Introducing Frank.

‘Frank’ is short for ‘franking credits’ or ‘dividend imputation’.

Life before Frank was different. Income received as dividends was taxed twice: firstly, at the company rate when the company paid its tax; and then a second time at the investor’s individual income tax rate when they received the dividend.

Frank was born in 1987 during the Hawke/Keating years. The impact of Frank is that investors who receive divided income are now only taxed to the extent of their tax rate on their share of the company’s pre-tax profit. This means with the company tax rate of 30%, investors with a tax rate of 30% pay no more tax, those on a tax rate above 30% pay the extra to top up to their individual rate and those on a tax rate below 30% receive a tax credit from the ATO to reduce the total tax paid to their individual tax rate.

For example, if their individual rate is 49% then an investor will only pay the difference which is 19%.

Frank matured when he turned 13. Since the year 2000 franking credits became fully refundable. That means that all Australian investors who do not pay tax or who have a tax rate less than 30% can be entitled to a refund. Frank sends some Australian shareholders cheques from the ATO.

In particular SMSFs and retirees can receive cheques from Frank.

Let’s have a look at Frank in action:

Let’s assume you own $10,000 of FRANK LTD’s shares. The current price of FRANK LTD is $16 per share meaning you own 625 shares.

FRANK LTD makes $2 of profit per share and pays company tax at 30% on that profit which is 60 cents, leaving $1.40 cents per share. FRANK LTD decides to pay shareholders $1.20 as a ‘100%’ or ‘fully’ franked dividend and to retain the rest to grow the business. Being fully franked means FRANK LTD attaches a 30% imputation credit to its dividend for the company tax it has already paid. This is not something you receive in cash from FRANK LTD. You need to claim FRANK LTD’s imputation credit as a ‘rebate’ or ‘offset’ in your annual tax return.

CALCULATING 100% FRANKED INCOME

|

Investment |

Share price X |

(625 X $16) |

$10,000 |

|

Dividend Income |

# of shares held X |

(625 X $1.20) |

$750 |

|

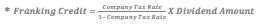

Franking Credit* |

|

(30/70 X $750) |

$321.43 |

|

Taxable Income (share of pre-tax company profit) |

Dividend Income + Franking Credit |

($750 + $321.43) |

$1,071.43 |

TAX TREATMENT OF FRANK LTD’s DIVIDEND

|

|

Investor 1 |

Investor 2 |

Investor 3 |

Investor 4 |

|

Tax rate# |

0% |

15% |

34.5% |

49% |

|

Typical Investor |

Retiree |

SMSF |

Individual |

Individual |

|

Dividend Income |

$750 |

$750 |

$750 |

$750 |

|

Franking Credit |

$321.43 |

$321.43 |

$321.43 |

$321.43 |

|

Taxable Income (share of pre-tax company profit) |

$1,071.43 |

$1,071.43 |

$1,071.43 |

$1,071.43 |

|

Gross tax payable |

$0.00 |

$160.71 |

$369.64 |

$525.00 |

|

Franking credit rebate |

$321.43 |

$321.43 |

$321.43 |

$321.43 |

|

Tax payable/ (refundable) |

($321.43) |

($160.71) |

$48.21 |

$203.57 |

|

After tax income |

$1,071.43 |

$910.71 |

$701.79 |

$546.43 |

# Tax rates include the Medicare Levy and the Temporary Budget Repair Levy as applicable.

As you can see from the tables above a retiree paying no income tax would receive a $321.43 refund from the ATO, while an individual on the highest marginal tax rate would only pay $203.57 on the $750 received.

It is no wonder that Australian investors are attracted to stocks which pay fully franked dividends.

Published: 09 August 2018