Three reasons to stay the course

Markets have moved with such speed and velocity in both directions since the beginning of the COVID outbreak it has been difficult for investors to adjust with so much conflicting information being circulated.

Decades of data, however, shows that staying invested through volatile times has been a smart long-term strategy.

There are three main reasons why you should avoid the impulse to hit the sell button.

Markets have moved with such speed and velocity in both directions since the beginning of the COVID outbreak it has been difficult for investors to adjust with so much conflicting information being circulated.

Decades of data, however, shows that staying invested through volatile times has been a smart long-term strategy.

There are three main reasons why you should avoid the impulse to hit the sell button, and keep invested when times get tough.

- Cashing out can mean missing out – investors who panic and sell, often miss the upside if markets rebound

- Markets have historically been resilient – when markets react consider a broader historical perspective before changing your course

- Time is on your side – it’s not a timing issue it’s a matter of time in the market.

Cashing out can mean missing out

Research shows that the worst days for the market are often followed by the best days. Staying in the market means you’ll be ready for a rebound. In July this year the S&P 500 posted its best monthly performance since late 2020. Reason to celebrate surely. Not for active fund managers. According to research from Bank of America, reported in the Financial Times, only 28 per cent of active fund managers focusing on big stocks beat their Russell 1000 benchmarks over the month. While all the main styles of mutual funds underperformed – core, growth and value.

As for the reasons for the disappointing results, a bearish stance “likely weighed on performance,” said Bank of America analyst Savita Subramanian in a note to clients. “Opportunities to beat the market are still scarce”, she said, making it a “tough environment’ for funds to pick stocks rather than piggybacking on indices.

And investors, it seems are voting with their feet. Globally, investors pulled a net US$640 billion from actively managed mutual funds in the first half of the year, according to figures from Morningstar. It’s a starkly different picture to the inflows of US$943 billion in 2021.

The proximity of best and worst performing market days is not a recent phenomenon. Over a 20 year period through to the end of 2019, six of the 10 best days in the market occurred within two weeks of the 10 worst days, according to Katherine Roy, Chief Retirement Strategist at JP Morgan.

The market falls and subsequent bounce of 2020 is a case in point.

Thursday, 12 March 2000 was the worst performing US market day in 20 years. But the following day, was the third best day. The following, Monday, 16 March then took over as the worst day in the 20-year period. Guess what happened the following Tuesday? 24 March broke new records at the time, the Dow Jones Industrial Average climbing 11 per cent in its best day since 1933. The S&P 500 meanwhile lifted 9.4 per cent.

Bank of America has looked at the impact on investor returns of missing the market’s best and worst days each decade. The table below demonstrates how large the missed opportunity can be for investors who dip in and out, and try and time the market.

Table 1: The difficulties of trying to time the market

The impact of missing the market’s best and worst days each decade by decade

|

Decade

|

Price return

|

Excluding worst 10 days of decade

|

Excluding best 10 days of decade

|

Excluding best/worst

|

|

1930

|

-42%

|

39%

|

-79%

|

-50%

|

|

1940

|

35%

|

136%

|

-14%

|

51%

|

|

1950

|

257%

|

425%

|

167%

|

293%

|

|

1960

|

54%

|

107%

|

14%

|

54%

|

|

1970

|

17%

|

59%

|

-20%

|

8%

|

|

1980

|

227%

|

572%

|

108%

|

328%

|

|

1990

|

316%

|

526%

|

186%

|

330%

|

|

2000

|

-24%

|

57%

|

-62%

|

-21%

|

|

2010

|

190%

|

351%

|

95%

|

203%

|

|

2020

|

18%

|

125%

|

-33%

|

27%

|

|

Since 1930

|

17,715%

|

3,793,787%

|

28%

|

27,213%

|

Source: Bank of America. S&P 500 returns. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Looking at data going back to 1930, the firm found that if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28 per cent. If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715 per cent.

Markets have historically been resilient

History shows that markets rebound after a crisis. It was reported in the AFR that over the course of 29 separate events dating back to Germany defeating France in 1940, it has taken the Dow Jones index 18 days on average from the beginning of the crisis to hit its low point, with an average decrease over that period of 11.6 per cent, according to data compiled by Bell Potter.

The recovery from the fall is even quicker: 23 out of the 29 events, or 86 per cent of the time, the benchmark was, on average, 7.6 per cent higher a month later. A year later, the market rebounds by an average of 24.7 per cent.

Global firm Ned Davis Research notes the same trend, finding that based on numerous crises since 1907, the US sharemarket declined 7 per cent on average, but six months later it was up 10 per cent and one year later it was around 15 per cent higher.

The Global Financial Crisis of 2008 is another example. The crisis sent international equities markets spiraling. But according to research from J.P Morgan, staying invested helped superannuation accounts recover more quickly. According to JP Morgan’s Katherine Roy, for those who stayed the course, account values fully bounced back within three years.

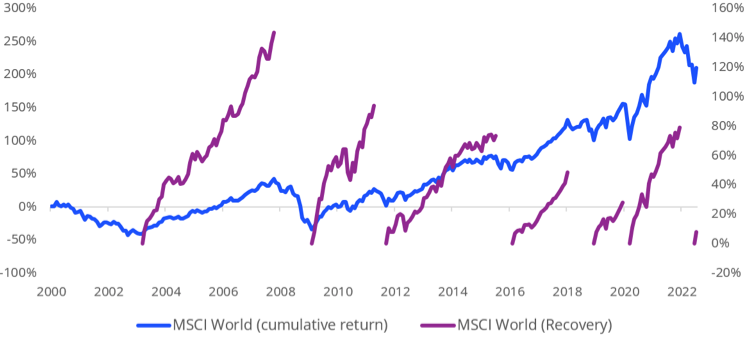

Chart 1: Cumulative performance during market recoveries

Source: VanEck, Bloomberg, MSCI. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

Time is on your side

Global equity markets can be volatile but have historically outperformed over the longer term.

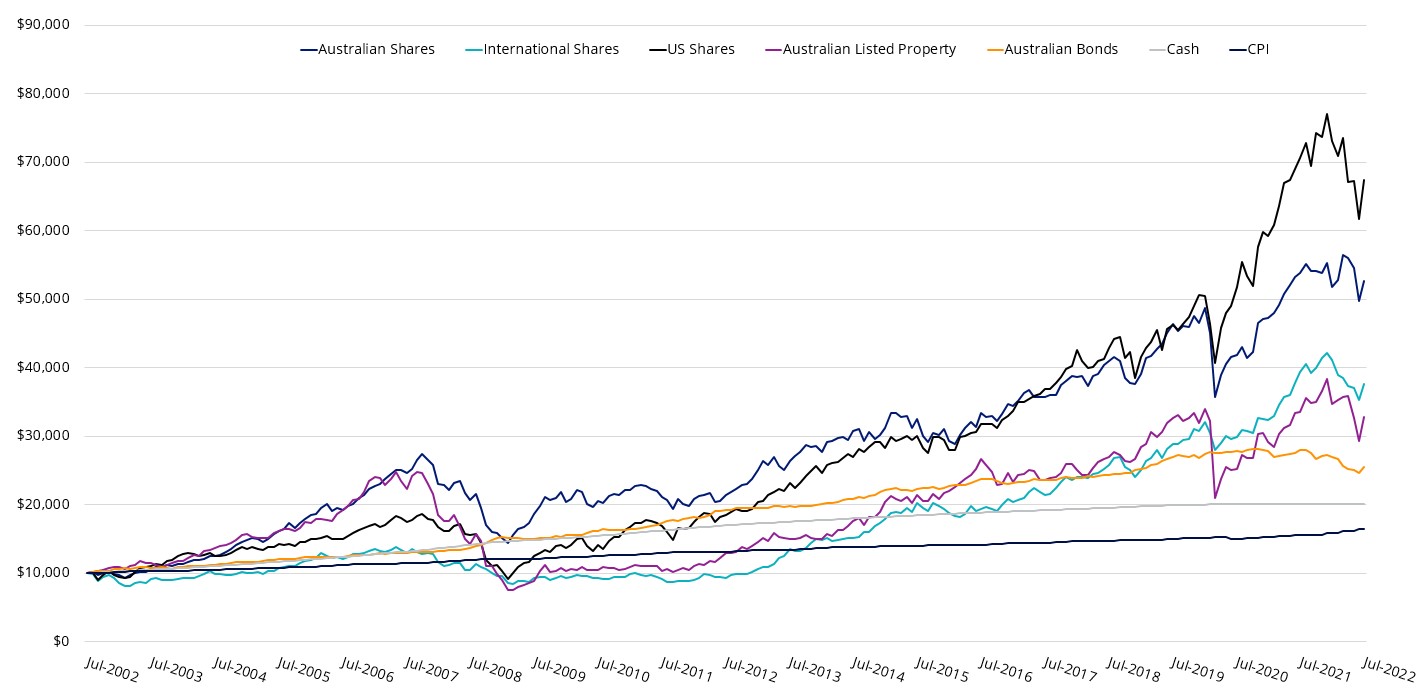

Chart 2: Twenty years of investment markets

Hypothetical growth of $10,000, July 2002 to July 2022

Source: Bloomberg. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Indices used: International shares is MSCI World ex Australia Index; Australian shares is S&P/ASX 200 Accumulation Index; Australian listed property is S&P/ASX 200 A-REITs Index; Australian Bonds is Bloomberg AusBond Composite 0+ years; Cash is Bloomberg AusBond Composite 0+years; US Shares is S&P 500; CPI is Australian CPI.

As the chart above highlights a hypothetical $10,000 investment in Australian shares in 2002 would now be worth almost $70,000 in 2022, the same investment in cash would have only generated around $20,000. Remember during that time we have had the GFC, the COVID crisis and now the recent market falls.

As a long-term investor, it’s wise to remember that it’s not a timing issue it’s a matter of time in the market. It is important that investors look beyond the positive and negative commentary and concentrate on long-term goals. Global equity markets can be volatile but have historically outperformed over the longer term. Investors should stay the course and keep focused on long term strategy.

Sharp market falls accompanied by screaming headlines are stressful for investors. The current situation is especially nerve-wracking as there are so many moving parts – inflation is high, interest rates are rising, the threat of a recession looms large, and, there are a number of geo-political tensions, including the war in Ukraine. Roy says “most people react when negative things happen and now, because things are happening so tightly together in terms of those rebound days, you’re not able to get back in in time, nor do people have the courage to do so,” Roy said. “So the best thing is to stay invested.”

Published: 02 September 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.