The next gold rush

Gold has been used in commerce as a currency since the Bronze Age. In 560 B.C., the first minted gold coins were produced in Lydia, a Kingdom of Asia Minor1. Because gold is a currency its price does not behave like other commodities. It’s also why gold equities do not behave like other mining shares. So far 2019 has been a stellar year for the shiny metal and those that dig it from the ground. We believe gold’s winning streak is likely to continue.

1 – Katz, J and Holmes, F (2008). The Goldwatcher: Demystifying Gold Investing Wiley, New York

Ancient history

While the Lydians were the first to mint coins for trade in 560 BC, it was the Egyptians 3,000 years earlier that were the first to smelt gold. It was a feature of their adornments, think King Tutankhamen’s funeral mask. Some of the techniques Egyptians used to craft jewellery are still used today.

In addition to its rarity, gold became useful to use as currency because it was easy to press into coins and bullion. Additionally it was also easy to identify because of its colour and density. Unlike other metals it does not tarnish. Gold gave rise to the concept of currency and it fits the three generally accepted conditions of money:

- Medium of exchange

- Unit of account

- Store of value

1800s to 1980s: The Gold Standard

Over time countries tied their currency to the amount of gold they physically held. This was called the gold standard. Great Britain was the first to do this and because of their economic might during the reign of Queen Anne other countries soon followed suit. By the 19thCentury all major countries other than China used the gold standard.

During the outbreak of World War 1, Britain abandoned the gold standard when Treasury notes were issued. The immediate impact was inflation and in 1925 Great Britain resumed the gold standard. This didn’t last long. The Great Depression forced countries to abandon the standard again.

In 1944 the Bretton Woods system, similar to the gold standard, was established to assist with trade. Again its existence was short lived as growing public debt incurred by the war in Vietnam, increased social welfare and inflation prompted President Nixon to undertake a series of economic measures, including temporarily floating the currency, which became known as the Nixon Shock. Within a few years a number of other countries including Japan had floated their currencies. The end of the Bretton Woods was ratified by the Jamaica Accords in 1976. By the early 1980s, all industrialised nations had floated their currencies.

Today

Gold is one of the most traded asset classes in the world. According to the World Gold Council1, “Gold ranks higher than all European sovereign debt markets and trails only US Treasuries and Japanese government bonds.” For investors gold has been seen as a safe haven for portfolios.

A higher gold price largely correlates to investors’ increasing unease about a weakening global financial system. Currently investors are worried about government indebtedness, geopolitical risks and the trade war. Investors have realised that central bank policies are having little impact. Last week in Jackson Hole, Chairman of the US Federal Reserve Jerome Powell, implied as much when he said there are “no recent precedents to guide any policy response to the current situation. While monetary policy is a powerful tool that works to support consumer spending, business investment and public confidence, it cannot provide a settled rule book for international trade.”

This type of uncertainty continues to fuel investor’s demand for gold as a safe haven asset. As gold mining stocks provide leverage to the gold price, it is no surprise that they have also enjoyed another surge higher. Since the beginning of the year the VanEck Vectors Gold Miners ETF (ASX code: GDX) has gained more than 40% (at time of writing, 30thAugust 2019).

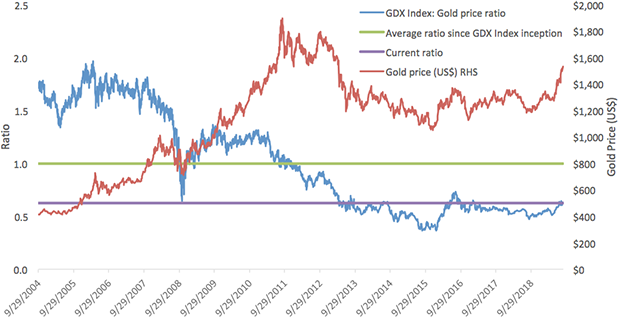

Despite the gold miners’ rally this year, gold stocks are historically cheap relative to the price of the metal.

The green line on the chart below shows price of gold bullion and the blue line shows the ratio of NYSE® Arca Gold Miners Index® to the price of gold bullion. The average of the ratio of the price of gold mining stocks to bullion over the 15 year period is approximately 1. This average was last achieved when gold was around $1,900 in 2011. From current levels, a return to the long term average of 1 would see gold miners rise by approximately 60%.

Source: VanEck, LBMA. Bloomberg; as at 29 August 2019. All figures in US dollars. Past performance is not a reliable indicator of future performance

Cost of Mining

The gold rushes across North America and Australia in the 1800s resulted from discoveries of placer gold in streams and sand deposits. Placer gold is mined using gravity and water to separate the gold from other materials around it. Better resourced and more experienced miners were able to dig into the earth in their search for deposits of lode gold, further and further below the surface. Lode deposits are the traditional veins of ore that are embedded in rocks and minerals.

Miners soon went from small parties of friends to larger collectives and companies. Soon, companies were the only ones with the resources required to mine deep enough. Mining became deeper and more dangerous. Today the majority of gold mining is done in open pit or underground mines. The world’s deepest mine is in South Africa and it goes 3.9 kilometres under the surface.

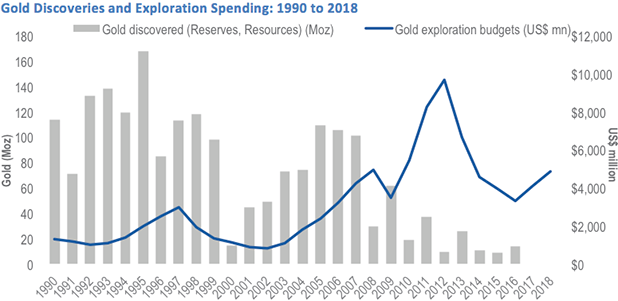

New gold deposits are becoming more difficult and more expensive to find.

Source: BofA Merrill Lynch Global Research; S&P Global Intelligence

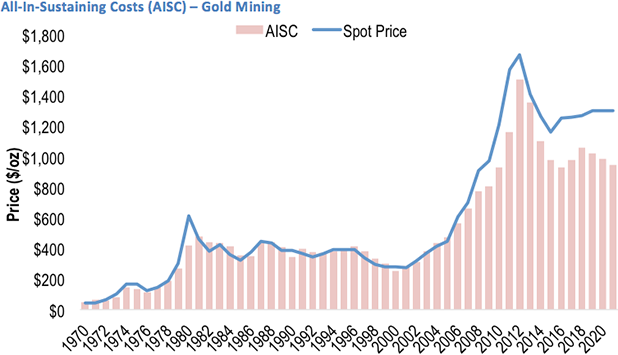

Yet amazingly, since the GFC, the cost of producing gold has gone down. This reduced cost of production is another reason gold mining companies are considered good value by many investors at the moment.

Source: Scotiabank, VanEck. Data as of June 2019.

VanEck is currently in the process of restructuring the offer of GDX on ASX. To make investing in global securities even easier the current funds are being replaced with new Australian funds. See www.vaneck.com.au/offer for more information.

IMPORTANT NOTICE Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States. VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the VanEck Vectors Gold Miners ETF (‘US Fund’). The Trust and the US Fund are regulated by US laws which differ from Australian laws. Trading in the US Fund’s shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) which are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. VanEck Associates serves as the investment adviser to the US Fund. VanEck, on behalf of the Trust, is the authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX.

Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general financial product information only and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and tax regulations. Before making an investment decision in relation to the US Fund you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies or the Trust gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the US Fund.

An investment in the US Fund may be subject to risks that include, among others, competitive pressures, dependency on the price of gold and silver bullion that may fluctuate substantially over short periods of time, periods of outperformance and underperformance of traditional investments such as bonds and stocks, and natural disasters, all of which may adversely affect the US Fund. Foreign investments are subject to risks, which include changes in economic and political conditions, foreign currency fluctuations, changes in foreign regulations, and changes in currency exchange rates that may negatively impact the US Fund’s return. Small- and medium- capitalisation companies may be subject to elevated risks. The US Fund’s assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors.

1World Gold Council (2011). Liquidity in the global gold market

Published: 30 August 2019