The age of disruption

Funds management in Australia has been largely resilient to disruption. That was the past, the future is here.

We’ve talked extensively about the rise of smart beta and the disruption of active management. We think that smart beta products are a disruptive innovation with the potential to affect the businesses of active managers. Now we are finally witnessing active managers changing their businesses, highlighting that the disruption is well and truly underway.

Disruptive innovation and smart beta

In January 2016, the CFA Institute's Financial Analysts Journal published an article titled ‘The Asset Manager's Dilemma: How Smart Beta is Disrupting the Investment Management Industry.'

In their paper authors, Ronald Kahn and Michael Lemmon compared, what they called, ‘pure alpha’ being generated by global active managers to the fees they were charging. ‘Alpha’ is financial industry jargon for outperformance above the market benchmark. The ‘pure alpha’ the authors refer to is the alpha that cannot be explained by smart beta factors. Therefore alpha can be attributed to ‘factors’ and ‘pure alpha’.

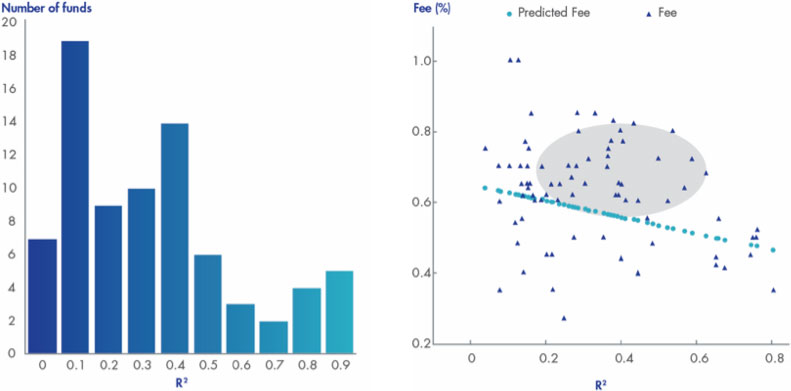

Kahn and Lemmon examined 79 global managers whose funds were benchmarked to either the MSCI World Index or the MSCI ACWI Index. What they found is presented below. The bar chart shows the proportion of the outperformance above the benchmark that can be explained by the smart beta factors. The closer to zero, the more ‘pure alpha’ that is generated.

The Asset Manager’s Dilemma: How Smart Beta is Disrupting the Investment Management Industry. Financial Analysts Journal

We can draw the following conclusions from the above bar chart:

- There is a large variance between managers in performance;

- For the average manager, 33% of active return that is over and above the MSCI World Index can be explained by smart beta factors; and

- For 30% of the managers, more than 40% of the return can be explained by smart beta factors.

The scatter diagram above on the right, combines the data in the bar graph with the actual fees being charged (the dark blue dots) and predicted fees (the light blue dots). The predicted fees represent what the authors of the paper think investors should be charged based on the amount of ‘pure alpha’ being produced.

The light blue dots are downward sloping, showing lower fees should be paid for smaller amounts of alpha. The grey highlighted area, according to the authors, shows roughly those funds that are most likely to be disrupted by smart beta. There are 29 out of 79 in the sample. That is over 35% of global equity managers, according to Kahn and Lemmon that will be disrupted by smart beta.

This highlights the need for active managers to evolve in response to this disruptive innovation. Most active managers deliver some combination of smart beta and pure alpha, and Kahn and Lemmon suggest these managers “should analyse their relative strengths and move toward offering either smart beta or pure alpha with appropriate fees.”

The above suggests that current fee levels are inconsistent with the outcome. They are too high.

The disruption is happening in Australia

The funds management industry in Australia has largely been protected from disruption. We believe a tectonic shift has commenced. In Australian active managers are responding and it’s straight out of the playbook outlined in the CFA Institute's Financial Analysts Journal. We are witnessing active managers explore ways to offer systematic approaches at a more palatable fee.

This is not without risks as it means clients paying the existing, inconsistent fees may move to this new approach which will result in cannibalisation. This however is more palatable than losing clients to a competing smart beta strategy. What happens too when the pure alpha approach underperforms the low-cost approach?

Our observation of the US experience demonstrates mixed success for active fund managers offering both systematic and pure active exposures. It is common for the systematic offering to fail to attract attention, more importantly it can emphasise deterioration in the pure alpha strategy.

Those fund managers who can demonstrate persistent ‘pure alpha’ however will thrive. But we think mixed offerings will become more common among active fund managers in Australia.

Active fund managers have often used management jargon like ‘disruptive innovation’ in their marketing when they describe how they assess the companies and industries they invest in. Often they do not apply this framework to their own business. Now to compete with existing smart beta strategies they have to recognise they are being disrupted. At the very least they need to lower fees and increase transparency to ensure their long-term survival.

We expect more active fund managers to assess their mix of pure alpha and smart beta and then adjust their product offerings accordingly.

Those that don’t, will not survive.

Published: 21 August 2020

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. See the PDS for details.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.