Introducing Frank

Meet Frank. He works in the ATO but Frank is cool. Frank gives you money rather than takes it away from you. Here, we introduce you to Frank so you can understand how he works and get the best out of him. Frank packs the greatest punch when he’s operating at 100%.

‘Frank’ is short for ‘franking credits’ or ‘dividend imputation’. Franking credits arise when Australian-resident companies pay income tax on their taxable income and distribute their after-tax profits with franking credits attached.

Life before Frank was different. Income received as dividends was taxed twice: first, at the company rate when the company paid tax on its profits; and then a second time at an individual investor’s income tax rate when they received the dividend income.

The Hawke/Keating government gave birth to Frank in 1987. The impact of Frank’s birth is that investors who receive dividend income are now only taxed on their share of the company’s pre-tax profit to the extent of their individual tax rate. So with a company tax rate of 30%, investors with a tax rate of 30% or less pay no more tax on their dividend income.

The dividend imputation system is designed to stop the double taxation of company profits and it can make investing in companies that pay fully franked dividends tax-effective. That's especially so when an investor's marginal tax rate is less than the company tax rate of 30 per cent.

If an individual’s tax rate is 47%, then an investor will only pay the difference with the company tax rate, which is 17%.

Frank matured when he turned 13. Since the year 2000, franking credits became fully refundable. That means that all Australian investors who do not pay tax or who have a tax rate of less than 30% can be entitled to a refund on the tax already paid by the company.

Frank now sends many Australian shareholders cheques from the ATO, putting more money in investors’ wallets. SMSFs and retirees receive the healthiest cheques from Frank.

Frank in action

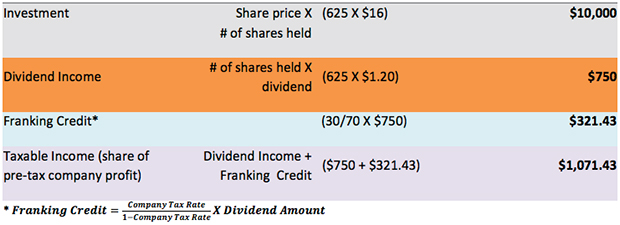

Let’s assume you buy $10,000 of FRANK LTD’s shares. The current price of FRANK LTD is $16 per share meaning you own 625 shares.

FRANK LTD makes $2 of profit per share and pays company tax at 30% on that profit, which is 60 cents, leaving $1.40 per share. FRANK LTD decides to pay shareholders $1.20 as a ‘100%’ or ‘fully’ franked dividend and to retain the rest to grow the business. Being fully franked means FRANK LTD attaches a 30% imputation credit to its dividend for the company tax it has already paid. This is not something you receive in cash from FRANK LTD. You need to claim FRANK LTD’s imputation credit as a ‘rebate’ or ‘offset’ in your annual tax return.

CALCULATING 100% FRANKED INCOME

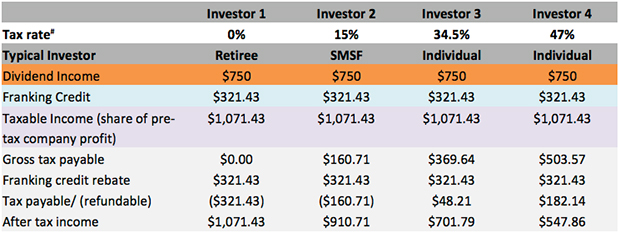

TAX TREATMENT OF FRANK LTD’s DIVIDEND

# Tax rates include the Medicare Levy.

As you can see from the tables above a retiree paying no income tax would receive a $321.43 refund from the ATO, while an individual on the highest marginal tax rate would only pay $182.14 on the $750 received.

It is no wonder that Australian investors are attracted to stocks which pay fully franked dividends.

If the investor doesn't pay income tax at all as they earn less than $18,201, or they are an SMSF in the pension phase, then they would get the full 30 cents credit back. Franking credits can therefore be an important source of income to your portfolio.

Caution: Frank isn’t always 100%

To take full advantage of the dividend imputation system, it’s important that Frank is working to maximum capacity, that is, that you invest in companies that pay dividends which are 100% franked. Many companies do not pay fully franked dividends if they earn income offshore or pay less than 30% tax on their earnings, for example, due either to a tax break, income being earned off shore or a previous year's losses being carried forward. In this case, those companies’ dividends will have franked and unfranked components, so the franking will be less than 100%.

Here, Frank won’t carry quite as much punch.

Bringing Frank into your portfolio

VanEck Vectors S&P/ASX Franked Dividend ETF (ASX code: FDIV) brings Frank to you in his best form, at 100%. The ETF is the first Australian equity ETF available on ASX that only includes companies that pay dividends with 100% franking credits. This means that investors in FDIV can expect that the dividend income the fund distributes will have 100% franking credits attached, which can give a significant boost to your after-tax position.

If you would like more information on FDIV please contact our ETF specialists on 02 8038 3300 or email us at info@vaneck.com.au

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors S&P/ASX Franked Dividend (‘Fund’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The "S&P/ASX Franked Dividend Index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and ASX Limited (“ASX”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or ASX and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions, or interruptions of the Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the index or Fund is not a recommendation by any party to buy, sell, or hold such security.

Published: 09 August 2018