Homer Simpson dragging down Australian banks

Research this week released by UBS indicates that nearly one third of Australian mortgage applications were completed with the same accuracy as Homer Simpson’s. The impact of so-called ‘liar loans’ could be detrimental to banks, but there is a simple way Australian investors can significantly reduce their exposure to a sector facing significant headwinds while improving diversification to the broader Australian market.

In the sixth episode of season 10 of The Simpsons, Homer's middle name was revealed to viewers. During that episode the following exchange between Homer and Marge Simpson occurred:

Homer: Homer Simpson does not lie twice on the same form. He never has and never will.

Marge: You lied dozens of times on our mortgage application.

Homer: Yeah, but they were all part of a single ball of lies.

According to UBS's Australian Banking Sector Update, released last week, one-third of mortgage applications were completed in Australia in 2017 were completed with the same honesty as Homer Simpson's. The UBS Evidence Lab dubs these loans, 'liar loans.' This idiom originated in the US during the subprime mortgage crisis to describe low and no doc mortgages or where the verification was not accurate. The UBS report states, "In Australia mortgages generally require full documentation (low doc loans represent <1% of new mortgages). However, the fact that approximately one-third of respondents state that their mortgage application was not "completely factual and accurate" suggests they too could be described as 'liar loans'."

UBS estimates these 'liar loans' represent roughly $500 billion of mortgages on bank's books or a whopping 18% of all outstanding Australian credit. While this estimate may be extreme and it's likely that prudent banks are aware that some applications deviate from the truth, the surprisingly high proportion of 'liar loans' poses an additional concern.

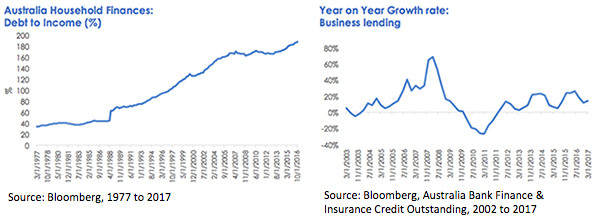

When you consider this research and Australia's record household debt level, stretched property prices, a slowdown in business borrowing and low income growth, banks will have to navigate these issues should a downturn occur.

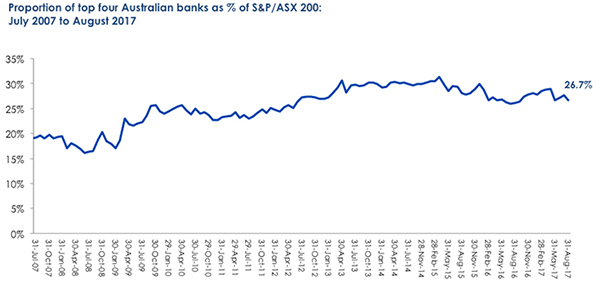

The consensus is that banks continue to face headwinds. This is problematic for many Australian investors as most Australian equity portfolios have significant exposure to the big four which represent nearly 30% of the S&P/ASX 200 Accumulation Index. In other words if you hold a blue chip portfolio or are invested in an Australian equity fund that tracks or benchmarks to the S&P/ASX 200, one out of every three of your dollars is likely to be invested in the banks. The chart below illustrates the weighting of the big four banks as a proportion of the S&P/ASX 200.

Source: Factset

Reduce bank concentration risk in a single trade

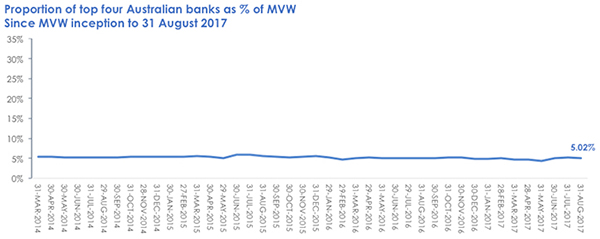

To address bank concentration risk the VanEck Vectors Australian Equal Weight ETF (ASX: MVW) is a diversified portfolio that is underweight the big four banks compared to a market-cap weighted portfolio. Partly as a result of this reduced exposure to big banks, MVW has outperformed the S&P/ASX 200 by an average of 4.23% per annum in each of the last three years and 4.26% p.a. since inception.

Performance of MVW to 31 August 2017

MVW Inception date is March 4, 2014.

Source: Morningstar Direct, as at 31 August 2017. Results are per annum, calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management costs but do not include brokerage costs of investing in MVW. Past performance is not a reliable indicator of future performance.

MVW equally weights the largest and most liquid stocks on the ASX (81 stocks @ 1.23% each). Relative to the S&P/ASX 200, the resulting portfolio:

- reduces big 4 banks exposure by ~22%; and

- reduces ASX top 10 exposure by ~40%

Source: Factset. MVW inception is March 4, 2014

Equal weighting is a strategy that has been around for quite some time with many academic institutions including London's Cass Business School, Goethe University and even Australia's own CSIRO Monash Superannuation Research Cluster studying the approach. Each found it superior to market capitalisation.

These all support our own findings which are published here:

Equal Weight: Outperforming three years on

The unequalled power of equal weight investing

Strong Foundations Have Equal Footings

With persistent headwinds facing banks, an alternative approach to Australian equity investing may be warranted.

For the record, it was revealed Homer's middle name was Jay.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity and issuer of the VanEck Vectors Australian Equal Weight ETF ('Fund'). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

1 CSIRO and Monash Superannuation Research Cluster support equal weighting here

London University's Cass Business school's findings are here

EDHEC Risk Institute findings are here

Published: 09 August 2018