The short and long of bond investing

As investors navigate a potential economic slowdown and the possibility of higher interest rates for longer, the lure of fixed income is understandable. The question for investors then is where they can maximise yields.

The popularity of Exchange Traded Products (ETPs) in Australia has reached unprecedented levels this year with the industry reaching an all-time high of $153.6 billion as at July 31staccording to ASX figures released last week. This marks a substantial increase from last year’s $130.2 billion (as at 31 July 2022). The biggest surprise, when you look a little closer at the figures, is the rise of fixed income ETPs which have grown over 40% since last year and now make up 15% of the total ASX ETP market.

But as investors navigate a potential economic slowdown and the possibility of higher interest rates for longer, the lure of fixed income is understandable. The question for investors then is where they can maximise yields.

It also might be worth considering diversifying offshore, as many offshore markets have higher interest rate regimes than Australia. Interest rates locally aren’t predicted to rise as much as many overseas countries as the recent rate increases have had a more wide-reaching and immediate impact on household and business budgets as many loans are variable and for a shorter term than in the US.

Investors are turning to safe-haven assets like short-term US treasury securities to diversify their portfolios and aim to reduce risks while gaining exposure to the ‘safety’ of the US.

Short-term US T-Bills

Backed by the full faith and credit of the US government, treasuries are considered among the safest investment assets on earth. US Treasury Bills, also known as T-Bills, are US government debt obligations with maturities of less than one year.

Savvy investors are also using T-Bills to diversify their portfolios, reduce risk and gain exposure to the US dollar.

Remember, bond yields move in the inverse direction to the price of the bond, that is when yields rise, bond prices fall and vice versa. Long-term bonds see their prices hit harder when rates rise. As a result of the recent jump in market interest rates investors “are now shifting back into short-term bond funds that can better withstand rising yields.” according to a recent article by CNBC.

There are several factors supporting the move to shorter-term US securities such as the robust US retail sales figures for July that propelled yields upwards and extended the anticipated timeline for a Federal Reserve rate reduction. The long-term 10-year Treasury yield is currently on the cusp of reaching peak levels not seen since 2007.

While inflation pressures have eased, central banks around the world have committed to higher interest rates until inflation comes back to target bands, leading to investor concerns that the Fed and other central banks are unlikely to let rates fall in the short-term.

Last week minutes from the Fed’s last meeting disclosed that the open market committee saw “significant upside risks to inflation, which could require further tightening of monetary policy.”

According to a recent article by Barrons, “when looking for juicy yields, investors these days should stay short. Buying long-dated Treasury bonds seemed like a great opportunity earlier this year, but now they look set to do what bonds have done all too often—lose money. Short-term Treasury bills, which yield more than 5.4%, still look like an investor’s better income bet.”

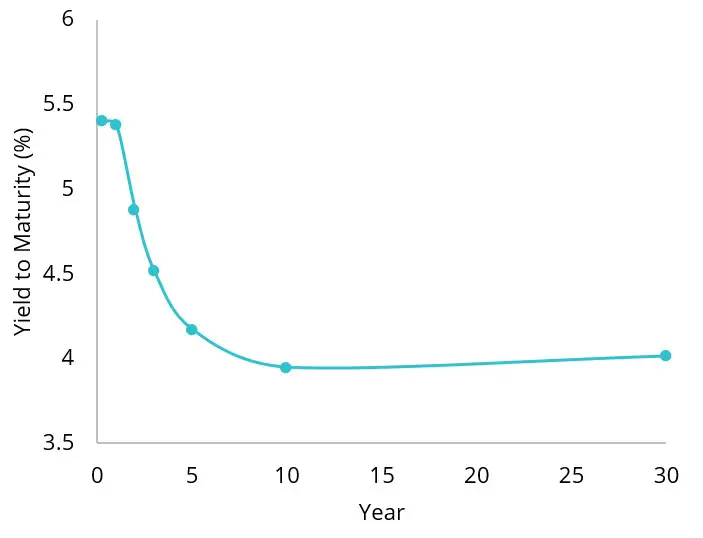

You can see from the chart below the US government yield curve is unusual as the shorter-dated 1-6m yields relative to the longer-dated 10-year is higher - at a multi-decade high. An inverted yield curve, such as this has been a leading indicator of a recession in the past.

Chart 1: US treasury yield curve

Source: Bloomberg, 31 July 2023

T-Bills

T-Bills are different from other types of bonds. Since they offer such short maturities, T-Bills don’t pay interest in the form of coupons like other bonds. Instead, they’re called ‘zero-coupon bonds,’ meaning that they’re initially sold at a discount and the difference between the initial purchase price and the ‘par value’ at redemption represents the interest.

Investors can also sell T-Bills before they mature and there is a huge market for these because of the market’s confidence in the issuer and their short-term profile. According to the most recent1US Treasury Monthly Statement of the Public Debt, there were US$3.9 trillion worth of T-Bills outstanding. For investors who value liquidity, this is a key selling point.

While the yield curve remains inverted as it does in Figure 1, it means that shorter-term bonds are generating higher yields compared to their longer-term counterparts. For example, the one-month Treasury bill is yielding around 5.40% whereas the 30-year bond is only yielding 4.25%.

Institutional investors are buying T-Bills too. According to the Financial Times Berkshire Hathaway’s cash and investments in short-term treasuries surged to $US 147 billion at the end of the second quarter of 2023, “underscoring Warren Buffett’s faith in the backbone of global financial markets despite the rocky political climate in Washington.”

Of that US$147 billion more than US$120 billion is invested in short-term Treasury bills.

The disclosure of the holdings came days after ratings agency Fitch removed the US’s triple AAA rating. But notwithstanding the downgrade, Buffett told CNBC in an interview on August 3 that the Fitch decision would not change the company’s investment strategy and that he was not worried about the US dollar or Treasury Market.

Buffet said; “Berkshire bought $10 billion in US Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month…There are some things people shouldn’t worry about,” he said. “This is one.”

Gain exposure to the US dollar

For Australian investors, exposure to liquid US T-Bills also offers exposure to the US dollar and a potential hedge against systemic or market episodes.

VanEck recently launched its 1-3 Month US Treasury Bond ETF (ASX: TBIL) which is Australian dollar unhedged and has been specifically designed this way with local investors in mind.

The USD exposure offered in TBIL may provide Australian investors with capital appreciation during periods of economic weakness. Historically, during periods of economic uncertainty or weakness, the Australian dollar has lost value relative to the US dollar because it is considered a “risk on” currency while the US dollar is considered “risk off.”

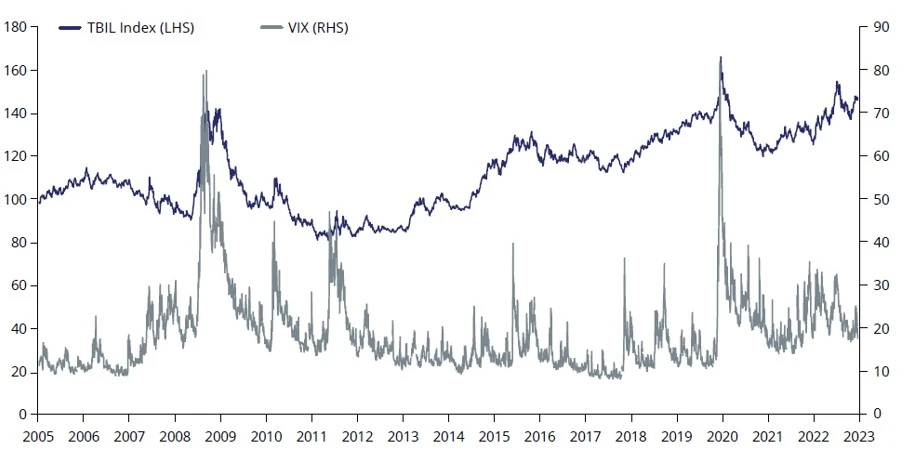

You can see this in the chart below which shows that an unhedged AUD exposure to T-Bills has experienced positive returns when market volatility increases, as represented by the VIX index. The Chicago Board Options Exchange's CBOE Volatility (VIX) Index is a measure of the stock market's expectation of volatility based on the S&P 500 index.

Conversely, if the AUD appreciates against the USD, there will be capital depreciation. Investors are taking currency risk.

Chart 2: Volatility and Bloomberg U.S. Treasury Bills: 1-3 Months Unhedged AUD Index (TBIL Index)

Source: Bloomberg, VanEck. Chart shows performance of Bloomberg U.S. Treasury Bills: 1-3 Months Unhedged AUD Index (TBIL Index) compared to VIX Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index or TBIL.

So, there are a number of reasons Australian investors are flocking to T-Bills. TBIL is an ETF that allows investors of all types to access this asset class via the ASX.

As always, we recommend you speak to your financial adviser or stock broker.

If you would like more information on TBIL please contact our ETF specialists on 02 8038 3300 or email us at info@vaneck.com.au

Key risks: There are risks associated with an investment in TBIL. These include but are not limited to interest rate movements, currency, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations.

Published: 27 August 2023

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

Bloomberg®” and the indices licensed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by VanEck Investments Limited (the “Licensee”). Bloomberg is not affiliated with the Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products referenced herein (the “Financial Products”). Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Indices or the Financial Products.