Skill, luck and everything in between

As any sports tipster knows – it’s very hard to pick all the winners every week. Likewise, if you tried, it would be impossible to get every tip wrong on purpose each week. Every single outcome is very difficult to predict and much is due to chance. Therefore, tipping involves luck. The same is true of investing. There is, however, an easy way to determine if your Australian equity manager is skilful or just lucky. It’s called persistence.

Skill is the ability to do something well, for example to carry out a task timely and effectively to achieve a positive outcome. Skill involves someone’s knowledge, expertise and actions. Luck, on the other hand, is what happens independent of the person’s knowledge and actions. Luck can produce both positive and negative outcomes and those outcomes are totally arbitrary.

It is often difficult to determine if an investment outcome is due to skill or just luck. According to Michael J Mauboussin, Head of Global Financial Strategies at Credit Suisse, there is an elegant test to know whether there is any skill involved: if an activity can be lost on purpose, then there is some skill in that activity.

Think of a professional sports person. They can lose on purpose to their son or daughter in a contest. In the world of investing there are no real tests of this. However, in his 2013 CFA Institute paper, ‘The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing’, Mauboussin concludes “a lot of investing success falls more toward the luck side of the continuum”.

The challenge for investors is to separate which fund managers are skilful and which are plain lucky.

Persistence

In investing, skill can be identified by persistent performance. The performance of a manager is measured by comparing their returns to a benchmark index. For an Australian equity manager this is the S&P/ASX 200. A skilful manager will persistently outperform this benchmark and their peers.

Every six months, S&P Dow Jones Indices release its SPIVA Australia scorecard and an accompanying research piece entitled ‘Persistence of Australian Funds’. It has been well documented that the SPIVA scorecard makes for poor reading for active managers. The most recent, for the period ending December 2017, reveals that nearly 60% of active Australian equity managers were outperformed by the S&P/ASX 200 over the previous twelve months.

Over longer time periods it gets worse, with almost 74% and 77% of active managers being outperformed by the benchmark over 10- and 15-year periods, respectively. Picking a skilful manager, one that persistently outperforms is extremely challenging.

According to S&P Dow Jones’ research, out of the 77 Australian equity funds in the top quartile in calendar year 2015, only four held onto their top quartile position in 2016 and 2017.

Out of the 203 Australian equity funds that beat the S&P/ASX 200 in 2015, only 16 outperformed again the two following years.

So the overwhelming majority of active fund managers in the last three years are not achieving persistent performance.

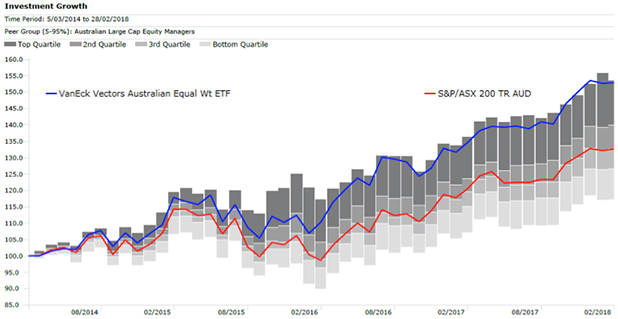

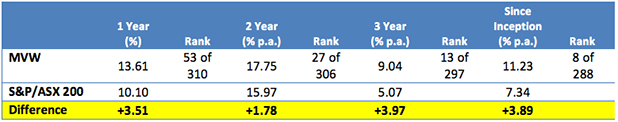

There is however an Australian equity ETF that has persistently outperformed the S&P/ASX 200 since its inception on ASX on 4 March 2014 while consistently achieving top quartile performance: the VanEck Vectors Australian Equal Weight ETF (MVW).

Performance and persistence of MVW

Inception date is March 4, 2014.

Source: Morningstar Direct, VanEck, as at 28 February 2018. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management fees and other costs incurred in the fund but do not include brokerage costs or buy/sell spreads incurred when investing in MVW. Past performance is not a reliable indicator of future performance. The Peer group of Australian Large Cap Equity Managers includes Morningstar’s Open Ended Australian Equity Large Blend Category, Morningstar’s Open Ended Australian Equity Large Growth Category and Morningstar’s Open Ended Australian Equity Large Value Category which are based on the defined universe funds that invest primarily in large Australian companies. Stocks in the top 70% of the Australian equities market based on market cap are defined as ‘large’.

MVW employs a passive rules based investment strategy that selects only the largest and most liquid securities on ASX and weights them equally at each quarterly rebalance (currently 84 stocks @ 1.19% each). The knowledge and expertise that gives rise to the skill in this strategy is embedded in the index rules for the fund.

The ability of an equal weight portfolio to outperform over longer time periods is supported by a large body of academic research from institutions such as The University of London's Cass Business School, EDHEC Business School, Goethe University and Australia's own Monash University. These findings reinforce industry research by index companies S&P Dow Jones Indices and MV Index Solutions.

In contrast, there seems to be more luck than skill involved with the majority of active fund managers. This view is supported by S&P Dow Jones Indices’ data on persistent performance. Some years, some fund managers are lucky, other years, the same managers are not.

The past four years have seen MVW achieve persistent outperformance.

IMPORTANT NOTICE:

This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck') as responsible entity of the VanEck Vectors Australian Equal Weight ETF (MVW) ('Fund'). This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person's individual objectives, financial situation nor needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser and consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance or any particular rate of return from the Fund.

Published: 09 August 2018