Top 10 lists always miss something

Another financial year has come and gone, and in its wake we’re once again faced with a deluge of 'top 10 funds' lists in the media. While these league tables are great publicity for funds that find themselves on top, they aren’t so great at capturing the whole market. Advisors and investors could also finish in the top 10.

Australia’s only dedicated financial and business newspaper, the Australian Financial Review (AFR) has published no fewer than five articles since the end of the financial year containing tables highlighting the best performing funds of the year:

- 18 July 2019 - Mercer names best-performing Aussie share funds

- 19 July 2019 - Top fundies warn on valuation risk

- 19 July 2019 - Where the money was made in ETFs

- 23 July 2019 - Global funds - the 2019 winners and losers

- 27 July 2019 - Revealed: Super's top performers

The most recent of these piqued our interest because we had recently written a Vector Insights on balanced and growth funds. This article is also important because many Australians have their superannuation invested in balanced and growth options as these are generally the ‘default’ option most of us end up in. Unbeknown to us at the time of writing our previous post, we were giving investors a window into building balanced and growth strategies using low-cost ETFs which would have been among the top performing when compared to those that appeared in the AFR. The results illustrate how using a combination of traditional market capitalisation and smart beta ETFs, not all VanEck ones, as simple building blocks in a portfolio you can achieve robust outcomes for low costs.

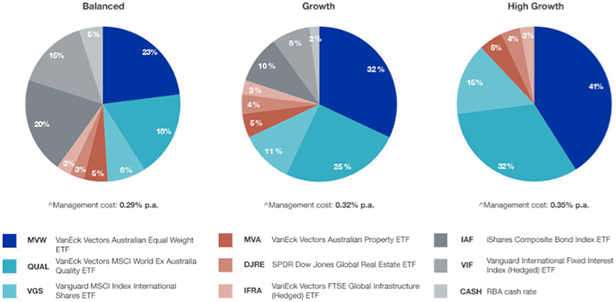

VanEck has partnered with Lonsec Investment Solutions Pty Ltd (Lonsec) to provide three low-cost model portfolios comprised entirely of ETFs. Information on these can be found here: https://www.vaneck.com.au/etf-model-portfolios

VanEck ETF Model Portfolios are powered by Lonsec drawing on their established research and portfolio construction expertise to provide recommended strategic asset allocations tailored to three risk/return profiles: Balanced, Growth and High Growth. Each model portfolio is split between growth and defensive assets across a range of ETFs that Lonsec considers provide an appropriate exposure to the relevant asset class.

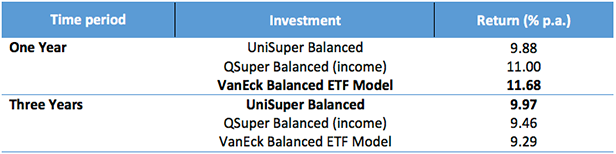

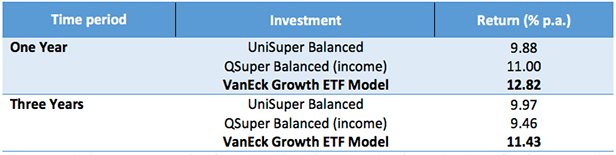

Tables 1 and 2 below show the returns of VanEck’s Balanced and Growth ETF portfolios based on the asset allocations outlined above. These models have been running since April 2016 and include ETFs from a number of ETF issuers, taking a best-of-breed approach. We have used ETFs that track traditional market cap weighted benchmark indices for Australian bonds, International bonds, Global Infrastructure and International Property. For Australian equities and Australian property we use smart beta ETFs and for International equities we use a combination of market capitalisation and smart beta ETFs.

In both cases the VanEck model has delivered the highest one year returns compared to the best performing balanced or growth superannuation portfolios reported in the AFR. Over three years to 30 June 2019, the VanEck Growth ETF model was also the best performing portfolio.

Table 1. Best performing super growth fund (61% to 80% allocation to growth assets/ 20% to 39% allocation to defensive assets) over one year to 30 June 2019 versus VanEck Balanced ETF Portfolio Model (60% growth / 40% defensive assets)

Table 2. Best performing super growth fund (61% to 80% allocation to growth assets/ 20 to 39% allocation to defensive assets) over 12 months to 30 June 2019 versus VanEck Growth ETF Portfolio Model (80% growth / 20% defensive assets)

Source: VanEck, ChantWest, QSuper website (accessed 30 July 2019) UniSuper website (accessed 30 July 2019), Performance period ending 30 June 2019. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. Results are net of management costs but do not include brokerage costs of investing in the ETFs. Performance on is not a reliable indicator of future performance. Assume rebalanced at the end of each calendar year. The RBA cash rate is used for cash.

ETFs used in VanEck Models: International Bonds – Vanguard International Fixed Interest Index ETF (Hedged), Australian Bonds – iShares Core Composite Bond ETF, International Equities – Vanguard MSCI Index International Shares ETF & VanEck Vectors MSCI World ex Australia Quality ETF, Australian Equities – VanEck Vectors Australian Equal Weight ETF, International Real Estate - SPDR Dow Jones Global Real Estate ETF, Global Infrastructure -VanEck Vectors FTSE Global Infrastructure (Hedged) ETF, Australian Property – Vanguard Australian Property ETF.

Warning: This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. The ETFs are named for illustrative purposes only and this does not constitute a recommendation of any financial products or product issuers. Before making any asset allocation or investment decision, you should seek personal financial advice from a licensed financial adviser to determine your risk profile and financial products that are appropriate for your personal circumstances and read the PDS.

Financial Express Index

Going further, when comparing a portfolio or multi-asset products against a benchmark, Australian research house Lonsec recommend you use the Financial Express (FE) multi-asset benchmarks. Below we compare the VanEck ETF Models to their relevant FE benchmark.

*Inception is the ASX listing date of VanEck Vectors FTSE Global Infrastructure (Hedged) ETF which was 29 April 2016

Source: VanEck, Performance period ending 30 June 2019. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. Results are net of management costs but do not include brokerage costs of investing in the ETFs. Performance on is not a reliable indicator of future performance.

Putting in into practice: ETFs are ideal tools for building robust portfolios.

It’s no wonder more and more investors are flocking to ETFs for their ease of use, low costs and transparency. As we’ve illustrated above they are also ideal building blocks for building diversified portfolios:

- They allow investors to access asset classes they otherwise could not. For example, until recently only infrastructure and global real estate, that have been pillars of institutional portfolios, have been difficult to access;

- Smart Beta ETFs allow investors to target better investment outcomes; and

- ETFs allow advisers to be investment strategists delivering outcome-oriented solutions, allowing them to buy (or dispose of) sectors and regions they think will outperform (or fall).

ETFs are ideal building blocks for portfolio construction and are an optimal investment and business risk management solution for advisers through diversification, liquidity, convenience and cost effectiveness.

For more information about VanEck’s ETF model portfolios – click here. The most recent performance is available - click here -

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). VanEck is the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. VanEck PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. PDSs of other issuers' ETFs are available from their websites. No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any funds. Past performance is not a reliable indicator of future performance.

This information is provided by Lonsec Investment Solutions Pty Ltd ABN: 95 608 837 583, a Corporate Authorised Representative (CAR 1236821) (LIS) of Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL421445 (Lonsec Research). LIS creates the model portfolios it distributes using the investment research provided by Lonsec Research but LIS has not had any involvement in the investment research process for Lonsec Research. LIS and Lonsec Research are owned by Lonsec Fiscal Holdings Pty Ltd ABN: 41 151 235 406. Please read the following before making any investment decision about any financial product mentioned in this document. Disclosure as at the date of publication: Lonsec Fiscal group companies receive fees and other benefits. Lonsec Research Pty Ltd ABN: 11 151 658 561 AFSL: 421445 receives fees from fund managers or product issuers for researching their financial product(s) using comprehensive and objective criteria. Lonsec Research receives subscriptions for providing research content to subscribers and fees for providing investment consulting advice to clients, which includes model portfolios, approved product lists and other advice. The fees are not linked to the financial product rating outcome or the inclusion of financial products in model portfolios, or in approved product lists. Warnings: Past performance is not a reliable indicator of future performance. Any express or implied rating or advice presented in this information is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s) alone, without taking into account the investment objectives, financial situation and particular needs (‘financial circumstances’) of any particular person. Before making an investment decision based on the rating(s) or advice, the reader must consider whether it is personally appropriate in light of his or her financial circumstances, or should seek independent financial advice on its appropriateness. If our advice relates to the acquisition or possible acquisition of particular financial product(s), the reader should obtain and consider the Investment Statement or Product Disclosure Statement for each financial product before making any decision about whether to acquire a financial product. Disclaimer: This information is for the exclusive use of the person to whom it is provided by Lonsec Research and must not be used or relied upon by any other person. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information, which is drawn from public information not verified by Lonsec Research. Financial conclusions, ratings and advice are reasonably held at the time of completion but subject to change without notice. Lonsec Research assumes no obligation to update this information following publication. Except for any liability which cannot be excluded, LIS and Lonsec Research, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in, misstatement or omission from, this information or any loss or damage suffered by the reader or any other person as a consequence of relying upon it.

Published: 02 August 2019