Enhance your cash yield

Term deposits, cash funds and cash management accounts are offering little in terms of yield and savvy investors are enhancing their yield with Australian floating rate notes (FRNs). The Australian FRN benchmark index, the Bloomberg AusBond Credit FRN 0+ Index, has consistently outperformed the cash proxy, the Bloomberg AusBond Bank Bill index.

VanEck recently launched its VanEck Vectors Australian Floating Rate ETF (ASX code: FLOT), a portfolio of investment grade Australian FRNs which tracks the Australian FRN benchmark.

Many Australian investors are holding too much cash which is yielding very little.

FRNs are an effective substitute for cash investments as they offer higher yields than cash with an ‘interest-rate risk’ profile similar to cash. That’s because the coupon interest rate of FRNs is ‘floating’ and resets every quarter in line with a reference interest rate. Coupons typically track the bank bill swap rate (BBSW), which rises (and falls) with official interest rates.

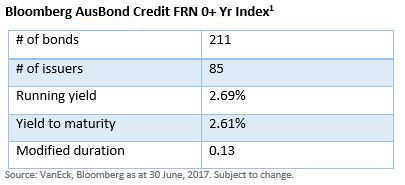

The yield on the benchmark FRN Index, the Bloomberg AusBond Credit FRN 0+ Yr Index, is currently 2.61% per annum which compares favourably to the largest cash management account in the country which is yielding 1.4%1 The chart below highlights the outperformance of FRNs since the global financial crisis, with the return on cash measured by the Bloomberg AusBond Bank Bill Index.

FRNs in a rising rate environment

The Reserve Bank of Australia (RBA) recently said it sees a ‘neutral’ cash rate of at least 3.5%2which is 200 basis points above where it is now. Investing in FRNs will allow investors to reap higher yields when official interest rates rise because their coupons will rise when they reset to a higher BBSW. This contrasts with:

-

bank savings accounts, where banks don’t necessarily pass on rate rises; and

-

term deposit rates, which are fixed.

Unlike fixed rate bonds FRNs also offer potential protection of investors’ capital against rising rates. When interest rates go up, yields on fixed rate bonds go down. In contrast, due to their coupons resetting regularly the prices of FRNs will remain relatively steady. Therefore FRNs are more like cash than fixed rate bonds.

VanEck Vectors Australian Floating Rate ETF (ASX code: FLOT)

FLOT is designed to provide the returns of the broad Australian FRN market as measured by the benchmark Bloomberg AusBond Credit FRN 0+ Yr Index. The Index rules require that FRNs must have an investment grade credit rating to be included. If a bond is downgraded, it is removed at the end of the month.

FLOT enables investors to invest in a diversified portfolio of FRNs from different sectors via a single trade on ASX and distributes four times a year. The ETF enable investors to easily access FRNs, which have historically only been available to institutional investors.

FLOT may suit retirees and SMSFs seeking a reliable income while aiming to preserve capital and investors who want to enhance their defensive sources of income by diversifying out of cash investments.

FLOT offers investors three key benefits:

- Potential Protection against rising rates

- Regular attractive yield compared to term deposits and cash funds

- Short term, high quality credit

As it is an ETF, FLOT also comes with the benefits of being cost effective, liquid and transparent.

1 As at 30 June 2017

2 http://www.rba.gov.au/monetary-policy/rba-board-minutes/2017/2017-07-04.html

IMPORTANT NOTICE: This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors Australian Floating Rate ETF ARSN 619 241 851 (“the Fund”). This information is general in nature and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

This information is believed to be accurate at the time of compilation but is subject to change. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with VanEck and do not approve, endorse, review, or recommend the Fund. BLOOMBERG and the Bloomberg Ausbond Credit FRN 0+ Yr Index (“the Index”) are trademarks or service marks of Bloomberg licensed to VanEck. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Index.

Related Insights

Published: 09 August 2018