Three ways to take on a falling US dollar (or rising Australian dollar)

Position your portfolio to benefit from the depreciation of the US dollar and the rise of the Australian dollar.

The value of the Australian dollar, relative to the US dollar, has been in the news lately.

One of the drivers of the value of the currency is interest rates. Recent rises in the Australian dollar have been attributed to the predicted contraction of the interest rate differential between Australia and the US, as the US pauses, while rates here continue to go up. The US dollar also faces other headwinds.

Many pundits think the recent tumble in the value of the US dollar could also be the beginning of a bigger plunge. US debt continues to reach historic highs, and last week rating agency Moody’s lowered its assessment of US credit outlook from stable to negative.

Currency movements have an impact on your international investments, but there are ways to position your portfolio to benefit from a depreciation of the US dollar.

Recent currency volatility has led investors to ponder: should they be investing in hedged or unhedged international investments, or a bit of both?

It’s important to remember over the long run, currency risks generally even out.

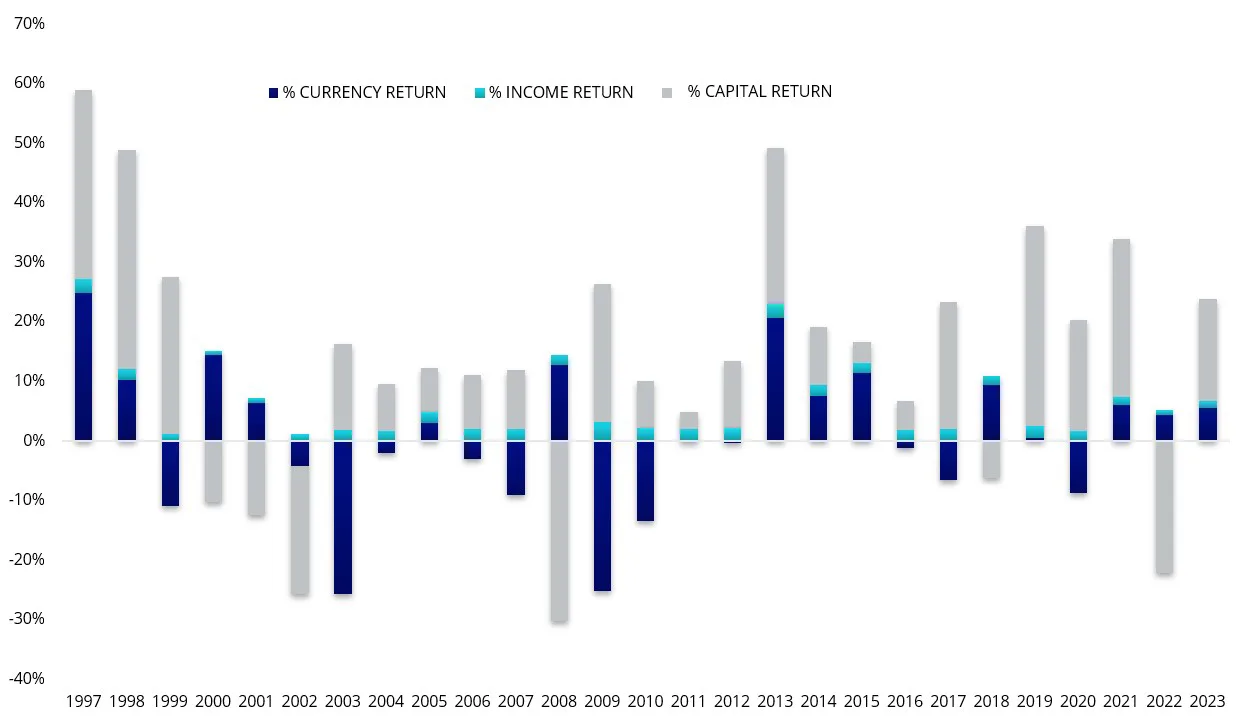

As an example, Chart 1 below shows the long-term returns for the unhedged index tracked by VanEck’s MSCI International Quality ETF (QUAL).

Chart 1: Calendar year breakdown of QUAL’s Index returns

Source: MSCI. Annual returns to the end of each calendar year data. The performance shown of the QUAL Index prior to its launch date is simulated based on the current index methodology. Results assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF and taxes. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance of the QUAL Index or QUAL.

The total return from currency for the calendar years from the start of 1997 to the end of 2023 is 0.02% p.a. Over that same time the index has returned 9.66% p.a. In other words, over a long-term period of 27 years, the decision to hedge or not hedge your international equities investment would have had a negligible impact on your overall portfolio performance.

However, for short to medium-term investors, the decision becomes more important.

Below we describe three strategies investors can utilise when the world’s most traded currency is falling in value.

1. Currency hedging

For investors that invest in US assets, the decision of whether to hedge your currency exposure for these assets is an important one, as movements in the US dollar versus the Australian dollar can either erode or add value to your investments. If, for example, the Australian dollar rises 10 per cent against the greenback, all other things being equal, the value of your offshore investments would fall by 10 per cent when assets are converted back into local currency. Movements in the currency can therefore have a big impact on your returns from international share investments. Hedging can play a part if you are a conservative investor and simply don’t want to expose yourself to any currency volatility.

Think about VanEck’s Morningstar Wide Moat ETF (MOAT), which is a US equity portfolio, or VanEck’s MSCI International Small Companies ETF (QSML) which has around 75% of its investments in the US. MOAT and QSML are unhedged, so as the Australian dollar jumped off its US62 cents October low to be around US64 cents now, that 3% gain would have adversely hit the value of MOAT and QSML.

The recently launched, VanEck MSCI International Small Companies Quality (AUD Hedged) ETF (QHSM) and VanEck Morningstar Wide Moat (AUD Hedged) ETF (MHOT), would have benefited from the Australian dollar’s relative strengthening.

QHSM and MHOT are hedged versions of QSML and MOAT, respectively.

Hedging makes good sense if you think the Australian dollar is going to rise further.

As an aside, in addition to QHSM and MHOT, we also offer AUD hedged versions of our MSCI International Quality and MSCI International Value ETFs which have the tickers QHAL and HVLU. And for income-oriented investors, where we think hedging ensures offshore income is not offset by currency movements, we offer currency-hedged ETFs with exposure to global infrastructure (IFRA) and international property (REIT).

2. Gold and gold miners

Gold is traditionally used by investors as a hedge against the US Federal Reserve and the US Government. The US dollar can lose value at any time if investors lose confidence in the US Fed or the US Government. Investors are assessing the implications of political dysfunction within the US Government. Recently, the US risked defaulting on its debt after Republicans refused to raise the debt ceiling unless their demands for budget cuts were met by Democrats and now, as Congress fails to pass the budget, a shutdown looms.

Reflecting gold’s appeal in a time of crisis, it recently jumped beyond US$2,000, toward its highest-ever price.

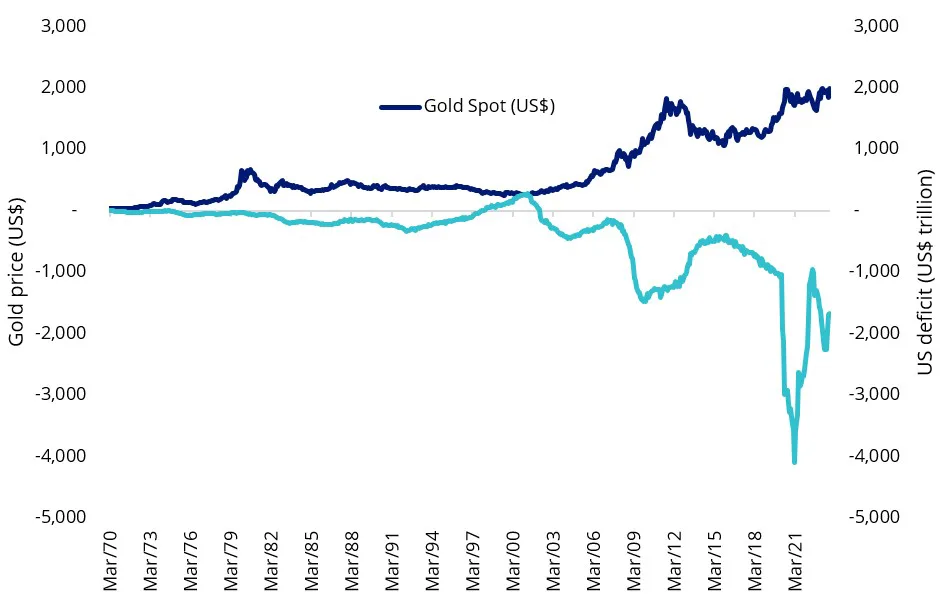

The US deficit continues to loom large and that will weigh on the value of the greenback moving ahead, pushing gold over US$2,000. Historically, gold has a negative correlation to the US budget, as can be seen in the chart below.

Chart 2: Gold price and US Budget Balance

Source: Bloomberg. Past performance is not indicative of future performance.

Gold, we think, should be considered as part of a portfolio as it provides a hedge against geopolitical and economic instability. We also think the long-term case for a stronger gold price remains and that an allocation to gold is an important diversification tool for portfolios.

Investors seeking exposure to gold can also consider investing in gold miners too. The advantage of investing in gold miners rather than gold itself is that their price typically rises more than the gold price itself, as miners’ margins increase from gold production (and vice versa). Many miners pay dividends too.

3. Emerging markets

A falling US dollar is often seen as good news for emerging markets, because it makes the cost of US goods and services, which they may import, cheaper in their own currencies. Also, emerging nations often have US dollar debt. If an EM country has a lot of US dollar debt, the weakening dollar deflates the value of that debt in local currency terms and servicing that debt will cost less.

When the US dollar falls, investors also turn to higher-yielding debt from emerging markets and money flows into their bond markets, supporting asset values.

Within equities, the weaker greenback is also good for countries which export commodities. The weaker US dollar is usually accompanied by stronger commodity prices, such as gold and iron ore, which in turn boosts growth and promotes trade surpluses for commodities exporters such as one of the world’s biggest emerging markets, Brazil.

Both emerging markets bonds and emerging markets equities can benefit from a falling US dollar.

Positioning for currency volatility

These three investment ideas: hedging your international equity exposure; buying gold and/or gold miners; and investing in emerging markets, are strategies to consider when investing in an environment in which there is pressure on the US dollar.

Always speak to a financial adviser to consider your individual financial circumstances, needs and objectives and read the relevant PDS before deciding to invest. Currency movements are unpredictable and volatile and are just one of the many risks that investors must navigate in these tricky times.

Key risks: Investing in the Funds involves risks that vary for each Fund. Notable risks for NUGG encompass custody, gold bullion and pricing risk. All other funds involve risks associated with industry sectors, foreign currency, currency hedging (hedged funds), liquidity, fund operations and tracking an index. See the respective PDS for details.

Published: 18 November 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.