Invest like the Future Fund

The Grammy Award for Best Alternative Music Album is presented to recording artists for quality albums in the alternative genre at the Grammy Awards. Winners have included Sinead O’Connor, REM, U2, Nirvana, Coldplay and David Bowie. Hardly a list of unknowns. This leads to the question, when does alternative become mainstream?

The same question could be asked in investment circles. Some so-called ‘alternative assets’ should now be considered mainstream. Institutional investors have looked past the label for property and infrastructure but an ongoing miscategorisation as alternative assets could mean they are underrepresented in most retail investors’ portfolios.

For too long, infrastructure and property have been lumped together in the ‘alternative assets’ bucket. Yet, these assets are definitely entering the mainstream. Already, large institutions use them, and more and more investors are catching on to their benefits.

Infrastructure and property assets typically deliver reliable income streams and potential capital growth to investors, as well as portfolio diversification. Recently, demand has increased as investors consider property and infrastructure as substitutes for historically high-yielding Australian equities given the slowing Australian economy and fears of lower yields ahead coupled with the potential winding back of franking credit refunds if the Labour party wins the upcoming federal election.

Institutional investors and large superannuation funds have long invested in infrastructure and global property assets. Australia’s single largest investor, the Future Fund, has lead the way.

At 31 March 2018, Australia’s sovereign wealth fund was valued at $141 billion. It has returned an impressive 8.5% per annum over the last 10 years, against a target annual benchmark return of 6.7%. Investment returns had added over $80 billion to the original contributions of $60.5 billion made by government.

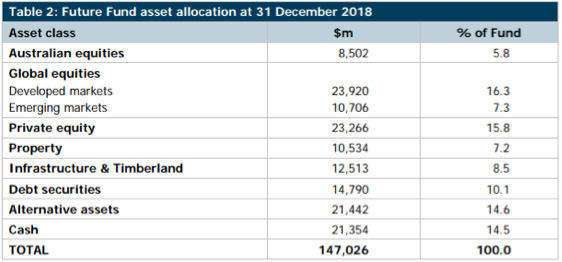

A significant 32 per cent of its portfolio is allocated to so-called ‘alternative assets’ such as infrastructure, property and private equity, which has helped to buoy its returns and reduce investment risks. That’s because returns on such assets aren’t highly correlated with stock markets. Below is the asset allocation the Future Fund most recently reported. Property and infrastructure are listed on different lines and not bundled with ‘alternative’ assets.

Future Fund asset allocation

The asset allocation of the Future Fund at 31 December 2018 is shown below:

Source: Future Fund, Portfolio update at 31 December 2018. The above is not a recommendation of an investment strategy and does not constitute personal financial advice for any individual.

Another large institutional investor, industry superannuation fund Hostplus, treats property and infrastructure as separate asset classes too.1AustralianSuper is another big investor in infrastructure assets and property, treating them separately from alternative assets. AustralianSuper has significant holdings in Ausgrid, NSW Ports, Westconnex and Brisbane Airport. Elsewhere around the globe, AustralianSuper holds stakes in Indianan Toll Road, Manchester Airport Group and Vienna Airport, and Anglican Water in the UK.

While the Future Fund, AustraliaSuper and HostPlus have the scale to buy infrastructure and property projects directly, for investors who are not as big, a good proxy is to invest in listed property and infrastructure trusts and companies. Unlisted, direct infrastructure and real estate assets do behave differently than listed equivalents as they are only priced periodically so do not have the same price movements as a listed asset. However the advantages of investing in listed securities is that they are often more diversified as they generally operate more than one asset. Listed infrastructure and property securities also provide greater liquidity. This means investors can buy and sell as required on an exchange, whereas an investor in a direct real estate or infrastructure project must first commit to a large capital outlay and then is subject to the risk that no one wants to buy the asset when they need to sell.

Listed infrastructure operators are typically large with little competition and protected by high barriers to entry. Infrastructure represents a range of assets from toll roads, airports, broadcasting towers to railways. Investors can reap income from infrastructure assets that adjusts throughout economic cycles and different interest rate environments, hence its appeal to institutional investors. Such assets aren’t highly correlated with the returns of equities so they provide crucial diversification which can protect portfolios’ value when equity markets sell off.

For property, Australian real estate investment trusts (REITs) account for just 3% of the world’s REIT opportunity. The US, Europe and Asia offer investment opportunities not readily available in Australia.

These asset classes are also accessible for small investors and can be used for the same diversification, defensive and income benefits. Yet many Australian investors still consider property and infrastructure, if they consider them at all, as alternative assets, and not mainstream asset classes. As a result, they may be underrepresented in most retail portfolios and investors are likely missing out on their potential benefits.

Defence when you need it

With rising risks around the economic cycle, infrastructure and property provide a hedge against an equity market downturn. They have strong defensive qualities as they achieve a high proportion of their returns from income rather than capital.

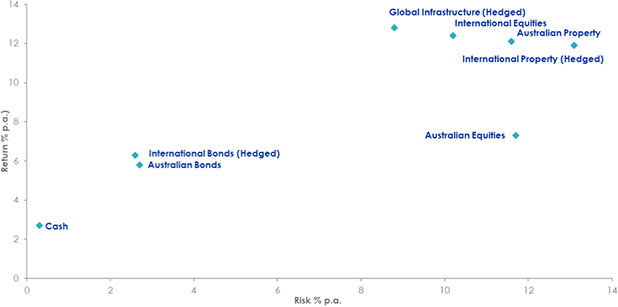

Below we illustrate that infrastructure and property are correlated to asset classes in most Australians’ portfolios using the standard market benchmarks as a proxy for each asset class. The FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD has become the global infrastructure benchmark used by industry participants including asset consultantsiand asset managersii. The chart below shows that infrastructure has been among the best performing asset classes since inception of this benchmark on 1 January 2010 while also being lowly correlated with traditional asset classes that dominate Australian portfolios. These include: Australian equities; Australian listed property; Australian bonds and cash; and unhedged exposures to international equities. Most Australian investors with global bonds in their portfolio seek a hedged exposure to limit the impact of currency movements on income and the same is true of the standard international (ex-Australia) property index, the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged.

Risk and reward of asset classes since inception of FTSE infrastructure benchmark

Source: Morningstar Direct, All returns in Australian dollars. Risk-reward 1 January 2010 – 31 March 2019. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used: Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite 0+ years; Global Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD; Australian Property – S&P/ASX 200 A-REIT, International Equities – MSCI World ex Australia Index; Australian Equities – S&P/ASX 200; International Property - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged

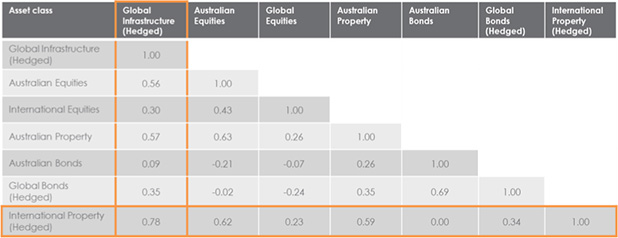

Below a correlation of 1.0 means the asset values move together while a score of -1.0 means they move in opposite directions. Anything below 0.5 could be considered a low correlation.

Correlation of asset classes

Source Morningstar Direct, All returns in Australian dollars. Correlation: 1 January 2010 to 31 March 2019. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used: Cash – RBA target cash rate, International Bonds – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite 0+ years; Global Infrastructure – FTSE Developed Core Infrastructure 50/50 Index Hedged into AUD; Australian Property – S&P/ASX 200 A-REIT, International Equities – MSCI World ex Australia Index; Australian Equities – S&P/ASX 200; International Property - FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged

Accessing property and infrastructure is now easy

ETFs have opened up infrastructure and property making them accessible to all types of investors and no longer just institutions like the Future Fund, HostPlus or AustralianSuper. Because ETFs are traded on the ASX, investors can easily buy and sell in amounts that suit their individual investment needs.

Because property and infrastructure provide potential diversification and defensive benefits yet have largely been misunderstood, VanEck has launched an online resource to help explain the rationale for our property and infrastructure ETF offerings. It is available here.

We encourage all investors and advisers to now consider property and infrastructure investments as mainstream and assess with their adviser or broker whether they can potentially benefit from investing in them just as Australia’s largest institutions have always done.

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is the responsible entity and issuer of VanEck Vectors FTSE International Property (Hedged) ETF ARSN 631 508 248 (‘REIT’), VanEck Vectors FTSE Global Infrastructure (Hedged) ETF ARSN 611 639 058 (‘IFRA’) and VanEck Vectors Australian Property ETF ARSN 165 151 771.This information is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available from www.vaneck.com.au or by calling 1300 68 38 37. No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance. REIT and IFRA are not in any way sponsored, endorsed, sold or promoted by the Future Fund, HostPlus or AustralianSuper. Companies are referred to for illustration only and are not a recommendation to purchase any security.

REIT and IFRA are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG’) (together the ‘Licensor Parties’) or by the Future Fund, HostPlus or AustralianSuper. None of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE EPRA Nareit Developed ex Australia Rental Index AUD Hedged or the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (together ‘the Indices’) upon which REIT and IFRA are respectively based, (ii) the figure at which the Indices are said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Indices for the purpose to which they are being put in connection with REIT and IFRA. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Indices to VanEck or to its clients. The Indices are calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Indices or (b) under any obligation to advise any person of any error therein. All rights in the Indices vest in FTSE. “FTSE®” is a trademark of LSEG and is used by FTSE and VanEck under licence.

1https://pds.hostplus.com.au/5-how-we-invest-your-money

iFrontier Advisers, “The Frontier Line: GLI Benchmarks”, March 2015

iiAndrew Maple-Brown, “Building a Defence”, June 2016

Published: 11 April 2019