Smart beta for bonds - credit where it's due

Smart beta approaches in equites are well documented but are rarely mentioned in the context of bonds. Investors have over 25 smart beta equity ETFs to choose from on ASX. In fixed income there are just a few. But while still in its infancy for Australian investors, the early indications are that for Australian bond investing, smart beta is here for the duration.

As with equities, bond investors are continually searching for better investment outcomes. In the world of equity indexing, smart beta has flourished. However for bonds index innovation is still in its beginnings. As advancements continue, investors will have more choice when constructing the defensive allocation of their portfolios.

Bond indices, unlike equity indices, are typically liability weighted and not asset weighted. This means that the most indebted issuers make up the largest portions in benchmark indices. In Australia the largest borrower is the Commonwealth Government so its bonds represent the largest part of the Australian benchmark bond index, the Bloomberg AusBond Composite 0+Yr Index. Likewise, the most indebted companies make up more of the index than those that don’t rely on borrowing.

An active Australian bond manager may attempt to outperform the Bloomberg AusBond Composite 0+Yr Index by:

- Anticipating and positioning the portfolio for changes in interest rates (interest rate/duration strategy); and/or

- Allocating more to sectors and issuers that they think will outperform the index (credit strategy).

They will do this using top-down economic and bottom-up company analysis. Top-down analysis involves analysing economic conditions to determine the direction and likelihood of interest rate moves and which sectors to rotate in and out of as the economy changes. Bottom-up analysis will involve assessing each bond issuer and determining the likelihood of them being able to repay the debt issued.

According to the most recent S&P Dow Jones Indices SPIVA scorecard, after fees, “over the 3-, 5-, and 10- year periods [to 31 December 2016], 90%, 77% and 88% of Australian bonds lagged the benchmark respectively.”1 This suggests that there is potential for innovative products such as smart beta ETFs to play a role in Australian portfolios.

The peculiarities of the bond markets has made index innovation such as smart beta more difficult than equities. Overseas many smart beta bond approaches are focused on weighting the index differently from liability weighting. Methods include: weighting by GDP for global bonds; or by using metrics such as earnings generation, size and liquidity to create index weights. The impact of all these methodologies is to underweight the most indebted issuers. However, liquidity is tight and prices are opaque, so there is a lack of long term data to prove the efficacy of these new approaches.

Enter Markit: the index provider best known for iTraxx, which active managers use to assess the risk spread of corporate bonds to government bonds. Founded on their deep knowledge of bond markets, Markit has created a smart beta corporate Australian dollar bond index based on yield and credit quality. The Markit iBoxx AUD Corporates Yield Plus Index (PLUS Index) includes only the top 50% highest yielding Australian corporate bonds relative to Australian Commonwealth government bonds with a similar maturity, much like an equity income smart beta index which focuses on dividends. Importantly, the PLUS Index only includes investment grade bonds.

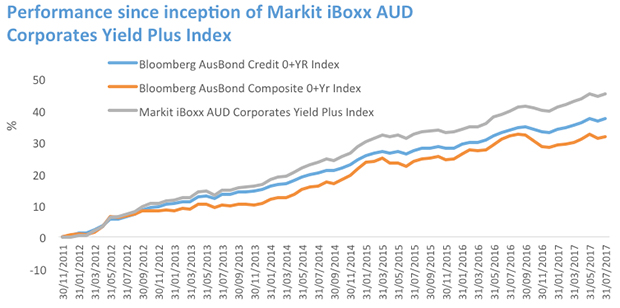

Source: VanEck, Morningstar; as at 31 July 2017. PLUS Index inception date is 30 November 2011.

The above graph is a hypothetical comparison of performance of the PLUS Index and other benchmark indices. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in PLUS. You cannot invest directly in an index. Past performance of PLUS Index is not a reliable indicator of future performance of PLUS.

VanEck Vectors Australian Corporate Bond Plus ETF (ASX code: PLUS) tracks the PLUS Index.

Now available on ASX , PLUS is a cost effective, liquid and transparent vehicle that is easy for investors to use to gain access to the top 50% highest yielding corporate bonds of investment grade quality.

Markit’s smart beta PLUS Index has enabled investors the ability to easily access fixed income assets. Credit where it is due.

IMPORTANT NOTICE: CONFIDENTIAL – FOR USE BY FINANCIAL SERVICES PROFESSIONALS ONLY

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors Australian Corporate Bond Plus ETF ARSN 617 941 241 ASX code: PLUS (“the Fund”). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if the Fund is appropriate for their circumstances. A copy of the PDS is available at vaneck.com.au or by calling 1300 68 38 37.

The Fund is based on the Markit iBoxx AUD Corporates Yield Plus Index (“the Index”). The Index is the property of Markit Indices Limited (“Markit”) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The Index and trademarks have been licensed for use by VanEck. The Fund is not sponsored, endorsed, or promoted by Markit.

The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

© 2017 VanEck

1 S&P Dow Jones Indices SPIVA® Australia Scorecard, Year-End 2016

Published: 09 August 2018