Investing evolution bringing revolution

The way investment managers manage money and how their performance is assessed has changed. To understand whether the professional fund managers you engage are keeping pace with evolving investment strategies, you need to look at α, ß and smart ß.

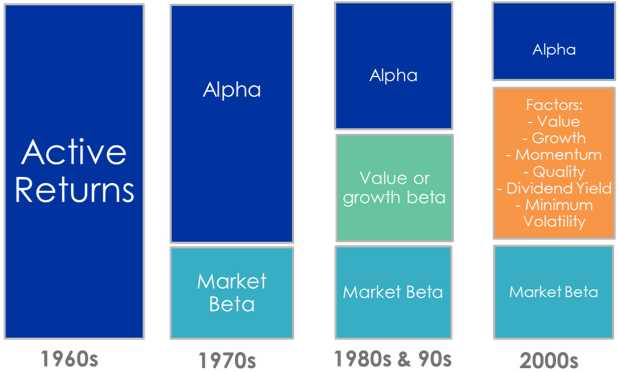

You may have seen this picture, or an adaption of it, before. It is an attempt to illustrate the evolution of active investment and it explains why smart beta is becoming so popular.

Source: VanEck

The picture shows that during the 1960s fund managers returns were comparable with each other. The industry was still in its infancy. It was also during this time research by Harry Markowitz and William Sharpe supported market capitalisation indices with their work on efficient markets, capital pricing models and risk adjusted returns. The calculation of indices and portfolios were done using adding machines and very rudimentary mainframe computers. Eventually market capitalisation indices became the standard measure for the market return, or market beta.

During the 1970s, according to the picture, rather than comparing performance to other managers, fund managers started to target outperforming the benchmark market capitalisation index. A fund manager’s return was separated into beta and alpha. Alpha represented the excess return the manager delivered above the market index. There were however grumblings within the world of academia that markets were inefficient and attempts were made to explain alpha to identify the inefficiencies active managers exploit.

Among the most influential works was that of Basu who in 1977 observed value stocks outperformed growth stocks. Suddenly the world was awash with ‘value’ managers and those that identified themselves as ‘growth’ managers.

In the 1980s and 1990s a fund manager could attribute their performance to:

- beta;

- their tilt to or away from value and growth factors; and

- alpha.

It is also worth noting that by the 80s and 90s computer technology had come a long way. Analysts now had PCs on their desks and some even had hand held devices.

Technological advances and the availability of big data, as everyone likes to call it, combined with the general growth in the asset management markets, have enabled the incredible growth in performance analysis. Today, as observed in the picture above, we can see an active manager’s returns are attributed to beta, alpha and a range of what are known as smart beta factors which effectively reduce the alpha part of the return which can be attributed to the manager’s skill.

Now too ETFs have made it possible for investors to invest in smart beta strategies that utilise these same factors for a fraction of the cost that active managers have historically been charging.

What this means for active managers is that they now need to justify their fees by providing alpha beyond just beta and smart beta factors and for many, they are failing to deliver and investors are shifting their money to low cost equivalent smart beta strategies. We have often seen this in practice. A good example is in relation to references to quality companies.

You often hear fund managers say that they aspire to look for companies in which Warren Buffet would invest. Warren Buffet’s mentor Benjamin Graham came up with the concept of quality investing. He used seven fundamental measures.

Graham’s seven fundamental measures

- Adequate size of the enterprise

- Sufficiently strong financial condition

- Earnings stability

- Dividend record

- Earnings growth

- Moderate Price to Earnings ratio

- Moderate ratio of Price to Assets

Graham defines a strong financial position as one in which long-term debt does not exceed current net assets and where there is a high return on equity (ROE). Graham argues that the best way to determine whether earnings will be maintained is to examine the earnings of the company over the past ten years.

Today there are well established benchmarks that adopt several of Graham’s key measures to determine a portfolio of quality international companies. The MSCI World ex Australia Quality Index (Quality Index) selects stocks based on: high ROE, low leverage and stable earnings.

Now let’s compare the Quality Index’s performance to a leading global manager who identifies quality as a factor they seek in the stocks in their portfolio.

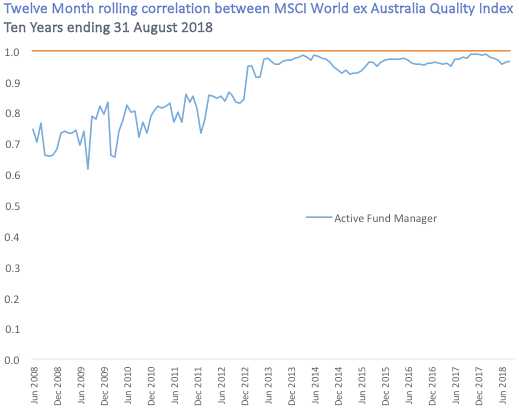

The chart below shows the correlation of the active manager’s portfolio to the Quality Index.

Source: Morningstar Direct, as at 31 July 2018. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF. You can not invest directly in the Index. The above performance information is not a reliable indicator of current or future performance of the indices or QUAL, which may be lower or higher.

As you can see the active manager’s portfolio has been very closely correlated to the Quality Index from 2013 to now.

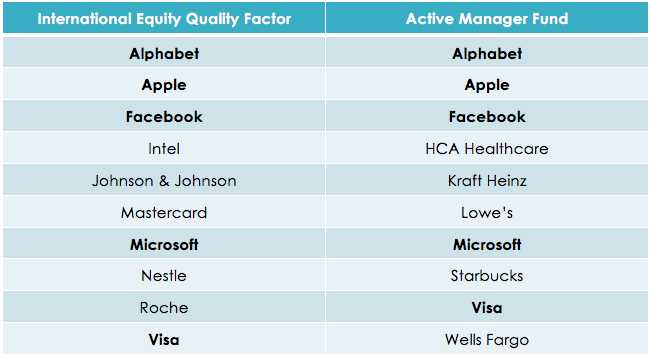

A comparison of the top 10 holdings illustrate the overlap.

Source: VanEck, MSCI, Active fund manager’s website, as at 31 August 2018.

Today there is an ETF (exchange traded funds) that tracks the Quality Index for a fraction of the cost of the actively managed fund. The fee for the ETF is 0.40% p.a. compared to the active manager’s fee of 1.35% p.a plus a performance fee.

The correlation above indicates that a large proportion of this manager’s performance may be explained by the quality smart beta factor and not alpha. To justify fees beyond the ETF’s 0.40% p.a. the manager should be providing investor’s significant alpha.

Perhaps they will. Active managers who are able to generate this alpha will survive, but those who are benchmark huggers or whose returns can be wholly explained by smart beta factors will need to adapt to survive, or at the very least – lower their fees.

This Vector Insights is adapted from an address at a recent industry forum. A full version of the presentation: “The rise of smart beta ETFs: The drive to design better benchmarks for optimal returns” is available here – watch now.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors MSCI World ex Australia Quality ETF (‘QUAL’). Nothing in this content is a solicitation to buy or an offer to sell shares of any investment in any jurisdiction including where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. This is general information only and not financial advice. It is intended for use by financial services professionals only. This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. QUAL is subject to investment risk, including possible loss of capital invested. QUAL invests in international markets. An investment in QUAL has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation. Past performance information about the Quality Index shown above does not include management fees and other costs associated with an investment in QUAL and is not a reliable indicator of future performance of QUAL. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the fund. QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.

Published: 06 October 2018