Trust in private credit

Last week ASIC released its private credit market review. Here we summarise its findings and where we think the Australian private credit market is headed.

Last week, ASIC released its high-level review of the private credit market in Australia.

The release of ASIC’s review follows its discussion paper released in February, titled, Australia’s evolving capital markets: A discussion paper on the dynamics between public and private markets and the feedback it requested from that paper.

ASIC’s February paper highlighted the growth in private markets, driven by factors such as the expansion of the superannuation system and the increasing prominence of private credit.

While these are not bad things, the paper suggests that one of the key differences between public markets and private markets presents a potential risk for the broader economy: the lack of transparency.

Where public markets provide, according to the paper, “price discovery and liquidity, facilitating efficient valuation, pricing and capital,” private markets rely on “methodologies and judgements” that “may not always be independent”.

This opacity, potential conflicts of interest, valuation uncertainty and potential illiquidity, ASIC Chair Joe Longo at the time stated, “are the key risks I am concerned for ASIC to focus on.

“The critical point is understanding whether there is a need for intervention, whether it is for ASIC or another regulator to consider, or whether we leave the market and wholesale investors to their own devices.”

Last week’s private credit review answers the question of whether market intervention is required.

Upon its release, the headlines last week included: “ASIC’s catalogue of questionable private credit behaviour”, “Poor disclosures, conflicts of interest, and a failure to prepare: ASIC has private credit figured out” and “Private credit a ‘systemic-risk’ for SMSFs: ASIC”.

While the headlines may have been a tad sensational, the key findings were:

- Opaque and misleading practices – Some funds were found to recycle investor capital as returns, disguise troubled loans, or use vague labels like “senior” or “investment grade” without clear basis.

- Conflicted fee structures – Managers in some cases retained upfront and default fees, with actual remuneration several multiples higher than disclosed, creating conflicts of interest.

- Related-party lending – Instances of lending to affiliated entities on inflated terms were identified.

- Systemic risk concentrations – A large portion of private credit in Australia is tied to property development and construction finance, heightening risk in a downturn.

- Regulatory escalation – ASIC has already imposed stop orders on several products and signalled that more enforcement action is on the way, particularly where disclosure and governance fall short.

But regulation, and calls for better transparency, are not new. Earlier this year in an opinion piece for the Australian Financial Review, I suggested that ASIC consider the Business Development Company (BDC) framework in the United States, created under the Small Business Investment Incentive Act of 1980.

“Designed to channel capital to small and mid-sized businesses, BDCs straddle the line between private credit exposure and public market oversight. Listed BDCs, traded on the NYSE or Nasdaq, are subject to the same rigorous reporting requirements as other investment companies.

“This includes quarterly disclosure of asset valuations, fair value methodologies and credit metrics. The result? A strengthening market backed by some of the world’s most sophisticated asset managers like Blackstone, Ares, Blue Owl and Oaktree. Transparency hasn’t hindered growth. If anything, it’s underpinned it.

“Contrast that with Australia, where private credit funds are generally not subject to any standardised reporting regime. Investors must often rely on management rather than verified metrics. In a landscape increasingly populated by retail capital, this asymmetry is worth addressing.” I wrote.

We believe ASIC will create a more transparent industry. A well-functioning market that better manages and discloses conflicts of interest. Not only would that benefit investors, but it could also enhance private credit’s benefit to the wider economy.

I had also written AFR opinion pieces about the importance of transparency and price discovery in private and public markets – here. I’ve also opined about concentration risk – here.

Concentration risk was highlighted by ASIC in its review as a potential structural problem within the Australian private credit market. ASIC estimates that around half of the $200 billion invested in private credit in Australia is invested in real estate, and it could be in that sector, ASIC fears, problems could potentially arise. According to the report, “conflicts of interest, opaque fee and interest margin arrangements, inconsistent and non-independent valuation methodologies, and ambiguous terminology. These practices are more prevalent in real estate–based funds.”

An ETF that invests in global listed private credit funds, with transparency and more diversification is within reach of all Australian investors.

Currently, all of the companies VanEck’s Global Listed Private Credit (AUD Hedged) ETF (LEND) invests in are US-listed BDCs, so while there is credit risk associated with BDCs, investing in an ETF like LEND, allows investors to access the private credit market and limit single LIT/BDC credit risk and increase diversification. A complete, daily transparent, list of holdings can be found - here.

None of the ASX-listed private credit funds are included in the index LEND tracks, the LPX Listed Private Credit AUD Hedged Index (LEND Index). This is due to the lack of underlying holdings transparency.

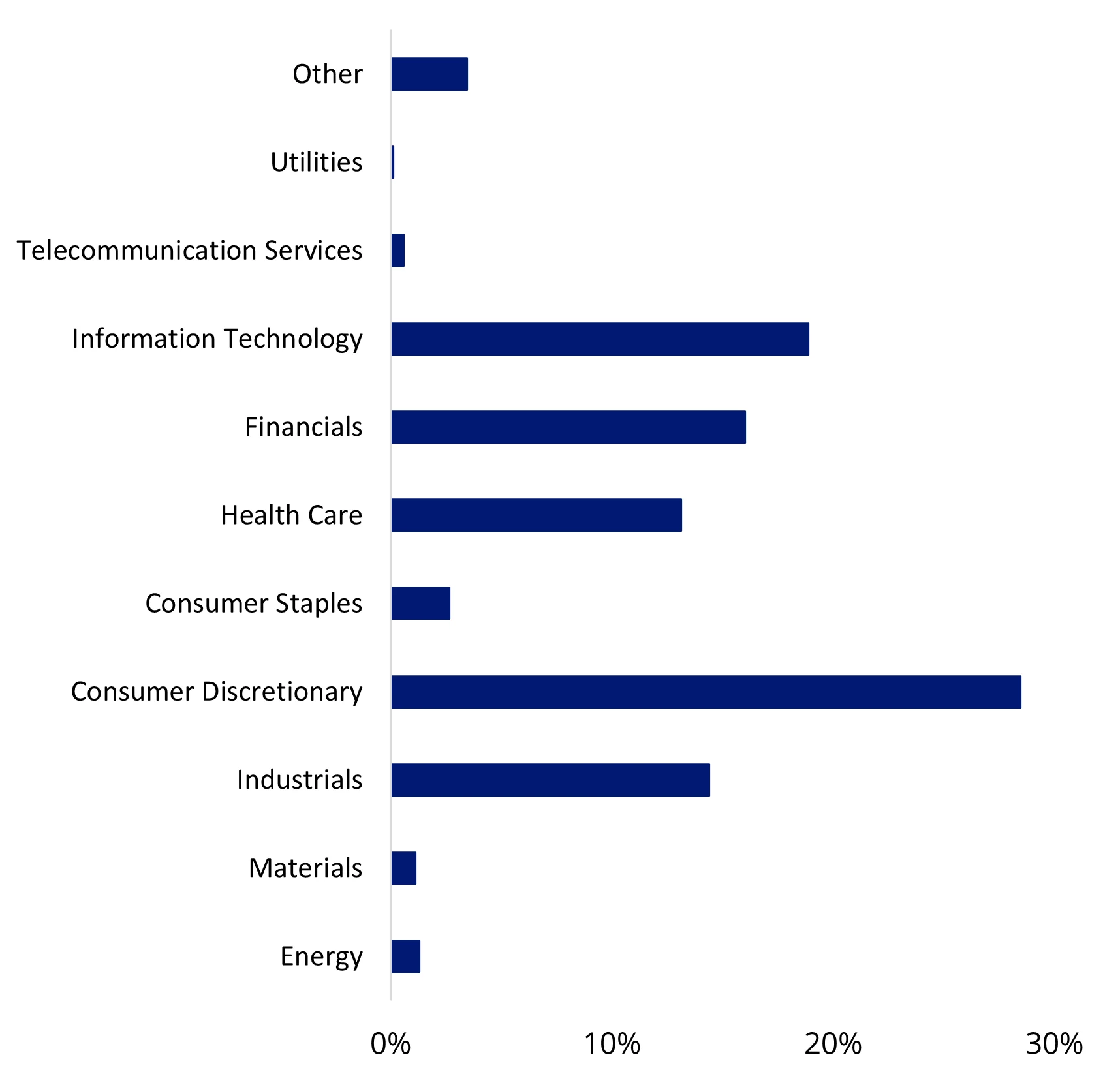

In terms of concentration, two of the largest ASX listed private credit LITs or LIC, have a greater than 50% exposure to real estate, one of them only lends to real estate. LEND gives exposure to 25 of the largest listed private credit companies, offering access to more diversified loan portfolios across industries such as healthcare and IT, which may help support prudent risk management. For reference, real estate would be a part of the financials sector below.

Chart 1: LEND Index GICS sector breakdown

Source: LPX AG, as at 31 August 2025

We welcome ASIC's private credit review and think investors benefit from greater transparency and better management and disclosure of conflicts of interest.

Private credit has a place in a well-diversified portfolio for those investors seeking income, commensurate with risk.

Key risks: An investment in LEND carries risks associated with: listed private credit, interest rates, credit/default, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Related Insights

Published: 26 September 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

LEND is likely to be appropriate for a consumer who is seeking a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and a very high risk/return profile.