Global healthcare expenditures account for 10.2% of the world’s GDP and are set to grow

Healthcare spending is expected to reach

US$14 trillion per year by 20301.

What makes healthcare a global growth opportunity?

HLTH | VanEck Vectors Global Healthcare Leaders ETF

HLTH focuses on quality global healthcare companies

MarketGrader undertakes a robust screening process of companies to identify the companies with the

best growth at a reasonable price (GARP) attributes for inclusion in the index that HLTH tracks.

Collection and screening of financial statements and company data

Millions of data records are screened to identify reporting anomalies and inconsistencies, and filter out those deemed unreliable.

Calculation of metrics designed to identify growth compounders

These include consistent growth with sustainable margins and high cash flow generation; a sound capital structure that doesn’t impair operating growth, combined with high returns on invested capital; and reasonable valuations relative to sustainable growth rates.

Calculation of 24 fundamental indicators focused on GARP + Quality

Indicators are classified into four categories: Growth, Value, Profitability and Cash Flow. As business models vary greatly across industries and sectors and between companies of very different scale, these indicators also vary to account for such differences.

Calculation of the final MarketGrader score and rating

The top 100 companies with the best score are considered. Then, the top 50 are selected based on market capitalisation. Constituents are equally weighted.

HLTH offers exposure to a global diversified portfolio of global healthcare stocks

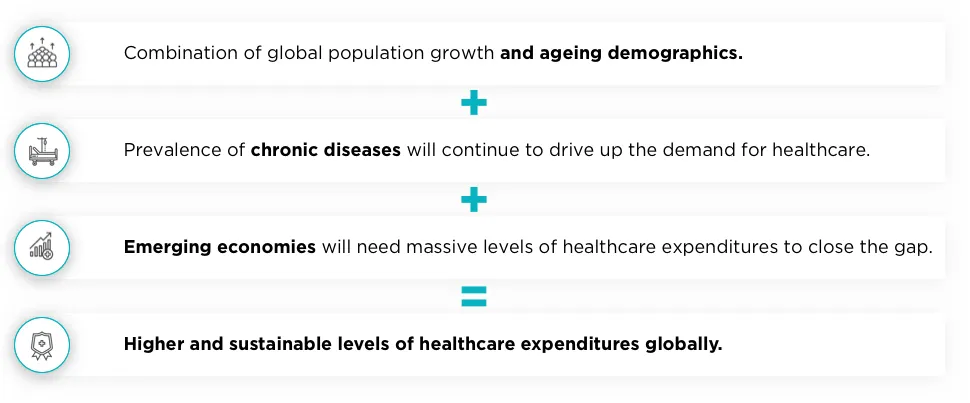

Global growth opportunity

A sector with significant growth potential due to shifting global demographics, social changes, research & development and innovation supporting increased demand in healthcare-related products and services.

Fundamentally strong companies

Invests in 50 fundamentally sound and attractively valued companies with the best growth prospects in the healthcare sector.

Targeted exposure and diversification

A portfolio which targets focused exposure to healthcare and offers true diversification by equally weighting across companies.

2Bloomberg, MarketGrader, 1 Jan 2007 to 31 December 2009, 1 Jan 2011 to 31 December 2011, 1 Jan 2020 to 30 June 2020

IMPORTANT NOTICE: This is general advice only and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak to a financial adviser to consider if HLTH is appropriate for your circumstances. The PDS is available here.