Tipping point reached for ETFs

The Hayne Royal Commission has brought forward a significant moment for investors. The ‘tipping point’ for exchange traded funds (ETFs) in Australia has been reached.

Gone are the days when investors thought exclusively of unlisted managed funds issued by large vertically integrated firms as the investment tool to diversify. Revelations at the Hayne Royal Commission highlighted issues with vertical integration and advice.

In the aftermath, it’s likely financial services companies will face greater regulation and we think one of the biggest beneficiaries will be ETFs because of their multiple advantages over unlisted funds, namely ease of use and transparency.

In The Tipping Point: How Little Things Can Make a Big Difference, Malcolm Gladwell analyses the dramatic moment when everything can change. This is known as the ‘tipping point’.

Gladwell says there are three rules to identify a tipping point. They are:

- The Law of the Few – it only takes a small group of people to create a tipping point, provided they have the power to persuade people;

- The Stickiness Factor – the message has to be memorable; and

- The Power of Context – the environment has to be right.

When Hayne handed down his final recommendations it was the tipping point for ETFs in Australia.

The Law of the Few

Gladwell further describes a tipping point as "the moment of critical mass, the threshold, the boiling point."

In his book, he says: "ideas and products and messages and behaviours spread like viruses do". The examples of such changes include the rise in popularity and sales of Hush Puppies shoes in the mid-1990s and the steep drop in New York City’s crime rate in the 1990s.

Similarly, ETF use in Australia is spreading quickly and the revelations at the Hayne Royal Commission have heighted the sense of awareness and increased interest. A large number of astute, well-connected and influential financial advisers, brokers and self-directed individuals are adopting ETFs in investment portfolios.

Gladwell’s first law is therefore met.

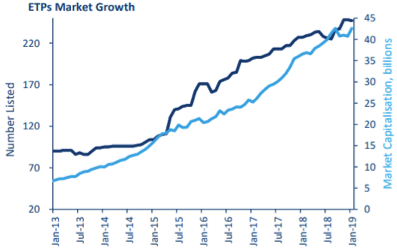

The market capitalisation growth of ETFs in Australia is illustrated by the light blue line in the graph below. The dark blue line tracks the growth of the number of exchange traded products (ETPs), of which ETFs are a significant subset. They account for 90% of the market capitalisation of the ETP market and 79% of the total number of ETPs listed.

Source: ASX Investment Products Monthly Update, January 2019.

The Stickiness Factor

ETFs also meet Gladwell’s second rule. The message that ETFs carry is quite simple and memorable. ETFs offer:

- Low fees;

- Full transparency - you see all your holdings on a daily basis and can see live prices on ASX;

- Tax efficiency; and

- Ease of use – you buy and sell on ASX as simply as trading shares.

More and more investors are adopting ETFs as a first choice.

The Power of Context

For a tipping point to be reached, the conditions and the circumstances have to be right. Up until now, the message of ease of use and transparency has not been enough to move the bulk of investment money.

The Hayne Royal Commission has provided the context. With the final recommendations now out in the public domain, Treasurer Frydenberg has vowed to take on all but one of the 76 recommendations.

These include rules that financial advisers must disclose lack of independence to their clients – so if they are recommending an in-house product, advisers will have to justify it. This will be hard to do.

Community expectations too have changed. The outcome of the Hayne Royal Commission should result in increased scrutiny of conflicts of interest. This is going to result in changes to how financial advice is given in Australia and how to satisfy client’s best interests.

So, the Power of Context exists for ETFs to achieve their tipping point. We expect unprecedented growth of ETFs into the mainstream will follow.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck) as the responsible entity and issuer of the VanEck Vectors Australian domiciled exchange traded funds (‘Funds’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a Fund, you should read the applicable PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. The Funds are subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any Fund.

Published: 28 February 2019