Indifference is good when investing

If you, like all active fund managers, believe that markets are inefficient, and the active Australian equities manager that you're invested with hasn't beaten the S&P/ASX 200 by 4% p.a. over the last four years, you can no longer afford to be indifferent to equal weight investing.

Most Australian equities active managers benchmark themselves against an index in which the constituents are weighted in proportion to their market capitalisation such as the S&P/ASX 200. Most passive Australian equities also track this type of index.

The theoretical underpinning for market capitalisation is the efficient market hypothesis, which supposes the price of each stock in the market reflects all the relevant information about that stock and thus securities trade at fair value.

Based on this theory, market capitalisation weighted indices should deliver the best returns for the least risk.

But they don’t.

There are weaknesses with the market capitalisation approach. By definition, investing in a passive fund that tracks a market capitalisation index means that you allocate more to bigger companies than to smaller ones. Consequently, this strategy may not uncover the best investment opportunities because when the market overvalues a stock, a fund tracking a market capitalisation index will buy too much of that overpriced stock. Conversely, when the market undervalues a stock, the fund sells too much of the low-priced or undervalued stock, potentially missing out on gains later when the pricing of the stock corrects.

Active managers aim to exploit these inefficiencies. They do this by considering all manner of factors such as size, value, quality and volatility. The result is a portfolio that is overweight and underweight stocks, sectors and factors relative to the market capitalisation benchmark. The predominant outcome for investors, however, has been high costs of managing such strategies and underperformance which has been highlighted time and time again by S&P Dow Jones Indices' SPIVA scorecard.

The philosophy of equal weight investing is based on the same one as active managers – that is markets are inefficient. Equal weighting does not consider factors, rather each stock that is included is weighted equally and as such is factor indifferent.

Equal weight investing was introduced to Australian investors on 4 March 2014, when the VanEck Vectors Australian Equal Weight ETF (MVW) was launched on ASX and over the past four years to 30 April it has outperformed the S&P/ASX 200 by 4.08% p.a.

Overcoming the problems of market capitalisation

A significant problem with market capitalisation indices is that they increase the risk of being concentrated in only a handful of stocks or sectors. Australia's S&P/ASX 200 is a good example of this.

The top 10 companies represent over 45% of the index. Four of the top six companies are banks. Investors buying a fund that ostensibly contains 200 stocks would likely assume such a broad-based fund to be better diversified. But not with the S&P/ASX 200. Active Australian equity managers that benchmark themselves to the S&P/ASX 200, due to fear of high tracking error, are often compelled to take similar positions to the benchmark. Sector and stock concentration may make sense if an investor is 'bullish' or confident the sector or stock will outperform. Yet this is not the reason people invest in the S&P/ASX 200 or an ETF tracking that index. They typically want true diversification.

A different, simple solution

Institutional investors, not wishing to be burdened with the problems of market capitalisation indices or paying excessive fees for underperforming active management, have driven the development of alternate weighting index strategies. Many of these new index methodologies use the same factors for determining the companies included in the index as those employed by active managers. – (to learn more about factors click here)

Equal weighting, like the methodology used by the MVIS Australia Equal Weight Index, which MVW tracks, is different. It does not use factors. Size, dividends, quality or value bear no impact on the stock selection or weighting in the index. The weight of each stock is one divided by the total number of stocks in the index.

In addition to being factor indifferent, the rebalancing process is inherently contrarian. At each rebalance, stocks that lost value are topped-up, while those that gained the most are trimmed back, resetting the portfolio to an overall equally weighted position. In effect, the portfolio is buying low and selling high.

This procedure has been identified by academics as a contributor to an equal weight index's outperformance relative to an equivalent market capitalisation index.

Diversification

Another reason an equal weight index performs differently is because it has stock and sector exposures different to the market capitalisation index.

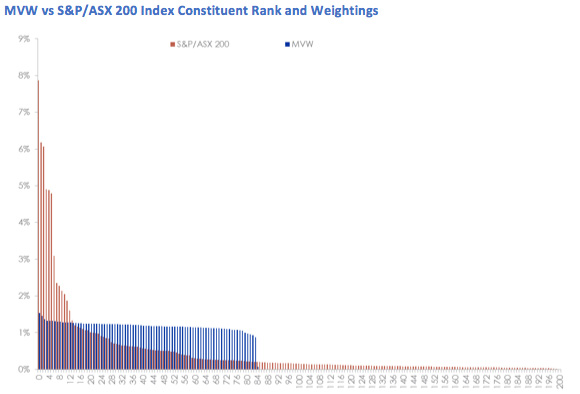

Below we compare MVW to the S&P/ASX 200.

Source: FactSet, as at 30 April 2018

MVW currently includes 84 of the largest and most liquid ASX listed companies. As the chart above illustrates, compared to the S&P/ASX 200, MVW has less exposure to the largest 14 stocks. It also doesn't invest in the 119 stocks in the long tail of the S&P/ASX 200 which tend to be rounding error in terms of performance of the market index.

MVW's remaining 70 holdings are strong Australian companies typically with experienced management teams, established brands and client bases, infrastructure and access to capital markets. Such companies can grow more quickly than their mega-cap counterparts, benefiting from flatter management structures, entrepreneurial drive and quick decision-making. Importantly these companies also have much greater potential to be taken over than the largest 14 stocks on ASX.

Allocating more to smaller size stocks rather than mega stocks has benefited MVW.

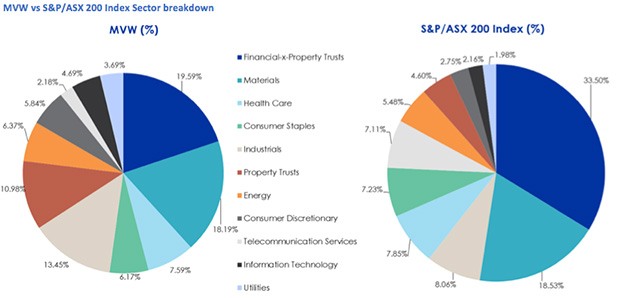

MVW also looks different from a sector perspective.

Source: FactSet, as at 30 April 2018

What is immediately obvious is that the equally weighted portfolio has much less exposure to financials. This increases exposure to other growing sectors of the Australian economy such as IT, consumer discretionary and industrials.

Performance

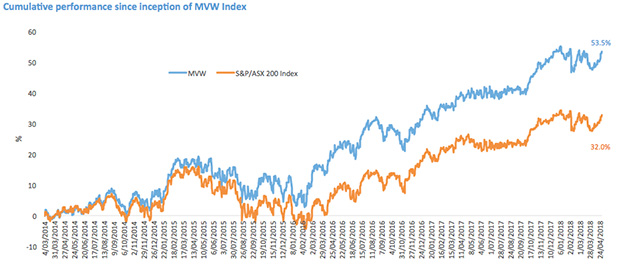

Historically, equal weighting has outperformed in Australia. Since its launch MVW has outperformed by 3.83% p.a.

Inception date is March 4, 2014.

Source: Morningstar Direct, as at 30 April 2018. Results are per annum, calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management costs but do not include brokerage costs of investing in MVW. Past performance is not a reliable indicator of future performance.

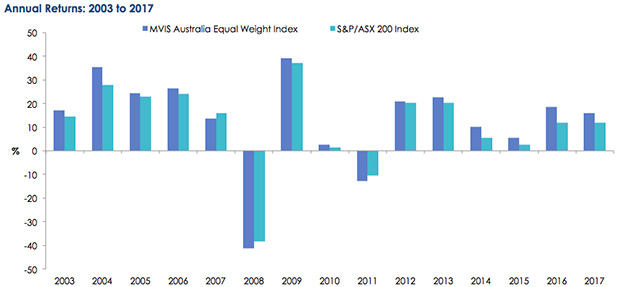

Over the long term, the MVIS Australia Equal Weight Index has outperformed in 12 of the past 15 calendar years including the last six in a row.

Source: VanEck, FactSet, as at 31 December 2017. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MVW. You can not invest directly in an index. Past performance of MVW’s Index is not a reliable indicator of future performance of MVW.

The outperformance of equal weighting results from its differing weighting methodology and its rebalancing process. Australian investors can no longer afford to be indifferent to this factor indifferent strategy.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity of the VanEck Vectors Australian Equal Weight ETF (MVW) ('Fund'). This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person's individual objectives, financial situation nor needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser and consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 3837. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the Fund.

MVIS Australia Equal Weight Index ('MVIS Index') is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany ('MVIS'). MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.

Published: 09 August 2018