see Bank of Ireland, Lloyds and Societe General are trading at wider spreads than ASX hybrids.

Figure 3: Spreads and Years to next call – ASX listed hybrids vs offshore capital securities

Source: Bentham, Bloomberg, as at 30 July 2021

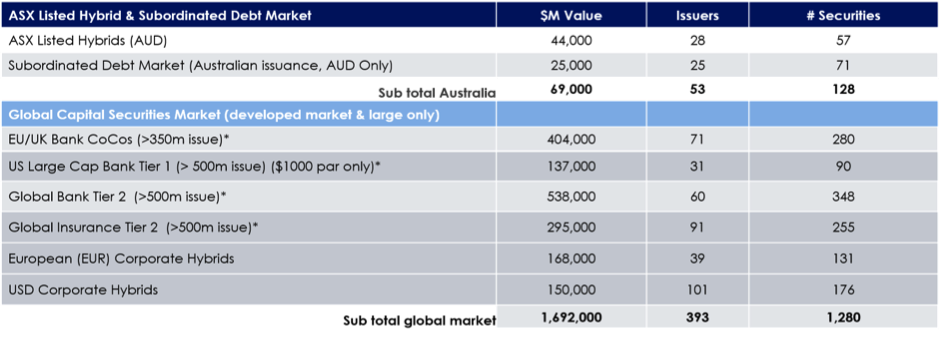

Market size differential: ASX hybrids versus offshore

The global capital securities market is at least 24 times larger than the Australian hybrid market. Australian major banks account for roughly 77% of all domestic ASX listed hybrid issuance, spread across only 4 issuers and 22 securities. This is dwarfed by the opportunity set offshore.

Figure 4: Bigger universe equals greater opportunities: Global Capital Securities Market

*Select currencies USD, GBP, CAD, EUR, AUD.

Source: ASX, Bloomberg, Bentham, 30 July 2021

If something were to go wrong with the Australian economy and an Australian major bank, not only would it severely affect the equity valuations of the banks, but also the valuations of these types of securities as well.

Liquidity size differential: ASX hybrids versus offshore

The ASX listed hybrid market tends to attract domestic and retail investors because franking credits are a key driver of valuations and not valued by offshore investors. This limited buyer base means that the market pricing and liquidity is sensitive to local demand. Hybrids are tightly held by buy and hold investors. By contrast, the European and UK bank “CoCo” market is a globally traded institutional market with higher levels of turnover. This also creates the opportunity for active management.

Figure 5: Trading levels of ASX listed hybrids vs offshore capital securities

|

|

Quarter

|

Calendar YTD

|

Last year

|

Market Size $A Bn

|

|

|

Turnover (% of Outstanding)

|

2Q21

|

YTD

|

Jan-Dec 20

|

|

|

|

AT1 £

|

14%

|

33%

|

64%

|

$

|

22

|

|

AT1 €

|

20%

|

46%

|

98%

|

$

|

96

|

|

AT1 $

|

9%

|

21%

|

44%

|

$

|

220

|

|

ASX Hybrid

|

4%

|

8%

|

19%

|

$

|

41

|

|

Comparitive turnover AT1 €/£

|

5

|

6

|

5

|

|

|

Volume Traded / Amount Outstanding

Source: Trax, Bentham, Bloomberg

Further, by having overlapping exposures to Australian banks via both shares and hybrids (for income) many investors’ portfolios exhibit unnecessary concentration risk that can be mitigated by investing globally.

Active management is key

Given the complexity around structure, triggers, optionality and hedging the risk it is necessary to take an active approach to identify mispricing opportunities.

VanEck together with leading credit & fixed interest specialists Bentham Asset Management have created a global capital securities opportunity on ASX, the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP).

In a world where income remains a key issue for retirees, bank capital securities are well placed to meet this demand.

By expanding the capital security universe to include selected offshore markets, which are not accessible to retail investors, investors can benefit from not only a larger opportunity set but also additional diversification.

Published: 13 August 2021

1- Yield to call is a measure of the return that is paid out if the security is held until the call date, which occurs sometimes before it reaches maturity. Yield to call does not account for fees or taxes. Yield to call is not a forecast, and is not a guarantee of, the future return of the fund which will vary from time to time.

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general advice only, not personal financial advice. The PDS is available here. An investment in GCAP carries risks associated with: subordination in the capital structure, bond markets generally, interest rate movements, derivatives, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.