Navigating the ‘infodemic’

Determining what is ‘real’ and ‘fake’ has become difficult. We’ve seen this with the outbreak of the new coronavirus. In the early days of an outbreak there is always uncertainty. People don’t like uncertainty and so seek out information. It has been hard for people to find trustworthy sources with many spreading unsubstantiated, false information about the coronavirus. It’s no surprise the World Health Organisation says the coronavirus outbreak has been accompanied by an “infodemic”. An epidemic like the coronavirus, with potential to become a global pandemic, has shaken us all. But history shows pandemics can often be just a sniffle in investment markets.

Driven by fears of the new coronavirus outbreak, equity markets have been volatile in the past few weeks. We’ve all heard about the increasing death toll. But as with all pandemics, uncertainty reigns in the early stages while true impact and facts are determined.

According to the World Health Organisation (WHO) in a report released on 2 February 2020, the “outbreak and response has been accompanied by a massive ‘infodemic’ — an over-abundance of information — some accurate and some not — that makes it hard for people to find trustworthy sources and reliable guidance when they need it.” This adds to the uncertainty.

Humans do not make good decisions in the face of uncertainty. This has been shown time and time again in academic tests and in investment markets. Psychologist Daniel Kahneman was awarded the Nobel Memorial Prize in Economic Sciences for his work concerning decision-making under uncertainty so making investment decisions based on the current infodemic could be fraught with danger.

It’s important not to get caught up in the hysteria. Savvy, patient investors are sticking to the facts and relying on experts. WHO has been busting myths on its own digital platforms.

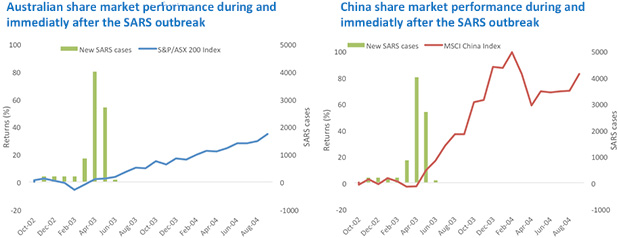

It is worthwhile too, to take a look at previous outbreaks such as SARS (severe acute respiratory syndrome) in 2003 to understand how markets behaved and how those governments tasked with preventing the loss of life and managing the economy reacted.

History has persistently shown that when outbreaks occur markets typically recover as they did following SARS and after the so-called “Swine Flu” in 2009/10.

Some analysts even suggest stocks like health care and those that rely on indoor consumption tend to be boosted, especially in China. An event such as the coronavirus also highlights the importance of being properly diversified so that the impact of these events can be better absorbed by your portfolio.

Many Australian investors have a domestic bias. The Australian economy is likely to be impacted because China’s demand for goods and services will decrease and sectors that are exposed to this are likely to suffer. This includes commodity producers and tourism operators.

Source: WHO, Morningstar Direct. 1 October 2002 to 30 September 2004. Returns in Australian dollars. Past performance is not a reliable indicator of future performance.

Economists and analysts reach back to the 2003 SARS outbreak to predict the potential impact of the coronavirus. Looking at the data, when new cases of SARS peaked, fears fell and equity markets recovered. In the case of SARS, the Australian Government was not required to undertake any significant stimulus. We think coronavirus could be different.

According to Treasury Papers, SARS had a “mild and temporary impact on the Australian economy, primarily through disrupted tourism and reduced exports. In 2003 the tourism downturn was somewhat offset by Australians deferring or cancelling overseas travel in favour of Australian destinations.”

This time, we think the Federal Government, having recently been intent on achieving a government surplus despite the RBA pleading for fiscal policy stimulus, may change its tack. In the face of the twin threat to the economy of the recent bushfires and coronavirus, the government now has a ‘reason’ to stimulate the economy by spending. This may ease the pressure on rates and stimulate the local consumer. Expect too, the domestic tourism campaign to be dialled up.

Back in 2003, the impact of SARS on the Chinese economy was much worse than Australia. It is estimated the SARS outbreak knocked 1% from China’s growth rate in 2003. This time the Chinese government has moved quickly to shore up its economy, announcing new policies over the past weekend to ensure liquidity, strengthening credit support and relieving the debt burden for troubled corporations and institutions, with extra measures in Wuhan province. China’s central bank, the Peoples Bank of China (PBOC), will inject 1.2 trillion renminbi. (~A$260 billion) was injected into local markets on reopening after the Chinese New Year holiday extension. Banks are lowering rates for targeted small and medium enterprises (SMEs) and it looks like 2020 deadlines for asset management rules may be postponed.

This policy reaction is similar to what happened when SARS hit in 2003. The government moved to safeguard SMEs and stimulated markets.

Since 2003, the Chinese economy has been transforming from a manufacturing to a consumption led economy, so it’s likely both the impact and the recovery, once the coronavirus is managed, will be different from 2003. Policy makers will not be able to rely on a quick fix and given the scale of the spread of the coronavirus, the recovery will take longer. The Chinese economy is a lot bigger than it was 17 years ago so it will not be able to as easily rely on a quick-fired manufacturing led rebound. As luck would have it the Chinese government has been focusing on its consumers since the commencement of its trade war with the US. We expect this focus to continue, so while the economic recovery will happen, it may be slower than in 2003. In 2003 China was growing at 10%. Last year China grew a more manageable 6.1%, so the negative impact of the epidemic will be easier to adapt to than in 2003. That assumes the virus remains at epidemic levels and does not spiral into a pandemic, for which the modern world has no precedent.

China – Domestic consumption – staples and discretionary sector

Throughout 2019 China’s leaders were talking up domestic consumption, as this had been the country’s economic driver for several years. Although China accounts for only 10% of global household consumption, it accounted for 31% of global household consumption growth from 2010 to 2017, according to a recent McKinsey Global Institute report1. Chinese consumers are not, of course, immune to a pandemic led economic slowdown any more than consumers in any other economy. Certain sectors such as staples are likely to do well. Consumers are crowding to supermarkets in favour of eating out and as such are supporting demand for staples that they buy off shelves like vegetables, noodles and condiments.

China - Technology

Of the four sectors labelled “new economy” in China, technology could be the most adversely affected by the slowdown associated with the coronavirus if global supply chains shift. This is more likely the longer the number of those infected continues to grow. This will impact some of China’s largest exports including smartphones, computers, tablets and overall consumer electronics.

However state investments in the high value-added tail of the technology supply chain have been accelerating through 2019. China’s domestic spending on research and development grew from US$9 billion in 2000 to $293 billion last year, now the second highest total R&D spending in the world behind only the United States2. We expect the government to continue its R&D spend to make China’s technology sector stronger.

China - Health care

It is expected too, healthcare companies will see elevated interest as demand for oxygen therapies, antibiotic agents, and diagnostic assays will increase. Chinese households were already devoting 7% of total discretionary spending to healthcare, higher than the 5% spent by Japanese households and on par with those in South Korea. And while household consumer patterns on healthcare will certainly propel additional growth, the biggest expenditures in the space will continue to be driven by the government. We have all seen the viral images of the hospital being erected in Wuhan.

Furthermore, in addition to direct healthcare expenditures as a direct result of the outbreak, Chinese consumers were already becoming more concerned about their overall health and fitness, which we believe is leading to increasing expenditures in health and lifestyle products and services. Many of these expenditures are showing up in consumer discretionary spending such as personal care and nutritional supplements.

While the new coronavirus is a situation we would rather see avoided, we do believe in China, “new economy” sectors will do relatively well. We’d also encourage investors to be well diversified so that their portfolios are exposed to different sectors, countries and economic cycles. Perspective is always important in these environments and while it is understandable to panic, timing the market is impossible.

While it is of little comfort, the US CDC estimates 15-21 million flu cases during the current flu season in the US resulted in 8,200 deaths. One of the concerns of the spread of the coronavirus has been its speed to spread. It took more than six months for 5,000 cases of SARS to be reported in China. There are already over 20,000 reported cases of the coronavirus in China. It’s important to remember it is easier for a virus to travel between the more urbanised Chinese populations in 2019 than it was 2003. This combined with the coronavirus’s apparent long incubation period and its ease of transmission have contributed to its spread. As a savvy investor you should seek up to date information from reliable sources. We counsel investors to keep calm and look for opportunities.

Overall we expect markets and economies to recover.

1China and the world. Inside the dynamics of a changing relationship. McKinsey Global Institute, July 2019.

2China and the world. Inside the dynamics of a changing relationship. McKinsey Global Institute, July 2019.

Published: 07 February 2020