When one ETF is not enough

In the 1950s, when Modern Portfolio Theory (MPT) was being put forward as a scientific approach to investing, one of its tenets was diversification. Then the two investment options considered were shares and bonds.

In practice, this theory meant that the equity component of the portfolio aims to provide growth potential, and the bond component aims to provide a source of stability and income through investments in fixed-income securities.

The approach is based on the idea that the share market’s historical returns have been higher than the bond market’s historical returns. Bonds have historically preserved capital and generally provided dependable income more reliably than the share market, which tends to experience more extreme rises and falls. In other words, returns between share markets and bond markets tend to be lowly correlated.

Diversifying a portfolio between the two asset classes, according to MPT, can help reduce overall risk.

Today, investors have better tools available to them than when MPT was born. The advent of new technologies enables investors to leverage financial reports and performance data points more effectively. The development of larger and more powerful semiconductors and computers to run complex mathematical algorithms, thereby optimising the risk-return computations, is also driving portfolios today. Furthermore, global listed infrastructure, listed property trusts and capital securities are asset classes that have been made investable over the last 70 years, and these tend to be less correlated to other asset classes.

Our biggest superannuation and sovereign wealth funds invest in these disparate asset classes, including infrastructure and real estate. They are also being included as part of diversified portfolios being recommended by financial advisers.

Australia’s financial adviser community has also been utilising managed accounts, including separately managed accounts and managed discretionary accounts, which offer financial advisers a scalable framework for delivering advice with institutional-grade portfolio governance, access to a vast array of investment manager expertise, real-time transparency and operational efficiency.

Coinciding with the growth of the superannuation industry and the growth in managed accounts has been the rise of exchange-traded funds (ETFs).

The ETF industry reached a record $299.4 billion in funds under management as at 31 August 2025, up from $70.5 billion five years ago. And we think this momentum is likely to continue.

Because there are ETFs that invest in many of these ‘newer’ uncorrelated asset classes, they feature in many of the managed accounts advisers use.

We think that the tenets of MPT are as strong as ever and believe a diversified approach to portfolio construction is critical to achieving investment objectives.

VanEck has created a series of notional model portfolios, which are split between growth and defensive assets across a range of ETFs that give exposure to many asset classes. Sometimes one ETF is not enough.

We have created these hypothetical portfolios using well-established research and portfolio construction expertise, considering risk and return.

An informed understanding of the risk and return profile of the various asset classes is important to the portfolio construction process.

The Australian Government (moneysmart.gov.au) has provided investors with a practical guide to investing called “Investing between the flags” which highlights typical investment portfolios including ‘balanced’ and ‘growth’ mixes based on desired return outcomes, having regard to investors’ different timeframes and levels of risk.

The Australian Securities & Investments Commission (ASIC) defines defensive assets as cash or government bonds, so for the purposes of the below, defensive assets are Australian bonds, international bonds and cash. This means the growth assets below are: Australian equities, international equities, Australian property, international property and global infrastructure.

Therefore, a balanced portfolio will include a mix of defensive and growth assets, while a portfolio targeting high growth has 100% allocated to growth assets.

Growth assets are considered riskier than defensive assets, so a high-growth portfolio is riskier than a balanced portfolio.

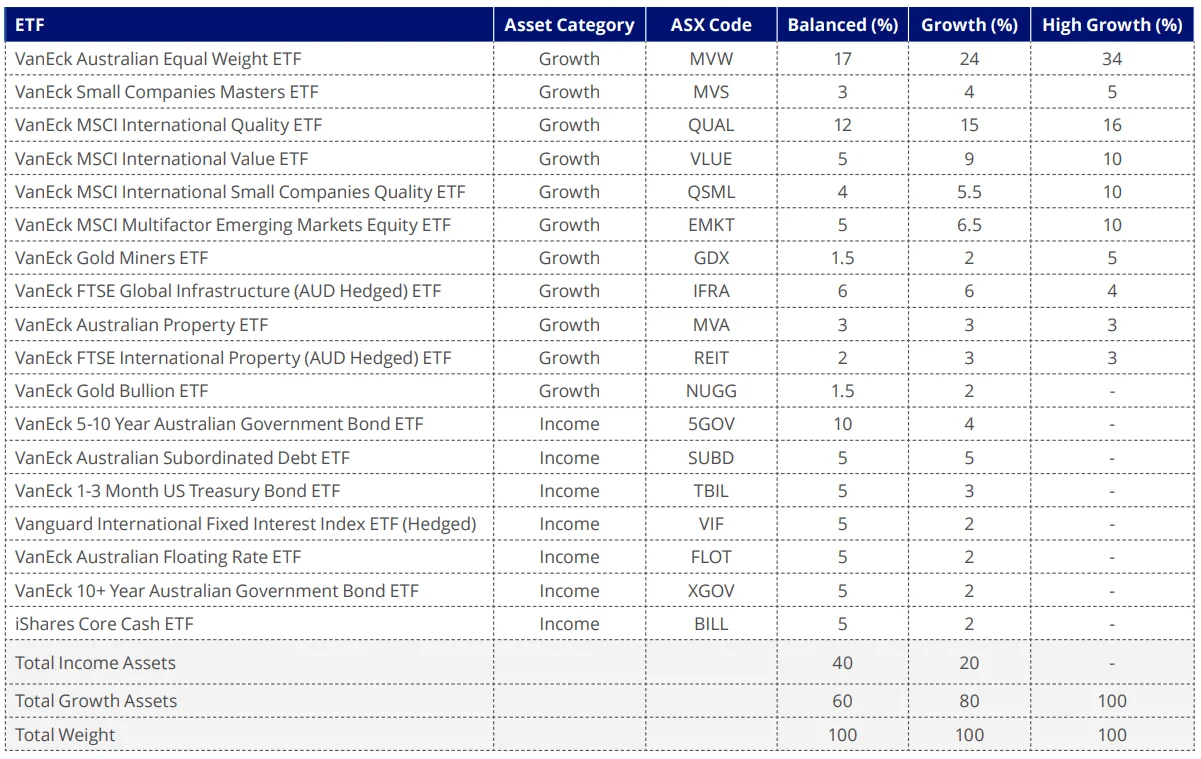

Below is an example of typical asset allocation in balanced, growth and high-growth portfolios.

Each notional model portfolio provides broad market exposure across asset classes, including Australian equities, global equities, property, infrastructure, Australian fixed income and international fixed income. You will note it includes VanEck’s ETFs, as well as funds from our ETF peers, where we do not have an equivalent capability. The portfolios include a mix of ‘beta’ and ‘smart beta’ strategies, utilising simple low-cost ETF strategies to deliver diversified exposure for considerably less cost than the average cost of Australian managed funds.

Warning: This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making any asset allocation or investment decision, you should seek personal financial advice from a licensed financial adviser to determine your risk profile and financial products that are appropriate for your personal circumstances.

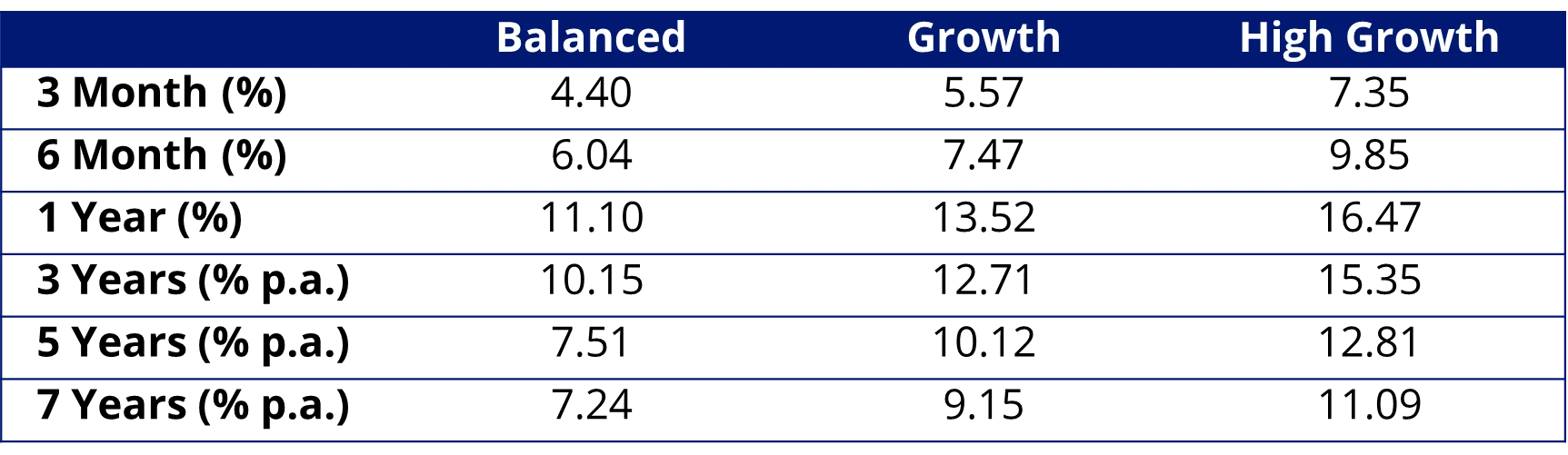

We have been calculating the modelled returns of these notional models for over seven years. The table below shows the net returns of hypothetical portfolios based on the notional models above, assuming net of fees and reinvestment of dividends

Returns for periods ending 31 August 2025.

As you can see from the above table, a hypothetical one-year investment in our model high growth portfolio for the period ending 31 August 2025 would have returned a strong 16.47%. It’s important to remember that equities have soared this year despite ‘Liberation Day’ tariffs, but even over the past five and seven years, these returns compare favourably to the returns of balanced and growth funds being reported by large superannuation funds and managed accounts.

The hypothetical returns are demonstrative of the benefits diversification can have for investors as a long-term portfolio strategy and how investors are using ETFs to achieve their investing goals. You may need to consider more than one.

An investment in any fund involves risk. As always, we would recommend you speak to a financial adviser or broker to determine which investment portfolio is right for you. The moneysmart.gov.au website also includes a guide to financial advice.

Related Insights

Published: 14 September 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.