Mighty MidCaps

Sometimes it’s hard being stuck in the middle but in the investment world MidCaps are the market’s sweet spot, combining the best of large and small cap opportunities.

Companies which are too big are constrained by their size in the sectors they dominate. Large-caps have more stability because of their huge size but because of this, they generally have less room to grow and therefore are never going to provide spectacular returns. The S&P/ASX 200 is dominated by a handful of large-cap stocks including the big four banks. These large-cap stocks are a favourite among Australian investors but when their performance takes a dive, investors look elsewhere.

At the other end of the spectrum are small sized companies which have more capacity to grow than large companies, but often have limited access to capital to drive expansion. Some of the best known large-caps in the world started out as small companies and have grown to become titans. Finding a hidden gem is one of the greatest potential benefits of investing in small caps but small companies also come with a lot more risk because they can fail spectacularly and crash into a fiery heap.

Then there is the middle of the spectrum – MidCaps. These companies offer a balance between the spirit and youth of the small caps with the stability of large companies. MidCaps tend to have experienced management teams, established brands and client bases, infrastructure and access to capital markets — advantages that small caps may lack. At the same time, they can grow more quickly than their large-cap counterparts, benefiting from flatter management structures, entrepreneurial drive and quick decision-making. This agility helps them to respond more quickly to external market forces.

MidCaps are often well known to investors but because they haven’t yet reached titan status, their performance isn’t always front of mind.

A great attribute of MidCaps is that they still have room to capture market share, offer new products, enter new markets, gain economies of scale or obtain intellectual property quickly. They also have a much greater potential to be taken over than the large caps have.

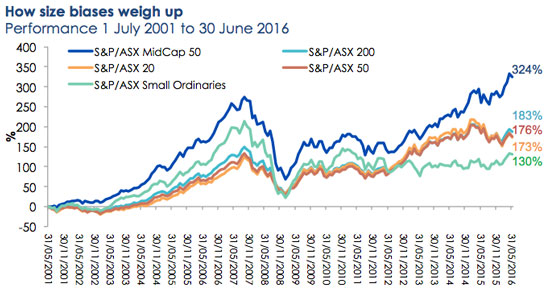

Midcap performance

Probably the best kept secret in the Australian investment industry is the performance of MidCaps. But like middle child syndrome, midcap performance often flies under the radar. For the past 15 years Australian midcap companies have outperformed their large-cap and small-cap siblings as shown in the following graph comparing the S&P/ASX MidCap 50 Index relative to the key S&P/ASX market capitalistion weighted indices.

Source: VanEck, Morningstar, as at 30 June 2016. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MVE. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

The following table shows the trailing performance of the S&P/ASX MidCap 50 in comparison to key S&P/ASX over the past five years.

Performance to 30 June 2016

|

Index |

YTD |

1 Year |

3 Years |

5 Years |

|

S&P/ASX 200 Index |

1.09 |

0.56 |

7.66 |

7.40 |

|

S&P/ASX 20 Index |

-3.86 |

-7.01 |

4.64 |

6.49 |

|

S&P/ASX 50 Index |

-0.55 |

-2.64 |

6.41 |

7.44 |

|

S&P/ASX Small Ordinaries Index |

6.94 |

14.40 |

9.13 |

1.00 |

|

S&P/ASX MidCap 50 Index |

9.32 |

17.71 |

16.30 |

9.60 |

Source: VanEck, Morningstar, as at 30 June 2016. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MVE. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance.

For the first time Australian investors can invest in an ETF which tracks the S&P/ASX MidCaps 50 Index. VanEck Vectors S&P/ASX MidCap ETF (ASX code: MVE) offers exposure the sweet spot of the investment universe, the ‘mighty MidCaps’.

For more information on MVE click here and speak to your financial adviser or broker.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors S&P/ASX MidCap ETF1 (‘Fund’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

The "S&P/ASX MidCap 50 Index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and ASX Limited (“ASX”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or ASX and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions or interruptions of the S&P/ASX MidCap 50 Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the index or Fund is not a recommendation by any party to buy, sell or hold such security.payment of income, the performance or any particular rate of return from the Fund.

iEffective 26 July 2016, the fund operates as VanEck Vectors S&P/ASX MidCap ETF, and tracks the S&P/ASX MidCap 50 Index. Prior to the 26 July 2016 the fund operated under the name VanEck Vectors Australian Emerging Resources ETF and aimed to closely track the MVIS Australia Junior Energy & Mining Index.

Published: 09 August 2018