Going back to basics

The ETF industry has come a long way since the early 1990s when there were only a handful of ETFs and virtually nobody used them. ETFs really came to the fore in the late 2000s and have since attracted hundreds of billions of dollars and driven a paradigm shift in investing. Fast forward to 2017 and the industry now surpasses US$3.8 trillion in assets and continues to go from strength to strength.

The structural trends in the wealth management industry such as fee for service, best interests duty and the perpetual debate about active versus passive performance continues to drive adoption of ETFs. Given this, we felt it was important to go back to basics and revisit the fundamentals of ETFs.

ETFs are simply ‘exchange traded funds’ that combine the best features of managed funds and listed shares. Built like managed funds, ETFs pool money from lots of investors into a fund which is professionally managed for the benefit of all investors. Like shares in listed companies, investors can trade units in an ETF on ASX. This is better than using managed funds because you can trade on ASX at live prices throughout the day. Managed funds process all requests throughout the day at the same price and don’t reveal that price until sometime later and only get the confirmation five to seven business days later.

ETFs are also passive strategies which hold a portfolio of securities based on a reference index. They buy securities in the index and only change their portfolio when the index changes. As a result, ETF investors benefit from lower management costs compared to active managed funds which often trade all the time.

What are the advantages of ETFs?

In addition to their ease of trading on ASX with live prices throughout the day, there are a number of advantages of ETFs for investors. Unlike managed funds ETFs give investors full transparency to the underlying holdings on a daily basis. They are cost effective relative to actively managed funds and they have tax advantages compared to unlisted managed funds.

ETFs also offer better liquidity than unlisted managed funds. Liquidity is important because it impacts how quickly an investor can access their money and the value of their investments. The two most important aspects of liquidity are:

- how a liquid investment can be readily converted to cash and

- the impact of liquidity on price.

A liquid investment can be bought or sold at a fair value without a significant premium or discount to its fair value. ETF investors can buy when they want and sell when they need at a price very close to the net asset value of the ETF unit, thereby avoiding premiums and discounts no matter the market conditions.

The table below summarises a range of beneficial features ETFs offer versus unlisted managed funds

Features |

ETFs |

Unlisted Managed Funds |

Traded on ASX |

Yes |

No |

Transparency of portfolio holdings |

Yes |

Limited |

Live pricing |

Yes |

No |

Intra-day trading |

Yes |

No |

Diversification |

Yes |

Yes |

The tax advantages of ETFs are possibly their best kept secret. Because investors trade ETFs on ASX with other investors, just like shares rather than a transaction entered into directly with the fund, they have a tax advantage over unlisted funds. It all comes down to the mechanism by which investors exit their investment. In unlisted funds the units held by the withdrawing investor are cancelled and a portion of the shares in the fund are sold to pay the investor out. The problem is that this capital gains tax liability doesn’t fall on the investor who is withdrawing. It falls on the investors who remain in the fund.

In an ETF this doesn’t happen because the exit mechanism is totally different. An investor who wants to sell their ETF simply sells their units to other investors or an institutional ‘Market Maker’ on ASX via an order placed with their broker. Only the Market Maker may actually ‘withdraw’ units from the ETF. If they do, most of the capital gains in the ETF are diverted to the Market Maker rather than being left behind for remaining investors.

These advantages have seen ETFs rise from modest beginnings and now account for nearly half of all trading in US stocks. Today, the global exchange traded product (ETP) industry has over 6,000 ETPs with assets over US$3.8 trillion in 53 countries1.

Active vs passive management

Also contributing to growth of the ETF industry is the declining performance of active managers over the past decade. The latest full year S&P Dow Jones SPIVA Scorecard of Australian active managers showed that in 2016 the majority of Australian active funds in all categories underperformed their respective benchmark indices over long-term horizons. Over the 10-year period ending 31 December 2016 more than 80% of international equity and Australian bond funds and more than 70% of Australian general equity and A-REITs funds unperformed their respective benchmarks.

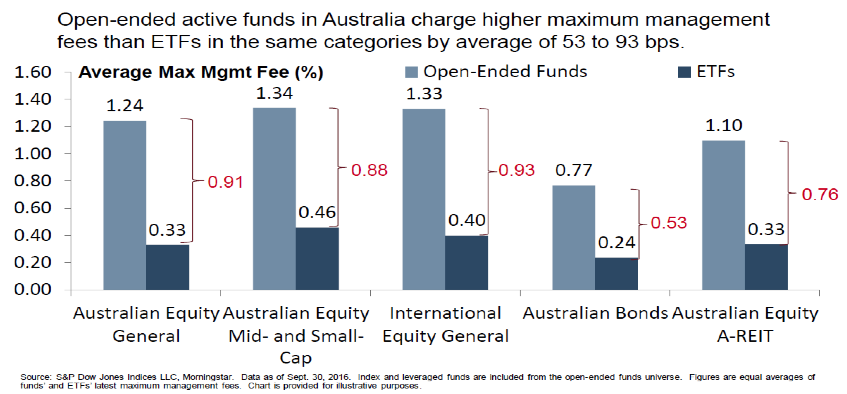

Despite underperformance, active funds in Australia charge higher maximum management fees by an average of 53 to 93 basis points relative to ETFs in the same category. Since ETFs track an index, they are typically able to achieve lower operating costs. The following graph compares the fees of open-ended active funds in Australia vs ETFs in the same category.

What’s ahead for the industry?

The ETF industry continues to move from strength to strength. Today, ETFs offer investors easy access to all manner of asset classes including domestic and international equities, fixed income, infrastructure or commodities, many of which were previously only available to large institutional investors. Given the broad range of ETFs available on ASX investors are increasingly using ETFs as key strategic and tactical building blocks in their portfolios. This involves using an ETF that comprises a core strategy (such as a broad based equal weight expose across Australian equities and a global quality strategy) and adding individual positions or satellites around that core, such as Australian small companies and global infrastructure.

Ten years from now it is likely the ETF industry will still be reaching new heights. Constant innovation in the sector is seeing the industry progressively develop. Smart beta ETFs are the fastest growing segment of the ETF sector, now accounting for over 20% of the US ETP industry. Importantly, investors are understanding that taking a passive approach to investing can lead to long-term performance in a domain that was once ruled by unlisted active managed funds.

Looking for the right ETF partner is paramount as the ETF industry becomes increasingly crowded. An ETF provider with a global presence, strong track record and experience managing passive strategies across asset classes is important to provide investors with the depth and breadth of ETF opportunities. Equally, the depth of resources and size and scale of the business is important to provide investors with robust ETF offerings.

The next Vector Insights will focus on best practice ETF trading.

IMPORTANT NOTICE:Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.

United States domiciled ETFs: VanEck Vectors ETF Trust ARBN 604 339 808 (the ‘Trust’) is the issuer of shares in the US Funds which trade on ASX under codes CETF, GDX and MOAT. The Trust and the US Funds are regulated by US laws that differ from Australian laws. Trading in the US Funds’ shares on ASX will be settled by CHESS Depositary Interests (‘CDIs’) that are also issued by the Trust. The Trust is organised in the State of Delaware, US. Liability of investors is limited. Van Eck Associates Corporation based in New York serves as the investment advisor to the US ETFs. VanEck, on behalf of the Trust, is the authorised intermediary for the offering of CDIs over the US Funds’ shares and issuer in respect of the CDIs and corresponding US Fund shares traded on ASX.

1ETFGI’s February 2017 global ETF and ETP industry insights report

Published: 09 August 2018