Quality companies glitter this US earnings season

A third of the S&P 500 companies announced Q2 2023 earnings so far, as well as 40% of the Dow Jones Industrial Average. And so far, companies that exhibit the quality factor have been shining bright.

The quality factor

The quality factor is a defensive strategy that has demonstrated outperformance in what is known as a ’late-cycle’ economic environment, and many market pundits believe we are in such an environment now. A late-cycle environment is one where economic growth is positive but slowing down.

Benjamin Graham wrote about quality in The Intelligent Investor in 1949, where he said investors should demand from a company “a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years.

Such companies, he claimed, show resilience by falling less in a downturn. World leader in index construction MSCI, echoing Graham, defines quality companies as those with: high return on equity (ROE), stable year-on-year earnings growth and low financial leverage. Applying a quality screen across global equities has resulted in an overweight position to those US technology mega caps that possess these characteristics having established a proven track record of delivering stable earnings growth.

The latest US earnings season has been no different despite fears of an imminent recession.

Quality companies beating expectations in US earnings season

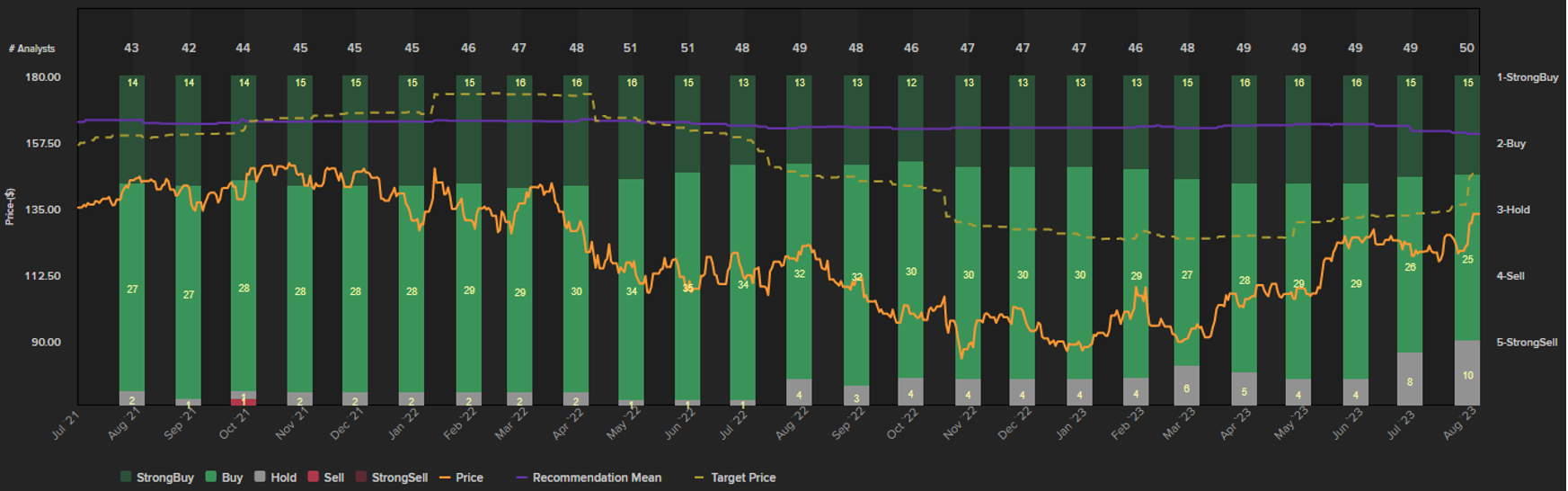

Alphabet

Google parent company Alphabet, reported better-than-expected second-quarter revenue and profit, driven by growth in its cloud-computing unit. The company’s core advertising business returned to growth following two straight quarters of declines. According to Barrons, Chief Financial Officer Ruth Porat said the firm was pleased with the speed of growth in search advertising revenue growth. During the firm’s earnings call, CEO Sundar Pichai touted a range of investments in artificial intelligence. Shares in the company popped by around 7% in extended trading on Tuesday following its results announcement and have rallied over 45% this year. According to the Wall Street Journal, Alphabet produces $71 billion in free cash flow and has had a little over $28 billion in capital expenditures over the past four quarters—more than the annual revenue of three-quarters of the companies in the S&P 500.

Chart 1: Analyst consensus - Alphabet

Source: Refinitiv, as at 31 July 2023.

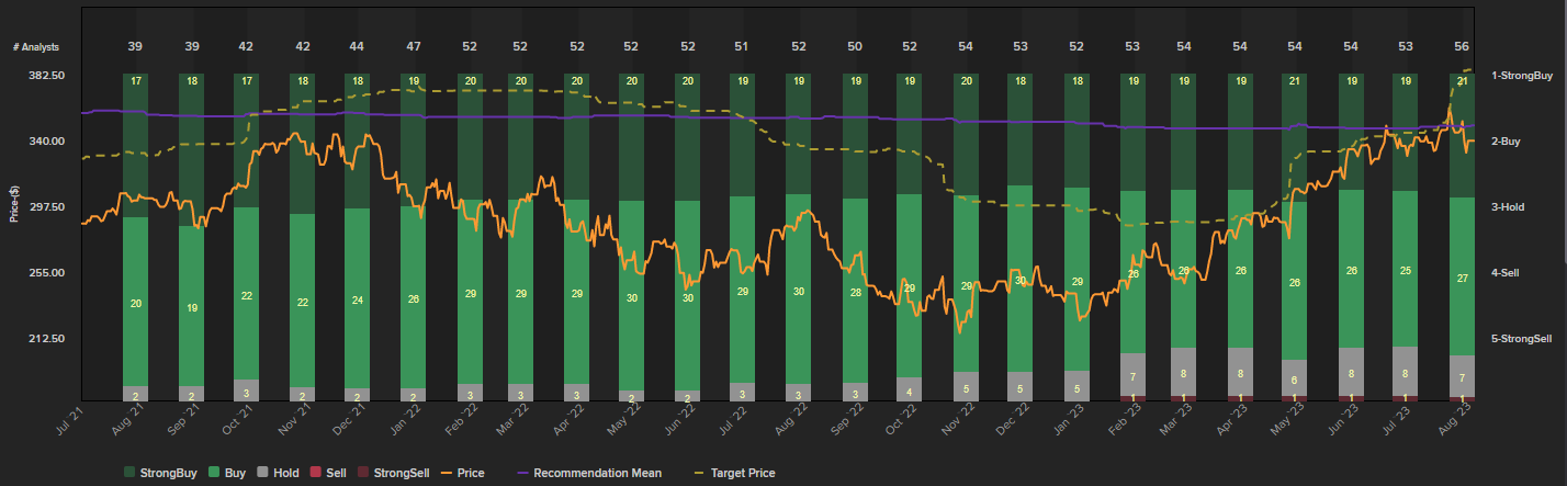

Microsoft

The software behemoth’s quarterly results came in ahead of Wall Street estimates for both revenue and profits. Microsoft’s cloud and enterprise software businesses beat Wall Street’s projections for the final quarter of its fiscal year, despite slowing corporate spending on technology across the globe. However, the company’s forward guidance for the September quarter fell short of estimates causing shares to trade lower immediately after the results. Shares in the company are up over 40% for the year largely due to the company’s aggressive adoption of genAI technology in its products. Microsoft now generates nearly $60 billion in annual free cash flow according to the Wall Street Journal.

According to CNBC “analysts think the stock can march on higher given the company’s leadership in artificial intelligence, among other drivers.”

“Holding a solid leadership position ahead of a large AI-driven tech cycle, Microsoft stands well positioned for durable double-digit EPS growth over multiple years,” Morgan Stanley analyst Keith Weiss wrote last week.

Weiss reiterated an overweight rating on Microsoft stock with a $415 per share price target, which implies 18% upside from Tuesday’s close.

JPMorgan’s Mark Murphy was similarly optimistic after Microsoft’s earnings, and reiterated an overweight rating with a $385 per share price target, or nearly 10% above the previous closing level.

Chart 2: Analyst consensus - Microsoft

Source: Refinitiv, as at 31 July 2023.

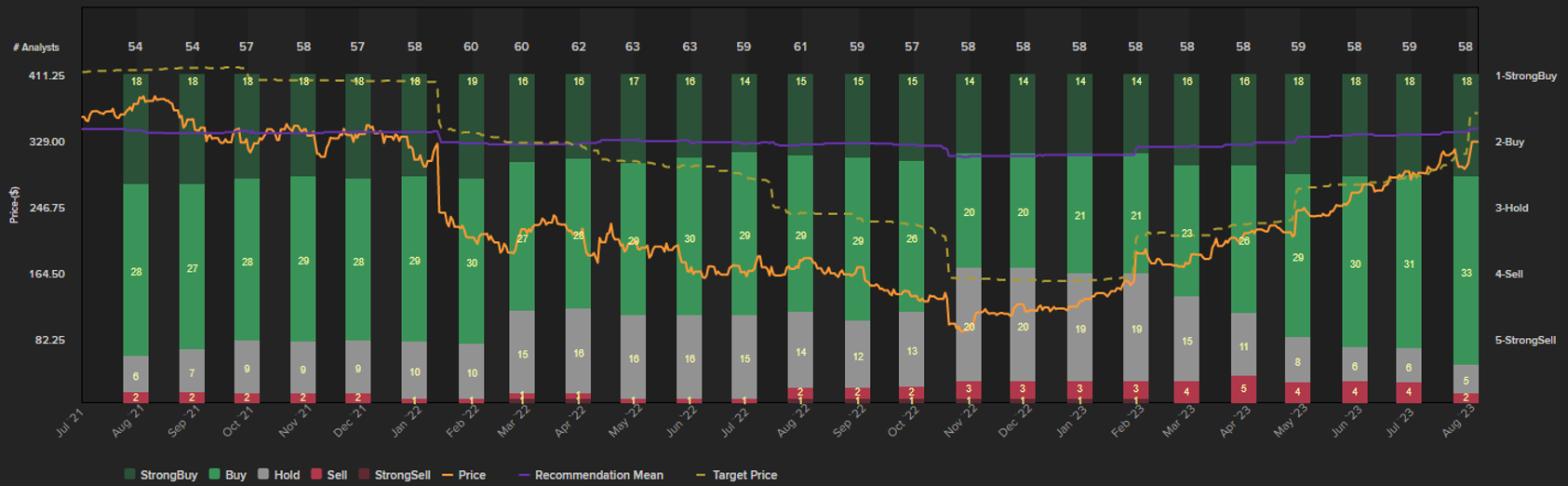

Meta

Facebook parent company Meta reported double-digit revenue growth for the first time since the fourth quarter of 2021 and issued a better-than-expected-guidance for the third quarter on the back of a rebound in the digital advertising market. The company has also reduced its capital spending plans for 2023 but spending is set to increase in 2024 as it expands its work on generative AI software.

Meta has efficiently reduced its expense base via layoffs this year, maintaining strong profit margins and return on equity.

Chart 3: Analyst consensus - Meta

Source: Refinitiv, as at 31 July 2023.

Coca Cola

The soft drink maker has raised its full year guidance as demand remains strong beating Wall Street estimates of second quarter earnings and revenue. RBC Capital Markets analyst Nik Modi said in a research note that beverage companies can offer a variety of price ranges—what he called “pricing optionality”—because of their varying package sizes. He rates Coca-Cola shares at outperform with a $69 price target.

UnitedHealth

UnitedHealth Group’s stock price jumped after the health-care giant reported second-quarter revenue and adjusted earnings that topped analyst’s expectations. The company also raised the low end of its full-year adjusted earnings outlook. The business last month flagged a surge in demand for non-urgent surgeries and outpatient services.

Earnings season still has a couple of weeks to go and names to keep an eye out for include Amazon which reports this week. According to CNBC the company is one of Morgan Stanley’s top picks for this earnings season. The firm believes potential catalysts include positive earnings revisions and its AWS Summit on cloud computing and generative artificial intelligence.

The Quality Factor

These results follow the release of research by index provider MSCI, Quality Time: Understanding factor investing which found “The past decade's market turbulence, marked by a bear-market episode, rising inflation and fluctuating rates, has emphasized the importance of high-quality firms. The extended history presented here offers robust evidence of quality’s performance and resilience. It also demonstrates its role in navigating risk and return in an ever-changing investment landscape.”

Further, “Historically, the index performed best in “Stagflation” and “Slow Growth”, which seem to be the descriptors in the media of the economy into the rest of 2023 and 2024.

Australian investors can access international quality companies via the VanEck MSCI International Quality ETF (ASX: QUAL). QUAL includes all the companies mentioned above in one simple trade.

Key Risks

An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 28 July 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.