Solid gold: Gold’s role in a portfolio

With queues forming in Sydney’s Martin Place and gold hitting record highs, interest is surging. Here are three reasons to consider an allocation in your portfolio.

“I have no views as to where (gold) will be (in the next five years), but the one thing I can tell you is it won’t do anything between now and then except look at you” - Warren Buffett, CNBC’s Squawk Box, 2009.

Warren Buffett famously derided gold as an investment. In his 2011 letter to Berkshire Hathaway shareholders, he bemoaned its lack of utility and that it wasn’t procreative. Gold doesn’t generate income, like a company.

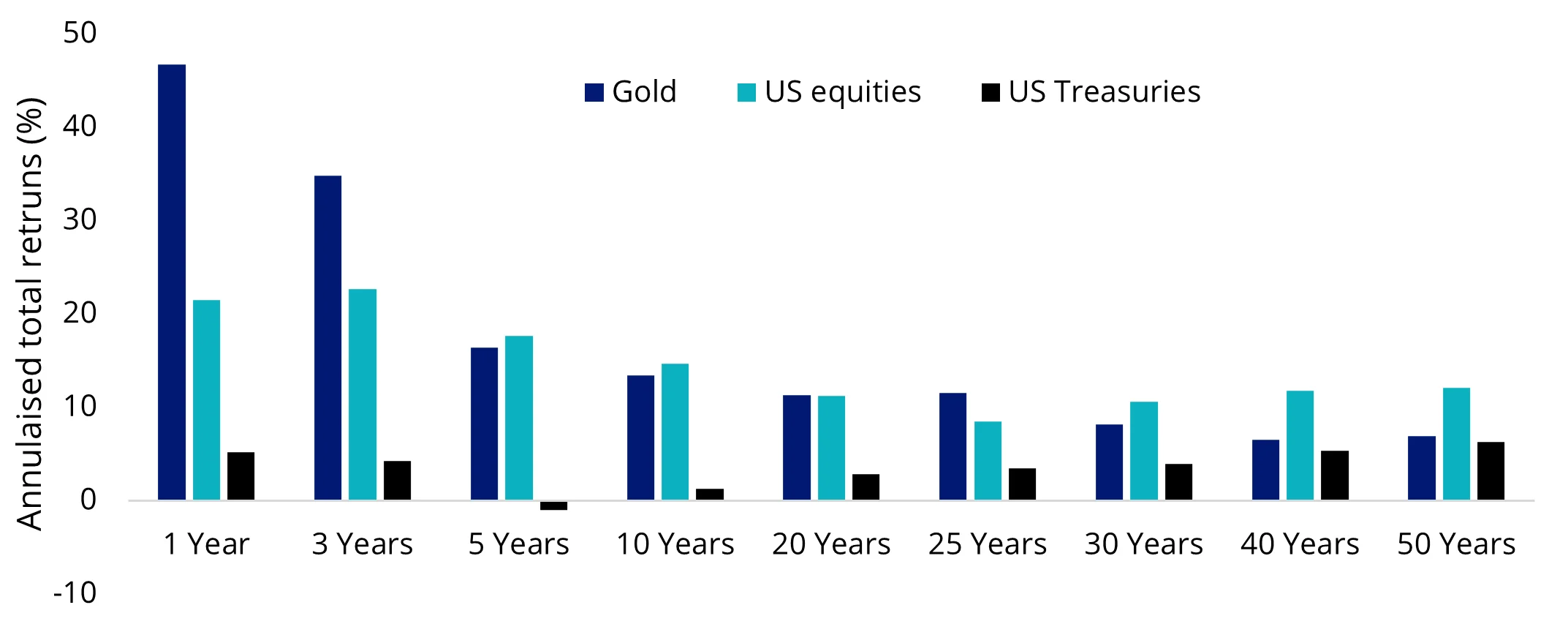

While gold hasn’t generated income, it has outperformed equity markets over the past twenty-five years. It is only when you go further back and include the bull runs of the 1980s and 1990s that equities outperformed over the very long term.

Over 50 years, the return on the price of gold has been more in line with bonds.

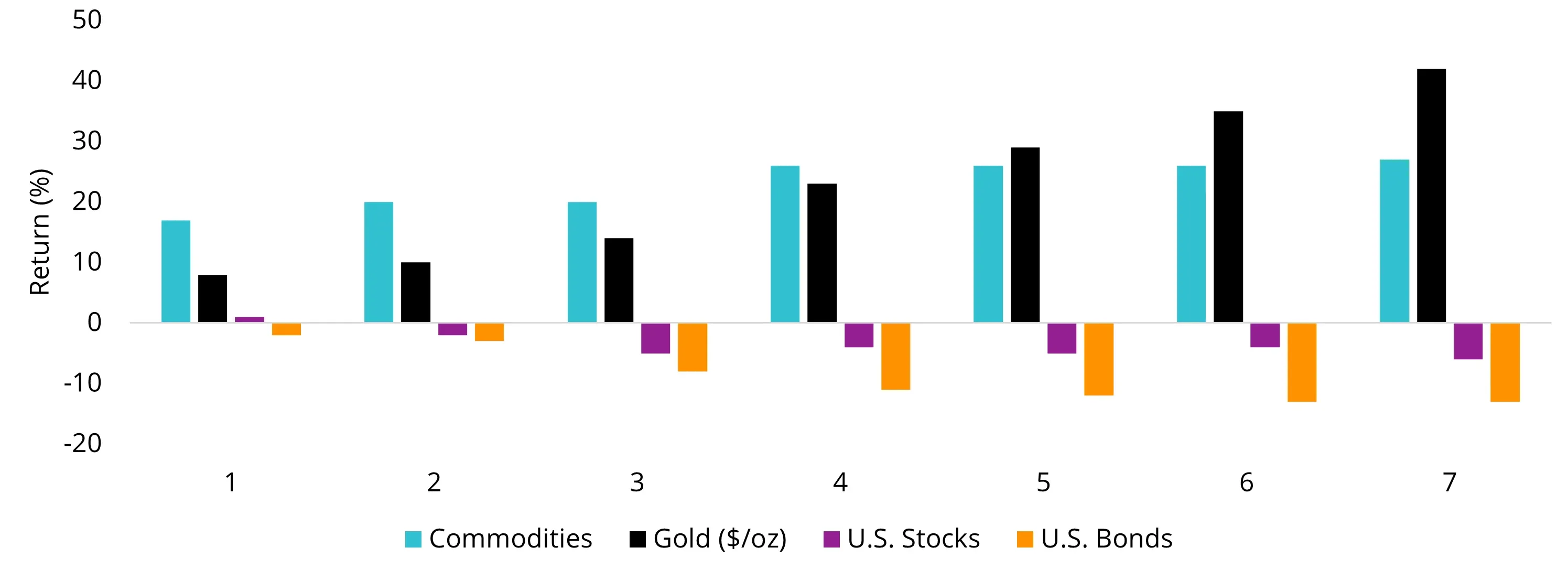

Exhibit 1: Gold’s performance versus other asset classes

Source: Morningstar Direct, data to 31 October 2025. All returns in US dollars. Gold is LBMA Gold Price PM, US equities is S&P 500 Index, US treasuries is Bloomberg Aggregate Bond Treasury Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Therefore, the first reason why gold should be in your portfolio is its performance. Not its strong performance, rather its different performance.

Reason 1: Gold’s performance

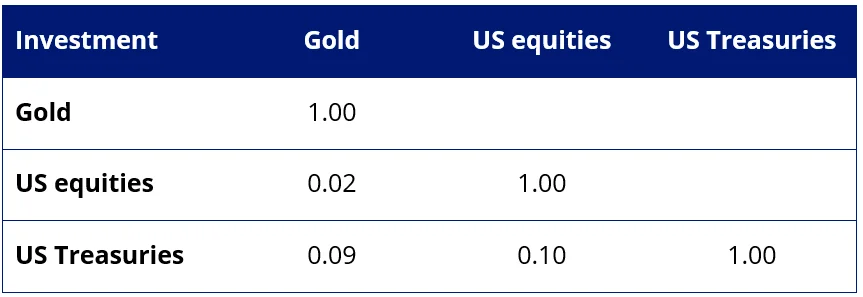

Gold’s performance over the past 50 years has not been tied to the economy in the way that equities and bonds have been. In a portfolio, this is important because it means that gold can behave as a counterbalance to market fluctuations. Allocating to assets that perform differently from each other is key to diversification. In Exhibit 2, you can see that gold is uncorrelated to bonds and equities. In the table, a 1 would represent a perfect correlation. Gold’s correlation to equities and bonds is low.

Exhibit 2: Gold correlation with other asset classes

Source: Morningstar Direct, Correlation is based on monthly return data over fifty years to 31 October 2025. All returns in US dollars. Gold is LBMA Gold Price PM, US equities is S&P 500 Index, US treasuries is Bloomberg Aggregate Bond Treasury Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

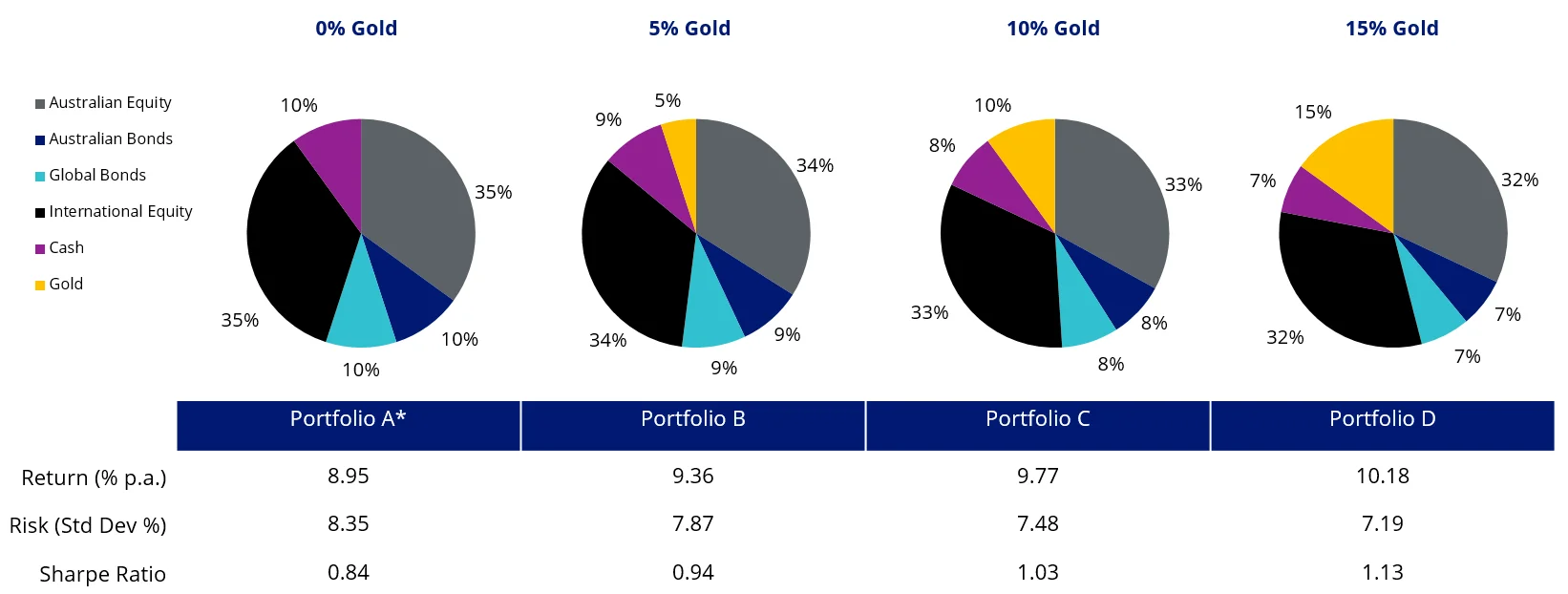

The standard blueprint for portfolio construction is a mix of growth assets (equities) and defensive assets (bonds and cash).

From an Australian investor’s viewpoint, the Australian Government (moneysmart.gov.au) has provided a practical guide to investing called “Investing between the flags”, which highlights typical investment portfolios, including a Balanced portfolio, which we have replicated as Portfolio A, in Exhibit 3.

Having established that gold’s historic performance has, over the long term, exhibited growth and defensive attributes, we have added it to Portfolio A, at 5%, 10% and 15% levels, in each instance reducing exposure to both growth and risk assets to make room for the yellow metal. In each instance where gold is added, portfolio returns increased, the volatility of the returns (a measure of risk) is lower, and the Sharpe ratio (a measure of risk-adjusted returns) is higher.

Exhibit 3: Adding gold to a portfolio

* Portfolio A based on MoneySmart Balanced portfolio

Source: Morningstar Direct, Ten year performance to 30 September 2025. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used to approximate investments Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged , Australian Bonds – Bloomberg AusBond Composite 0+ years, Gold – LBMA Gold Price, International Equities – MSCI World ex Australia Index , Australian Equities – S&P/ASX 200 Accumulation Index.

The next reason gold should be included in a portfolio is linked to government and central bank policies and the supply of money.

Reason 2: The gold price increases with US money supply

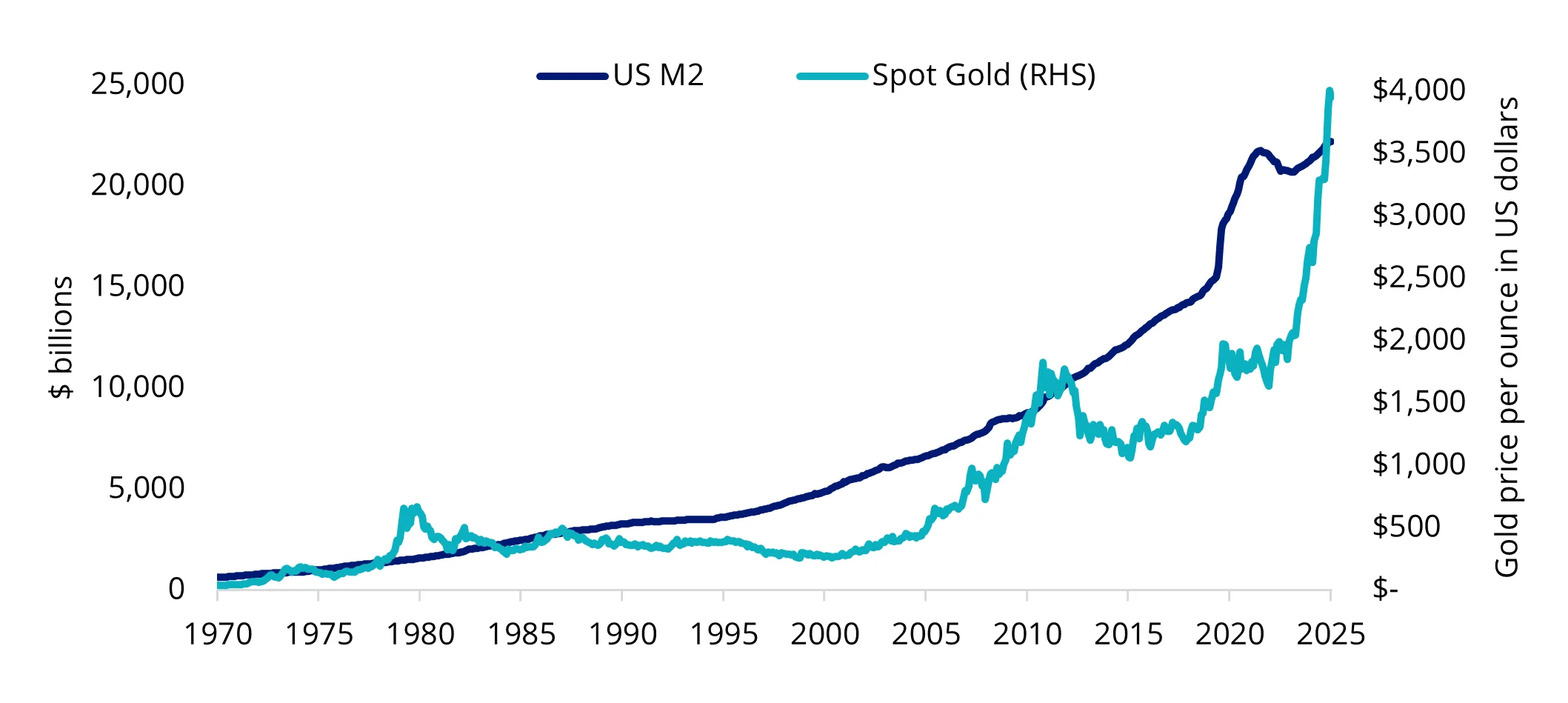

The reason is more technical, but important to understand. Before 1971, the US dollar was linked to gold under the Bretton Woods system. Under this system gold could be converted into US dollars at a fixed rate of $35 per ounce. This was not sustainable because it limited the government’s ability to stimulate the economy.

President Nixon left the Bretton Woods system, and since then, gold has been used by investors as a protection against governments’ and their central banks' overspending/printing money.

Economists measure money supply as M2. The chart below shows the relationship between the US money supply and the price of gold.

Exhibit 4: US M2 and the gold price

Source: Bloomberg, Federal Reserve of St Louis. October 1970 to October 2025. Past performance is not a reliable indicator of future performance.

Never-ending increases in the money supply are the mechanism that supports the total absence of financial constraint through the depreciation of the US dollar. In many ways, the price appreciation of gold reflects the value of the US dollar over the past 50 years. Much has been made of the depreciation of the US dollar recently.

When a currency depreciates, it means that the cost of importing goods and services is higher, and this could lead to inflation. Inflation has long been cited as a reason to invest in gold.

Reason 3: Gold shines during inflationary periods

The original goldbug, James Dines, became famous for his bullish gold predictions throughout the 1970s and 1980s. According to a Streetwise note reporting on his death at age 90 in 2022, "In 1980, The Wall Street Journal wrote, "Metals mania vindicates such economic Cassandras as James Dines, who for years have urged investment in gold as a safe hedge in an inflation-weary world."

Inflation is one of the most potent threats to the value of your investments. Over time, it erodes purchasing power, reduces corporate profits, and diminishes the real value of bond interest payments. Gold, meanwhile, retains its value.

A feature of the 1970s and 1980s was inflation. Today, inflation remains a concern for central banks globally. Inflation reared its head after the world emerged from its COVID lockdowns, as extreme government stimulus and unconventional central bank intervention increased the money supply. In many places, it has not dissipated, and the renaissance in gold’s price since the end of 2021 has coincided with this increase in inflation.

Exhibit 5: Gold versus other asset classes at varying inflation levels (1969 to 2024)

Source: VanEck, Bloomberg. Data as of December 2024. US Stocks is represented by the S&P 500 Index. US Bonds is represented by US Treasury Bond (10-Year Estimate). Commodities is represented by the Bloomberg Commodity Index. You cannot invest in an index. Past performance is not indicative of future results.

These three reasons for including gold in a portfolio have been debated since the 1970s. There may also be other, more immediate, factors at play that explain why people are lining up to buy gold now.

Why are people lining up to buy gold

To use another Buffett-ism “Gold is a way of going long on fear.”

There is no doubt that many investors are fearful that many markets are fully priced, having run for some time.

Other factors that may have also increased investors' fear include extreme government spending, massive government debts and seemingly unchecked money creation. When you consider this and combine it with geopolitical risks, investors have a lot to grapple with in the near term.

The increased government debt and its spending combined with geopolitics, going back to reason three, create an ideal environment for a sustained period of above-target inflation. This all plays into why investors are flocking to gold now.

The next question, naturally, is how much of a portfolio should be allocated to gold. Zero is not the answer, and hopefully those lining up aren’t allocating 100%.

While there’s no one-size-fits-all answer, a 5% to 15% allocation to gold is supported with a time-tested approach to asset allocation. We think this should be enough to provide the diversification benefits outlined above and protection against inflation, market volatility and geopolitical risks.

It’s important to note that gold should not be used as a speculative play or a temporary hedge. We consider gold to be a strategic long-term investment that can enhance your portfolio’s resilience. Unlike other assets, gold is not tied to corporate earnings, interest rate policies or government fiscal decisions. It moves to the beat of its own drum, providing valuable diversification. Gold, we think, has an important role to play in portfolios.

Related Insights

Published: 07 November 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.