'Tis the season for Quality

Especially with the new Star Wars movie being released.

In case you are not aware, there is a new Star Wars movie being released on 18 December 2015. The Star Wars Empire is now a part of Disney’s stable of popular and recognisable characters to which fans have strong emotional ties. After a carefully orchestrated marketing campaign, Star Wars: The Force Awakens has already experienced the most presales of any film in history and Disney is already working on new movies and spinoffs from the Star Wars franchise, so a strong launch for The Force Awakens could drive opportunities for years to come. Disney is a company that is expected to increase earnings, with a strong balance sheet and well performing assets. Disney is a Quality company.

In the low growth, low inflation economic season that global markets are currently in the middle of, Quality outperforms.

Quality companies:

- have durable business models that are less correlated to the business cycle,

- are easy to identify and understand; and most importantly,

- outperform over the long term.

Quality investing is not new, having been identified in the late 30’s by the founding father of value investing, Benjamin Graham. More recently, Quality investing gained prominence after the dot-com bust and the collapses of high-growth companies such as Enron and WorldCom. A Quality investor would have avoided these companies and limited losses as they would have only invested in companies that have strong financials and earnings stability. Quality investors are therefore best placed to withstand negative business cycles.

Quality companies are easy to identify. Graham defines a Quality company as having “a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years.” Graham defines a strong financial position as long-term debt not exceeding current net assets and a high return on equity (ROE). Graham says that the best way to determine whether earnings will be maintained is to examine long term earnings. MSCI, the world’s largest index provider, has created a Quality Index based on Graham’s quality factors which includes only the highest scoring stocks based on three easily identifiable financial characteristics:

- High ROE;

- Low earnings variability; and

- Low debt-to-equity ratio.

The temptation for investors to follow fads or invest in regions or sectors that are experiencing rapid growth is understandable. Graham identified these types of investors as speculators. Many professional investors are successful speculators, but they are exposed to higher risks and higher costs. As Graham, his student Warren Buffett and numerous academics have proven investing only in quality companies results in outperformance over the long term.

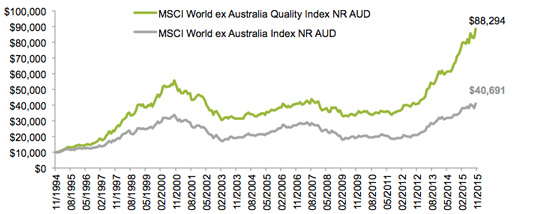

Source: MSCI, Market Vectors, iRate, as at 31 October 2015

The above graph is a hypothetical comparison of performance of a $10,000 investment in the Index and the parent index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF. You cannot invest directly in the Index. The above performance information is not a reliable indicator of current or future performance of the indices or QUAL, which may be lower or higher.

The Market Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) tracks the MSCI World ex Australia Quality Index. An investment in QUAL gives you the ability to trade a portfolio of quality international shares including Disney in Australian dollars, during the Australian trading day. QUAL launched on the ASX on 29 October 2014.

Performance of QUAL to 31 October 2015

Index |

1mth |

3mths |

CYTD |

1yr |

QUAL |

6.98% |

3.10% |

20.59% |

30.80% |

MSCI World ex Australia Index |

6.31% |

0.23% |

17.36% |

26.98% |

Excess Returns |

+0.67% |

+2.87% |

+3.23% |

+3.82% |

Source: Morningstar Direct, as at 31 October 2015. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and are net of management costs but do not include brokerage costs of investing in QUAL. The above performance information is not a reliable indicator of current or future performance of QUAL, which may be lower or higher.

May the performance be with you.

For more information on QUAL click here.

To speak to a Market Vectors ETF specialist please call us on 02 8038 3300 or send an email to info@marketvectors.com.au.

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity ('MVI') of the Market Vectors MSCI World ex Australia Quality ETF ('QUAL'). MVI is a wholly owned subsidiary of Van Eck Associates Corporation based in New York ('Van Eck Global').

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation nor needs ('circumstances'). Before making an investment decision in relation to QUAL, you should read the product disclosure statement ('PDS') and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

QUAL is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

QUAL is indexed to a MSCI Index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the Reference Index. The PDS contains a more detailed description of the limited relationship MSCI has with MVI and QUAL.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.

Published: 09 August 2018