Long or 'Shorten' banks

The revelations about the big banks’ misconduct that were uncovered by the Hayne Royal Commission have provided reasons enough to avoid bank shares, yet the final recommendations of Commissioner Hayne are still unknown. Additionally, polls indicate next year’s Federal election will be won by Labor, who have already announced policies that could impact banks. Surprisingly, despite these headwinds, banks have done better than the broader Australian equities market in 2018. How the banks will perform in 2019 is anyone’s guess. ETFs allow investors to position themselves for any possibility. Here we describe below the different ways investors can position themselves with ETFs for any outcome of the Royal Commission, the election and anything else that may come up in 2019.

The big four banks represent around 25% of the S&P/ASX 200 Accumulation Index (S&P/ASX 200) by market capitalisation. They form a powerful oligopoly and while their market position is secure, their value as investments is open to question. Banks face significant headwinds in 2019. These include:

- Slowing earnings growth as a result of the stalling property market. Banks are over-exposed to mortgages and falling property prices makes their lending books more vulnerable;

- Risks tied to the outcome of the Royal Commission which may lead to greater regulation of the banks; and

- A possible Labor win at the federal election in 2019 could dampen demand for bank shares, given Labor has said it will wind back negative gearing and franking credit refunds.

Depending on your view about the current price of bank shares, there are three approaches you can take:

- You’re a pessimist: banks are dubious investments and their share prices will suffer if Labor is elected and the property market continues to fall and their reputations are further tarnished once the Royal Commission hands down its final recommendations;

- You’re an optimist: all the bad news is already priced into bank shares. Banks are under-appreciated for the cash cows that they are; or

- You sit in the middle of the road: the big banks are necessary; profitable and even if Labor wins and removes franking credit refunds they will remain a good source of dividend income. But they’re still risky investments, best held in small measure.

The pessimist’s view

Pessimists view the outcome of the Royal Commission as a negative for banks – and for good reason. Their reputations have been left in tatters, especially those of the Commonwealth Bank and NAB, which have been the subject of the most negative headlines. Any increased regulation of banks will likely incur additional costs, on top of increased capital requirements. Furthermore, pessimists see the likelihood of increased banking competition in the sector which could further erode their earnings growth.

Another significant headwind is the slowing of the property market, which has stymied credit growth for the big banks and the money they generate from home mortgages. Housing credit growth in September 2018 was 5.2%,1the lowest for almost five years. That may slow further still as the property market stalls in Sydney and Melbourne.

Furthermore, if Labor wins the federal election next year, demand for bank shares may drop. The Labor Party has said it will abolish cash refunds for surplus franking credits from 1 July 2019. The big banks pay fully franking dividends, attracting demand from income-seeking investors. This may drop if Labor’s policy is invoked.

The optimist’s view

Optimists, on the other hand, see the four major banks as wielding immense power due to their size and critical role in the economy. Banks have always emerged from past scrutiny, stronger than ever. They continue to make record profits, despite low earnings growth. They are very big businesses with a captured market.

Despite headwinds, Australia’s largest four banks operate as an oligopoly that gives them a structural competitive advantage, ensuring they’ll deliver excess profits over the long-run. They also continue to offer fully franked dividend income that looks more attractive relative to bonds and the broader market which is likely to drive continued demand for high-yielding bank shares, even if cash refunds for surplus franking credit are removed. Optimists may also believe Labor’s proposed changes to franking credits and negative gearing will not pass through Parliament.

Also, if interest rates start to rise, banks could stand to benefit. Unlike bond values, their share prices may well rise on higher interest rates as their margins will likely improve, the optimists say.

Middle of the road

Despite slowing earnings growth, banks are still very profitable. While they face risks, banks are still a worthwhile investment because banks make a lot of money and they pay attractive dividends which will remain an important source of income even if Labor removes franking credit refunds. So they have a role in most investors’ portfolios as income-producing growth assets.

Position your bank exposure with one trade

Whether you are an optimist or a pessimist, or sit half-way, some degree of exposure to the Australian banking sector is important for a well-balanced portfolio. With VanEck’s ETFs, you can position your portfolio to suit your views on the banking sector, whether you desire a large or small exposure.

ETFs are diversified portfolios that can be used as building blocks for investors to easily construct and adjust their investment portfolio via simple trades on ASX. VanEck offers three ETFs which enable investors to achieve varying degrees of exposure to the Australian banking sector depending on their level of confidence:

- Low confidence (the pessimists): You can achieve low exposure to the banks while maintaining broad diversified exposure to the rest of the Australian economy and share market using VanEck’s Australian Equal Weight ETF (MVW);

- Moderate confidence (Middle of the road): You can achieve a moderate exposure to the banks in a diversified portfolio of companies in our S&P/ASX Franked Dividend ETF (FDIV); or

- High confidence (the optimists): You can access pure and diversified exposure to banks using VanEck’s Australian Banks ETF (MVB).

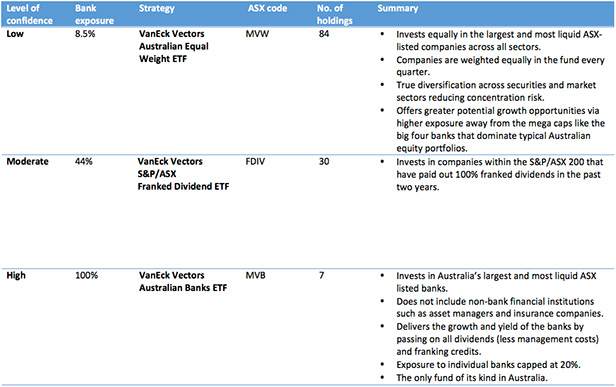

The following table details the varying levels of exposure to Australian banks offered by VanEck’s ETF strategies.

These three options give investors considerable flexibility. In addition to their ease of trading on ASX with live prices throughout the day, VanEck’s ETFs give investors full transparency to their underlying holdings, on a daily basis, unlike managed funds or active ETFs. ETFs also offer better liquidity than unlisted managed funds and similar liquidity to holding bank shares directly. So no matter your outlook on banks, VanEck’s ETFs allow you to invest according to your view.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck) as the responsible entity and issuer of the VanEck Vectors Australian domiciled exchange traded funds (‘Funds’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general advice only about financial products and not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a Fund, you should read the applicable PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. The Funds are subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any Fund.

1RBA Credit Aggregates data for September 2018.

Published: 07 December 2018