The power of compounding fees

Investors know the power of compounding. Put simply, compounding is the earnings on earnings, the impact of which amplifies returns over time.

Fees erode earnings, and over time the impact of fees compounds, too. The result is that those who pay higher fees, usually everyday investors, do not get to see the financial benefits touted by their investment manager who often demonstrates their intellectual prowess by showing outperformance before fees.

The compounding impact of higher fees are bigger than you may realise.

Albert Einstein was one of the most influential minds ever. If stories are to be believed, then he also offered views on finance. A story on compounding, that appeared in Inc magazine, started with an oft-told antidote about Albert Einstein who was asked what mankind's greatest invention was. As the story goes, he replied: "Compound interest." You may have also seen this quote attributed to Einstein, “Compound interest is the eighth wonder of the world.”

But beware.

Another quote attributed to Einstein on the subject of compounding is, "He who understands it, earns it; he who doesn't, pays it." Whether he said this or not, this one is interesting for investors to consider.

Earlier this year, the CFA Institute’s Financial Analysis Journal published an article, Fund Selection: Sense and Sensibility1. Its authors analysed the results of the performance, and fees, of Luxembourg and Ireland-based UCITS funds over a 12-year period. What was interesting is that the paper also assessed different fee levels. The authors found that active funds can demonstrate outperformance for institutional investors paying lower fees, whereas those paying higher fees, the authors call this group ‘retail’, underperform.

According to Batlussen et al2, “Unfortunately, the retail investor — given the fees — cannot benefit much from this active management skill.”

The researchers also found differences between equities and fixed income, while they found equity funds could find some success over passive peers over time, “Retail investors experienced negative net outperformance due to the level of fees across fixed income categories,” they found.3

Fees erode returns. And if returns compound, so too do fees.

Jack Bogle, who has probably done more for retail investors than anyone else said, “Net return is simply the gross return of your investment portfolio less the costs you incur. Keep your investment expenses low, for the tyranny of compounding costs can devastate the miracle of compounding returns.”

Let’s have a look at this in practice.

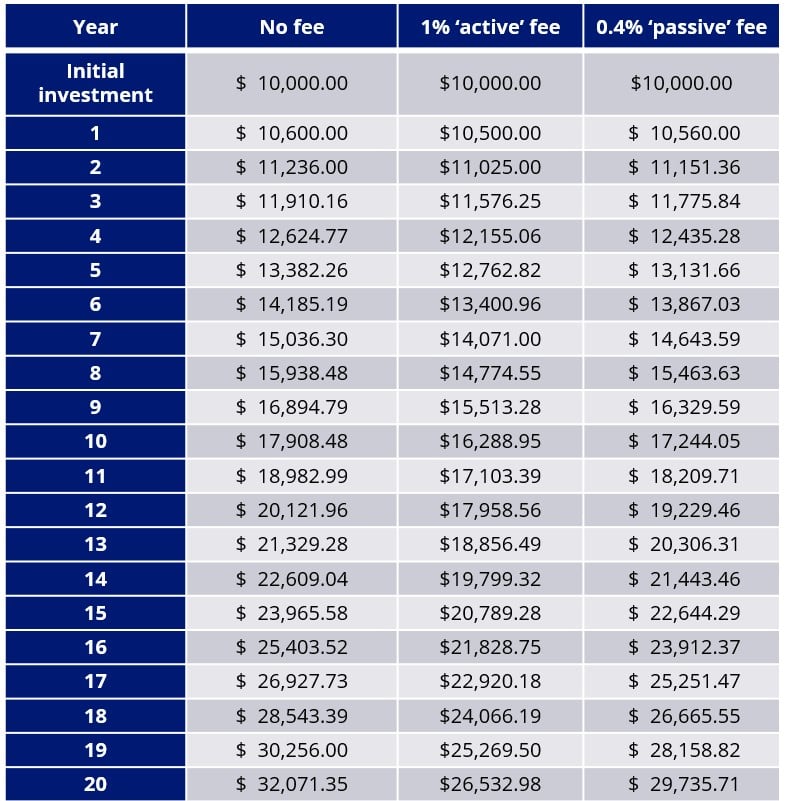

The table below shows the impact of compounding on a hypothetical $10,000 investment that returns 6% before fees (the no fee column) each year for 20 years. We’ve also calculated the hypothetical investment returns with a 1% ‘active’ fee and a 0.4% ‘passive’ fee. By year seven, the passive fee is over $570 or 4.07%. That means to catch up the following year, the active manager would have to outperform by over 4% after fees. By year 20 the difference is over $3,200 or 12%. This is all theoretical, but you can see the impact higher fees can have on an investment.

Table 1: Impact of fees on 6% p.a.

What this means is that active managers have to outperform equivalent passive funds by, at least, the difference between their total fees (including any performance fees) and the passive fund’s lower fees to just break even with the passive fund. If they underperform, or perform in line with the passive fund, then to catch up, they have to outperform by even more.

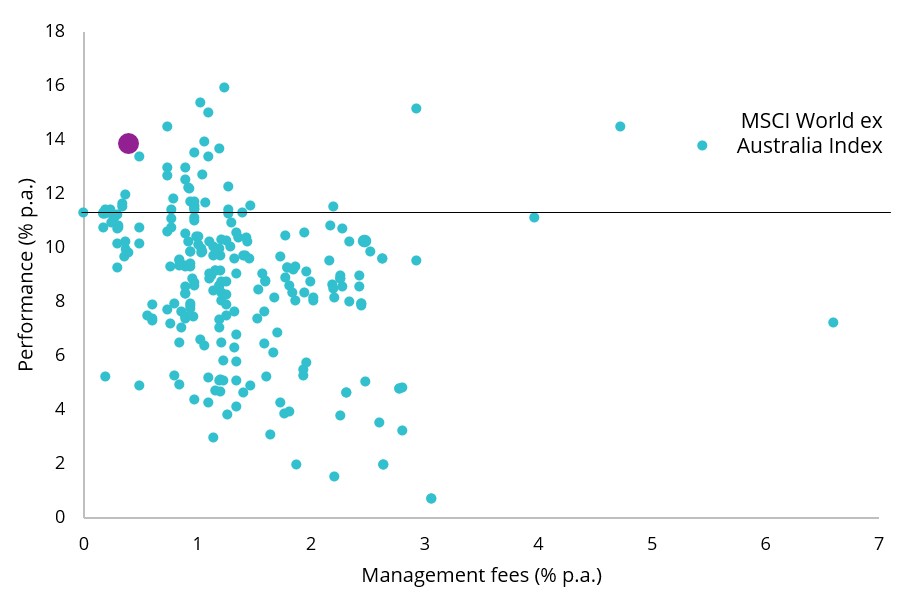

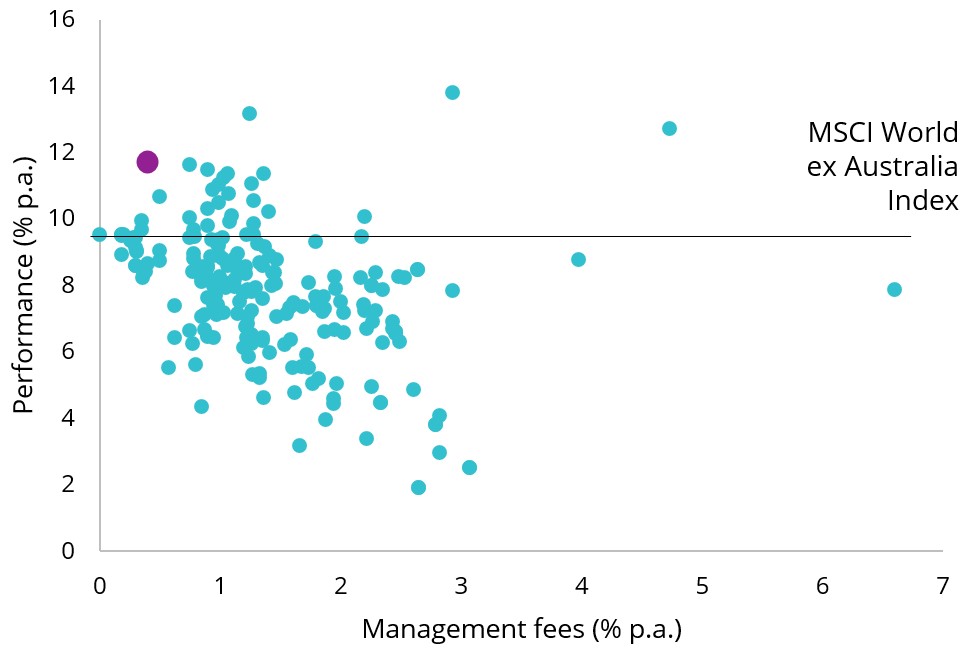

Let’s have a look at how this has played out in practice, the VanEck MSCI International Quality ETF (QUAL) is a passive fund that efficiently delivers a portfolio of high-quality international equities for a competitive price. QUAL charges just 0.40% p.a. making QUAL one of the lowest fee managed funds in its global equity group. You can see below, QUAL as represented by the purple dot, has a relatively low fee (closer to the left) while also standing as those managers that can boast outperformance, after fees, over the past five and seven years to the end of September 2022.

Chart 1 - Global equity: Five year performance versus fees

Chart 2 - Global equity: Seven year performance versus fees

Chart 1 and 2 source: Morningstar, VanEck, as at 30 September 2022. Past performance is not a reliable indicator of future performance. Results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads. Returns for periods longer than one year are annualised. The peer group of Global Equities includes Morningstar’s Open Ended Global Equity Blend Category, Morningstar’s Open Ended Global Equity Growth Category and Morningstar’s Open Ended Global Equity Value Category which are based on the defined Australian universe of funds that invest primarily in large global companies. Management fees are Indirect Cost Ratio in Morningstar Direct and includes performance fees.

In the above charts, most active global equity funds charge much higher fees than QUAL, generally between 1% and 2%, yet not many of them achieved long term returns higher than QUAL. For those funds to outperform QUAL, they will have to beat it by their underperformance and the difference in fees they charge.

Fees are important.

You can also see above, consistent with the CFA article, Fund Selection: Sense and Sensibility, despite the higher fees charged by many active managers, a majority underperform the global benchmark, the MSCI World ex Australia Index, over the long term, including some of the most popular international equities funds.

The authors of Fund Selection: Sense and Sensibility provide a framework, across 35 different categories, that determines the minimum required selection skill needed at various levels of fees. It determines how good an active manager’s skill must be to beat a passive equivalent. Investors then need to determine whether that level of skill is realistic. This is difficult.

Look out for an upcoming Vector Insights, in which we will help investors determine if their manager is exhibiting a level of ‘skill’ that is realistic to achieve outperformance, after fees.

Because fees, like interest, compound.

Note: Like all investments, there are risks associated with an investment in QUAL. These include ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

1- Guido Baltussen, Stan Beckers, Jan Jaap Hazenberg & Willem Van Der Scheer (2022) Fund Selection: Sense and Sensibility, Financial Analysts Journal, 78:3, 30-48, DOI: 10.1080/0015198X.2022.2066452

2- ibid

3 – ibid

Published: 27 October 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.