Building a stronger foundation with infrastructure

Transurban’s recent strong results and upgraded dividend guidance highlight infrastructure’s strength

- Transurban 's strong results and upgraded dividend guidance highlight infrastructure 's strength

- Infrastructure is a defensive asset class as the businesses are generally monopolies that are essential to an economy with inelastic demand

- Income from infrastructure assets is typically more stable compared to equities and higher than traditional defensive assets such as bonds

- Australian investors have a limited choice of infrastructure on ASX and like all asset classes investors benefit from diversification

- VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA) is the only global infrastructure ETF on ASX

- IFRA currently invests in 151 global infrastructure securities and has delivered low cost outperformance relative to other global infrastructure options

Infrastructure as a defensive asset

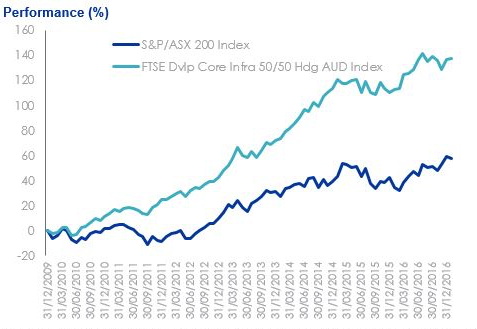

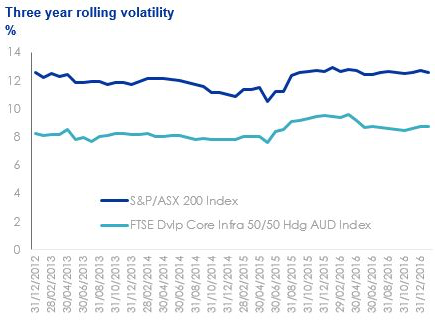

Infrastructure assets have demonstrated lower volatility and a low correlation compared to traditional asset classes. They are large and have little or no competition, protected by high barriers to entry. Global infrastructure securities have exhibited significant outperformance with less volatility than Australian shares.

Source: Morningstar Direct, 31/12/2009 to 31/1/2017. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Infrastructure yields are stable

Infrastructure assets are long lasting with inflation linked cash flows often mandated by government regulation. Therefore yield from a portfolio of infrastructure securities is stable.

Global infrastructure opportunities on ASX differ on performance and cost

There are limited infrastructure stocks on ASX and savvy investors diversify to limit stock concentration and take advantage of a broader range of opportunities.

There are a number of diversified global infrastructure options on ASX. The most popular ones are:

- IFRA - VanEck Vectors FTSE Global Infrastructure (Hedged) ETF - the only low cost ETF on ASX;

- MICH - Magellan Infrastructure Fund (Currency Hedged) (Managed Fund) - an active ETF; and

- ALI - Argo Global Listed Infrastructure Fund - a listed investment company or LIC.

1. Total Costs

To compare the performance of these funds we have compared the returns of the FTSE Developed Core Infrastructure 50/50 Hedged into AUD Index (IFRA Index), adjusted for IFRA 's fees, to ALI and as MICH doesn 't have 12 months track record, Magellan 's equivalent unlisted fund.

2. Performance

The above table shows that over the past twelve months the IFRA Index has outperformed. While this performance is short term it has been during a period of exteme market volatility punctuated with Brexit and the Trump election. Active managers typically suggest their stock selection pays off during periods of heightened market volatility but in the last 12 months they have underperformed.

VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (ASX: IFRA) is the only global infrastructure ETF on ASX. IFRA currently invests in 151 global infrastructure securities and has delivered low cost outperformance relative to other global infrastructure options.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck ') as responsible entity and issuer of the VanEck Vectors FTSE Global Infrastructure (Hedged) ETF (‘Fund '). This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person 's individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

IFRA invests in international markets. An investment in IFRA has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.

The Fund is not in any way sponsored, endorsed, sold or promoted by FTSE International Limited or the London Stock Exchange Group companies (‘LSEG ') (together the ‘Licensor Parties ') and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (with net dividends reinvested) (‘Index ') upon which the Fund is based, (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Fund. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Reference Index to VanEck or to its clients. The Reference Index is calculated by FTSE or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Reference Index or (b) under any obligation to advise any person of any error therein. All rights in the Reference Index vest in FTSE. “FTSE®” is a trade mark of LSEG and is used by FTSE and VanEck under licence.

Published: 09 August 2018