How the battle is being won with smart beta

Despite rising share markets, 2016 was a bad year for small-cap fund managers, indeed, for most fund managers. But the smart ones succeeded.

Despite rising share markets, 2016 was a bad year for small-cap fund managers, indeed, for most fund managers.

The SPIVA Australia Full Year 2016 Scorecard reveals the majority of active fund managers are failing to beat their benchmark indices. Over one year to 31 December 2016, 82% of small and mid-cap fund managers underperformed their benchmark indices. Over five years, only one in two (52%) outperformed. Over three years, around just one in three (38%) outperformed. So the underperformance is a trend, not an aberration.

As a result, investors' loyalties to active fund managers are being eroded. Investors are smartening up and walking away from often expensive active fund managers and turning to smart beta – especially in the small-cap arena.

Mastering small-caps with smart beta

A new white paper by VanEck, Mastering Small Companies with Smart Beta , reveals that a smart beta index strategy in liquid Australian small companies which pay regular dividends is likely to experience greater returns and lower downside over the long term compared to small companies that don't pay regular dividends.

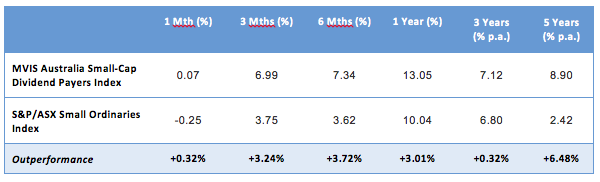

The white paper finds the smart beta index, the MVIS Australia Small-Cap Dividend Payers Index (MVS Index), has benefitted from strong returns and lower downside risk over the long term compared to the benchmark market capitalisation index, the S&P/ASX Small Ordinaries Index. The table below reveals the extent of this outperformance.

MVS Index performance

Source: Morningstar Direct as at 30 April 2017. Results are calculated daily and assume immediate reinvestment of all dividends. You cannot invest in an index. MVS Index results do not include costs of investing in MVS. Past performance of the MVS Index is not a reliable indicator of future performance of MVS.

Dividend filter drives outperformance

Dividend screening is the first point of difference between the MVS Index and the Small Ordinaries Index. Many of the companies excluded from the MVS Index have a negative return on equity (ROE). In other words, they are making a loss rather than making a profit and cannot pay dividends.

The dividend filter also has the effect of excluding companies with the least stable earnings. By excluding companies on the basis of ROE and earnings stability, the dividend filter is excluding what are known in the jargon of smart beta as 'lower quality' companies. The MVS Index can therefore be described as having a 'quality tilt'.

Another distinguishing feature is MVS Index's increased exposure to low volatility stocks as the dividend filter has the effect of excluding many higher volatility stocks. Numerous studies have concluded that a portfolio of low volatility stocks produces higher risk-adjusted returns than a portfolio of high volatility stocks.

This is smart beta true to its word: targeting a specific investment outcome, namely outperformance in small-caps; by applying a rules based methodology, namely only investing in companies that consistently pay dividends; has consistently delivered results to investors.

Power in performance

Smart beta products, by carving out a significant component of active management and offering it more cheaply and more transparently, are quickly drawing investors' money.

Since listing on ASX two years ago, the VanEck Vectors Small Companies Masters ETF (ASX code: MVS) has attracted $55 million in assets. The ETF, Australia's only smart beta Australian small-cap ETF, is generating significant interest from institutions, financial advisers and SMSFs who are seeking the low cost, transparency, liquidity and tradability of ETFs and a demonstrable track record of outperformance compared to the S&P/ASX Small Ordinaries Index.

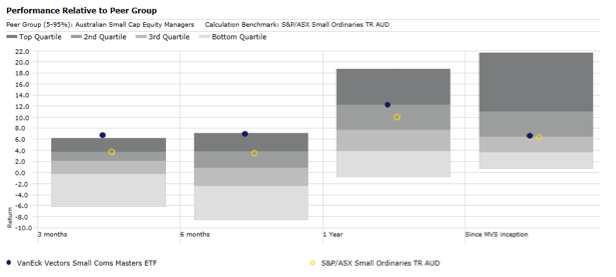

MVS has easily outperformed the S&P/ASX Small Ordinaries Index and many actively managed small-cap funds as the following table reveals.

Source: Morningstar Direct as at 30 April 2017. Australian Small Cap Equity Managers Universe is based on the defined universe funds that invest primarily in small Australian companies. Stocks in the bottom 30% of the Australian equities market based on market cap are defined as 'mid/small cap.'

VanEck's own experience is one of rapid growth. Overall, its smart beta ETFs have attracted significant inflows since inception and we expect this to continue as smart beta disrupts active funds management. Prudent investors are assessing their exposure to active small-cap managers and they are smartening and allocating to smart beta.

For more information about VanEck's range of smart beta ETFs, click here.

General information only

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity and issuer of the VanEck Vectors Small Companies Masters ETF ('Fund'). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

MVIS Australia Small-Cap Dividend Payers Index ('MVS Index') is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany ('MVIS'). MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVS Index. Solactive uses its best efforts to ensure that the MVS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVS Index to third parties.

Published: 09 August 2018