Q: How would Benjamin Graham invest internationally?

A: According to Quality factors.

The book details how investors can avoid becoming speculators. Graham defines investors as those seeking the preservation of the principal of their investments and adequate returns. Investment decisions lacking these objectives, Graham says, are made by speculators, and are exposed to higher risks and costs.

A recurring theme of The Intelligent Investor is that investors should demand from a company "a sufficiently strong financial position and the potential that its earnings will at least be maintained over the years."

Graham defines a strong financial position as one whose long-term debt does not exceed current net assets and high return on equity (ROE). Graham argues that the best way to determine whether earnings will be maintained is to examine the earnings of the company over the past ten years.

It would be impossible for “intelligent” Australian investors diversifying internationally to analyse these characteristics for each company around the world.

MSCI, one of the world's largest index providers, does the work for us. MSCI analyses the stocks in its global universe and identifies the companies with the strongest fundamentals for inclusion in its Quality indices.

According to MSCI, "Quality growth companies tend to have high ROE, stable earnings that are uncorrelated with the broad business cycle, and strong balance sheets with low financial leverage."

MSCI’s description matches the characteristics Graham insisted investors should demand from companies and is the basis for the MSCI's World ex Australia Quality Index.

MSCI only includes the highest scoring companies that comprise the top 30% by market capitalisation of its global universe. MSCI Quality scores are based on three fundamental factors:

- ROE;

- Earnings variability; and

- Debt-to-equity ratio.

Market Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) tracks the MSCI World ex Australia Quality Index. "Intelligent investors" can now access a portfolio of 300 quality international companies in a single trade on the ASX.

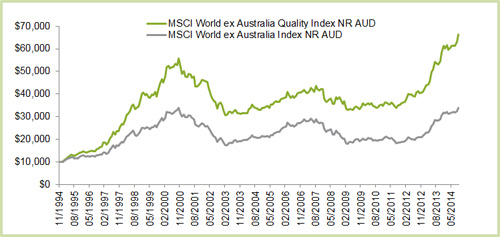

The following chart illustrates the outperformance of the MSCI World ex Australia Quality Index relative to its global universe and the standard market capitalisation MSCI World ex Australia Index.

Source: Bloomberg, iRate, as at 31 August, 2014.

The above graph is a hypothetical comparison of the performance of a $10,000 investment in the Index and the parent index. Results are calculated to the last business day of the month, assuming immediate reinvestment of all dividends and excluding costs associated with investing in the ETF. You cannot invest directly in the Index. The above performance information is not a reliable indicator of current or future performance of the indices or QUAL, which may be lower or higher.

The long term results of Graham's practices are well documented and evidenced by the ongoing success of his many high profile pupils.

Given that Graham’s most famous student recently told his own investors that they would be better off investing in low-cost index funds, we think that when it comes to international equities, Graham would have invested in QUAL.

Disclaimer: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 ('MVIL') as the Responsible Entity and issuer of units in the Market Vectors MSCI World ex Australia Quality ETF ('the Fund' or 'QUAL'). This is general information only and not financial advice. It does not take into account any person’s objectives, financial situation or needs ('circumstances'). Before making an investment decision in relation to the Fund you should read the current Product Disclosure Statement (‘PDS’) and with the assistance of a financial adviser consider if the decision is appropriate for your circumstances. A copy of the PDS is available at www.marketvectors.com.au or by calling the Registrar on 1300 MV ETFS (1300 68 3837). Investors can buy and sell units in the Fund on the ASX via a stockbroker or financial adviser. ‘Authorised Participants’ can invest in the Fund directly with MVIL by completing the application form in the PDS. The Fund is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to the Fund or Reference Index. The PDS contains a more detailed description of the limited relationship MSCI has with MVI and the Fund.

MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York ('Van Eck Global'). The Fund is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of future performance.

None of MVIL, any other member of the Van Eck Global group or MSCI guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

©2014 Market Vectors Australia Pty Ltd. All rights reserved. Market Vectors®and Van Eck®are trademarks of Van Eck Global.

Published: 09 August 2018