The Story of an ETF Creation

A key factor to understanding how ETFs work is understanding the process of creating and redeeming units in the fund. It's how ETFs gain exposure to the market and is the secret weapon that enables ETFs to be less administrative, less costly and more tax efficient for investors than unlisted managed funds – all factors which ultimately benefit investors.

When investing in unlisted managed funds, investors apply to buy units in the fund and after processing the application, at best, the next day, the fund manager creates new units which they issue directly to the new investor. The price of the units is unknown at the time of the transaction and typically investors are required to fill out a comprehensive application form and do a 100-point security check. This process can be time consuming.

When investors wish to redeem or sell their units in an unlisted managed fund they can only do this with the manager of the fund who cancels the units in exchange for the current exit price of the fund. Again, this price is determined over the following days.

The application and redemption process for unlisted managed funds lacks transparency and creates an onerous administration burden on the investor.

Unlike unlisted managed funds, ETF units are quoted on ASX and this gives investors the flexibility to invest in real time throughout the day, just like trading shares. Investors buy and sell units on ASX at a price they can see and agree to at the time of the transaction. This is different to an unlisted managed fund where investors can only buy and sell units with the fund manager.

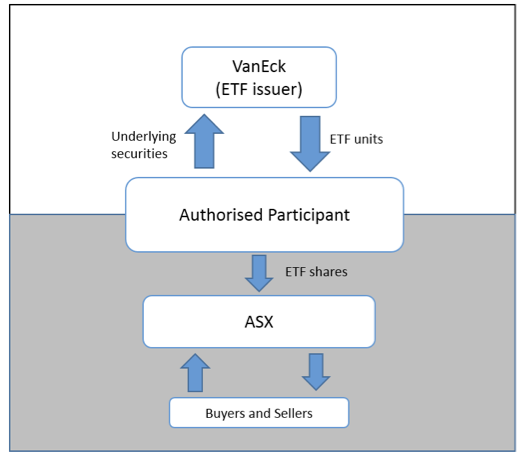

In an ETF, ASX investors don't buy and sell ETF units directly with the issuer, instead the units are traded on ASX like listed shares. In the same way that a listed company uses large institutions known as 'ASX trading participants' to arrange for its shares to be listed on ASX, ETFs also employ trading participants to arrange for the ETF units to be traded on ASX. As a result, there is only one type of client that an ETF issuer will issue and redeem units to. That is an institutional trading participant known as an 'Authorised Participant' or 'AP'. It is the process of creating units and redeeming them with APs that sets ETFs apart from unlisted managed funds.

The issuing of ETF Units to an AP is known as a 'creation'. When an ETF issuer 'creates' units in its fund, an AP buys up a basket of securities matching the ETF's investment strategy. The AP then sells these securities to the ETF issuer in exchange for ETF units. The AP then offers these newly created ETF units on ASX where they can be bought and sold by investors. When the AP wants to redeem fund units of the ETF, they follow the same process in reverse.

As a result of the creation and redemption process performed by an AP, an ETF issuer typically doesn't have to buy or sell securities every day thus keeping transaction costs low in comparison to unlisted managed funds.

To help illustrate this process, the below chart shows the ETF unit creation and redemption process.

Source: VanEck

The ETF unit creation and redemption process also keeps supply and demand of the ETF units in continual balance and provides a "hidden" layer of liquidity not evident by looking at trading volumes alone. New ETF units can be created by the AP as required to meet increased investor demand and redeemed to reduce any excess supply. This is an important distinction from unlisted managed funds. This means the price of the ETF units traded on ASX remains close to the net assets value of the fund thereby minimising the potential for a premium on a buy and any discount on a sale transaction.

The redemption process also creates a tax efficiency as the AP takes on the capital gains within the fund that are generated by the sale of securities out of the portfolio. This shields the ordinary investor from the associated tax liability (this tax benefit is explained in detail here).

The creation and redemption process is one of the best kept secrets of ETFs. It provides an efficient mechanism for the ETF issuer and it minimises capital gains tax liabilities for investors and lowers transaction costs. As investors trade on ASX, compared to unlisted managed funds investors, they have greater price transparency and less administration especially as they don't have to complete an application or withdrawal form every time they wish to trade.

The creation and redemption process is a key difference between ETFs and unlisted managed funds which ultimately provides greater benefits to investors seeking exposure to a wide variety of asset classes or markets.

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 ('VanEck'). This is general information only and not financial advice. It does not take into account any person's individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.

Published: 09 August 2018